3 Stocks Top Analysts Say Will Soar in 2021

Sentiment is on the rise because the annus horribilis 2020 winds to an finish. There’s a sense, in any case we now have been by way of over the previous ten months, that issues simply cannot worsen. And so, traders are trying ahead to 2021.

Two large components in market uncertainty are on their option to resolving themselves. First, COVID-19 vaccines are in the works, and two main drug firms have introduced that vaccines will likely be accessible in a matter of months. And second, Democrat Joe Biden will take workplace in the White House, with a strengthened GOP opposition in Congress. The prospect of aid from the coronavirus and a divided authorities unable to enact excessive or controversial measures guarantees us a level of stability that will likely be welcome.

A sense of optimism and a notion that there are alternatives accessible, have Wall Street’s analysts tagging shares for achievement. We’ve pulled up the TipRanks data on three shares that high-rated analysts have tagged as doubtlessly robust investments. These are buy-rated equities, with double-digit upside potential for the approaching 12 months.

LendingTree, Inc. (TREE)

First up is LendingTree, the web market that connects debtors and lenders. The firm presents debtors choices to buy aggressive charges, mortgage phrases, and varied financing merchandise. Among the choices, from a number of financing sources, are bank cards, deposit accounts, and insurance coverage merchandise. LendingTree relies in North Carolina, with workplaces in New York, Chicago, and Seattle.

In the third quarter, the corporate confirmed blended fiscal outcomes. Revenues had been up sequentially, gaining 19% to succeed in $220 million – however earnings had been down, each sequentially and year-over-year. At minus $1.33, the EPS was net-negative, and much under the year-ago quarter’s $1.70.

Covering this inventory for Needham, 5-star analyst Mayank Tandon – rated #66 general out of greater than 7,100 inventory execs – is upbeat regardless of the current turndown after the Q3 outcomes.

Tandon famous, “[We] remain positive on the shares of TREE LT as we believe that the company is well-positioned to generate strong and consistent revenue… Consumer revenue dropped 68% Y/Y as the pandemic constrained consumer credit originations, but trends improved on a sequential basis due to better personal loan volumes and a seasonal boost from the student loan business…”

“TREE’s diversified portfolio of personal finance products and the strong secular trends driving the shift of personal finance advertising and shopping to digital channels will help the company achieve its LT growth targets,” the analyst concluded.

To this finish, Tandon charges TREE a Buy, and units a $375 worth goal. At present ranges, his goal suggests a 44% upside for the inventory in 2021. (To watch Tandon’s observe file, click here)

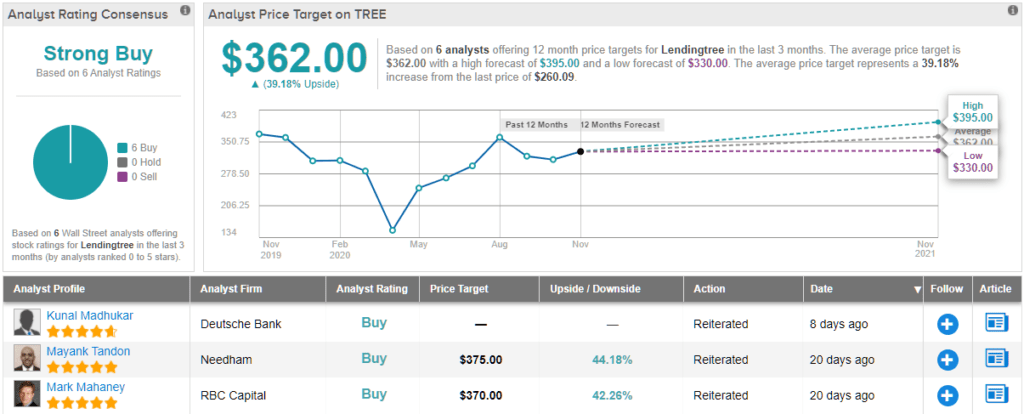

LendingTree has a unanimous Strong Buy analyst consensus ranking, primarily based on 6 Buy evaluations set in current week. The inventory’s common worth goal, $362, implies it has room for 39% progress from the present share worth of $260.09. (See TREE stock analysis on TipRanks)

Allegro MicroSystems (ALGM)

Allegro MicroSystems is a semiconductor firm and fabless producer of built-in circuits for sensor techniques and analyst energy applied sciences. The firm’s merchandise are used in the automotive and industrial sectors, and embody options for creating electrical automobile management techniques. Allegro’s circuit chips can be discovered in information facilities and inexperienced power functions.

Allegro is new to the inventory markets, having held its IPO simply this previous October. The inventory debuted at $14 per share, and the corporate put 25 million shares up for supply. In its first day of buying and selling, it closed at greater than $17 per share, grossing over $440 million for the IPO. Since then, ALGM has gained 35% in lower than 4 weeks of buying and selling.

Vijay Rakesh, 5-star analyst with Mizuho, is clearly bullish on this newly public firm.

(*3*) Rakesh wrote.

Along along with his upbeat feedback, Rakesh offers this inventory a Buy ranking and a $28 worth goal. His goal implies an upside potential of ~17% for the subsequent 12 months. (To watch Rakesh’s observe file, click here)

Overall, this chip maker is a Wall Street favourite. Out of 6 analysts polled in the final 3 months, all 6 are bullish on ALGM. With a return potential of ~18%, the inventory’s consensus goal worth stands at $28.29. (See ALGM stock analysis on TipRanks)

American Well (AMWL)

American Well, additionally known as AmWell, connects sufferers, well being care suppliers, and insurers to advertise high quality care outcomes in a digital world. The firm boasts over 55 main insurers and greater than 62,000 suppliers incorporating its service into their networks, giving entry to greater than 80 million potential sufferers.

AmWell is one other newcomer to the markets. This previous September, the corporate held its IPO and raised greater than $742 million. Over 41.2 million shares had been offered, with the preliminary worth of $18. This in contrast effectively to the 35 million shares and $14 to $16 worth anticipated previous to the occasion.

In its first quarter buying and selling as a public firm, AmWell reported a number of good points in key metrics. Revenue was up year-over-year, rising 80% to succeed in $62.6 million. The energetic supplier whole – greater than 62,000 – represents a 930% enhance in the previous 12 months, and exhibits robust progress for the corporate. And the corporate registered over 1.4 million affected person visits through the quarter, a 450% enhance from the year-ago quarter.

Piper Sandler’s 5-star analyst Sean Wieland notes the significance of community progress for AMWL, writing in his observe on the inventory: “62K providers are using the AMWL Network, up almost 10x from a year ago. The increase was driven primarily by providers employed by, or affiliated with, AMWL’s health systems and payor clients… As the number of providers on the network grows, so does the value of the network; network expansion makes it easier for patients to find the right provider and for providers to find the right patient.”

Wieland charges AMWL an Overweight (i.e. Buy), and his $44 worth goal signifies his confidence in an upside of 78% for the subsequent 12 months. (To watch Wieland’s observe file, click here)

All in all, AMWL’s Moderate Buy consensus ranking relies on 8 evaluations, together with 5 Buys and 3 Holds. The shares are promoting for $24.71 and their common worth goal, at $35.86, represents a forty five% upside potential. (See AMWL stock analysis at TipRanks)

To discover good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this text are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.