iShares Edge MSCI Min Vol: A Strategy That Makes Sense

The iShares Edge MSCI Min Vol ETF failed to protect assets from sharp losses when it mattered most in 2020.

But I do not think that the fund, underappreciated by many, deserves to be dismissed when large cap growth may continue to underperform.

The potential upside of investing strategically in USMV, as a diversification tool, may justify owning the ETF today.

The iShares Edge MSCI Min Vol (USMV) is an underappreciated ETF, in my opinion, and maybe understandably so. Some investors dismiss the fund due to its inferior performance, measured by absolute returns, since the 2011 inception: annual gains of "only" 13.1% vs. the S&P 500's (SPY) 14.5% and the Nasdaq 100's (QQQ) 20.7%.

But I have a couple of reasons to believe that USMV may be a very useful ETF today – despite having pointed out that the low volatility fund "failed [to protect assets from sharp losses] when it mattered most" in 2020.

Credit: Patrick Weissenberger @ Unsplash

Regarding convictions

When it comes to convictions about future market movements, I have been defending since September that the next few months will most likely favor value and small cap rather than growth and large cap stocks. Should my predictions prove to be true, any investment strategy that closely tracks indices like the S&P 500 and Nasdaq 100 will probably underperform those that track the Dow Jones and Russell 2000.

To be clear, the iShares minimum volatility fund still invests in some of the same names represented in the large cap growth indices. But there are a couple of key difference worth highlighting. First, Big Tech favorites Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOG) represent only about 2% of the total portfolio vs. the S&P 500's 22% and the Nasdaq's 45%. Smaller exposure to FAAMG means less dependence on the large cap growth factor, particularly tech.

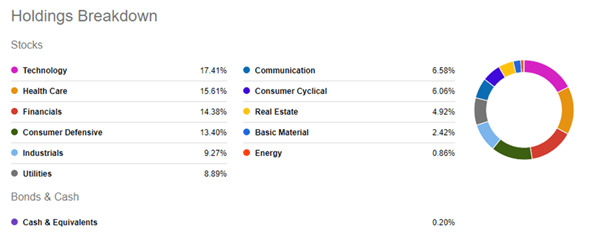

Second, USMV is more heavily allocated to value and/or cyclical stocks. The chart below illustrates how financial services, industrials and real estate account for about 29% of the total assets. By contrast, the S&P 500 allocates only 24% to these same sectors while the Nasdaq, less than 3%.

Source: Seeking Alpha

Better complement to the portfolio

Another reason for giving USMV a bit more thought today is portfolio strategy. The ETF has historically produced lower volatility than the S&P 500, as one would have expected. In addition, the fund's monthly returns have been correlated with the broad market index at a factor of 0.85 – not very low, but certainly lower than the correlation between the S&P 500 and the Nasdaq.

Lower volatility and lower correlation mean that USMV has had diversification value inside a portfolio. Lower portfolio risk means, for example, that an investor can afford to dial up the risk knob to capture slightly higher returns without exposing the portfolio to more pronounced ups and downs.

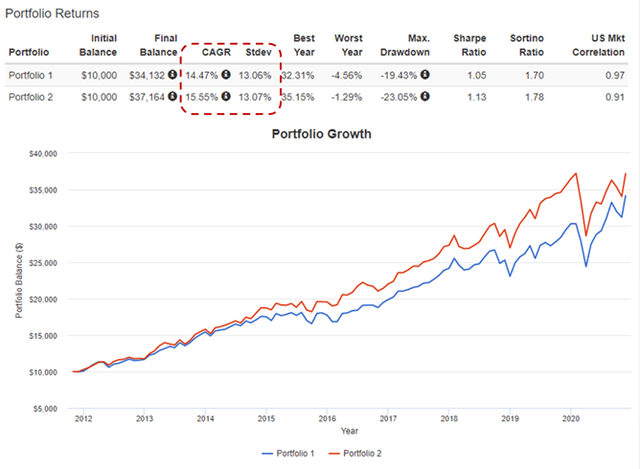

Here is an idea that could work. Rather than investing passively in the S&P 500 (portfolio 1 in blue below), I would propose a slightly more elaborate strategy (portfolio 2 in red below) : 90% USMV and 10% ProShares UltraPro S&P 500 (UPRO), which is a 3x leveraged ETF, rebalanced quarterly. This portfolio would effectively be invested 90% in low volatility stocks and 30% in the broad market, for total exposure of 120% to risk assets.

Source: Portfolio Visualizer

Because of the better diversification that USMV allows for, the leveraged portfolio described above would have produced about the same level of volatility as the S&P 500 (see dotted red box above), while producing about 110 bps of additional annual returns – what most of us would call "alpha".

To be clear, past results are in no way a guarantee of future performance. However, especially now that large cap growth has been facing some headwinds and may continue to do so, the potential upside of investing strategically in USMV may justify owning the ETF today.

A helping hand

Stocks have been on a choppy ride this year, and the future still looks uncertain. But my SRG portfolios have been beating the S&P 500 in 2020 and since inception, producing far superior risk-adjusted returns. To find out how I have created a better strategy to grow your money in any economic environment, click here to take advantage of the 14-day free trial today.

Disclosure: I am/we are long AAPL, AMZN, MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.