Trupanion: An Overvalued Insurance Company

Trupanion's total revenue grew by 31% in Q3 2020. Monthly Average Revenue per Pet and the Lifetime Value per Pet have been trending up.

The company currently has a "first mover" advantage. The main key risk to the business is the entrance of other insurance providers.

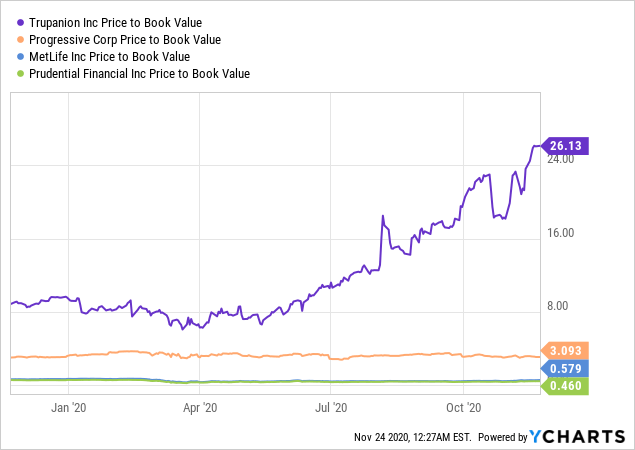

Trupanion now trades at a price to book ratio of 26.1x which is much higher than other insurance companies.

I believe adding a few speculative stocks to a diversified portfolio is a good way for investors to get better returns. Analyzing these types of stocks involves understanding the business model and market opportunity. One such company that initially piqued my interest is Trupanion (TRUP). However, after doing some due diligence, I believe that the company does not necessarily have the economic moat to justify its valuation.

Just a brief background on the company, Trupanion is a medical insurance provider for dogs and cats, operating in the US and Canada. The company offers a subscription service for individual owners for their pet insurance needs. The subscription service accounts for roughly 78.3% of revenue. The company has an "other" business segment as well that is focused on companies or organizations that want to offer pet insurance as a benefit. This segment makes up the remaining 21.7% of revenue.

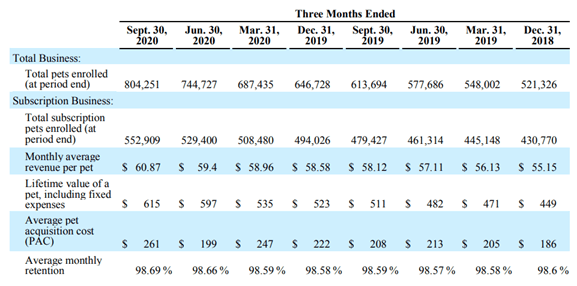

Looking at the company's Q3 2020 results, we can see the company had a blockbuster quarter. Total revenue grew by 31% compared to the same time last year from $99.3 million to $130.1 million. The total number of enrolled pets grew by 31% as well from 613,694 to 804,251. Specifically, the number of pets enrolled in the company's subscription business grew from 479,427 to 552,909. Equally important is that the Monthly Average Revenue per Pet and the Lifetime Value per Pet have been trending up. Monthly Average Revenue per Pet hit a two year high this quarter at $60.87. This is good news for the company as an increase in monthly average revenue tends to have an outsized impact on the company's revenue per pet. Lifetime Value per Pet in Q3 2020 was $615 per pet, a growth of 20.4% compared to $511 per pet at the same time last year.

Net Income though is a different story as the company had a Net Loss for the quarter of -$2.5 million in Q3 2020 compared to a slight income of $782,000 in Q3 2019. This loss though was partially due to an increase in marketing spend of $4.1 million. Given that the company has a retention rate of 98.7%, I expect that this wouldn't be an issue moving forward as the business scales.

Strategic Assessment

When evaluating growth stocks, you need to determine if the company is part of a large secular trend or solving an important need. This along with the industry's TAM should help you determine if there is room for the company to grow to its valuation. In the case of Trupanion, it is clear that the company is riding on the "humanization of pets" trend. I've touched on this trend previously when discussing Chewy (CHWY) in this article. The "humanization of pets" describes spending as much on pets as they might do on themselves or a child. Since pets are now considered "part of the family", Trupanion helps owners budget and care for these pets in the event of sickness or injury. It works the same way as normal insurance in that healthy pets subsidize non-healthy pets.

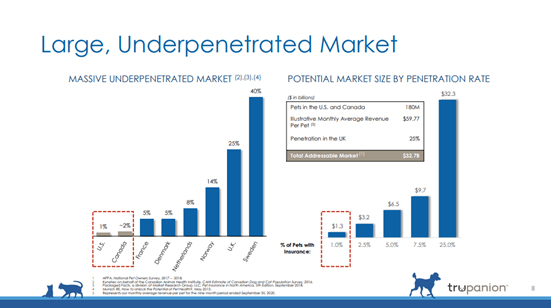

The company estimates a massive potential TAM as only 1% and 2% of all pets in the US and Canada have some form of insurance. Looking over at Europe, we can see that pets with insurance are multiples of this number. Even being conservative and taking France's 5% penetration would imply 5x market growth in the US. Assuming the same penetration rate as the UK of 25%, the company is forecasting the industry TAM of $32.3 billion. Apart from the under penetration of the market, the industry is also facing some tailwinds from the increase in pets due to the coronavirus pandemic. Pets have the potential to help people deal with stress and isolation due to COVID and the subsequent lockdowns. Furthermore, the transition to work from home has made pet ownership easier as well.

At Trupanion, we understand the power of the pet. One of the few perks of COVID has been the transition to remote working, which has given many the freedom to bring a new pet into the household. Undoubtedly, where and how people work has changed. We are now more confident than ever that pet medical insurance as a workplace benefit should remain a positive trend for years to come.

Trupanion currently has a "first mover" advantage. The industry in 2019 was worth $1.72 billion. The industry grew by $330 million in revenue in 2019, of that growth Trupanion had a share of 29%. This to me indicates that Trupanion is a market leader in a growing industry. Currently, the main key risk to Trupanion as a business is the entrance of other insurance providers. Trupanion may be a leader in pet insurance but it is a small company when looking at the insurance industry as a whole. Trupanion has a market cap of $3.5 billion and total assets of $317 million. Compare this to companies like Progressive (PGR) with a market cap of $54.5 billion.

Trupanion does have a few factors in its favor. First, it has deep veterinary relationships. The company offers direct veterinary invoice payment. The company also has a robust and comprehensive offering with features like the freedom to choose any veterinarian, covering hereditary conditions, and no payout limits. This will allow the company to build brand equity in the near-term. Other advantages the company claims such as using data and technology can be replicated by other firms. I don't know what would stop a Life or Home insurance company from simply offering pets as an add-on to their offering. Because of this, I view Trupanion as having a pretty narrow moat. However, Trupanion has taken steps to deepen this moat recently by partnering with Aflac (AFL) to distribute Pet Insurance to companies so that they can offer it as a benefit. Aflac also has a significant presence in Japan which Trupanion can leverage.

Valuation and Conclusion

In terms of valuation, the company is currently trading at a price to sales ratio of 7.2x which is not uncommon for a high-growth company. The company has been growing revenue at an impressive rate of 25.4% 5-year CAGR. However, I am concerned about the company's "narrow moat" with regard to its business. From what I can tell, Trupanion basically acts like a normal insurance company albeit for pets. There is nothing in the business model that is inherently disruptive or that can't easily be copied by other insurance firms. I believe that insurance itself is a commoditized product so there could be minimal switching costs from Trupanion if other insurance companies start coming up with their own pet insurance offerings. Because of this, I struggle to see why it should trade at book value multiples of the leaders of the industry. Due to the recent run-up in stock price, Trupanion now trades at a price to book ratio of 26.1x which is much higher than other insurance companies. I have Trupanion as an avoid.

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Caveat emptor! (Buyer beware.) Please do your own proper due diligence on any stock directly or indirectly mentioned in this article. You probably should seek advice from a broker or financial adviser before making any investment decisions. I don't know you or your specific circumstances, therefore, your tolerance and suitability to take risk may differ. This article should be considered general information, and not relied on as a formal investment recommendation.