American International Group, Inc.: Warrants Overvalued Vs. Call Options

In 2011, American International Group issued publicly-traded warrants that expire in January 19, 2021, with an exercise price of $45 per share.

These warrants currently traded significantly higher than the company's call options with similar terms.

The warrant holders could swap out of the warrants into the call options for the same risk profile but better upsides.

Investment Thesis

Besides common stock, American International Group, Inc. (AIG) also has publicly-traded warrants (AIG.WS) outstanding with a strike price at $45 and the expiration date on January 19, 2021. The warrants traded at $1.40 per share as of November 24, 2020, while AIG call options with similar terms ($45 strike price and expiration date on January 15, 2021) traded just at $0.70 per share.

At these price levels, the warrant holders should sell the warrants and roll the proceeds into the call options to pick up twice as many underlying shares. If AIG stock price indeed goes above $45 per share by January 15th next year, the prices of warrant and call option should converge but call option can be exercisable into twice as many AIG shares. If AIG stock price fails to hit $45, both warrant and call option will expire worthlessly. So, by doing this switch trade, call option will have twice the upside while the downside is the same as warrant.

By the time this writeup is published, the price gap between AIG warrant and call option may have already narrowed or converged. However, it always makes sense to monitor the relative value relationship between this pair and do the switch trade if the price gap becomes significant again.

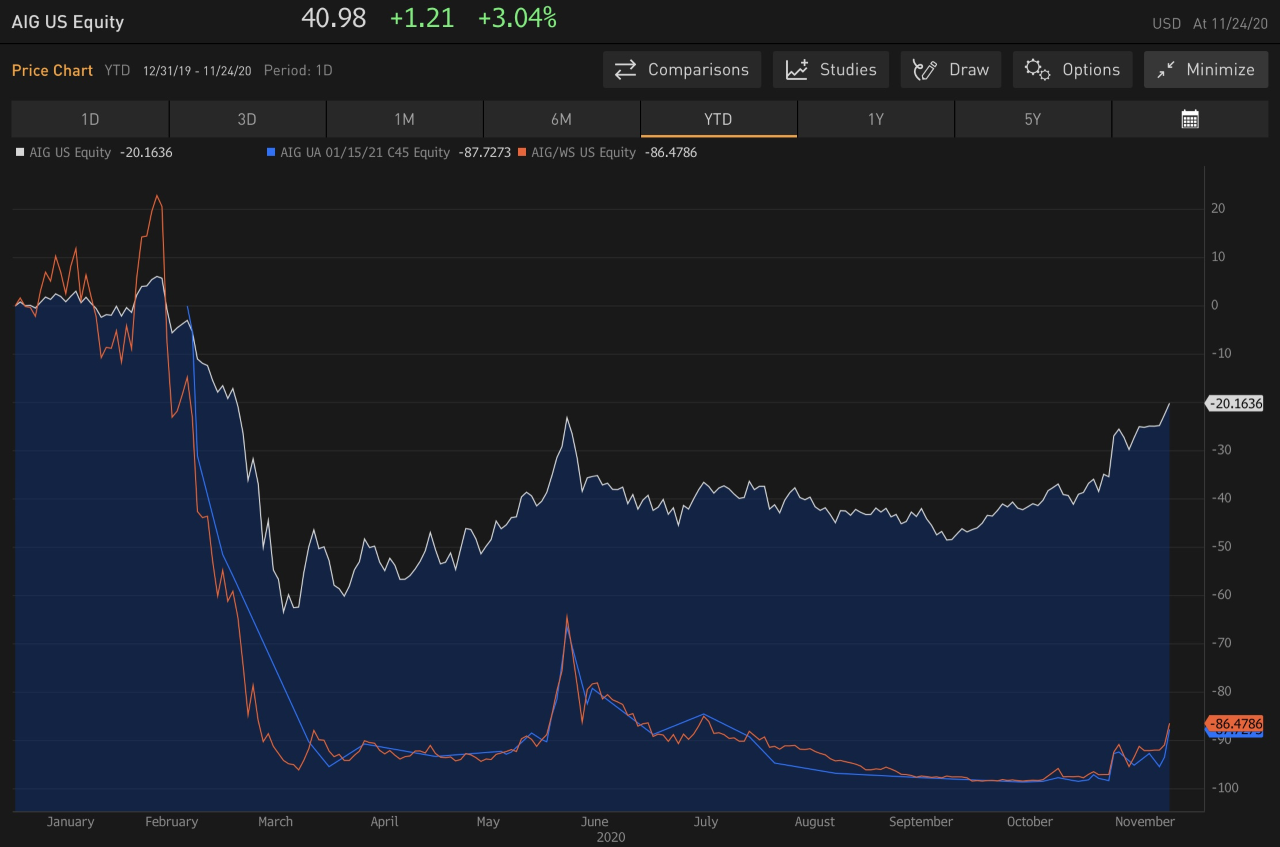

AIG Stock vs. Warrant vs. Call

Source: Bloomberg.

AIG Warrants vs. Call Options

On January 19, 2021, as part of its recapitalization, AIG issued to its common stock shareholders 10-year warrants in the form of a dividend. The warrants have an exercise price of $45 per share and will expire on January 19, 2021. Per the company 10-K, there were 55,951,659 AIG warrants outstanding as of December 31, 2019. The warrants are publicly-traded on NYSE with the ticker AIG.WS.

AIG.WS payoff structure could mostly be replicated by AIG call options with $45 strike price and January 15, 2021, maturity date. The table below summarizes the key terms of the warrant and call option of AIG.

Term Summary: AIG Warrants vs. Call Options

AIG Warrant | AIG 1/15/2021 $45 Call | |

Strike Price | $45/share | $45/share |

Expiration Date | 1/19/2021 | 1/15/2021 |

Shares Outstanding/Open Interest | 55.95 million** | 10,699 |

Market Price (Bid/Ask) | $1.40/$1.43 | $0.62/$0.70 |

*As of 11/24/2020

**As of 12/31/2019

Source: Bloomberg and company filings.

One thing that really stands out from the table is that the warrant price was twice as much as that of call option. If a warrant holder owns 100 shares of warrants, he could potentially sell them at $1.40 per share and roll the proceeds ($1.40*100=$140) into 2 contracts of call options at $0.70 per share ($0.70*200=$140). By doing this trade, the investor will:

1) Own 200 shares of underlying AIG common stocks via the two call contract

2) Have the same downside as both warrant and call option will expire worthless if AIG stock does not hit above $45 per share by January 15, 2021

3) Have twice upside if AIG stock price goes above $45 by January 15, 2021. To illustrate this with an example, if AIG stock reaches $50 per share by January 15, 2021, both warrant and call option prices should trade close to $5 per share (i.e. market price minus strike price). So, 100 shares of warrants (100 underlying AIG shares) will be worth $500 while 2 call option contracts (200 underlying AIG shares) will be worth $1,000.

Given where AIG common stock traded on November 24, 2020, it would not be a stretch to assume it could go up another 12% to above $45 over the next seven weeks, especially under current market conditions. So, this switch trade for existing warrant holders might most likely play out.

AIG Warrant vs. Call

Source: Bloomberg.

Key Risks

The switch trade is not without risks. Besides expiring worthless as mentioned earlier, there are three more risks for consideration:

1) Expiration dates mismatch. The warrant expires on January 19th and the call option on January 15th. What could happen is AIG stock trades below $45 by January 15th (call option expires worthless) and jumps above $45 on Jan 19th (warrant expires in the money)

2) Structural difference between warrants and options. Warrant is different from option in several ways. One key difference is that warrant is issued by the company directly to the investors and the company can revise the warrant terms before expiration, such as strike price and/or expiration date. Options are just financial instrument traded between investors and the underlying company cannot make any changes to the option terms. For example, AIG could extend the warrant expiration date which increases value of a warrant vs. the call option expiring in January.

3) Warrants buyback. AIG warrants are included in the company's $1.5 billion share repurchase program together with common stocks. When and if the company can buy them back to reduce potential dilution while call options will not be repurchased by AIG.

Conclusion

AIG warrants currently traded twice as much as its call options with similar terms. If the warrant holders believe AIG common stock could go above $45 per share at the expiration next January, they could switch into the call options for likely better upsides. The downside risk of owning the warrants and call options are the same, i.e. expiring worthless if AIG stock trades below $45 by the expiration date.

Disclosure: I am/we are long AIG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.