Hill-Rom: Deep Value Proposition At A 30% Discount To Peers

Hill-Rom Holdings has enjoyed a strong 2H 2020, with sequential growth across quarters, and a mild recovery from Covid-related headwinds.

Moderate stability in bed demand, strength in international markets, and penetration in emerging markets have driven top-line growth in Q4.

Management is confident in mid single-digit growth for 2021, and we believe that ~400bps Covid-19 tailwind may drive bed revenues from Europe's situation.

Shares trade at a reasonable discount to peers, and considering our modelling, Hill-Rom presents as a value proposition for longer-term players.

We are bullish on the long-term outlook of the company and believe that the foreseeable headwinds are near-term only.

Investment Thesis

Hill-Rom (HRC) has finished the fiscal year with a strong sequential performance. We believe that the company has the potential to continue this trajectory over the years to come, albeit with some headwinds to drivers to the growth engine. This year, a combination of new product releases, aggressive acquisition activity, stringent active portfolio management and underlying growth in organic investments have surmounted to all-time high gross margins and operating leverage for FY2020.

Chart YTD:

Data Source: Author's Bloomberg Terminal

Thus, we are confident that management's impressive decision-making this year will transcend over the course of the coming periods, driving growth at the top and reflecting the same in valuation expansion. Management have set out a plan that incorporates new product momentum, deeper penetration into emerging markets, and expanding their footprint there, in addition to ongoing acquisition activity to deliver long-tailed asset returns for shareholder value. Below, we link the company's performance in the most recent quarter to the sequential growth drivers in the flywheel, alongside valuation and foreseeable risks.

2H Performance Steals The Show, But Headwinds Remain

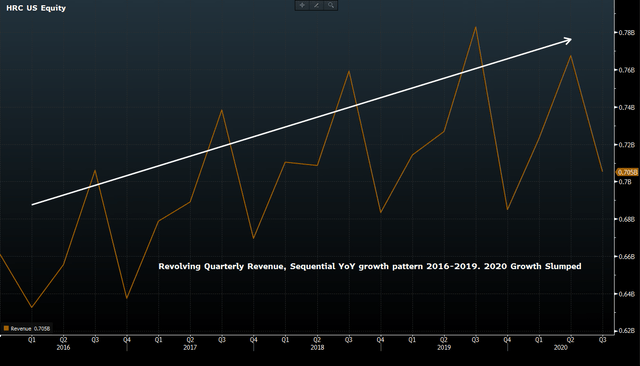

Management were quick to highlight the sequential growth pattern across Q3 and Q4 in the earnings call. Q4 came in above company estimates, beat consensus by ~$8 million, and surmounted to ~$705 million. Growth at the top reflected the stability in demand for hospital beds, alongside sequential recovery within the remainder of the portfolio. Covid-19 provided a small tailwind of ~490bps with bed demand in particular, which will diminish over the coming periods, as cases begin to settle in the US and abroad. Speaking of the geographical breakdown, US core revenue was down 15% quarter/quarter and was underscored by a slump in capital revenue. Management highlighted the key deficiencies from things like surgical equipment and hospital beds, to illustrate. Offsetting the weakness here was strength in the international portfolio, which managed 5% sequential growth, alongside emerging market penetration, which was bolstered by 10% growth throughout China and the Middle East.

Revolving Quarterly Revenue, Sequential Growth 2016-2020:

Data Source: Author's Bloomberg Terminal

Segmentally, the patient support segment was weaker this quarter and slowed from 23% to a ~13% run rate in Q4, down 14% YoY. We believe the company can maintain double-digit cadence here over the coming quarters, as deferrals in physician consultations and run of the mill patient checkups have recommenced, which should continue well into Q1 2021 at least. Bed revenue saw the biggest decline of 20% sequentially, however, the stability in bed demand was certainly reflected at the top, and peak Covid-related bed demand from Q3 contributed as a large, one-off that impacted the income statement at that time from our analysis. So, the core bed business was relatively flat in that sense and reflected a stabilisation in demand for medical surgery beds and ICU beds, in particular.

We believe that heightened bed demand in Europe will contribute an approximate ~400bps tailwind on the back of Covid-19 over the coming periods, as cases have begun to surge there again. Already in Q4, ~$25 million of European bed revenue was attributed to Covid-related demand, thus, the trend will likely continue across European markets in the near term. Therefore, we've modelled ~$30 million in Covid-related bed revenue over the coming periods into Q1 2021. Additionally, the surgical solutions segment decreased 29% and contributed ~$80 million to the top, coming in well above estimations. This segment faced headwinds across the quarter, as large construction projects continue to be delayed in key geographical zones. Thus, demand for capital equipment was slumped also. Management are confident in a strong recovery from here in Surgical Solutions and have included this sentiment into 2021 guidance.

Guidance and Outlook

Although hospital net capital expenditures are showing a recovery from setbacks earlier this year, HRC will likely face headwinds from delays in large capital outlays that are tied up in construction and deferred medical procedures. Certainly, there have been signs of a positive recovery in deferred procedures at the back end of 2020, which will have a net impact on the financial position of various hospitals within HRS's network. However, considering the state of affairs this year, including the net impact from patient deferrals this year, hospitals will likely remain tight on budgetary allocation and capital allocation over the coming years. It is likely that the preference will remain with orthopaedic electives due to their contribution to top and bottom lines. We've confirmed much of this with hospital executives we speak with regularly. So, HRC will likely be forced to dance around this and discover channels to realise the upside in spite of CAPEX uncertainties from hospitals.

To illustrate, we believe that the net impact of deferrals will realise a significant downgrade in hospital CAPEX over the coming year at least. We've seen evidence of this reflected already in major health centres that have reported ~60% reduction in capital spend this year, with an average ~30% YoY reduction for the remainder of FY2020 in a number of entities. Thus, HRC will certainly absorb the shock of this trend over the next year, which will hamper the cadence of growth to mid single-digits, as guided by management. Guidance has indicated a ~3%-5% decline at the top, which is a slight downgrade from consensus. Management believe free cash flow of ~$300 million is not unreasonable to expect for FY2021, and we would confer with this range, based on the macroeconomic and end market crosscurrents that will be absorbed by HRC over the coming year.

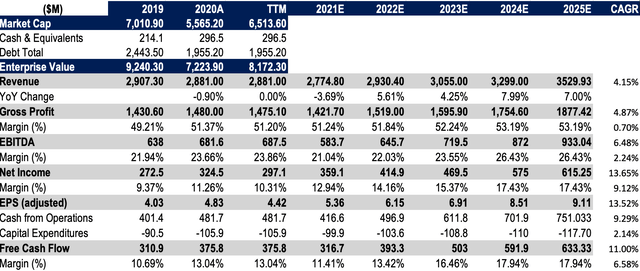

2021 guidance implies a recovery in pandemic-affected portfolio segments, which will be bolstered by the increase in clinic utilisation and patient volumes through major centres. We would also note that the complete divestiture from surgical consumables has been contained from 2021 guidance. We are confident that HRC will drive mid single-digit level growth at the top at the base, particularly given the easing of Covid-19 headwinds, and a recovery in patient volumes. We have modelled CAGR at the top of ~4% by 2025 in the base case, alongside significant free cash conversion at ~12%-18% sequentially, over the next 5 years. We believe that the company will run into some turbulence over the coming 3-year period, as hospital CAPEX and financing will be tight, therefore, we see a flat growth period until 2023, followed by a healthy recovery thereafter. Additionally, we believe earnings will be strong for shareholders, and we model ~$9 EPS by 2025, and a 2021 EPS estimate of $5.36, in line with consensus. In this vein, the foreseeable headwinds seem to be more near term and thus are reflected in our modelling over 2021 and beyond. Long-term investors will benefit from the outlook over the longer-term horizon.

Financial Summary & Forecasts, 2021E-2025E, base case:

Data Source: HRC SEC Filings; Author's Calculations

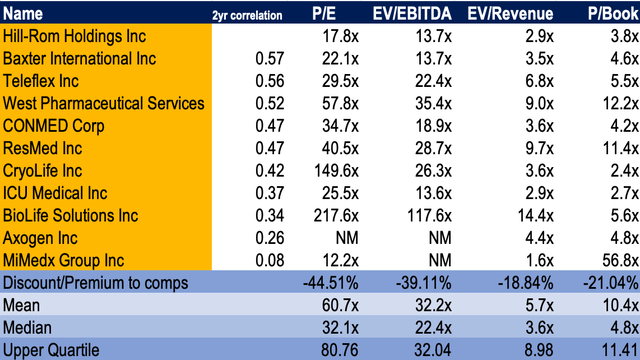

Valuation

Shares are trading at a decent discount to peers on a multiples basis. Shares are trading at ~18x P/E, just under 14x Q4 EBITDA and ~3x top-line sales. 3.8x book value signals excellent value creation for shareholders, albeit at a ~21% discount to the peer median. With the anticipated rotation into value-type equities over the coming periods, now that "a vaccine" is here, then investors will continue to fly to quality, seeking deep value propositions over the periods to come. Additionally, the gradual steepening of the yield curve indicates to us that value stocks will likely converge to the upside. We've baked this into our modelling for HRC, alongside the heavy quantitative due diligence we perform an all equity holdings. Thus, HRC trades at a discount to peers, and we believe that there is value in the discount, meaning HRC is a candidate for an undervalued label.

HRC Trades At An Average -31% Discount To Peers Across Multiples:

Data Source: Author's Bloomberg Terminal; Author's Calculations

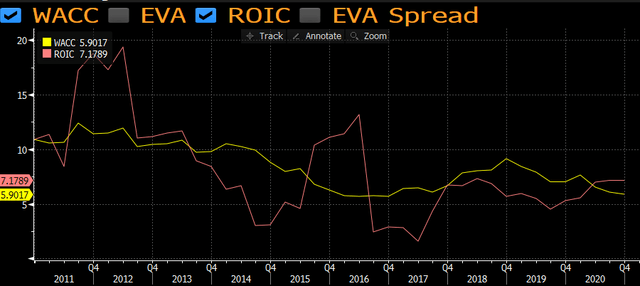

Providing further evidence for the value proposition is the company's ROIC outweighing the cost of capital over the last period. This is important to factor for HRC, considering their reliance on capital placements and invested capital in the operating model. Thus, we believe ROIC of ~7.2% for the quarter, which has grown substantially over the last 3 years, adds weight to the value proposition above. We are of the firm belief that companies that evidence growth in ROIC and that see a return over the cost of capital are subject to valuation expansion in forthcoming periods. This is backed by empirical data supporting the same, and we would postulate that HRC will benefit from multiples expansion over the coming years. Long-term investors will benefit from this information, in their own investment reasoning.

HRC's Q4 ROIC of 7.2% Outweighs The Cost Of Capital (5.9%):

Data Source: Author's Bloomberg Terminal

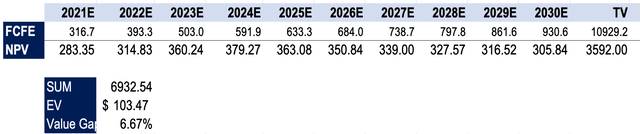

When examining the future value of HRC's asset returns, we've discounted FCFE estimates into 2030 back to today at a discount rate of 11.77%. This reflects the opportunity cost of holding a 10-year treasury and the S&P 500 index. We've also created other scenarios with higher discount rates, to price in the risk-adjustment of a severe reduction in hospital capital expenditure, and challenges of blown-out acquisition costs over the coming periods. Using the former implied inputs, we arrive at a fair value of $103.47, or ~7% upside on today's trading (subject to change with publication times). This supports the thesis that shares are also trading at a respectable discount, especially considering the ROIC growth over the previous 3 years.

DCF FCFE, 11.77% Hurdle Rate, Base Case $103.47; ~7% Upside:

Data Source: Author's Calculations

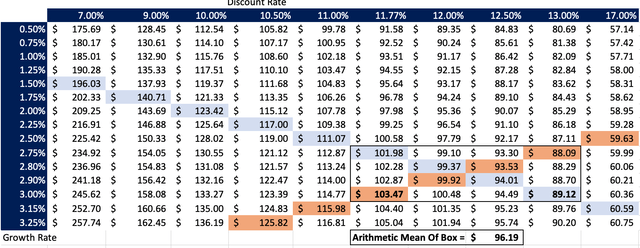

Investors can view the sensitivity in the DCF model on the sensitivity matrix below. We would point investors to the box within the matrix, which outlines the upper and outer limits to our DCF assumptions. A discount rate of 13% adds in a ~140bps risk-adjustment that we feel would be appropriate in the downside case. As there are no outliers within the data set, then it is appropriate to take the arithmetic mean of the same, where we see a fair value of $96.19, a small downside to today's trading (subject to change with publication times). Thus, we believe that the sensitivity in the model lies within the downside risks that would affect the company coming into the future, namely via failed acquisitions and a worse than expected reduction in net hospital CAPEX, in key markets.

Sensitivity Matrix - The Sensitivity Lies Within The Downside Risks HRC Is Exposed To Over The Coming Periods:

Data Source: Author's Calculations

Price Target of $106-$127 in Base & Upside Case, Respectively:

Using multiples to assign a price target, we've assigned our 2021 P/E estimate to our 2021 EPS estimate, to arrive at a price target of $106.13 in the base case:

2021 estimates:

- 19.8x P/E

- $5.36 EPS

- 2021 Price target = 19.8 x 5.36 = $106.13

In the upside case, we've set a small 1.2x premium to our 2021 P/E estimate, to reflect the single digit top-line growth guidance:

- 2021 P/E x 1.2x Premium = 23.8x

- 2021 EPS - $5.36

- Upside Price Target = 23.8 x 5.36 = $127

One way to postulate and be scrupulous is to factor the variance in all of the above figures and then calculate the expected valuation by taking arithmetic mean of the range of values from $96 to $127, which gives a fair value and reasonable price target of $108 (factoring all inputs from all scenarios). Although, this methodology only serves to consolidate the variance in valuation outcomes in our analysis, to assist investors in their own reasoning.

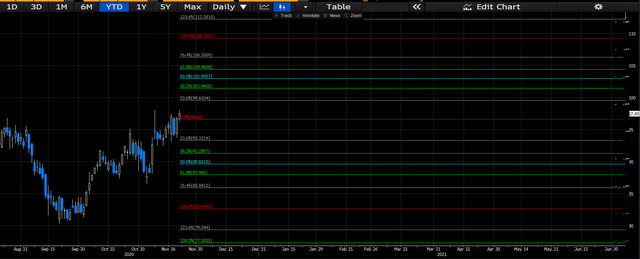

Investors can observe the range in potential pricing outcomes should shares continue along their current trajectory on the chart below. We would encourage longer-term investors to examine the below chart to assist in entry and exit reasoning into Q1 and Q2 of 2021. We believe that shares may continue to trend sideways for the time being, as discussed in the below section of the report.

Potential Pricing Outcomes Until June 2021, Based On Current Trajectory:

Data Source: Author's Bloomberg Terminal

Further Considerations

On the charts, there has been no real exciting movement of shares YTD. There was a large run-up from the V-shaped recovery back in March/April, however, shares have trended sideways since, and given away all the highs of April and July. Back in June/July, shares made a large M-shaped retracement back to the support level, before breaking that line and continuing south until September. There has been a small consolidation since October, where the near-term level of support has been defined. Shares are now trading back at the previous level of support, and there is a small amount of upward pressure from near-term pricing activity. The mouth of the small ascending triangle has begun to close completely, meaning that shares will likely continue their near-term uptrend back into the defined ranges of May-July. This range is shown via the green and red trend lines on the chart below. Investors can observe the near-term support that has formed since October, where shares are currently being tested at the resistance level.

Near-Term Support, Trading Back At Pre-Defined Support Of May-July:

Data Source: Author's Bloomberg Terminal

Giving the future trajectory some additional flavour is the RSI ranges bounding out of oversold territory back in September. However, offsetting this is the on balance volume level making a gradual down step to below pre-Covid levels, which is combined with flat momentum at current trading. Longer-term investors should factor in all of this information, especially given the chance that prices may converge to the upside, in relation to macroeconomic and overall market crosscurrents from a value sense. Shares are currently within healthy RSI ranges, and volatility is currently contained tightly around the mean return in price dispersion from September. Thus, entry at the current level is certainly warranted, in view of the value gap from our valuation. However, investors should consider the myriad of other factors that may continue to impact HRC shares, including competition and momentum deficits over the coming periods.

Healthy RSI Ranges, On Balance Volume Down Step Since July, Momentum Stable. But, Near-Term Price Dispersion Remains Tightly Wrapped Around The Mean:

Data Source: Author's Bloomberg Terminal

In Short - Risks & Conclusion

HRC has shown investors a good year of sequential growth that has been backed by small Covid-tailwinds, but balanced via headwinds from the same. Patient volumes in key centres and in particular, hospital CAPEX over the coming years, present as key risks to our valuation and upside scenario. We do believe that hospitals will remain tight in their budgeting over the coming periods, although worse than expected hospital financing decisions will certainly play to the downside for HRC's operating performance. Additionally, there is wider competition within the medical surgery segment of HRC's bed product mix that could impact the portfolio spread. We would also advocate that acquisition activity must remain profitable and contained from a cost perspective, otherwise investors may realise downside from failed M&A decisions over these coming periods. Management have committed to acquisition activity to drive value over the long-run in their growth vision, and we are confident that decision-making will remain sound there. Nonetheless, these are factors for investors to consider.

Furthermore, shares seem to be trading at a discount to peers, and with the upside over the coming years priced into growth model, then the market may be under-reflecting this upside potential at current prices. We believe that HRC presents as a value proposition at a reasonable discount, especially as the effect of Covid-19 begins to diminish from 2022 onwards. We would advocate that long-term players with a horizon of 5-10 years are ideal candidates for HRC. One thing to consider in that vein is the level of downside volatility that's plagued shares this year, and that the market may hold off on rewarding HRC further, should the above risks play out. In any sense, we are bullish on the long-term outlook of the company and believe that active portfolio management, key capital allocation, adherence to the growth vision, and key focus on the product mix will continue to drive shareholder value over the coming years. We look forward to providing additional coverage.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.