Nagaraj Shetti of HDFC Securities feels a sustainable move above 13,150 levels could negate this bearish pattern completely.

The market rebounded sharply after a day of 1.5 percent correction and closed the November series expiry day with one percent gains on November 26, led by rally in banking and financials, metals, and pharma stocks.

The BSE Sensex climbed 431.64 points to 44,259.74, while the Nifty50 jumped 128.60 points to 12,987 and formed bullish candle on the daily charts.

"Technically, this pattern indicates comeback of bulls from the lows, after one session of weakness. The formation of Bearish Engulfing pattern of Wednesday has placed again at the verge of negation," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"A sustainable move above 13,150 levels could negate this bearish pattern completely. Previously, for the few occasions the market has failed to show any follow-through weakness post such Bearish Engulfing pattern. This is positive indication and signals a strength of upside momentum in the market," he said.

related news

The overall market breadth has turned up on November 26, after a decline of November 25, and broad market indices like MidCcap 100 and SmallCap 100 have closed higher by 0.86 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,845.6, followed by 12,704.2. If the index moves up, the key resistance levels to watch out for are 13,073.2 and 13,159.4.

Nifty Bank

The Bank Nifty rose 353.40 points or 1.21 percent to 29,549.80 on November 26. The important pivot level, which will act as crucial support for the index, is placed at 29,107.61, followed by 28,665.4. On the upside, key resistance levels are placed at 29,807.51 and 30,065.2.

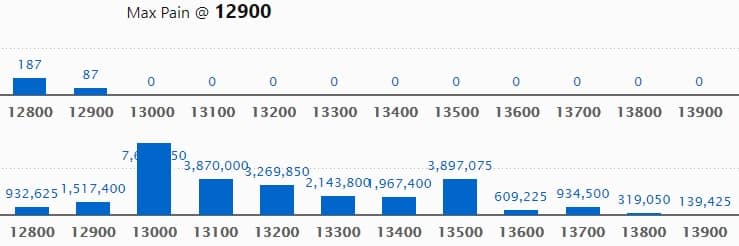

Call option data

Maximum Call open interest of 76.60 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the December series.

This is followed by 13,500 strike, which holds 38.97 lakh contracts, and 13,100 strike, which has accumulated 38.70 lakh contracts.

Call writing was seen at 13,000 strike, which added 32.79 lakh contracts, followed by 13,100 strike which added 1.29 lakh contracts.

Call unwinding was seen at 12,900 strike, which shed 16.11 lakh contracts, followed by 13,500 strike which shed 10.01 lakh contracts and 13,300 strike which shed 5.26 lakh contracts.

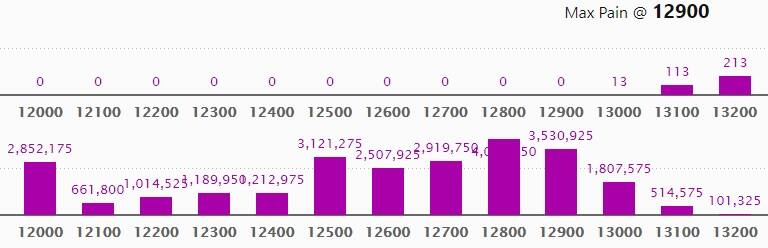

Put option data

Maximum Put open interest of 40.78 lakh contracts was seen at 12,800 strike, which will act as a crucial support in the December series.

This is followed by 12,900 strike, which holds 35.30 lakh contracts, and 12,500 strike, which has accumulated 31.21 lakh contracts.

Put writing was seen at 12,900 strike, which added 13.78 lakh contracts, followed by 12,700 strike, which added 2.43 lakh contracts and 12,300 strike which added 2.10 lakh contracts.

Put unwinding was seen at 13,000 strike, which shed 2.45 lakh contracts, followed by 13,100 strike, which shed 1.89 lakh contracts and 12,500 strike, which shed 1.51 lakh contracts.

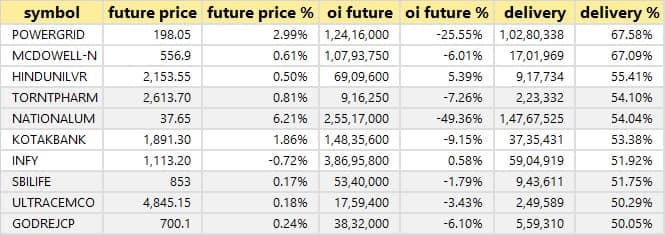

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

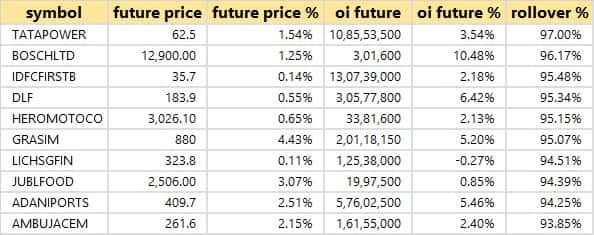

Rollovers

104 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which long build-up was seen.

1 stock saw long unwinding

Based on the open interest future percentage, here is the 1 stock in which long unwinding was seen.![]()

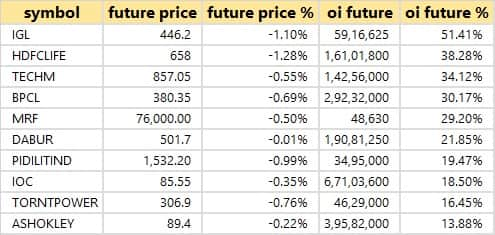

20 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

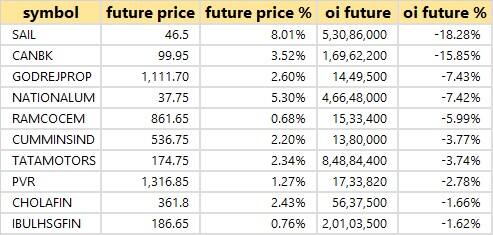

12 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

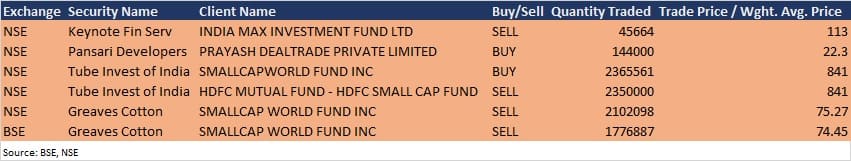

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

IIFL Wealth Management: Company will be participating in Anand Rathi Road Show via Conference call on November 27 and Motilal Oswal Ideation Conference, 2020 on December 18.

Hero MotoCorp: Company will be participating in Nomura Investment Forum 2020 on December 1 and JP Morgan Global Auto Week on December 7.

Bosch: Company will be participating in Virtual Investor Conference organized by Motilal Oswal Financial Services on December 1.

Kennametal India: Board meeting on December 4 to consider the merger of WIDIA India Tooling Private Limited with its holding company viz., Kennametal India Limited.

Sanghvi Forging and Engineering: Company's 32nd Annual General Meeting is scheduled to be held on December 24.

Stocks in the news

AU Small Finance Bank: Bank made strategic investment of Rs 7.70 crore in NPCI, wherein 61,320 equity shares at book value of Rs 1,256 per share are allocated to the bank constituting around 0.44% shareholding of NPCI.

HFCL: Promoter entity MN Ventures acquired additional 5 lakh equity shares in the company via open market transaction.

Action Construction Equipment: Promoter Vijay Agarwal acquired further 6,500 shares in company via open market transaction.

Filatex India: Vrinda Bhageria, daughter of Madhu Sudhan Bhageria, Chairman and Managing Director acquired 7 lakh equity shares in company, increasing her stake to 2.06% via open market transaction.

Mahindra & Mahindra: Subsidiary Mahindra Holdings agreed to sell its entire 100% stake in Mahindra First Choice Services (MFCS) and Optionally Convertible Redeemable Preference Shares in Auto Digitech (ADPL) to TVS Automobile Solutions (TASL). M&M signed a Share Subscription Agreement for subscribing securities of TVS Automobile Solutions (TASL).

Tube Investments of India: Company acquired controlling interest in CG Power and Industrial Solutions via allotment of equity shares & warrants.

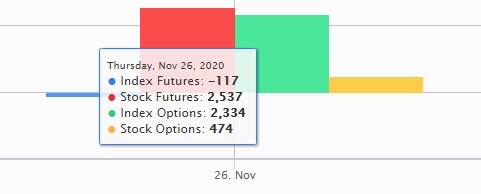

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,027.31 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 3,400.1 crore in the Indian equity market on November 26, as per provisional data available on the NSE.