SDOW - 3x Leveraged Pureplay On The DJIA Heading South

While equity indices infallibly smash one new all-time high after another, questions persist regarding a near-term top.

Global economies reflect conditions only matched by the early 1930s – massive joblessness, destroyed consumer confidence, economic destruction, increased geo-political divisiveness.

And with interest rates at rock-bottom levels underscoring little ammunition left in the monetary policy barrel, it seems sovereign states now intend to spend their way out of trouble.

If overstimulated equity markets are due for a widespread correction, a few go-to instruments in your toolset are indispensable.

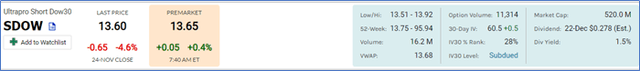

SDOW – Proshares UltraPro Short Dow 30 may likely be one of them.

Brief Thesis

I was first exposed to the ProShares UltraPro Short Dow 30 (SDOW) early in my career as a securities trader, initially questioning its usefulness. Why have a short ETF on the Dow when, if I so desire, I can just short the index? While this essay is not to encourage rife short positions on equity indexes, it remains critical to understand central characteristics of each tool.

And 2 compelling characteristics stand at the forefront of this ETF – the avoidance of hard to borrow fees and the avoidance of any dividend payments a short position on long equity may be exposed to.

Naturally, over the long term, I remain bearish on SDOW because it is designed to persistently lose value over time. But I do recommend it as a go-to mechanism to build near-term tactical trading opportunities and defensive positions. Given the leveraged nature of the ETF, it is not suggested as a long-term portfolio holding.

Source: Market Chameleon

Overview

SDOW is an iteration of a short play on the daily performance of the Dow Jones Industrial Average index. It supplies investors leveraged short exposure to price action in the Dow through a standard ETF offering.

Assuredly, most readers of Seeking Alpha are fully aware of the DJIA and its historical importance in US securities history over the past 100 years – but a quick refresher:

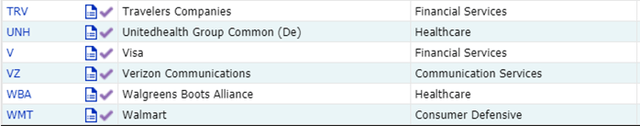

The Dow Jones Industrial Index is a price-weighted stock market index tracking the value of 30 large publicly listed US companies. Created by Charles Dow in 1896, it maintains more historical and symbolic significance than providing a contemporary outlook on the health of the US economy. It is not the oldest however – this accolade goes to the Dow Jones Transportation Average underscoring the importance of the nascent transport sector in the early 20th century.

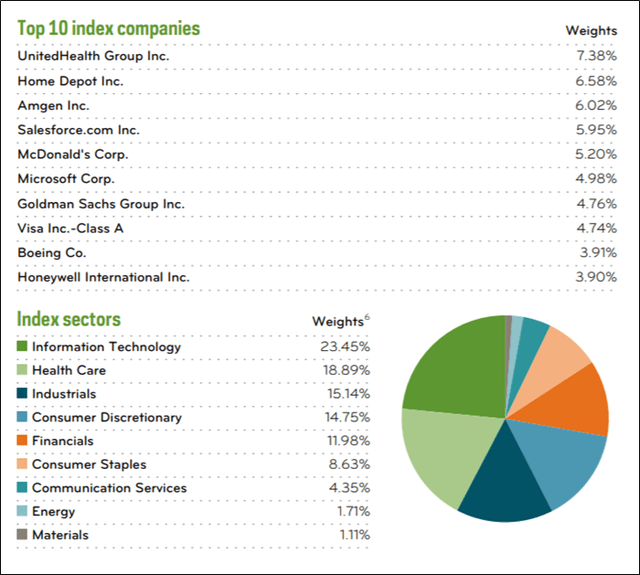

All 30 Dow companies have a presence on the S&P 500 too. Price weighting, as opposed to market-cap weighting, is an important underlying characteristic of the index – it consists in taking the sum of all prices of 30 stocks in the index and dividing by a divisor which is adjusted for stock splits, dividends and other price-altering events.

This type of weighting implies that stocks with more elevated prices will have more relevant impacts on the index's movement with inconsequential consideration given to the actual size of the industry sector or its market capitalization.

The 30 Dow listed companies include the following:

Dow listed companies

Source: Market Chameleon

Structure

The ProShares UltraPro Short Dow 30 is a 3x leveraged exchange traded fund providing inverse exposure to the price-weighted Dow Jones Industrial Average. Due to its structural make-up, a hyper-leveraged bet on movements in the underlying 30 Industrial US components, it should be treated accordingly. Its sole purpose is a tactical trading tool allowing traders to hedge out downside risk during sharp or lasting reversals.

It uses OTC derivatives to occasion the leverage required to build inverse returns, underlining purposeful counterparty risk for any long-term holders.

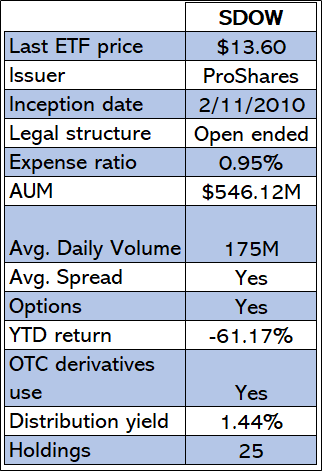

ETF Fact Sheet

Source: Spreadsheet tabulated by author with data from ETF.com

Not unlike other super-leveraged ETFs, which I have written about – such as YINN 3X levered Bull in a China Shop – SDOW rebalances leverage exposure daily signifying that overnight holders of the security will be exposed to differences in expected returns, originated through the effects of compounding.

Volume and assets under management stay surprisingly undersized given the respective importance of the Dow, accessibility to information regarding it and the product’s time on the market. SDOW’s expense ratio continues to be middle-of-the-road in terms of pricing at 0.95%, not as onerous as other more exotic levered ETFs which price at around 1.30%-1.50% but considerably higher than the more prominent household names such as SPY, DIA or QQQ.

It is noteworthy to highlight that ultra-levered thematic plays generally carry a higher expense ratio, as the costs associated with administering OTC derivative transactions remains significant.

Annual Returns Year to Date - SDOW

Source: Tradingview

Eyeballing price returns year to date on SDOW does stress a few things:

- The mechanical nature by which the product loses value, exposing it to multiple reverse splits to avoid long-term value destruction.

- The explosive nature by which the product can swing to the upside during times of hyper volatility like what we witnessed in March earlier this year.

Composition

Source: ETF Fact Sheet

Recent Volatility Profile

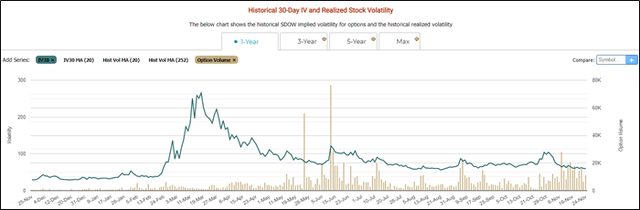

Volatility Profile SDOW YTD

Source: Market Chameleon

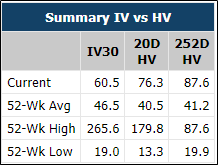

Summary Implied Volatility v Historical Volatility

Source: Market Chameleon

Current implied volatility of SDOW weighs in at 60.5 which is in the 28th percentile rank. This highlights the comparably muted volatility and emphasizes the momentous move to the upside which has recently been seen on the Dow 30. Presently, 30-day at-the-money implied volatility is approximately -18% below its 20-day moving average, underscoring a trend to the downside. It is also worth pointing out the 52-week high IV30 ranks as a gauge of how explosive the product can punctually be to the upside.

Key Takeaways

- ProShares UltraPro Short Dow 30 despite being on the market for some time is possibly less well-known than its run-of-the-mill long opposites such as DIA.

- The ETF is 3x leveraged and uses over the counter derivatives to achieve targeted leverage. This implies that it is only useful for short term trading and hedging only – it also carries a specific risk profile associated with ultra-leveraged ETF pure plays.

- SDOW allows traders to build tactical bearish positions against the Dow Jones Industrial Average without necessarily being exposed to dividend payments or hard to borrow fees which could be associated with simply selling a long Dow 30 ETF such as DIA.

- Expense fees remain at the higher end of global ETF offerings, reflective of the costs associated with managing multiple OTC derivative transactions to generate leverage.

- Like all leveraged ETFs, SDOW comes with considerable capital destruction risk generated by its volatility profile.

SDOW despite being relatively unknown, has been a part of the leveraged ETF mainstays allowing traders to build tactical hedged positions against the Dow Jones Industrial Average Index while avoiding some of the peculiarities of holding long assets short. It presents noteworthy characteristics, its hyper-leveraged profile, tactical trading nature, and OTC derivative usage which put it in the category of high-risk ETFs.

Accordingly, traders should make themselves fully aware of the fact sheet before building meaningful positions. Given the current macroeconomic environment the world is facing – with multiple structural, monetary, and fiscal headwinds on the horizon – it is worth keeping SDOW in the toolkit for limited punctual future use.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.