PTY: Not A Good Time To Buy This High-Yield CEF

After a huge drawdown in March, PTY has clawed back most of its losses.

However, it's done so in large part due to its premium to net asset value surging to 28%. NAV remains down meaningfully from pre-pandemic levels.

With the Fed's corporate bond buying effort set to slow down after December, look for weakness in the high-yield space.

At a large premium to NAV and with risk to the downside in corporate bonds here, PTY is not attractive today.

The PIMCO Corporate & Income Opportunity Fund (NYSE:PTY) is one of the most popular closed-end funds "CEFs" with retail investors. And it's not hard to see why. PTY pays a monthly dividend at a current 9% yield.

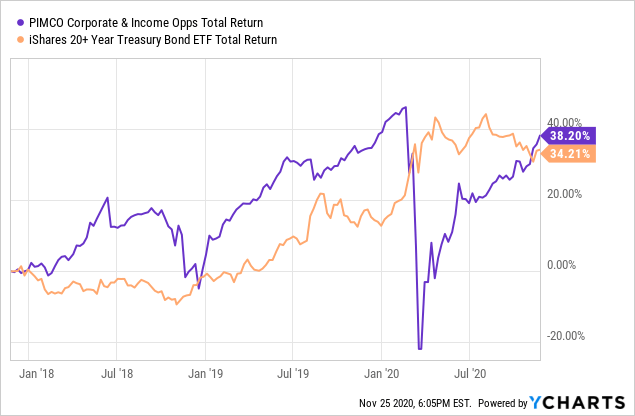

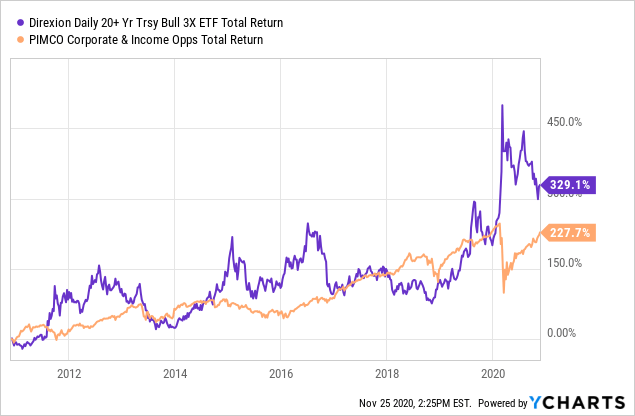

And its historical performance has been strong, even though results have trailed off over the past three years. It has barely beaten long-dated unlevered treasury bonds (TLT) since 2018, and with way more volatility to boot:

That said, PTY has beaten the S&P 500 and government bonds in total returns if you zoom out farther. That's an impressive accomplishment for a fixed income product, even acknowledging the high degree of leverage the fund uses to achieve those returns. Throw in the monthly dividend and it's not hard to see the appeal of the product. So, why isn't it a good buy now?

Past Returns Are Unlikely To Be Repeated

First things first, it will be difficult for PTY to repeat its past successes simply because of where interest rates are. You can make a lot of money owning bonds that yield, say, 9% as they trade down to 6%. You get a fat starting yield and bond price appreciation. As interest rates get closer and closer to zero, however, the ability to make capital gains in bonds declines. And, of course, the coupons on the new paper you buy for the fund also decrease. PTY should still be able to grow NAV in the future, but it will likely be at a slower rate than in the past. Given that PTY's average coupon is down to 4.16%, lower interest rates are really starting to affect the fund's future potential.

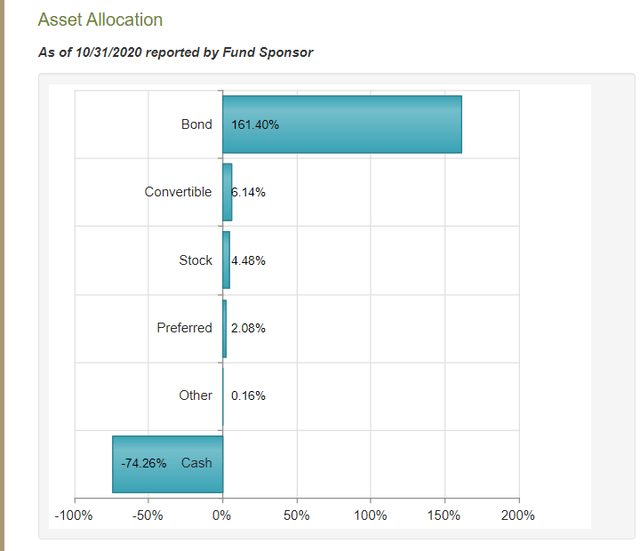

Furthermore, we can see the impact of falling interest rates by comparing a straight-up levered treasury bond fund (TMF) against PTY. You might wonder why I'd use a levered ETF for the comparison? The reason is that PTY itself is 174% long at the moment:

Source: CEFconnect

Anyways, treasury bonds have had low interest rates ever since the financial crisis, so the majority of returns come from bond price appreciation, not yield. As bond yields have continued to plummet, leveraged funds tracking treasuries have done great; TMF is up more than 300% over the past decade, for example:

The levered government bond fund has significantly outperformed PTY over the past decade, even with all the inherent slippage you have in 3x levered funds. Long story short, if bond yields continuously go down, you'll make money owning bonds (yield down, price up after all) regardless of what assets you pick. If you just want to speculate on interest rates, there's no need to add high levels of credit risk to the equation.

I'm generally against leveraged ETFs in general; don't take this as a recommendation of TMF. However, if you simply want a levered play on interest rates going down, you can do it by owning something like TMF or buying government bond futures, and then, you don't have to worry about the premium, high management fee, and credit risk of PTY.

Understand Your Credit Risk

Levered government bonds, unlike PTY, come with another perk: there's no meaningful credit risk. You'll notice the government bond fund sharply outperformed PTY in 2011, 2016, and most dramatically in early 2020 when people started to wonder if corporate bonds would actually be repaid or not. If you're simply making a bet on lower interest rates forever, owning government paper is arguably a better way to play that than via speculating in high-yield bonds with leverage.

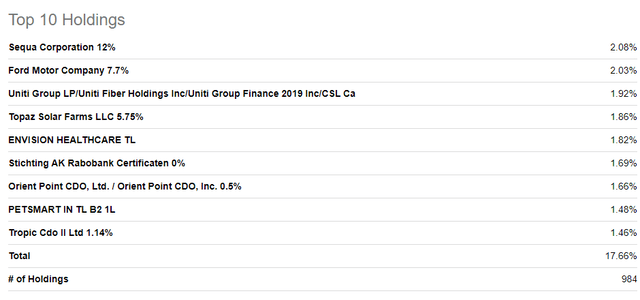

The largest holding in PTY as of this writing is Sequa Corp, which Fitch downgraded to CCC+ earlier this year. Sequa works in a niche of the aerospace business, which is obviously troubled, given this year's events. And even prior to the pandemic, Sequa was generally cash flow-negative according to Fitch. PTY's Top 10 holdings list is not all that much more inspiring:

PTY Top Holdings. Source: Seeking Alpha

You have a variety of hard to understand CDO investments, along with paper from the likes of less than rock-solid companies such as Ford (F) and Uniti (UNIT) in addition to Sequa. Most individual investors seeking safe low-risk income wouldn't pick something like Sequa as a top holding and then add a big dollop of leverage on top of it. I don't have a problem with a CEF doing this, but please do know what you own before you buy.

Additionally, there's some merit to diversifying these sorts of high-risk bets to soften the downside when things go wrong. However, in a real washout, many of these sorts of firms will struggle to pay their bills simultaneously. It's no coincidence that PTY shares actually dropped faster than the stock market back in March.

Generally, fixed income is supposed to be lower risk than stocks, but that's not necessarily the case here. I, for one, would rather own, say, Johnson & Johnson (JNJ) stock as opposed to debt of some cash flow negative aerospace components company during a pandemic.

Treasury Is Turning Off The Corporate Bond Relief Program

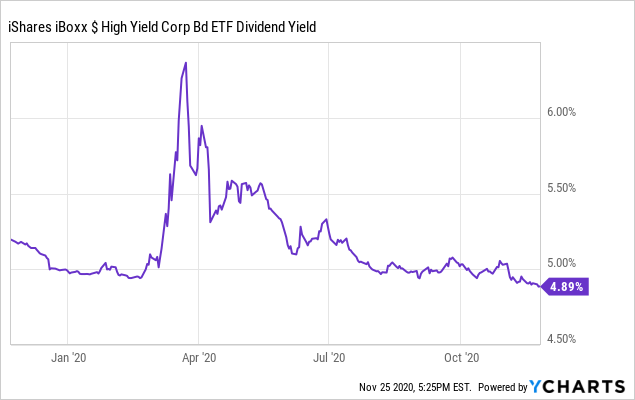

Junk bonds recovered from March with record speed; yields on the iShares High Yield Bond ETF (HYG) just reached a new low, retreating from nearly 7% to just 4.9% now:

Data by YCharts

Data by YChartsWhat caused such a rapid recovery? A big part of it was that the Treasury gave the Fed a huge sum of money with which to go out and buy corporate bonds. When the Central Bank starts hitting the asks on a huge array of bond products, it gives other investors the green light to do the same, driving a rapid repricing of risk.

Now, flip it around. What happens when the Central Bank stops buying bonds? We're about to find out. According to Reuters:

U.S. Treasury Secretary Steven Mnuchin said [last] Thursday that key pandemic lending programs at the Federal Reserve would expire on Dec. 31, putting the outgoing Trump administration at odds with the central bank and potentially adding stress to the economy as President-elect Joe Biden organizes his administration.

In a letter to Fed Chair Jerome Powell, Mnuchin said the $455 billion allocated to Treasury under the CARES Act last spring, much of it set aside to support Fed lending to businesses, nonprofits and local governments, should be instead available for Congress to reallocate.

This was a surprising move by Mr. Mnuchin, as Fed officials had expected the lending support to continue on. Atlanta Fed President Raphael Bostic said that:

“I think given where the economy is, and there is so much uncertainty still out there, it is prudent to keep those things open."

But it appears that the Treasury thought differently, and so these lending programs will start to wind down in just over a month.

Potentially, the Biden Administration may try to reactivate certain Fed authority. However, with the Senate likely to be controlled by the Republicans after the January run-offs, it will be difficult to pass more large stimulus efforts in the new administration. All that to say that the corporate bond market should anticipate much less support in the coming months. That, in turn, will be a negative for PTY's share price.

Big Premium To NAV

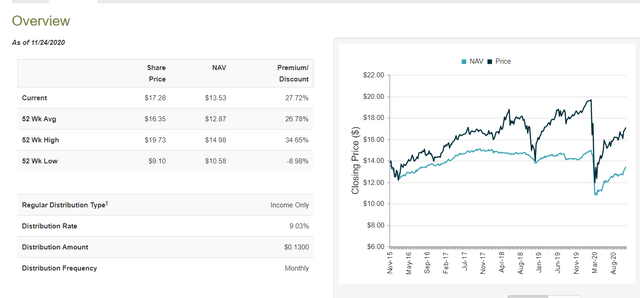

Another issue with CEFs is their premium or discount to net asset value. PTY, along with other PIMCO products, often trade at premiums, given their strong historical performance. However, the premium is not a constant feature, rather it drifts around quite a bit:

Source: CEFconnect

As you can see, in early 2016, late 2018, and March 2020, PTY traded down to its NAV. In March, for example, it briefly hit a 9% discount to NAV. Now, however, PTY is back to a 28% premium to NAV, which is above its 52-week average and is closing in on the peak 35% premium that it has previously reached. In number terms, in March, you could pay $9.10 for $10.58 of assets. Now, you can pay $17.28 per share for $13.53 of assets. One of those is a significantly better offer than the other.

As there have been three opportunities to buy PTY stock at NAV over the past five years, it's not unreasonable to keep this on your radar and look to buy during market sell-offs. At minimum, you can probably get it at a much smaller than 28% premium if you are patient.

If You Want To Buy PTY, Wait For A Rainy Day

If you do want to own PTY shares, the time to buy is during credit events. When people are wondering whether high-yield issuers will have access to capital or not, that's when prices come down, and you can get a fair entry price. In a downturn, you get a double-effect on the share price as the NAV declines and the premium to NAV drops simultaneously. This is how you got PTY's share price down 50% in March even though NAV was down much less than that.

Historically, PTY has produced its enviable total returns in large part from the dividend reinvestment component during down periods. By contrast, reinvested shares in early 2018 or late last year, when credit markets were calm, have produced far lower total returns.

I give PTY's team acknowledgement for doing a good job in a risky asset space - the long-term track record is solid. However, realize that much of it comes from interest rates steadily going down, which won't go on forever, and that the price of PTY periodically drops to NAV. Buying at a 28% premium to NAV while junk bonds are at near-record-low yields is not a recipe for success.

This is an Ian's Insider Corner report published March 29th for our service's subscribers. If you enjoyed this, consider our service to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

Disclosure: I am/we are long JNJ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.