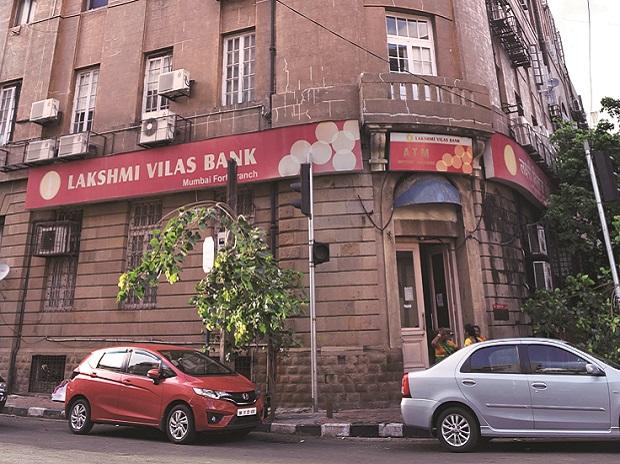

The Madras High Court has refused to stay the merger of Lakshmi Vilas Bank (LVB) with DBS Bank India. The court adjourned the plea moved by AUM Capital Market Pvt Ltd challenging the merger to January 21.

Today, a division bench of the Madras High Court consisting of Justice Vineet Kothari and Justice M S Ramesh said "no blanket interim order can be granted against the merger as the scheme has already come to operation".

They said the Centre and RBI are free to proceed further with the merger as per the scheme. The bench adjourned the hearing to January 21 and asked the Centre and the RBI to file counters, while rejecting RBI and DBS India request to keep in abeyance the order not to take any further actions prejudicial to the shareholders of LVB for three weeks.

The petitioner alleged that the merger scheme had been devised in violation of the Banking Regulation Act which requires the RBI to take into consideration all the stakeholders of the bank that is being merged.

The Madras High Court has asked DBS Bank India to give an undertaking that it would compensate the shareholders of LVB in case the writ petition filed against the amalgamation scheme is decided against it

“It was argued that after protecting the interests of depositors and the creditors, one has to explore the avenues for protecting the shareholders, but here it was not done. The decision taken to merge LVB with DBS Bank India was arbitrary and devious,” PS Raman, who appeared for the petitioner, said.

He said the court was also told that DBS Bank India was ready to acquire 50 per cent stake in LVB earlier for about Rs 5,000 crore which the RBI declined then, but now the entire LVB is given free of cost to DBS Bank India.

“The court was told that thousands of shareholders had subscribed to LVB’s premium rights issue and in seven months time what would have gone wrong,” Raman told the court.

The lawyer further argued that sufficient notice was not given to the LVB shareholders to submit their objections to the draft amalgamation scheme.

He added, the capital of over 97,000 shareholders was wiped out overnight while the Supreme Court had said at least five days time should be given.

He pointed to the court though the shareholders had submitted their objections to the draft amalgamation scheme, no change was made in the draft and it was announced as the final scheme.

Appearing for AUM, Datar expressed grievance over the entire capital of over 97,000 individual investors being wiped out overnight by way of the amalgamation scheme.

Datar also told the court that it was the first time the shareholders value was wiped out entirely while amalgamating a bank under Section 45 of the Banking Regulation Act. He said there ought to have been a bidding process for LVB.

The counsel for RBI argued that the stay against the amalgamation should not be given as it would result in chaos.

On Thursday, the Bombay High Court on Thursday refused to grant stay on the final scheme of amalgamation between DBS Bank and Lakshmi Vilas Bank which will came into effect today. A group of promoter entities had initiated legal action against the Reserve Bank of India, the Union of India & DBS Bank, seeking claims for shareholders whose entire equity will be wiped out post the amalgamation.

A writ petition was filed in the Bombay High Court by Kare Electronics & Development Pvt Ltd, Pranava Electronics Pvt Ltd and K R Pradeep. A separate petition was filed by Indiabulls Housing Finance which holds 4.99 per cent in LVB. The petition stated while the promoters are not against the amalgamation per se, they argued that LVB has been given away by RBI in a hurry without taking into account shareholders' interest, said the person cited earlier.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU