In the world of streaming, news from the major players breaks all the time, changing the competitive landscape, and with so much happening, investors can easily miss something important.

To succeed in today’s cord-cutters market, savvy investors know to make savvy choices, they need to look beyond the numbers as sometimes important information isn’t on a balance sheet.

HBO Max continued to make news this week as it was revealed the company was reportedly prepping for another internal screen-to-stream acquisition, which had also been sought after by Netflix.

Disney+ surprised everyone with the pickup of unannounced Taylor Swift project showcasing the company’s ability to still pull off surprises and bolster its roster without pulling projects from theaters.

Netflix had a busy week with news of a massive New Mexico studio expansion and a test of a new larger “most-watched list,” both of which address key areas of need.

(Credit: Warner Bros.)

The streaming market is crowded - main-streamers, niche services, webisodes and all points in between are continuing to slowly take full control over the television landscape. A lot can happen in a short period of time, and investors can easily miss something important.

The "Streaming Spotlight" is a look at back at recent streaming news and the companies that made the biggest moves - whether shareholders realized it or not. To succeed in today's cord-cutters market, savvy investors know to make savvy choices, it is about more than just numbers, and some of the most important information sometimes isn't on a balance sheet.

In this edition of the "Streaming Spotlight," we'll look at AT&T (NYSE:T) (via HBO Max), Disney (NYSE:DIS) and Netflix (NASDAQ:NFLX).

HBO Max Tips More Of Its Streaming Hand After Netflix Makes Offer

(Credit: Warner Bros.)

Investors likely realized HBO Max's big moves the other week were less of a one-off plan and more of a sign of things to come. The upcoming addition of Wonder Woman 1984 to HBO Max's platform on Christmas Day clearly represents a huge shift in how the streaming landscape has changed but exactly what comes after was still a mystery.

But it's fun to guess right?

As it turns out, instead of just blindly making theories, we actually have some real info to work with - and it comes from an unlikely source.

Netflix.

As reported first by The Hollywood Reporter, Netflix recently made a $200 million bid acquire Godzilla vs. Kong - the next film in the rebooted and connected "MonsterVerse" franchises. The idea makes complete sense for Netflix as it would be another big "get" for it to draw subscribers, but there's more to it.

Netflix thought this through and realized that the film's production company Legendary Studios held a 75% stake in the project - meaning it'd probably like a guaranteed return on its investment versus taking its chances in theaters.

$200 million is also the amount the most recent Godzilla film (King of the Monsters) earned in 2019. It was also the most of any of the films in the series including Kong: Skull Island. At least domestically - and that's the point.

Let's say Legendary sells to Netflix for $200 million - it would still have to figure out distribution in places like China, where Netflix does not operate. So it could still do a theatrical release in the region, which is where the films have been most successful (and even a film like Tenet which got decimated domestically, flourished).

It's also a lot easier to take a risk on theaters when you start with $200 million in the bank.

Here's the catch - the other 25% of the film is owned by Warner Bros. which as we've seen is finding its streaming footing. Warners reportedly blocked the deal as they want to explore the possibility of it going to HBO Max.

Now officially HBO Max won't confirm anything beyond:

"We plan to release Godzilla vs. Kong theatrically next year as scheduled."

And while that's probably true, we are living in a different world than a few weeks ago, and in this one, tentpole blockbuster films CAN go to theaters and streaming simultaneously without exhibitors losing their minds (mostly).

So while the film may be coming to theaters "as scheduled," that doesn't prevent a simultaneously streaming release. I recently wrote about how shareholders of Comcast's (NASDAQ:CMCSA) Peacock streamer are watching it in its own battle for an identity, and the same applies here. HBO Max really needed to get its Roku (NASDAQ:ROKU)/Amazon Fire Stick (NASDAQ:AMZN) situations figured out first, and now that both seem sorted out (or close enough), it can begin to figure out how best to utilize the new exposure.

For investors, this is one you should file in the back of your mind for later because a lot will depend on how WW84 does. Should it succeed and drive subs to the level AT&T/HBO Max hopes, then expect more like it to follow - and if it doesn't well, that won't necessarily preclude future deals, but it would take on new meaning.

Either way, what happens will now be more telling than any "official" info we were ever likely to receive in the first place.

Disney's "Swift" Move Surprises In Right Ways

(Credit: Disney)

In few cases would one probably expect a new Taylor Swift project to warrant coverage on a site about investing. And yet here we are - but not for the reasons you'd expect.

Yes, this is obviously a big "get" for Disney+, and it will drive subscribers, but that really goes without saying. For investors, though, its presence on the service signals two bigger things - both of which are tied to areas the House of Mouse usually gets dinged on by analysts and investors.

The smaller, but still important, aspect is that this was a surprise.

Consumers and press alike did not see this coming, and it harkens back to similar moves HBO has done with Beyonce and Netflix has done…well on a usual basis. Disney as a company likes to make big splashes, but usually at choregraphed key times.

Fan expos, investor events, earnings reports, etc. Out-of-the-blue drops are not usually its style, but it worked well here and shows all parties Disney can also make magic in any space it's in (though given it's Disney, many should have known that already).

The other aspect is bigger and ties into frequent inaccurate claims around the streamer's content. We've seen everything from it does not have enough new content, enough overall content or even enough of the right content to keep competing.

After only a year, Disney's streaming numbers not only dwarf competitors by comparison, but they also just recently bailed out the entire company following a dip in earnings due to COVID.

In other words, Disney+ is doing this fine.

Yet a number of analysts and investors seem fixated on this idea that Disney needs to lean further into streaming and really shake things up. Whether it's because they see a larger upside for returns or they think the service just can't keep up, the overwhelming driver is because they believe THIS is the service that can finally catch Netflix and it needs to move now.

I've written before why I think it's okay to lean in, but not go full tilt, and I stand by that (for now, it also looks like Disney does as well). What many people overlook is that while theaters and the traditional method are quickly becoming antiquated, if utilized correctly, they can still be profitable for studios.

Releasing the latest Marvel or Star Wars project can still net massive amounts of cash, which is why you won't see either's slate getting switched from screen to stream. Taylor Swift's folklore: the long pond studio sessions on the other hand is a perfect example of something you'd never expect either in theaters or even on Disney+.

Realistically, I would have pegged this as an Apple TV+ (NASDAQ:AAPL) play or Netflix play or even an Amazon Prime play before thinking about Disney, but there's something to be said for the support a Disney project gets. From an exclusive break on Good Morning America to a push across the company's large portfolio in general, the service does offer things that you can't really get other places.

It's a strong synergetic opportunity that offsets a lot of those concerns and was part of what made this a statement acquisition.

The Disney direct-to-consumer approach is a big topic, and I'll discuss it more ahead of the company's highly anticipated investor day on December 10th - but for now I'll say this, investors have never underestimated Disney before, and this reminds them why.

Netflix Expands On Accessibility While Also Expanding Production

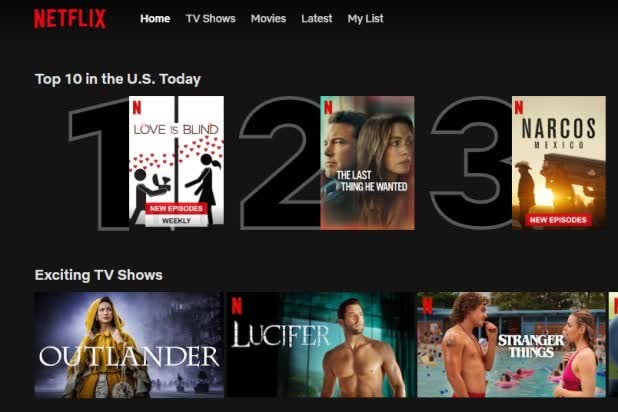

(Credit: Netflix)

Netflix didn't just have a busy week for what it was doing behind the scenes, but it had a busy week in general. Outside of the HBO Max/MonsterVerse talks, the company made news with two more areas of expansion.

That's the beauty of Netflix, it's like a shark - it can't stop moving, and that's what we've seen consistently over the years.

The first area is more a long-term play. Netflix will grow its ABQ studios in Albuquerque, New Mexico, by 300 acres and in the process commit to a billion dollars' worth of productions.

In addition to creating over 1,000 new long-term jobs and nearly 1,500 construction jobs, the company is also vowing to support the underrepresented content creators and industry professional in the region. It's a solid move that will allow the streamer to find new talent and continue growing in a space it will control - without having to compete for funding, location and creatives solely in the Hollywood region.

All of which helping to drive the bottom line for investors.

In the short term, though, Netflix also is making moves, and this ties back to another project it pulled the curtain back on earlier this month. As I discussed in a past column, Netflix is bringing a test to France for a linear pre-programmed channel called Netflix Direct. This free add-on is designed to cut through the clutter and help viewers overwhelmed by the streamer's many options to have something chosen for them.

Now comes reports that the UK also got its own test - this time revolving around expanding Netflix's "Top 10" list to a "Top 50" list. News of the test was welcomed by many as the idea of helping viewers have an easier time finding content has long been something a vocal minority has hoped would be addressed.

A Top 10 list helps, but it's also very limiting, and it also doesn't take much guess-work as to what will be on it. Yet being able to dive down deeper should really help subscribers find what exactly they want to watch versus what an algorithm thinks they should watch.

The other interesting aspect here ties into Netflix continually being criticized for its decisions to cancel programs after just two or three seasons. While Netflix refuses to give real numbers, an expanded "top" list would let people see exactly where certain content places. So now if a series fails to break the Top 50 for a consistent period of time, it's all the more likely Netflix doesn't see it as valuable enough to keep making new episodes.

It's just a small thing, but in this ever-growing space, the small things are proving to be the differentiator. Investors in this space have learned it's not just the big moves that drives success, but it's the finer littler points that refine over time.

Netflix has learned that as well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.