Hannon Armstrong: Greenback Boogie

Year to date, this is my third bullish post on Hannon Armstrong Sustainable Infrastructure Capital. I called it first when it was about $32, and now, it is about $54, and I am still bullish.

The company’s dual income model of investment and loans, growing profits, a solid $2.5 billion pipeline, and an impressive roster of clients are factors that can propel the stock.

Best of all, there is the massive clean energy push that’s about to happen once the new administration moves into the WH.

We can no longer continue with a status quo energy policy. We must create sustainable clean energy jobs and leave the planet to our children and grandchildren in better shape than we found it. − Jeff Merkley

I am “renewably” bullish on Hannon Armstrong Sustainable Infrastructure Capital (HASI) – this being my third HASI-bullish piece in 2020. I rated it as a buy in January 2020 at around $32, which was before the virus disrupted our economy, and then, again, in August 2020, by which time, it had zipped to $42.

Image Source: Twitter/The Lead-Lag Report

The stock has appreciated to about $54 as of November 24, 2020, and I am still as bullish on it as I was before. In fact, this time, I am even more bullish because President-elect has pledged to spend trillions on renewable energy infrastructure, and there is clarity now on when and how the COVID-19 pandemic will end.

To me, HASI spells greenbacks, and here’s my boogie:

Investment Gains

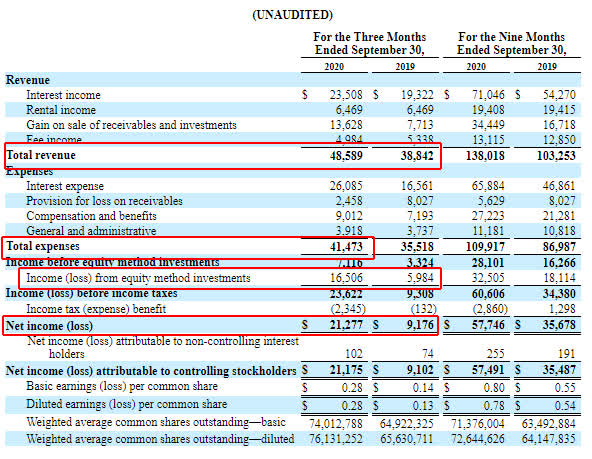

Image Source: HASI’s SEC Filing

HASI reported a net income of $21.3 million in Q3 2020 as compared to $9.2 million in Q3 2019. That’s a 130% increase in net income year over year. The net income rose on account of gain on sale of investments ($6 million) and income from equity investments ($6 million). The company operates a dual revenue model (investment and loans) and is in a sunrise sector.

Its investment portfolio expanded to $2.2 billion in Q3 2020, and the investment pipeline for the next 12 months is worth $2.5 billion. Therefore, investment gains are likely to become a significant contributor to profits in the medium to long term.

Limited Downside

In August 2020, HASI issued 0% convertible senior notes due August 2023 at $48.36, when its stock price was hovering at about $41. The company considers itself among the few dividend-paying companies ever to issue 0% convertible bonds. Also, the near-20% premium to its then-price reflected the demand for the stock.

The transaction reassures investors and analysts that the current price of about $54 faces a limited downside risk.

Reduced Cost of Debt

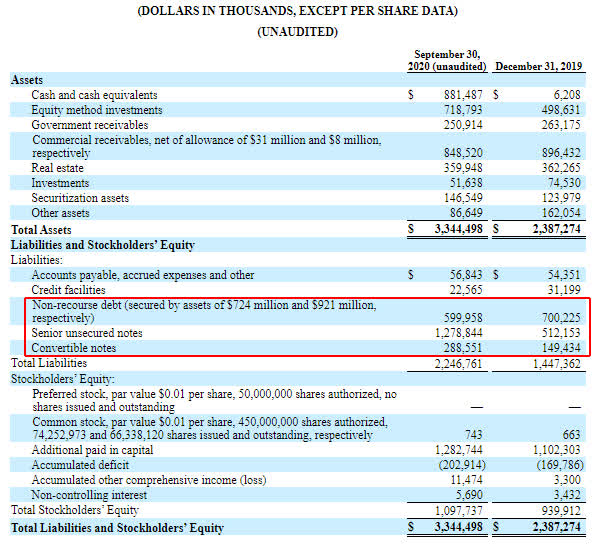

Image Source: HASI’s SEC Filing

HASI’s debt spiked from $1.36 billion as of December 31, 2019, to $2.16 billion as of September 30, 2020, excluding credit facilities – an increase of 59%. Its interest expense spiked to $26 million in Q3 2020 from $16.5 million in Q3 2019, an increase of 57%.

The company’s corporate debt is trading below 4%, and it does not have any debt maturities until September 2022. HASI is regularly and voluntarily using its cash flows to prepay high-cost debt. Going forward, investors can expect to witness a reduction in its quarterly interest expense.

HASI’s Dividend History

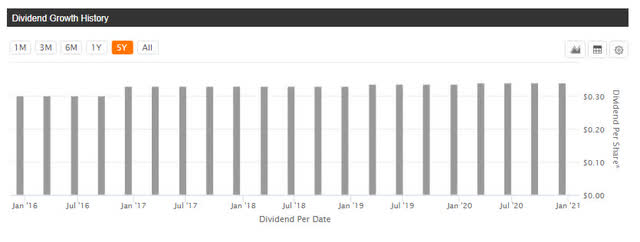

HASI has declared $1.36 as a dividend for 2020, which works to a TTM dividend yield of 2.60% and a payout ratio of 90.85%.

Image Source: HASI’s Dividend History

The company is a consistent dividend payer, and the payouts have grown at a CAGR of 7.81% over the last 5 years. Aside from growth investors, the company’s modest dividend yield and consistent payouts have the potential to attract a variety of investors who prefer value and income over growth.

Summing Up

The outlook for renewable energy has brightened, and HASI seems all set to cash in. Many global energy and renewable power companies are HASI’s clients, and the company’s $2.5 billion pipeline for the 12 months is likely to add more reputed players. It has ready-to-deploy cash and equivalents worth $881 million as of September 30, 2020.

Reducing interest expenses, increasing revenues, clarity on COVID-19 vaccine, potential investment gains, a dual-income business model (loans and investment), and a global inclination to shift to renewable power are factors that work in HASI’s favor. President-elect Joe Biden’s clean energy push can turn out to be the icing on the cake.

HASI is a modest income high-growth play in a business that is about to boom. Just like the last time, I am still bullish on the stock this time too, and consider it as a solid long-term investment.

*Like this article? Don't forget to click the Follow button above!

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.