Kingsoft Cloud: Buying Ahead Of Short-And-Long Term Drivers

Kingsoft Cloud is the largest independent cloud service provider in China.

It has delivered phenomenal revenue growth amid ongoing digital transformation trends and the increasingly rapid rollout of enterprise cloud projects across China.

I elaborate on Kingsoft Cloud's long-term catalysts and operating leverage.

In the near term, the pending addition of Kingsoft Cloud to the MSCI China All Shares Index could drive interest into the stock.

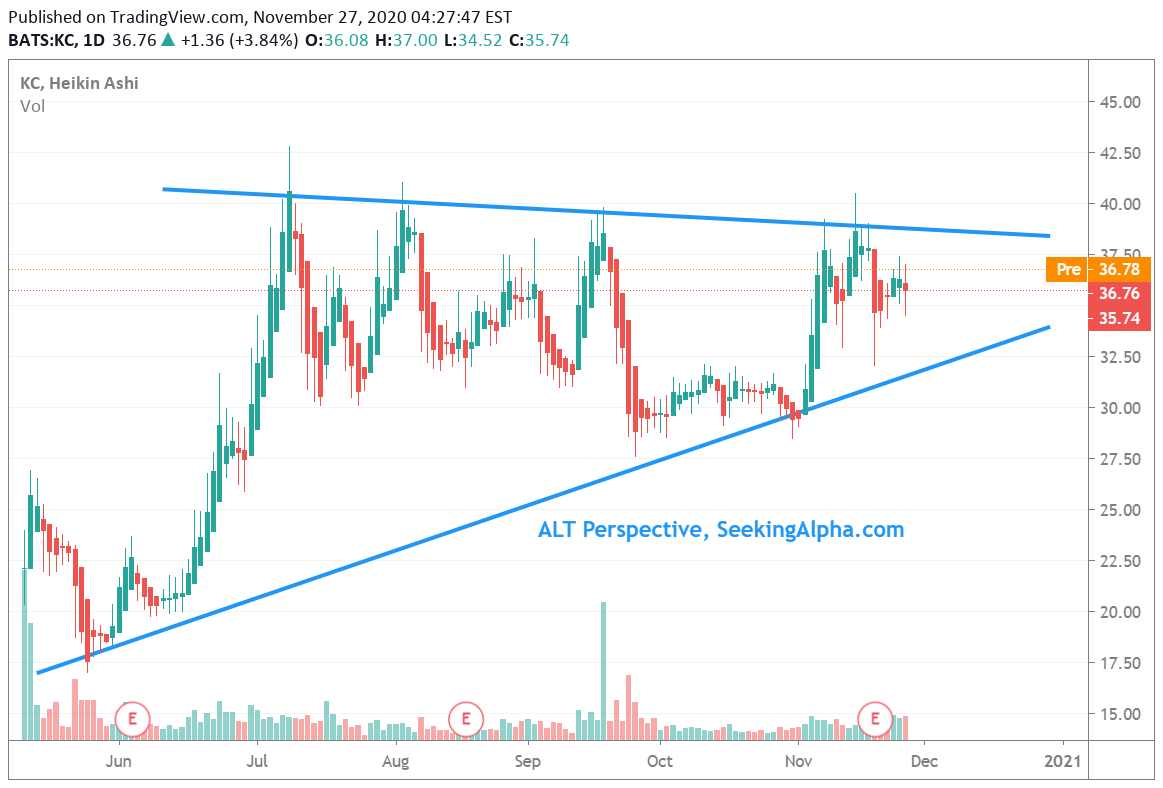

Price chart-wise, Kingsoft Cloud is seemingly trading within an ascending triangle formation.

Kingsoft Cloud Holdings Limited (KC) is the largest independent cloud service provider in China. It was spun off from Hong Kong-listed Kingsoft Corporation Limited (OTCPK:KSFTF)(OTCPK:KGFTY) and made its debut on Nasdaq on May 8, 2020. By virtue of being the first Chinese company to list in the U.S. following the coronavirus pandemic stock market plunge in March, Kingsoft Cloud was able to attract investors keen on riding the remarkable V-shaped China recovery.

Consequently, Kingsoft Cloud was able to close its first trading day up 38 percent to $23.49, from the IPO price of $17, the midpoint of the indicative range. Although the stock backtracked in the weeks thereafter, it rebounded strongly from June and has been trading in a roughly $10 range since July.

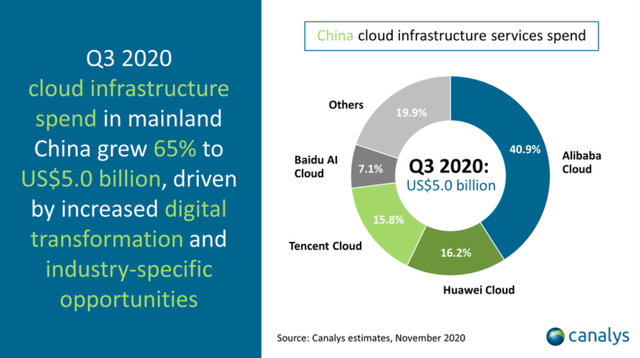

Internet titans Alibaba Group (BABA), Tencent Holdings (OTCPK:TCTZF)(OTCPK:TCEHY), and Baidu (BIDU) collectively held 63.8 percent of China's cloud infrastructure services spend as of the third quarter of 2020, according to research firm Canalys. Kingsoft Cloud, which is understood to be the fifth-largest player after Baidu, differentiates itself from the giants in the fast-growing market with its oft-mentioned neutrality.

Source: Canalys

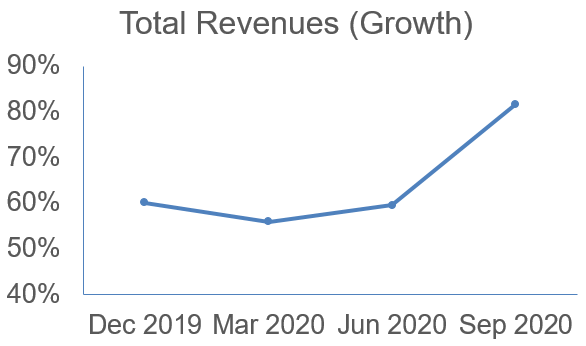

Mr. Yulin Wang, Chief Executive Officer of Kingsoft Cloud attributed the "ongoing digital transformation trends and the increasingly rapid roll out of enterprise cloud projects" across China for the solid revenue growth of 72.6 percent year-over-year [YoY] it achieved in the quarter ending September 2020. As a testament of the strong fundamentals, even as projects were deferred in the first quarter of 2020 on COVID-19 uncertainties and movement restrictions, its YoY growth stayed above 50 percent.

Source: ALT Perspective (company data)

Although the largest business segment of Kingsoft Cloud is the public cloud services, it is the smaller enterprise cloud services that grew rapidly. Revenues from enterprise cloud services jumped 257.3 percent to RMB409.1 million (US$60.2 million) from RMB114.5 million in the same period of 2019. Revenues from public cloud services grew 48.1 percent to RMB1,309.7 million (US$192.9 million) from RMB884.5 million in the same period of 2019.

In the public cloud space, Kingsoft Cloud was able to ride on the government drive to shift to cloud storage and leverage big data. The management cited the example of Hubei province which sought out the company to provide infrastructure as a service [IaaS] and platform as a service [PaaS] for integrated solutions including a hospital information system via the cloud and digitalizing medical records.

In the financial services sector, Kingsoft Cloud emphasized its neutrality advantage (ostensibly as it doesn't have a financial arm unlike Alibaba and Tencent), enabling it to "gain momentum in large banks". The management cited the example of one of the largest state-owned banks tapping the company to "provide secure and stable services to a national commercial bank with nearly RMB7 trillion in assets."

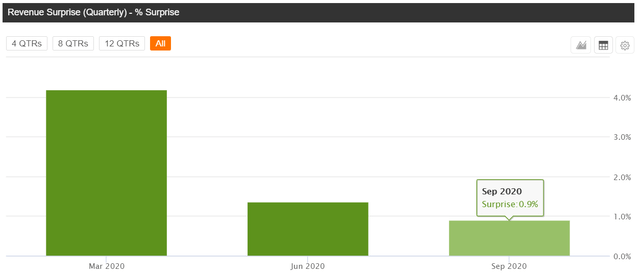

Unfortunately, while the third-quarter results were pleasing, the market was disappointed with the fourth-quarter revenue forecast of RMB1.88-1.95 billion versus the RMB1.98 billion consensus. The stock sold off following the weak guidance. With Kingsoft Cloud delivering a mere 0.9-1.4 percent revenue beat for the past two quarters, shareholders are probably not believing that the management was low-balling their guidance to deliver a surprise eventually.

Source: Seeking Alpha Premium

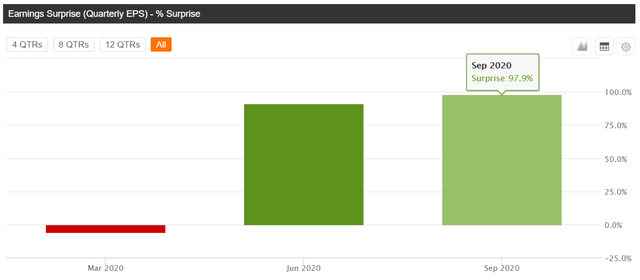

However, shareholders should take note of the wonderful earnings surprises Kingsoft Cloud has achieved in the past two quarters. With more than 90 percent beats, if the company continues this trend, the EPS would turn positive much faster than analysts are projecting.

Source: Seeking Alpha Premium

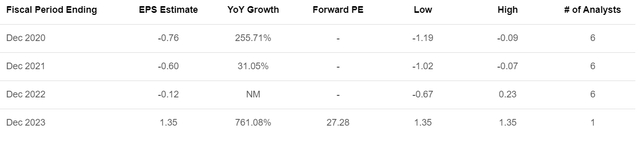

According to the data (available to Seeking Alpha paying subscribers), Kingsoft Cloud could see a positive EPS from 2023. The company has seen a tripling in its non-GAAP gross profit margin in the third quarter, jumping to 6.6 percent from 2.1 percent in the same period in 2019.

Source: Seeking Alpha Premium

Gleaning from the earnings call, I derived that Kingsoft Cloud has economies of scale and operating leverage from similar projects that it secures. For instance, it cited projects in the healthcare sector that are "highly standardized" and replicable.

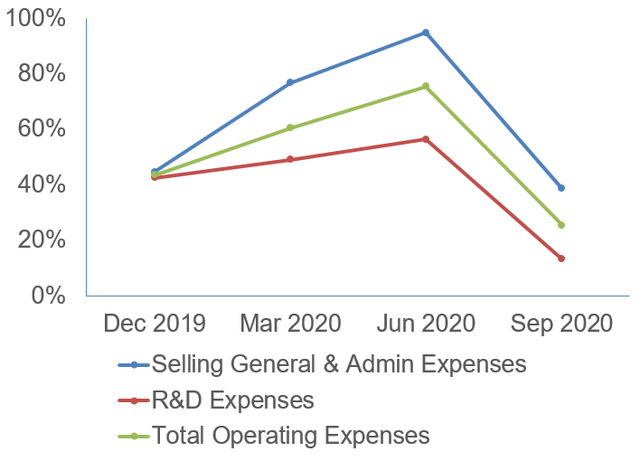

YoY changes in selling and marketing expenses, general and administrative expenses, and research and development expenses reversed the trend in the last reported quarter. Consequently, the growth in total operating expenses stopped accelerating and increased just 25 percent YoY, compared to 75 percent YoY in the previous quarter.

Source: ALT Perspective (company data)

Ultimately, investors are looking for fast revenue growth at Kingsoft Cloud. Analysts are projecting a slowdown in its revenue growth but still expect a rapid 32 percent YoY increase five years down the road. The management believes video cloud, gaming cloud, and education cloud to "keep growing in the future".

Source: Seeking Alpha Premium

Although there were initial concerns about ByteDance's (BDNCE) launch of its own cloud business, the CEO clarified that they do not target the "same field[s]". Kingsoft Cloud also still maintains "a very close and healthy relationship" with ByteDance.

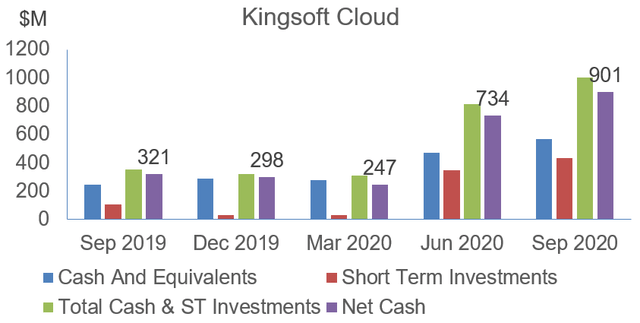

Following the IPO, Kingsoft Cloud has seen its cash and short-term investments swell and continued to grow in the quarter ending September 2020. More impressive is that the net cash is nearly as high, indicating a low debt level. The chief financial officer said during the earnings call that the company was "sufficiently funded at this moment". This reduces the concern of a dilution from near-term fundraising which could drag down the share price.

Source: ALT Perspective (company data)

With the third-quarter results already announced last week, the short-term share price driver now turns to the pending addition of Kingsoft Cloud to the MSCI China All Shares Index (KALL) which will take place as of the close of November 30, 2020.

Price chart-wise, Kingsoft Cloud is seemingly trading within an ascending triangle formation. This is a bullish chart pattern but only confirmed if the stock breaks decisively above the multi-months resistance level now hovering above $38. With the triangle nearing "completion" by early 2021, bullish investors could get on board before the cloud potentially reach for the sky. Those who are cautious should wait for the breakout on the upside.

Source: ALT Perspective (drawn on TradingView)

What is your take? Share your thoughts with the Seeking Alpha community in the comments field. If you like this article, click on the orange "Follow" button and make sure the "Get email alerts" is checked so that you will be informed of my next article the moment it's published. Leaving a comment would ensure you have access to the comments stream after the article goes behind the paywall.

Disclosure: I am/we are long BABA, BIDU, TCEHY, KC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.