If we take a step back to take a closer look at how the debt and its servicing indicators have moved in recent years we find that while the Centre’s debt/GDP has trended downward, the states’ debt to GDP ratio has trended up since 2015-16. (Illustration by C R Sasikumar)

If we take a step back to take a closer look at how the debt and its servicing indicators have moved in recent years we find that while the Centre’s debt/GDP has trended downward, the states’ debt to GDP ratio has trended up since 2015-16. (Illustration by C R Sasikumar)The pandemic has delivered a “scissor cut” to the government’s finances. On the one hand, economic output, and therefore government revenues, are shrinking, while on the other, the government has to spend more to safeguard lives and livelihoods.

The effect of this goes far beyond a widening of the deficit. It has far-reaching consequences for both the Centre’s and states’ ability to invest and lift the economy out of the current phase. It also means more borrowings. And as states have a good part of their revenue stream coming from the Centre, it changes their debt servicing ability for the worse.

First, consider the revenue side. Not surprisingly, in the first half of the fiscal — April-September — the Centre’s net revenue (tax and non-tax) collection stood at Rs 5.5 lakh crore or merely 27.3 per cent of the budget for the full fiscal year (compared to 41.6 per cent of budgeted target collected in the first half of the previous fiscal year). Seen another way, revenue collections in the first half of the year were down 32.5 per cent year-on-year, as compared to an average 15 per cent growth over the same period in the previous five fiscals.

Presently, fiscal data for the first half of the year (April-September) is available only for 11 large or so called non-special category states. As per our analysis, these states’ own revenue is down 21.5 per cent year-on-year as compared to the previous five years’ average growth of 10.4 per cent. If we add the Centre’s transfer to these states, then the decline in revenue for the latter reduces to 16.5 per cent. Ergo, the shortfall in states’ revenue seems less steep than that in the Centre’s. But it is important to note that the states’ revenue shortfall is partly mitigated by central transfers.

Source: CEIC, RBI, MoSPI

Source: CEIC, RBI, MoSPIWhat has been the impact of such a large fall in revenue collections? Most directly, the Centre’s total expenditure has declined 0.6 per cent year-on-year during the first half of the current financial year. This is led by an 11.6 per cent decline in capital expenditure, with revenue expenditure mildly up 1 per cent.

For the 11 states, total expenditure and capital spending have contracted by 1.5 per cent and 23.4 per cent respectively, while revenue expenditures have grown by 1.5 per cent. Since the bulk of the revenue expenditure is committed in nature, it is difficult to prune this expenditure. Even within that, allocations for pension and subsidies are down 10 per cent and 20 per cent, respectively. Growth in overall revenue expenditure is still higher for states, arguably, as they are at the forefront of the fight against the pandemic. More importantly, health being a state subject (states spend a little over two and a half times that by the Centre on medical and public health), states will have to shoulder a major part of the health expenditure burden on account of the pandemic.

An important aside: While both the Centre and states have cut capital expenditure, the latter have cut it by more as they face a harder budget constraint. This is worrying as states undertake more than 60 per cent of the overall general government capital expenditure. In fact, over the past few years, to adhere to their fiscal consolidation roadmaps, states have curtailed capital spending. For instance, in 2019-20, capital expenditure by states stood at Rs 4.97 lakh crore, down 20 per cent from the budgeted target of Rs 6.22 lakh crore, while revenue expenditure was down just 9 per cent. On the other hand, the Centre’s actual capital expenditure was along budgeted lines.

To be able to maintain their spending in the face of such a sharp decline in revenue, governments have been forced to increase borrowings. So far this year, both the Centre’s as well as the states’ market borrowing have increased by 50 per cent year-on-year (both undertake borrowings in addition to those from the market). This means that debt levels are set to rise sharply. At the end of 2019-20, overall general government debt stood at a nine-year high of 76.7 per cent of GDP (50.4 per cent for the Centre and 26.3 per cent for the states).

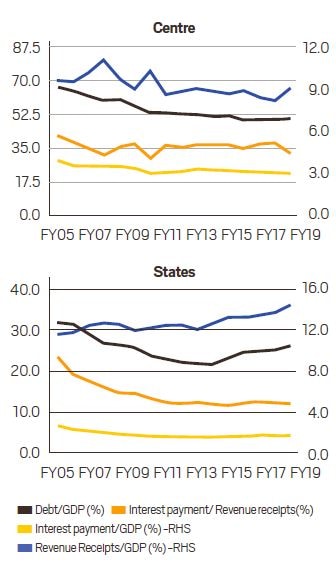

If we take a step back to take a closer look at how the debt and its servicing indicators have moved in recent years we find that while the Centre’s debt/GDP has trended downward, the states’ debt to GDP ratio has trended up since 2015-16. But surprisingly, the ratio of interest payments to revenue receipts for states — one of the indicators of debt sustainability which generally moves in sync with the debt ratio — has continued to trend down. That is, the two paths have diverged.

This is because of continuously improving revenue streams for the states, while the interest outgo remained on a fixed path. States’ revenue/GDP ratio rose from 13.3 per cent in 2015-16 to 14.5 per cent in 2019-20. Remember that states’ revenue comprises their own revenue as well as transfers from the Centre (which includes both tax devolution and grants). If not for the higher growth in transfers from the Centre, this indicator of debt sustainability would have stagnated.

The share of central transfers in states’ revenue increased from around 42 per cent in 2014-2015 to around 47 per cent in 2019-20 (largely due to a rise in share of the divisible tax pool from 32 per cent to 42 per cent beginning in 2015-16, courtesy of the 14th Finance Commission). This explains states’ financial vulnerability when they do not receive adequate and timely funds from the Centre.

The bottom line is that with the slowdown in growth, and as a consequence in government’s revenues (for both, the Centre and states), debt servicing for states, which looked comfortable, is set to become burdensome.

Combined with rising debt levels, this means that states are unlikely to push up their capital expenditure. The Reserve Bank of India’s recent publication “State Finances: A Study of Budgets of 2020-21” also found that capital spending by states turns out to be pro-cyclical, that is, it tends to be lower during a low growth phase, and vice versa. Besides, the spending sensitivity to debt is higher at a debt ratio of greater than 25 per cent.

Currently, 12 large states have a debt to GSDP (gross state domestic product) ratio of over 25 per cent, seven of which have a ratio greater than 30 per cent (Punjab has the highest ratio at 40 per cent). The situation is set to worsen and more states are expected to end up having debt to GSDP ratio of 25 per cent.

Consequently, overall investments could take a substantial hit this fiscal year with the government’s and the private sector’s ability and willingness to invest impaired, despite the fall in interest rates (adjusting for inflation, real rates are even lower). The private sector will remain wary of investing as demand uncertainty continues, and capacity utilisation remains low, at an average 58.6 per cent so far this year, way below the 71.9 per cent seen last year. Hence, it might a while before the cylinder of public investment starts firing.

This article first appeared in the print edition on November 26, 2020 under the title ‘A long winter for economy’. Joshi is chief economist and Verma is senior economist CRISIL Ltd