Despite Recent Rally, IYE Is Stuck On My Avoid List

Energy has had some recent success, but the longer-term trend is still troubling.

While there is some value in the space, compared to other sectors, investors need to be careful as the supply of oil remains high.

IYE is an inferior option, in my view, with similar holdings to other passive ETFs, but a much higher expense ratio.

Main Thesis

The purpose of this article is to evaluate the iShares U.S. Energy ETF (IYE) as an investment option at its current market price. The Energy sector has been the dog of the market this past year, although it has had some recent success. The good news is, despite rising share values, they are still very reasonably priced compared to the market. The bad news is, there are valid reasons for this. The supply of oil remains high, and this reality has accelerated with many global economies still on partial lockdown. As COVID-19 cases continue to climb around the U.S., I do not see a change in this pattern anytime soon. Yes, a vaccine has improved the outlook measurably, but it will take months to complete and distribute it to millions of people. Due to this, the oil futures market is predicting higher prices ahead, but I believe the current signaling is too optimistic, given the macro-realities.

Background

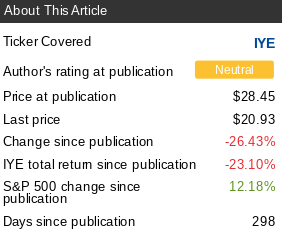

First, a little about IYE. The fund's stated objective is "to track the investment results of an index composed of U.S. equities in the energy sector". This offers investors exposure to companies that produce and distribute oil and gas. IYE is currently trading at $20.93/share and yields 4.97% annually. When I covered IYE back in February, I cautioned investors against this option. Specifically, I felt the Energy sector faced some strong headwinds, and I also found IYE to be inferior to other passive Energy ETFs. In hindsight, this was a good call, but I was not nearly bearish enough, as the fund has seen a 23% drop since then:

Source: Seeking Alpha

Given all that has occurred since this article, including a massive market drop, notable underperformance for the Energy sector, and a recent surge in IYE's share price, I figured it was time to take another look at the fund. After review, I believe Energy's recent gains will be difficult to sustain, and also that better funds exist to play this space. Thus, I am keeping my rating at neutral, and I will explain why in detail below.

Don't Get Overconfident With Energy

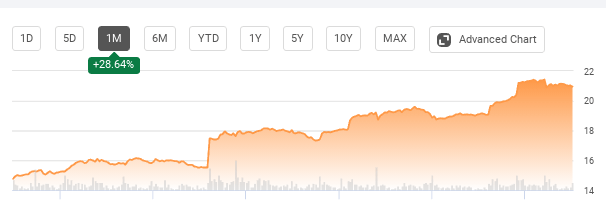

To begin the review, I want to start a quick look at Energy's performance, compared to the broader market. Clearly, Energy has been on fire lately, and that has probably piqued the interest of many investors who have been on the sidelines for a while. In this market "fear of missing out" is very real, and the jump in share prices over the past month has probably encouraged more money to pour in. As a result, IYE is up over 28% over the past month:

Source: Seeking Alpha

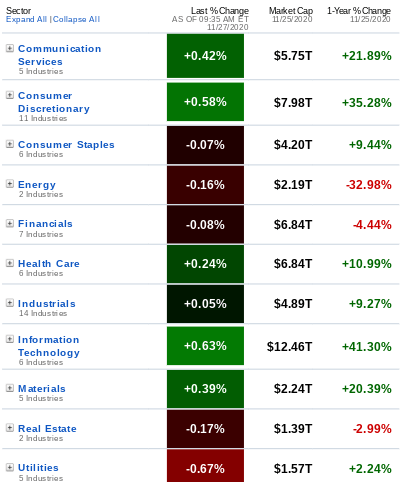

Certainly, this is a great gain in a short time period. But it begs the question - can it last? While Energy and other cyclical sectors will probably perform well as economies re-open, it is important to remember what has been going on over the past year. This helps put the recent uptick in perspective and highlights the risk in buying into this sector that has been the laggard of the entire market. To illustrate, consider the graphic below, showing the 1-year return of each of the market's sectors:

Source: Fidelity

As you can see, Energy is the clear loser this past year. Of course, this opens up a relative value in the sector, so investors may see this as a legitimate reason to keep owning (or buying) Energy. But it also exposes the risk investors are taking. Energy can perform poorly, especially compared to the rest of the market, for a long time. After a 40-50% drop, a 28% rise only helps so much.

My takeaway here is, despite the recent gap higher, the longer-term trend is still bearish. I am not saying that Energy is going to give up all the recent gains going forward, but I do use it as support to avoid getting overconfident in this sector. For those who stay long, they have to accept the very real risk of above-average losses over time.

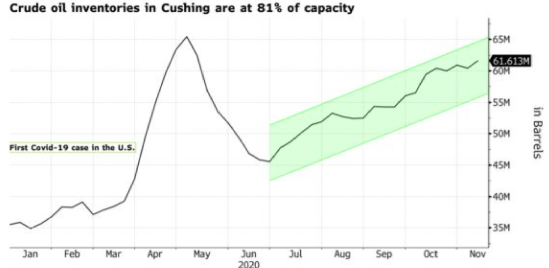

Oil Glut Is Growing Again

My second point looks at the oil market and helps explain why, despite the recent rally, I am reluctant to go "bullish" on the sector at the moment. Certainly, the positive news around the COVID-19 vaccine, along with more clarity regarding the U.S. presidential election, are great for the market and Energy shares as well. Therefore, I do not view the recent gains as unjustified. However, I am concerned with their ability to continue in the months ahead. Yes, investors should expect oil demand to climb in 2021, but the reality is the world is still awash in oil. As lockdowns have persisted around the globe, the amount of oil sitting unused continues to climb, as displayed below:

Source: Bloomberg

My takeaway here is investors should understand that, even if demand rises in the months ahead, there is plenty of supply to meet this demand. This will limit the gains to oil prices in the short term, unless demand comes in well above expectations. Given Energy's sharp rise, this tells me we may be nearing a top, which will limit total return heading into the new year.

Futures Market Suggests Higher Prices Ahead, I'm Not So Sure

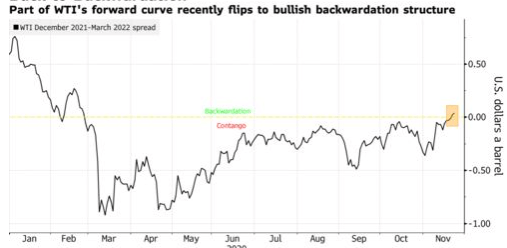

Through this review, my tone has not been very positive. But, in fairness to Energy, the sector has been a great story this past month. Therefore, it is important to consider there is quite a bit of bullish sentiment in this corner of the market, and this could drive further gains. This is a key reason I am not "bearish", as there is enough upside potential to make me wary of shorting this play. Furthermore, while I have my own take on oil's price direction, the futures market has a different take. As oil has risen, so have bets that it will keep going higher. This sentiment has reshaped the oil futures curve, with near-term prices rebounding more than later-dated ones. This has reversed a negative trend that started in late February, as shown below:

Source: Bloomberg

The point here is the market has finally begun to expect higher future prices, rather than lower future prices, which was the expectation since the COVID-19 crisis began. This is a positive signal, but my concern is that the market has now baked in the good news, limiting further gains.

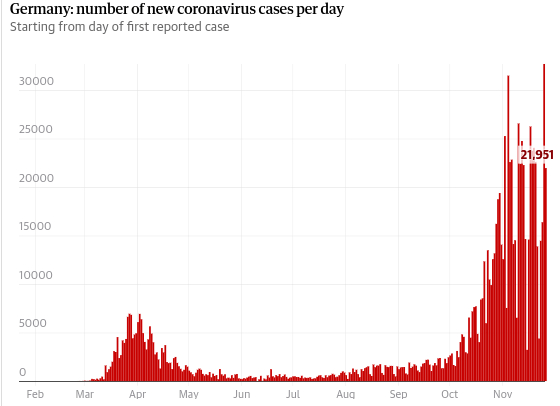

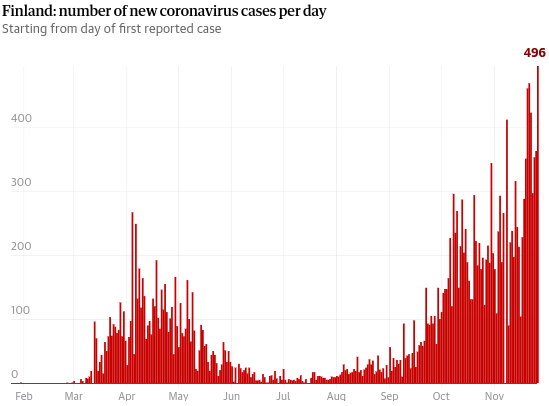

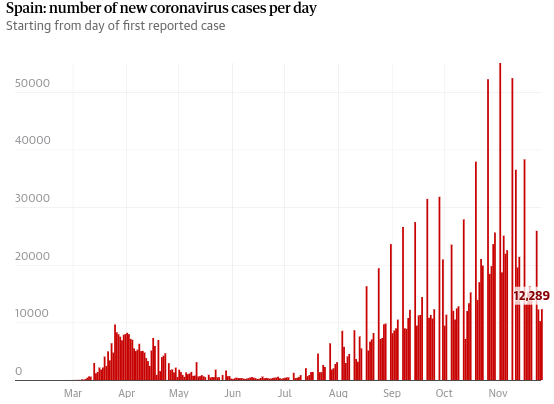

This outlook certainly puts me at odds with the broader futures market. Ultimately, I think the market is simply too enthusiastic right now. The news of a vaccine has accelerated the idea we will be back to normal sooner than expected. But Energy is a volatile sector. While it may be a decent move in 2021 as economies re-open, there is plenty of time between now and then. In the interim, a vaccine is still not on the market, and COVID-19 cases are rising around the globe. While readers are probably aware of the surge in the U.S., we need to understand this is not an American phenomenon. New cases are also spiking across Europe, with Germany, Finland, and Spain as examples:

Source: The Guardian

My thought is we have not seen the last of lockdowns and, if anything, they will probably pop back up in Europe again, similar to what we are seeing here in America. This will keep businesses closed, travel at muted levels, and hurt consumer sentiment. All of these developments will depress demand for oil, which makes me expect prices to decline again before heading higher.

Cost To Own IYE Is Not Worth It

My final point is a simple one, but very important. Specifically, it touches on a key reason why, even if I was bullish on Energy right now, I would not pick IYE as my way to play the sector. While I would not fault anyone for seeing some value in this sector right now, they should consider other passive options instead, in my opinion. The key reason is, the fund's expense ratio is quite high in relation to similar Energy ETFs. For a passive fund that tracks a relatively straightforward index, the current expense ratio of 0.42% raises a red flag to me. While high in isolation, it is especially concerning when we consider what Energy options from Vanguard and State Street charge, as shown below:

| Fund | Expense Ratio | Number of Holdings | Percent of Portfolio in Exxon Mobil (XOM) and Chevron (CVX) |

| IYE | .42% | 36 | 43% |

| Energy Select Sector SPDR ETF (XLE) | .13% | 25 | 44% |

| Vanguard Energy ETF (VDE) | .10% | 115 | 43% |

Source: iShares, Seeking Alpha

Clearly, IYE is much more expensive, and this is an attribute that has persisted for a long time. Therefore, I do not see this as likely to change in 2021 and would certainly advocate selecting either XLE or VDE in the place of IYE.

Of course, there can be valid reasons to pay more for a particular fund. Perhaps, investors are getting active management that is performing well, or perhaps, the underlying holdings are more favorable, justifying the higher fee. Both of these cases, however, do not apply to IYE. This fund is passively managed and tracks an index similar to VDE and XLE, so there is not a compelling reason to own IYE over them. To support this view, we do not have to look much further than the top two holdings of each fund. They are identical and make up a similar amount in each. Ultimately, IYE sports an above-average expense ratio for average holdings. This makes it unjustifiable, in my view.

Bottom Line

Oil prices have finally reversed their downward trend, and IYE has reaped the rewards. Rather than riding this momentum higher, I would exercise caution. COVID-19 cases keep rising, mass distribution of a vaccine is not a short-term reality, and oil supplies have recovered after a drop earlier this year. While Energy does offer some value in relative terms, IYE is not an advantageous way to play the sector. Therefore, I am not upgrading my outlook on IYE, and I would recommend investors consider other Energy ETF options at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.