Fidelity MSCI Consumer Discretionary Index ETF- A Few Reasons Why I'm Avoiding This ETF

The ETF lacks diversification, is top-heavy, and is currently overvalued.

There is very little compensatory income yield and the dividend profile is one of the worst in the consumer discretionary space.

The growth-to-value rotation has gained pace in November and some of FDIS's holdings could be susceptible to this shift.

Consumer discretionary macro data shows signs of topping out, and there are also other economic, health, and political risks ahead.

Introduction

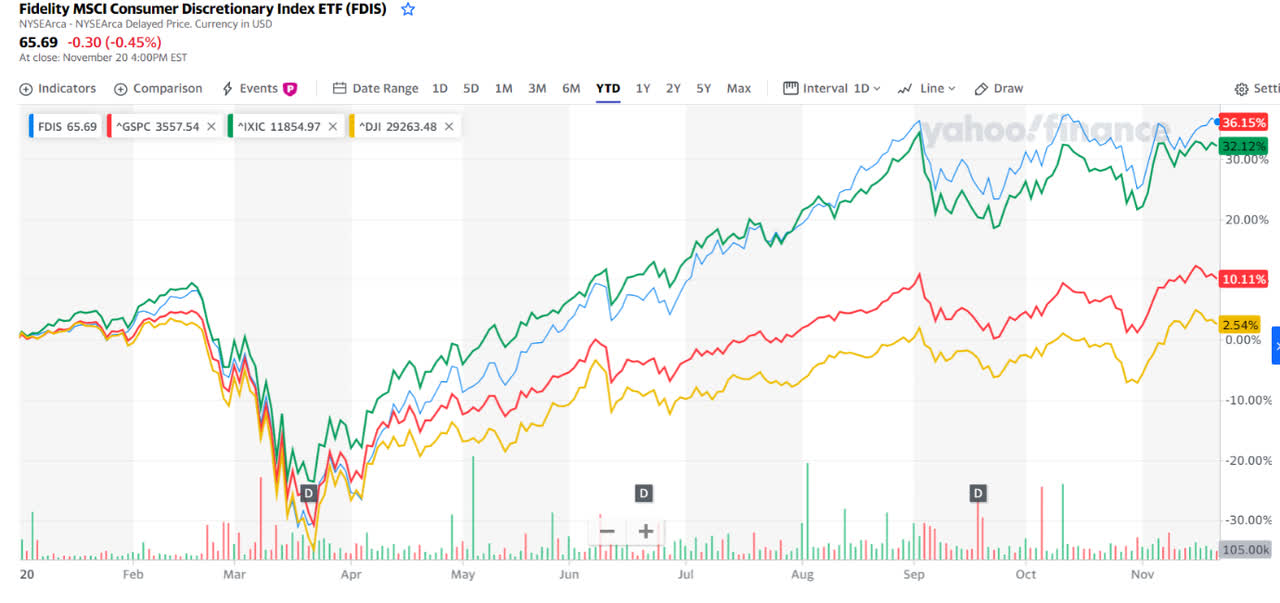

The Fidelity MSCI Consumer Discretionary Index ETF (NYSEARCA:FDIS) has served as an excellent alpha-generating vehicle in 2020, outperforming the three key benchmark indices - The S&P 500 (SP500), The NASDAQ-100 (NDX), and the Dow Jones Industrial Average (DJIA) on a YTD basis. That said, I remain wary of any further outsized gains from the current levels, and will attempt to elaborate on some of my concerns in this article.

Source: Yahoo Finance

Not well-diversified, top-heavy, and overvalued

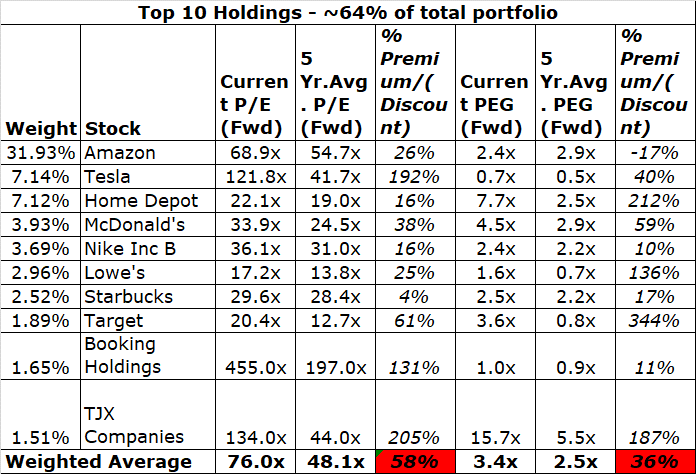

Despite offering investors access to 260 stocks, FDIS suffers from strong concentration risk, with the top-10 making up for more than 64% and one stock in particular - Amazon, Inc. (AMZN), almost making up for a third of FDIS’s total holdings.

From a valuation perspective as well, these top-10 stocks look very expensive relative to their historical averages. As you can see from the table below, from a forward P/E perspective, the top-10 weighted average multiple currently represents a 58% premium to its historical average. Considering these stocks' growth profiles, you also want to consider if the price is reflective of earnings growth potential, and that's where your forward PEG multiple comes in. Except for Amazon, none of the next nine largest holdings trade at a discount to their historical averages. On a weighted average basis, the current forward PEG multiple represents a 36% premium to the historical average. At such steep valuation levels, I believe it's unreasonable to expect even further sustained periods of outperformance.

Source: Prepared by the writer using data from Seeking Alpha and YCharts

Admittedly on account of its strengths in e-commerce and AWS, AMZN's prospects are somewhat less adversely impacted than say a specialty retailer, a home furnisher, or a restaurant player, but I still believe this is an overcrowded space where one is unlikely to find significant upside from these levels. Technically, on the charts, AMZN has not been able to make any progress since its September highs, and had formed something akin to a double top reversal pattern in mid-October; last week we saw another bearish pattern - the death cross pattern with the key 50DMA dropping below the 100DMA - this will likely have awakened a lot of short-sellers.

Source: Trading View

Weak dividend credentials

If you’re looking for income, this is not the place to be. The consumer discretionary landscape has traditionally not been a great dividend-paying sector but FDIS is the weakest of a weak bunch. Over the last three years, dividends have grown at a CAGR of less than 2% whilst the other two big peers in this space - VCR and XLY have seen CAGRs of 5% and 2.7% respectively. At current price levels, you get a minuscule yield of 0.7%, well below its historical average of 1.2%, and also lower than the current yields of VCR (6%) and XLY (0.9%). FDIS's recent dividend record over the last two quarters too has been very disappointing (June dividends were cut by ~40% YoY, and September dividends were cut by ~36% YoY).

Likely rotation ahead from growth to value

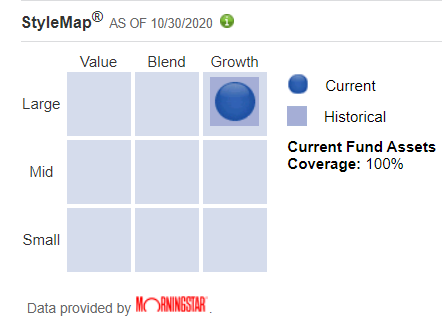

Source: FDIS

From a style point of view, FDIS has been classified as a large-cap growth fund in the Morningstar database, although admittedly, not all the key holdings have demonstrated growth characteristics over the years. Yet still, I suspect a number of growth stocks in this ETF could be susceptible to fund outflows as the growth segment feels overbought, and you’re likely to see some rotation into value names; in fact, it looks as though this shift may have already begun.

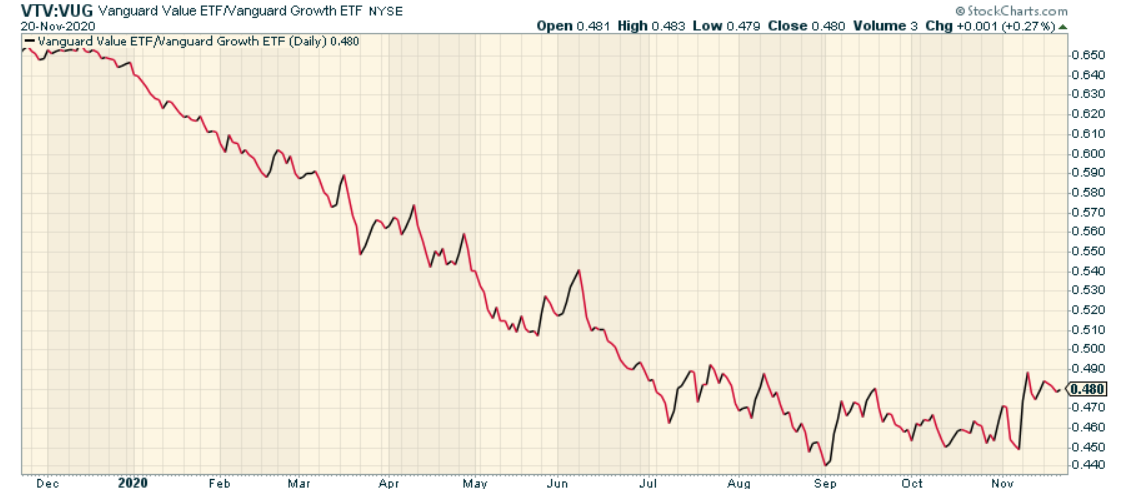

As you can see from the long-term value/growth chart, from 2009 to 2020, the value/growth ratio has tended to oscillate between 0.625x-0.825x; in 2020, we saw this plunge to record lows of 0.45x. However, since the start of November, there has been a pickup in this ratio and it currently trades at 0.48x. Going forward, I would expect a quest towards further mean-reversion, and whilst we may not get back to historical highs, there is still sufficient scope for this ratio to improve; this shift would be bad for the prospects of some key growth stocks of FDIS.

Source: Stockcharts.com

Source: Stockcharts.com

Consumer discretionary related macro not as resilient as many people think it is

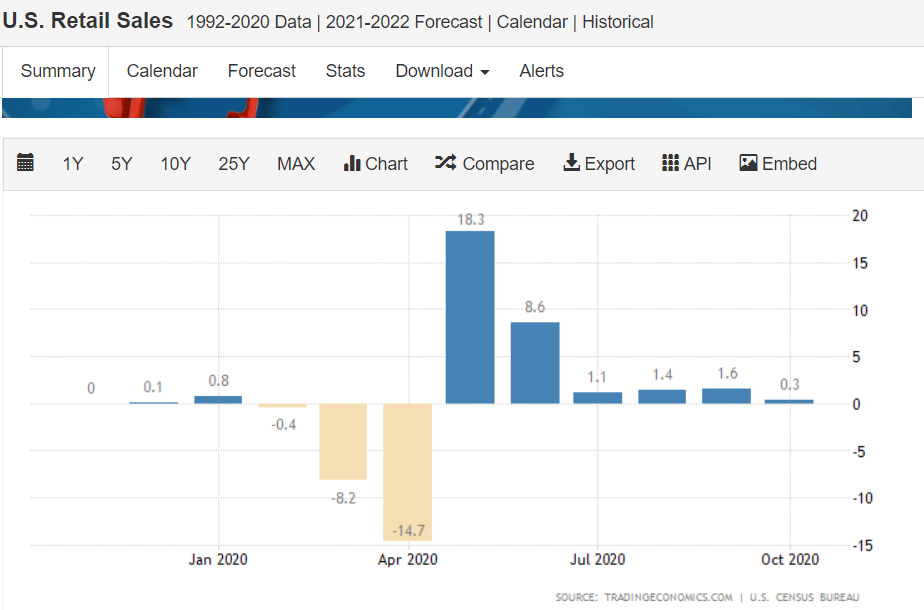

The recent US retail sales and inventory data suggests that the strong momentum we saw post the initial lockdown continues to dim. Last week’s retail sales report showed that October only saw a miserly gain of 0.3% m-o-m, below Street expectations of a 0.5% monthly gain. Also, September’s initial figure of +1.9% m-o-m was scaled down to 1.6% mom. I could be wrong but it has become increasingly clear that the initial ramp-up in retail sales (May and June) was primarily driven by the stimulus cheques handed out by the government, and not on account of any underlying strength at the ground level; without this fiscal support, it is questionable if we would have seen any sizeable momentum at all.

Source: Trading Economics

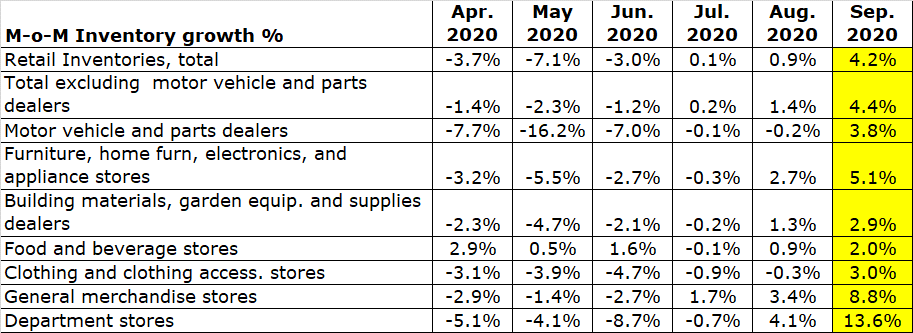

The other metric I look at as a leading indicator is the progression in the inventory levels; when inventory is low and declining, one can expect sales momentum to generally sustain, but when you see inventories increase, this usually tends to mark some plateau or a decline in sales momentum in the months ahead. As you can see from the table below, last week’s retail inventory report for September showed an m-o-m increase in inventory for all seven categories of the retail sales data. This is the first time we are seeing a sequential pickup in inventory across all retail categories since April 2020.

Source: Census.gov

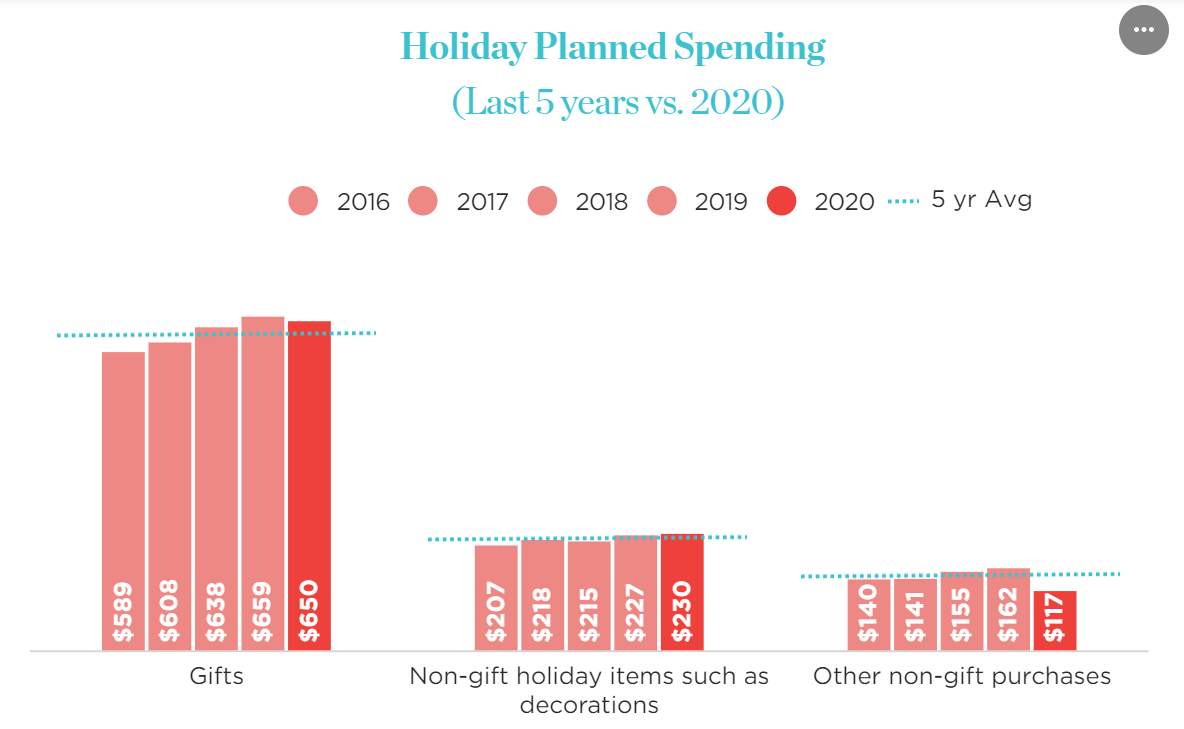

I acknowledge that Thanksgiving weekend should serve as a shot in the arm to help boost the volume run rate in discretionary sales relative to recent months, but I also think discretionary bulls are disregarding the real possibility that the average ticket size of retail goods during the holiday season will likely be lower than what it was last year. As a rough approximation, a recent survey by the NRF (National Retail Federation) covering planned holiday spending in 2020 shows that gifts and other non-gift purchases will be lower than last year (the latter is poised to be significantly below the 5-year average).

Source: NRF

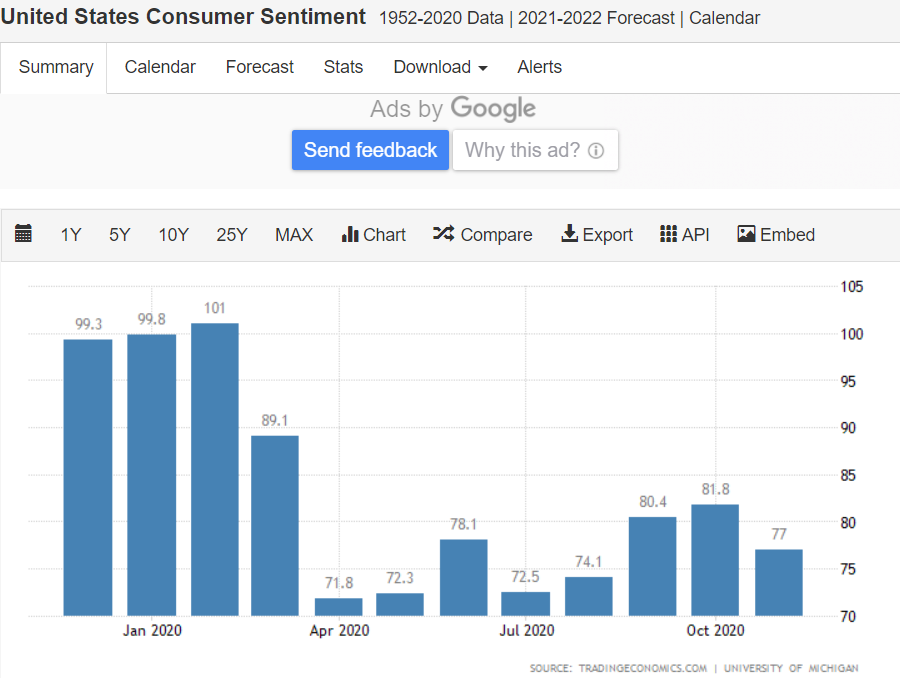

US consumer sentiment is another leading indicator that provides some indication of the future health of the broad discretionary sector and the latest reading for November dropped to 77, well below expectations of 82 and last month’s figure of 81.8. Crucially, the index measuring consumer’s future economic prospects dropped significantly from 79.2 in October to 71.3 in November.

Source: Trading Economics

The employment situation isn’t great either. As per the latest BLS release, nonfarm employment levels are still ~10m lower than the Feb-2020, pre-pandemic levels, and after declining for 5 successive weeks, jobless claims last week rose by ~4.5% on a weekly basis to 742,000. The Pandemic Unemployment Assistance (PUA) program and the 13-week unemployment benefits program will expire after Christmas, and according to a report by The Century Foundation, this will put 12 million Americans at risk.

Over the last few months, discretionary stocks have continued to trend up in anticipation of further stimulus, and an expectation of a slowdown in coronavirus cases. Joe Biden’s victory may help bring further stimulus at some point in 2021, but given the congressional split, it would be challenging to build consensus on the quantum and nature of the stimulus, and I suspect Republicans will be keen to rein in some of the ambitious spending plans that many had envisaged pre-elections.

The other challenge is with regards to the coronavirus cases which don’t show any signs of abating. Cases hit record levels of 195,500 last week and the 7-day average is now 20% higher than a week ago and is up c.5% week on week in 43 states. We are now seeing signs of restrictions being put in place, and a continuation of this could dampen the holiday season that many retail and discretionary players are banking on. This will also dampen confidence in restaurants, hotels, and other discretionary leisure avenues.

Closing thoughts

FDIS has enjoyed its time in the sun, delivering returns of c.36% YTD, but at current price levels, valuations are prohibitive (as per YCharts, FDIS currently trades at a weighted average P/E of 35x), and don't reflect some of the macro risks in-store. The ETF also does not offer you any significant dividend yield that could mitigate any potential fall. I remain wary of further upside. Tread cautiously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.