Equity LifeStyle Properties: Secure Your Future With This Growing REIT

Equity LifeStyle Properties has seen continued growth in its operating metrics, with strong occupancy.

It should benefit from the coming wave of retirees over the next decade, and the continued increase in home ownership.

It has a strong track record of shareholder returns, and I see that continuing for the foreseeable future.

It’s been three months since I last visited Equity Lifestyle Properties (ELS), and at that time, I leaned towards neutral on the stock, with the valuation being my primary concern. Since then, the share price has dropped by 9.3%, thereby resulting in a better valuation for the stock. In this article, I show why I’m starting to warm up to ELS, and evaluate what makes it an attractive buy for long-term investors, so let’s get started.

(Source: Company website)

A Look Into Equity Lifestyle

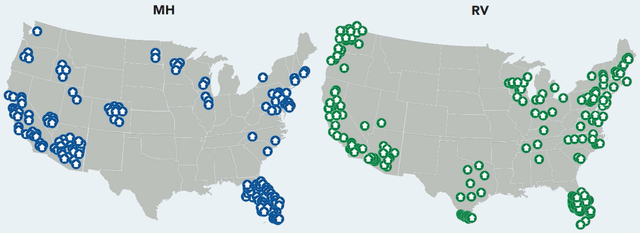

Equity LifeStyle Properties is a leading REIT that owns and operates MH (manufactured home) communities, and RV resorts and campgrounds in North America. It's been in business for over 50 years, and currently owns or has a controlling interest in 415 communities and resorts in 33 states and British Columbia, with more than 156,000 sites. As seen below, Equity LifeStyle's properties are generally located in attractive coastal markets and the south, which have attractive income demographics and population growth. In addition, its RV and MH sites generally form clusters, thereby making them more efficient to manage.

(Source: November Investor Presentation)

What I find attractive about Equity Lifestyle (and the manufactured housing sector in general) is the durability of the business model, given the sticky tenant relationships. That’s because ELS owns the land on which the manufactured housing units sit. Therefore, the tenants who own the units tend to have significant skin in the game, which helps to ensure stable rent checks on the land leases. Plus, ELS’s properties are in high-quality locations, with more than 90 properties with a lake, river or ocean frontage, and more than 120 properties within 10 mines of coastal United States.

I also like the fact that a good portion of Equity Lifestyle’s properties are located in warmer climates, which make them attractive for retirees. This is supported by the fact that the average age for Equity Lifestyle’s new residents is 59 for MH and 55 for RV communities. According to the U.S. Census Bureau, the 65+ age group is growing faster than the general population, with 1 in 5 U.S. residents expected to be in retirement age by the year 2030. Given ELS’s strong presence in warmer climates, I see it as being well-positioned to take advantage of this secular demographic shift.

ELS continues to demonstrate growth, with normalized FFO/share growing by 3.7% YoY, to $0.55 in Q3’20. Core MH base rental income grew by 4.5% YoY in the month of October, and core occupancy remained strong, at 95.3%, as of October 31, 2020. Core RV base rental income grew by 8.7% YoY in October, driven by growth in both annual and seasonal/transient residents. I see the RV business as being rather resilient during this pandemic, as outdoor activities are perceived as being far less riskier than indoor activities, due to the better air circulation/social distancing of the outdoors.

Plus, I see ELS’s MH communities benefiting from rising home ownership trends in this low interest rate environment. In October, the Radian (RDN) Home Price Index indicated an expected 7.8% YoY growth in home prices over the next 12 months. This would be on top of the annualized growth rate of 7.4% in home prices on a YTD basis. Plus, I’m encouraged by ELS attracting younger customers to its RV sites, as noted by management during the recent conference call:

We are attracting new younger customers to our RV resorts with our digital marketing, analytics show strong demand among customers under 34 years old, with 18 to 24-year-olds showing increases of over 300% and 25 to 35-year-olds showing increases of over 140% in online revenue compared to last year. These trends represent an opportunity to grow in future years by providing an excellent customer experience and retaining these newer customers.”

Meanwhile, ELS continues to grow, as it made two acquisitions of leased properties for $36M, and two acquisitions of development properties for $16.3M in October, all of which were funded with available cash. This is supported by ELS’s strong balance sheet, with total debt-to-adjusted EBITDAre of 5.0x, which sits below the 6.0x that I generally prefer to see for REITs. Its debt maturities are also well-staggered, with just 14% of its debt maturing in the next 7 years, and no maturities until 2022.

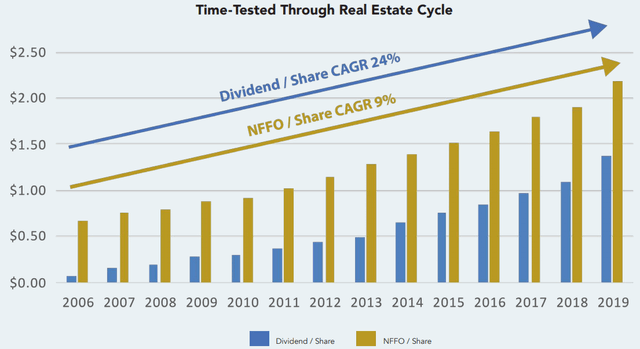

The 2.3% dividend yield remains well-covered, at a payout ratio of 64%, with a 5-year CAGR of 13.5%. As seen below, ELS has a strong track record of growth through economic cycles, with Normalized FFO growing at a 9% CAGR since 2006.

(Source: November Investor Presentation)

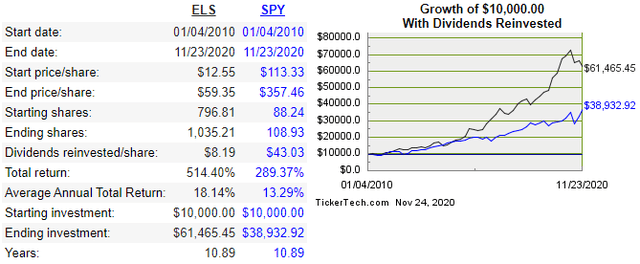

This has translated into outperformance on a total return basis. As seen below, ELS has outperformed, with an 18.1% CAGR (including dividends) since 2010. This compares favorably to the 13.3% return of the S&P 500 over the same timeframe.

(Source: Dividend Channel)

Risks to Consider

The recent surge in new daily COVID-19 cases could put a damper in consumer mobility in the near term, which could affect Equity Lifestyle’s RV operating metrics. This is supported by management’s projection of a $0.7M YoY decline in Core RV base rental income for the current quarter (Q4’20). However, I’m not too concerned, as ELS has weathered the current pandemic well thus far, and outdoor activities are relatively immune to the effects from COVID-19.

Investor Takeaway

Equity Lifestyle Properties has well-located properties that should benefit from the wave of retirees coming over the next decade. It has weathered the current pandemic rather well, and is doing a good job of attracting people, both young and old, to its RV parks. Plus, I see the trend of rising home ownership as being a positive for Equity Lifestyle’s MH communities.

The shares currently trade at $59.67, with a forward P/FFO of 27.5. I’ll be the first to admit that the shares are not cheap. However, I find it to be reasonable, considering the recent share price weakness, the durable business model, and the strong track record of growth.

In situations like this, I’m reminded of the following Warren Buffett quote: “It’s far better to buy a wonderful company at a fair price, than to buy a fair company at a wonderful price.” Analysts seem to agree with my sentiment, with a consensus Buy rating (score of 4.2 out of 5) and an average price target of $72. Buy for income and growth.

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.