Pinnacle West: Now Overvalued With Only A Limited Upside

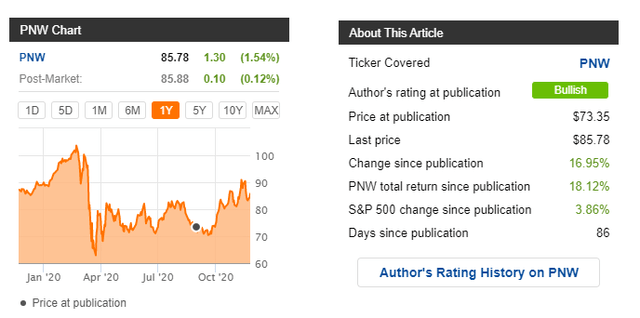

I wrote about Pinnacle West Capital Corporation a few months back. The company, at that point, was a slightly undervalued "BUY".

The price has appreciated, and a few weeks ago, the company breached the "overvalued" level of my price target.

While a qualitative company, an upside of only 3-7% based on conservative valuation estimates means the company is now a "HOLD".

Pinnacle West Capital Corporation (PNW) gives every indication of being a utility company that you want to own. That is the reason I invested in the company on numerous occasions a few months back. The article I published back then gives an indication of the results of such a decision.

(Source: Pinnacle West Capital Corporation - A Utility With A 12% Upside)

While short-term reversion is always positive, it would have been nice to be able to purchase more of the stock at undervaluation for longer. However, at this point, it becomes relevant to look over and adjust the company's thesis somewhat.

In a matter of around 86 days, the picture has changed rather significantly.

Pinnacle West Capital Corporation - How has the company been doing?

For specifics regarding the company and its operation, I direct you to my initial article. In this section, we'll look at 3Q20 - which is the last quarter the company presents us with, and which came in at a significant YoY.

EPS came in at $3.07 for the quarter, an increase of nearly 30 cents compared to 2019. This flowed from a mix of adjusted gross margins as well as pension net benefits, with some offsetting factors from income taxes and D&A.

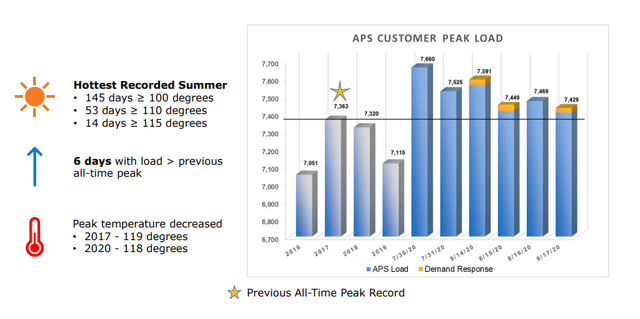

The record summer of 2020 in Arizona certainly played a part in these results...

(Source: 3Q20 Presentation, Pinnacle West Capital Corporation)

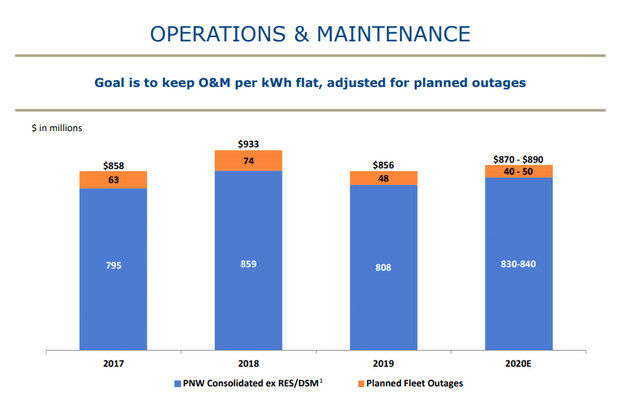

...but there's also some impressive growth in base rates, both current and projected to 2022, and expects around a 6-7 average annual growth rate here. Outages have been few, and plans for maintenance for 2020 look comparative or lower next to previous years.

(Source: 3Q20 Presentation, Pinnacle West Capital Corporation)

Current outages for the company for 2020 have included 3 outages in Four Corners, Palo Verde, and Four Corners again, with only one outage left for 4Q20 with a planned duration of 44 days.

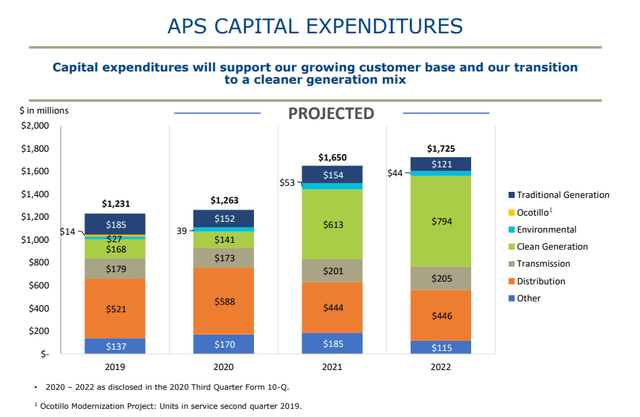

As I pointed out in my more general article on the company, PNW also plans to transition to a "greener" generating base overall, and this is set to increase exponentially as early as 2021-2022.

(Source: 3Q20 Presentation, Pinnacle West Capital Corporation)

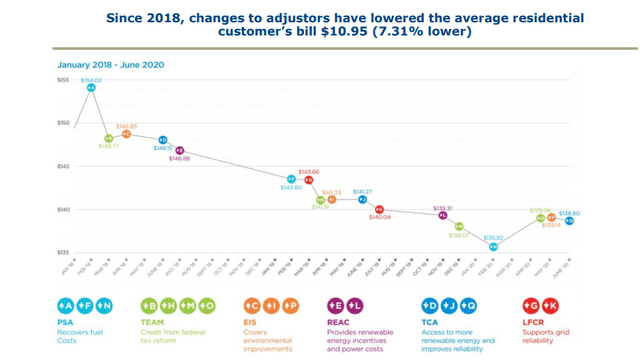

However, while the company is earning more, and rates are rising, changes to adjustor have actually managed to lower the average residential electric bill by 7% in less than 3 years.

(Source: 3Q20 Presentation, Pinnacle West Capital Corporation)

So, Pinnacle West certainly seems to be humming. I mentioned the company's stellar credit and overall fundamentals in my last article - none of that has really changed. The current debt/cap is around 52%, which is mostly in line for a company like this. Remember, we're talking about a regulated utility. The only volatile or cyclical effect here is the gross margins of weather, and there can't be any sort of "steady" or recurring effects here, with 2Q19 giving a -$35M effect and 2Q20 being a positive $37M effect.

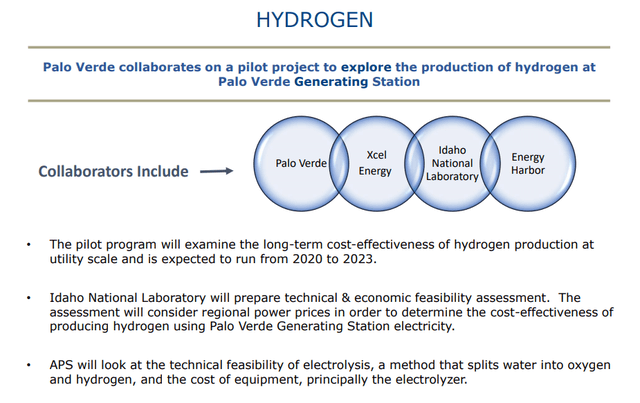

On the innovative, positive side of news, the company's Palo Verde station will collaborate on a pilot project to explore hydrogen production. Intended to run for around 3 years, the company will measure long-term cost-effectiveness.

(Source: 3Q20 Presentation, Pinnacle West Capital Corporation)

On the forecast side of things, the company expects the coming few years to vary some from the typical boring cadence of a utility's earnings and development. 1.5-2.5% annual average growth in retail customers is expected, as companies are expected to, at a higher degree, come to Arizona. There are a number of instances where news will have positive effects for the company in terms of increased demand from large-scale customers.

Amazon (AMZN) is planning 13 new job sites and 3,000 jobs, and housing permits in Maricopa County continue to increase - 30% YoY for 2020 July-August.

(Source: 3Q20 Presentation, Pinnacle West Capital Corporation)

Additionally, Microsoft (MSFT) is constructing all three of its new data centers in Arizona, with 100 permanent jobs and 1,400 construction jobs. More companies are opening centers, including Stream Data Centers, Stack Infrastructure, and other employers as well, like Red Bull. All of these employers will require power, and PNW is well-positioned to deliver on this.

In short, the future for PNW is expected to continue as stable, as boring, and as positive as the previous few years. Utilities are low-growth companies, with fairly impressive dividends that don't grow all that much compared to some other alternatives. In the longer term, the chance is that they actually underperform overall indices - this is especially true if you invest at the "wrong" time, wherein you set yourself up for sub-par rates of return.

Let me show you what I mean.

Pinnacle West Capital Corporation - What is the valuation?

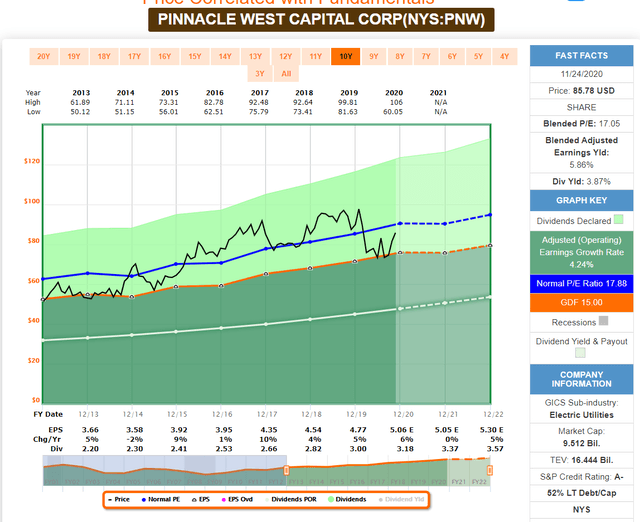

The key for investing in any company is not to overpay. In the case of PNW, it becomes, on a 10-year basis, an exercise in the "fair" value and the "premium" valuation.

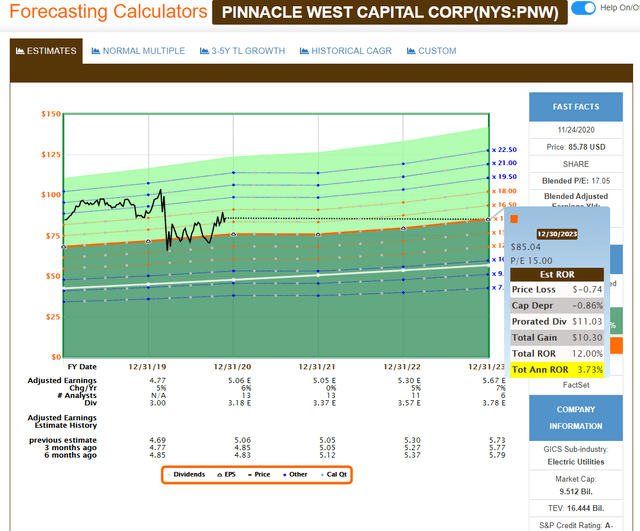

(Source: F.A.S.T Graphs)

As we can see, any time the company touched down on the 15X average weighted P/E-mark, the stock would firmly, at some point, shoot back up, only to eventually come down again. Investing above the premium valuation over time means that your returns will probably be less over time than had you invested cheaper - both in terms of capital RoR and dividends.

A quick comparison. Had you invested at around 20X P/E back in 2017, your returns until today would be 12.5%, or 3.8% annual RoR. That includes dividends and comes to a 1.4% growth ex-dividends. Not that impressive.

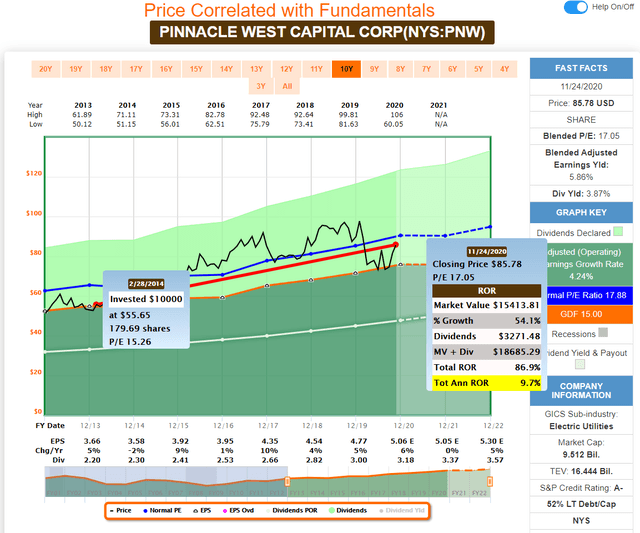

(Source: F.A.S.T Graphs)

Say instead that you'd invested at the last time the company traded firmly at 15X P/E - outside of this year. Well, that's 54% growth and nearly 87% total RoR. Very different. Valuation here is the key, and this also brings us to the problem.

I bought my stake in PNW at close to 15X P/E. That stake is now up, and my dividends are appealing 4.3%+ on my entire position including FX.

However, looking at expectations and what could happen if the company decided to come back down, these forecasts show a somewhat dim set of prospects.

(Source: F.A.S.T graphs)

At an average EPS growth of 4.4% per year, which I believe to be fairly accurate, and where analysts have a 100% hit rate with the company, your returns at a 15X valuation would be no more than 3.7% per year, or a 12% total, with actual negative capital depreciation.

Now, is the company guaranteed to fall? Of course, not. It might trade at higher multiples - but history shows us that PNW as a company is likely to go through these cycles, and I don't see any indication that this has changed. Even giving the company a 16-17X based on current forecasts brings us to no more than a 5-7% annual rate of return. You essentially have to consider the company very premium-valued to get acceptable, 9-11% annual rates of return, and that's a bit too "positive" to hang my hat on - at least for me.

At the same time, we shouldn't exaggerate today's position too much. It's still down from Pre-COVID levels, and there's a potential upside to be had here. I just view that potential upside to be uncertain enough that I no longer consider the company worth investing in. I'm willing to give the utility around 16-17X premium, which means that based on current valuation, the company is 1-5% overvalued. I wouldn't pay more than $81/share for the company, and I'd much prefer under $80.

While the Street might have agreed with me a few months back, they no longer do. Current price targets average from $75-$103 with an average of around $90/share. However, only 2 analysts out of 15 hold a "BUY" rating, with most standing at "HOLD" (Source: S&P Global). I personally, and obviously, agree with the "HOLD" here, based on somewhat of overvaluation which means appeal once again when it disappears.

That forms the basis of my changed thesis for the company.

Thesis

This article is part of my ambition to write about undervalued dividend companies that I view as "safe" for investment. The purpose of these investments is never staggering amounts of capital appreciation or growth found in some of the more growth-oriented investment strategies - but a market-beating rate of return that combines an appealing 2-6% dividend yield with a high likelihood of short- to mid-term capital appreciation as the undervalued company reverts to a mean - and that is it.

It's my personal view that any investor should initially safeguard their life by first focusing on constructing a fundamentally safe stream of recurring income. Once this is achieved, one can focus on higher rates of capital appreciation which typically are accompanied by higher amounts of risk. My personal failures thus far have been limited to scenarios where I diverge from this logic, thereby putting this fundamental capital at risk. This doesn't mean that I view growth companies as uninvestable - the appeal of the two aren't mutually exclusive, but investors shouldn't mix the two up. When comparing the two and when considering the target audience for the historically safer and dividend-paying companies, it seems intuitively obvious to me that the safer choice when building the basics of a portfolio is to stick to these companies.

When writing about these companies, I try to pick the most qualitative and secure investments, where a lack of significant downside is more important than a massive upside. The so-called best-of-breed, the best of their kind, the safest around - however you want to label them. I achieve this by picking companies with high credit ratings, good dividend coverage ratios, good historical results, good forecasts, and an appealingly fundamental operating model and market.

Pinnacle West Capital Corporation certainly is a utility that warrants one of those "qualitative" stickers. Credit rating, sub-60% EPS payout ratio, less than 5X net debt/EBITDA, 26+ years of dividend without a reduction, and an earnings growth tradition that follows the pattern we're looking for more or less exactly confirms this company as a qualitative, defensive investment. You could "want", you could "buy", and you could hold this company - at the right price.

Unfortunately, that particular price isn't where the company is found today. While not a horrible price, you're essentially risking sub-par returns by investing in the company at this particular valuation.

Because of this, an overvaluation of around 1-5%, I think waiting and "HOLDING" is the better strategy here.

Thank you for reading.

Disclosure: I am/we are long PNW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.