Autohome: Cheap And Cash-Generating Company

Autohome offers leads and services to automobile consumers in China.

Autohome valuation is equal to $10 billion. If we assume forward EBITDA of $718 million, Autohome trades at 13x-14x.

The company had a CFO of $415 million. It means that Autohome does not need external financing to support its operations. It is quite ideal.

I would expect traders to push the price mark above $120 or 17x-19x EBITDA.

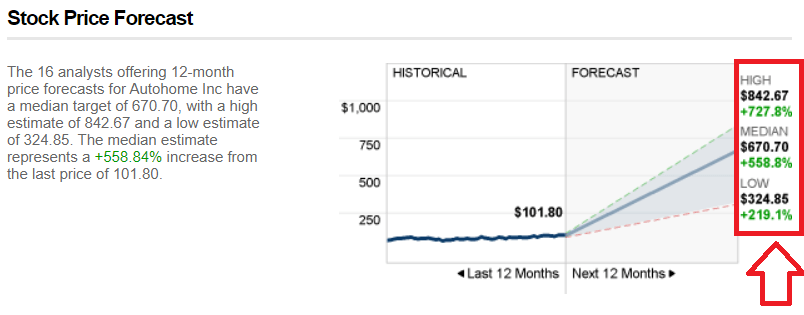

According to 16 analysts, Autohome could hit a median of $670 in the next twelve months.

Autohome (ATHM) trades at 13x-14x EBITDA, with 41% net income margin, cash, and no debt. I as well as many other analysts opine that the stock price could increase more than 20% in the twelve months. Some analysts believe that more than 300% stock returns could happen. To sum up, if you are looking for investments in China, Autohome may be of your interest.

Autohome

Founded in 2008, Autohome offers leads and services to automobile consumers in China. Customers can access automobile content by visiting company’s websites autohome.com.cn and che168.com. The company’s products are presented in the annual report with the following words:

We believe that the growing user base and strong user loyalty, our nationwide advertising platform, high-quality, diverse and targeted advertising solutions, enriched and customized content, our ability to innovate valuable products for our customers and our big data analytics capabilities, all integrated in a robust and technology-driven automotive ecosystem covering all aspects of the automobile ownership life cycle, have led to our steady growth and has laid the foundation for our leading position.

Source: 20-F

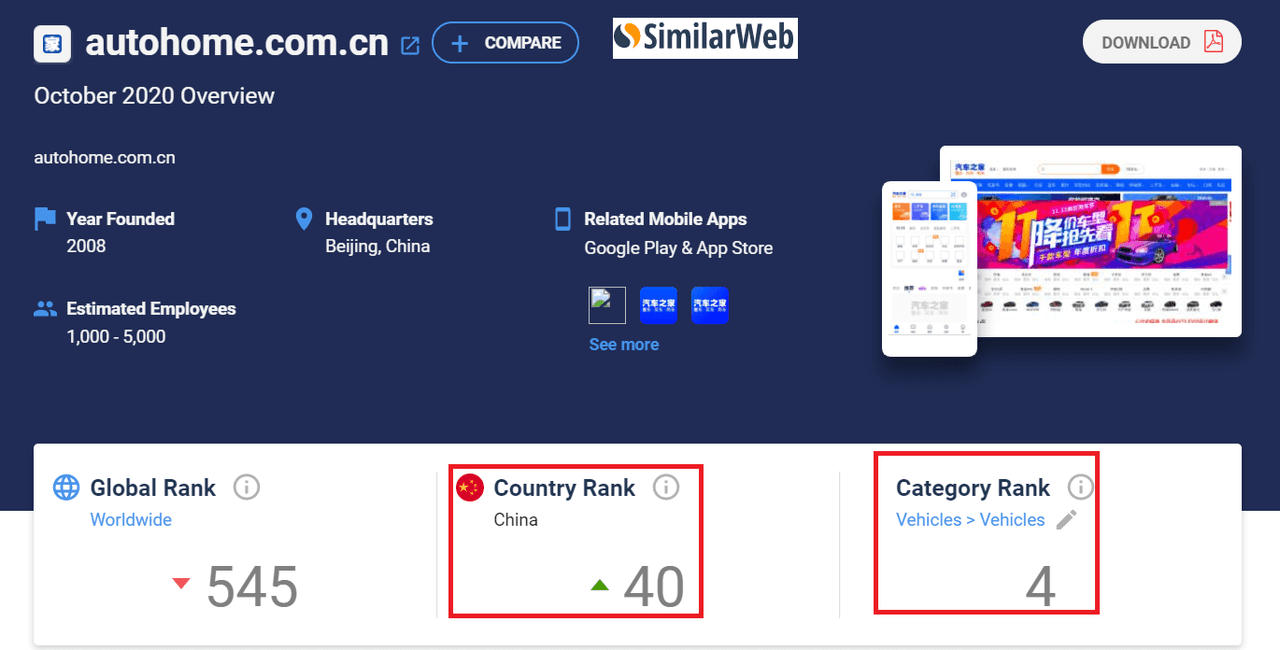

According to similarweb, autohome.com.cn is the 40th most visited website in China. In addition, it appears to be the 4th most visited website for the vehicles category.

Source: SimilarWeb

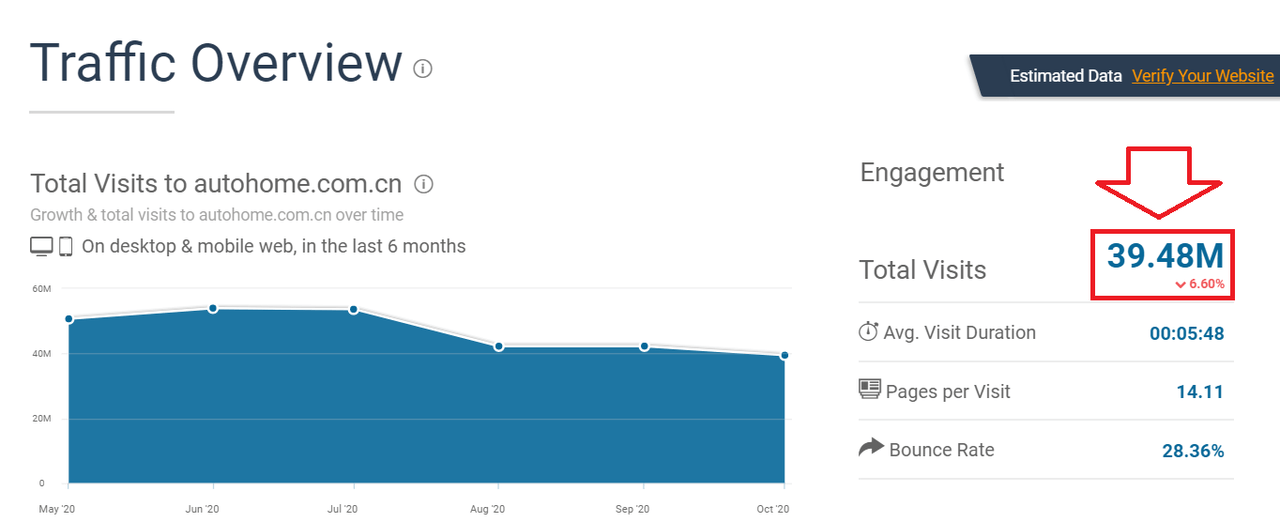

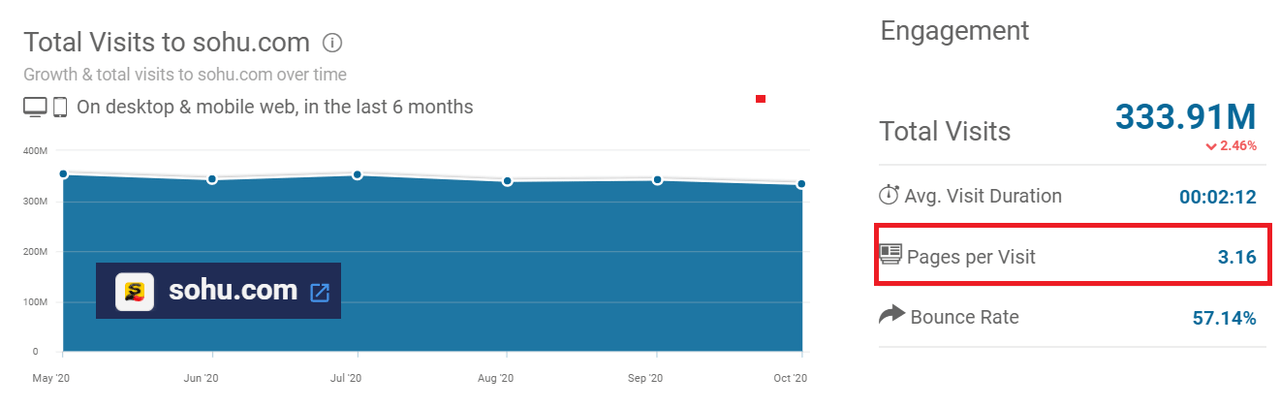

With more than 39.4 million visits per month and 14 pages per visit, let me say that the company’s numbers are very impressive. Notice that other websites in China, like Sohu.com (NASDAQ:SOHU), which is quite well-known, don’t get that amount of pages per visit. In addition, the average visit duration of Autohome is more than 5 minutes, which looks like a lot. SOHU shows less than 3 minutes per visit. To sum up, Autohome knows very well what it is doing.

Source: SimilarWeb

Source: SimilarWeb - SOHU

No Concentration Of Clients

Autohome does not have a large concentration of clients. In my opinion, if one automaker decides to stop paying Autohome, many other clients will be available. According to the annual report, five clients are responsible for 24% of the company’s media services. I believe that investors start worrying when one customer accounts for more than 10% of the total sales. Media services account for less than 50% of the total revenue:

In 2019, our top five automaker advertisers contributed 24.0% of our media services revenues. We believe that our major future revenue growth will be focused on deepening our existing commercial relationships with automakers to increase our share of each automaker’s budget. Source 20-F

Autohome: 41% Net Income Margin

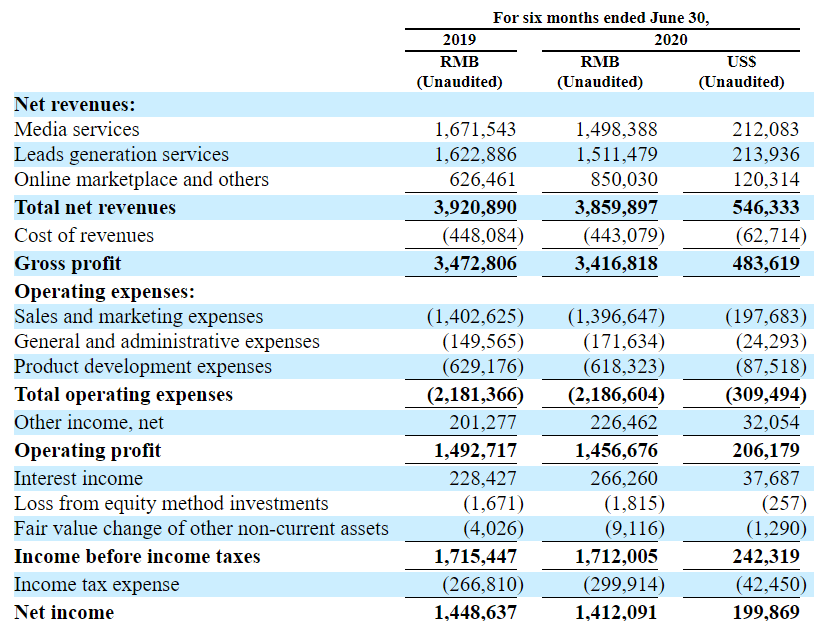

Autohome does not report significant sales growth. In my opinion, the company may be interesting because of its net income. In the six months ended June 30, 2020, the company released 41% net income margin and a net income of $199 million. Most sales come from media services and lead generation services The company has an interest income/sales ratio of only 6%. In my opinion, value investors will most likely appreciate the company’s business model:

Source: 10-Q

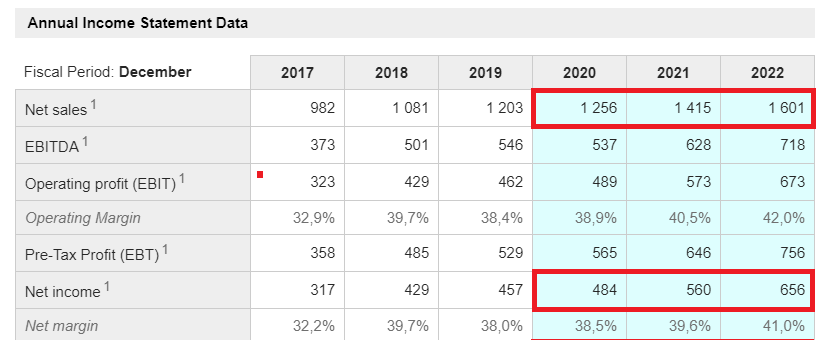

Market analysts are expecting small sales growth in 2020 and 2021. That’s not ideal. However, the interesting feature in the company is that net income is expected to grow by 15% and 17% in 2021 and 2022 respectively. In addition, net margin will most likely increase from 38.5% in 2020 to 41% in 2022.

Source: Market Screener

I don’t really want to enter into very specific cash flow analysis. However, I will mention that in 2019, the company had a CFO of $415 million. It means that Autohome does not need external financing to support its operations. It is quite ideal:

Source: 20-F

Good Amount Of Cash

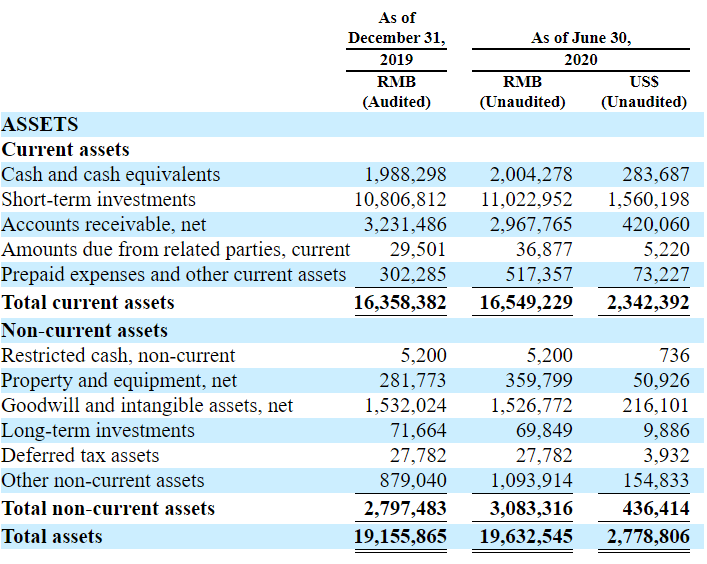

I do appreciate the company’s balance sheet because of the amount of cash and short term investments. The company has close to 1.843 billion in total liquidity. That’s quite ideal. In my view, it means that Autohome will not be selling equity any time soon. Shareholders are most likely not worried about potential equity dilution.

Source: 10-Q

Value investors will most likely appreciate that Autohome acquired three companies very recently. As a result, Autohome shareholders may be enjoying synergies and goodwill soon. It appears to be another reason to expect additional net income or net margin increase:

Goodwill represents the excess of the purchase price over the amounts assigned to the fair value of the assets acquired and the liabilities assumed of an acquired business. Our goodwill at December 31, 2018 and 2019 were related to our acquisition of Cheerbright, China Topside and Norstar Source: 20-F

With regards to the company’s liabilities, Autohome does not report any financial debt. I like it. The company finances its business model with deferred revenue, advances from customers, and accrued expenses. I really appreciate business models, in which you don’t need to talk to bankers. When clients are happy to receive their products a bit late, you know that you are in a good industry.

Source: 10-Q

Autohome Valued At 13x-14x EBITDA

With 119 million shares at $100, I get a total market capitalization of $11.9 billion. With liquidity of $1.843 billion, Autohome valuation is equal to $10 billion. If we assume forward EBITDA of $718 million, Autohome trades at 13x-14x. If we take into account that the company’s EBITDA margin is larger than 40%, I believe that the company is cheap. Other companies traded at richer valuations with less EBITDA margin. For instance, BIDU (BIDU), the online company, traded at more than 80x EBITDA with an EBITDA margin of close to 30%.

Source: Ycharts

I don’t think Autohome will trade at 80x EBITDA. However, most analysts would not be surprised if we see the company trading at 17x-19x EBITDA in the future. Also notice that the company does not need financing. Its cash flow from operations is positive and is equal to more than $400 million. In my view, private equity analysts and bankers would be interested in the business model of Autohome.

Institutions Are Buying Shares And Forecasts Are Optimistic

I do believe that checking the activity of institutional investors helps retail investors. Well-known investors like Lazard, Invesco, or Vanguard bought large stakes of Autohome in the past. They clearly believe that the company represents a fantastic opportunity:

Source: Cnn

Source: Cnn

I don’t really know how analysts are performing security analysis on Autohome. According to 16 analysts, Autohome could hit a median of $670 in the next twelve months. At 18x EBITDA, I would say that the shares are worth no more than $124. I guess I am a bit pessimistic about my EBITDA forecast. I have always preferred to be a conservative investor:

Source: Cnn

Risks

The company is a controlled entity, which means that the Board Of Directors may sometimes take decisions to benefit the largest shareholder. Most listed companies from China are controlled entities, so most investors don’t really care about this fact. With that, I believe that minority investors should get to know:

As of February 29, 2020, Yun Chen, a wholly owned subsidiary of Ping An Insurance (Group) Company of China, Ltd., or Ping An Group, owned 51.9% of the total voting rights in our company, and we are a “controlled company” under Section 303A of the New York Stock Exchange Listed Company Manual. Source: 20-F

Very recently, the SEC noted that it may force firms from China to use auditors supervised by the United States. It is not the first time that the SEC has issued this kind of statement. I don’t expect anything bad to happen to Autohome if auditors from the US review the accounts. However, there are certain risks. If Autohome cannot sell shares in the United States, the lack of access to liquidity may push the share price down:

Source: WSJ

On December 7, 2018, the SEC and the PCAOB issued a joint statement highlighting continued challenges faced by the U.S. regulators in their oversight of financial statement audits of U.S.-listed companies with significant operations in China. Source: 20-F

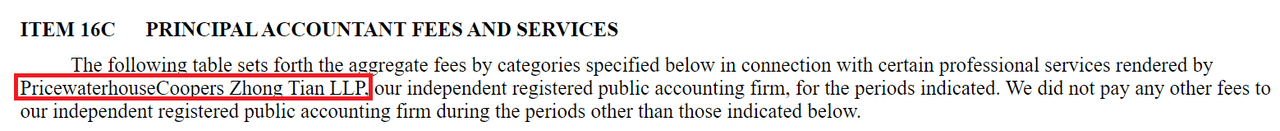

The company’s auditor is from the United States, which will most likely help. If the SEC enforces any action, an auditor from the same firm in the United States may have to work with chinese auditors. In this case, I don’t see a large trouble:

Source: 20-F

If you regularly invest in China, you know that transactions with third parties are very common. If you don’t like that the controlling shareholder makes transactions with the company, you simply don’t invest in China or other emerging markets. Autohome is not a different case. With that, I believe that I have to note it in the article:

Since Ping An Group became our controlling shareholder, it provided services including rental and property management services, technical services and other miscellaneous services, and assets to us for a total amount of RMB55.2 million in 2017, RMB88.7 million in 2018 and RMB107.7 million (US$15.5 million) in 2019. Source: 20-F

Conclusion

Autohome runs a business model showing double digit EBITDA margin and positive CFO. It will most likely trade at more than 13x EBITDA. I would not expect the share price to trade at more than $600 at the year end like other analysts. However, I would expect traders to push the price mark above $120 or 17x-19x EBITDA. Taking into account the goodwill and the recent transactions, margins may be even larger. As a result, larger valuations would make even more sense.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ATHM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.