California Water Service Group is a Dividend King with 53 years of consecutive annual dividend growth.

The company operates in a regulated industry and grows organically and through acquisitions.

The stock has a negative beta, meaning that it is inversely correlated with the broader market.

The stock is overvalued at the moment.

California Water Service Group (CWT) is a Dividend King that has a 53-year history of annually raising the dividend. In general, I like water utilities. They have stable earnings and cash flow since their product -water and wastewater treatment - is in demand. Population growth tends to produce low single-digit growth in the top and bottom lines each year. The stocks have negative or at least very low correlation with the broader market. This means water utilities provide ballast for portfolios in down markets. That said, investors have discovered water utilities. California Water is no exception, and despite being a Dividend King, the stock is overvalued. However, at the right price I would strongly consider California Water. I am neutral on this stock at the moment.

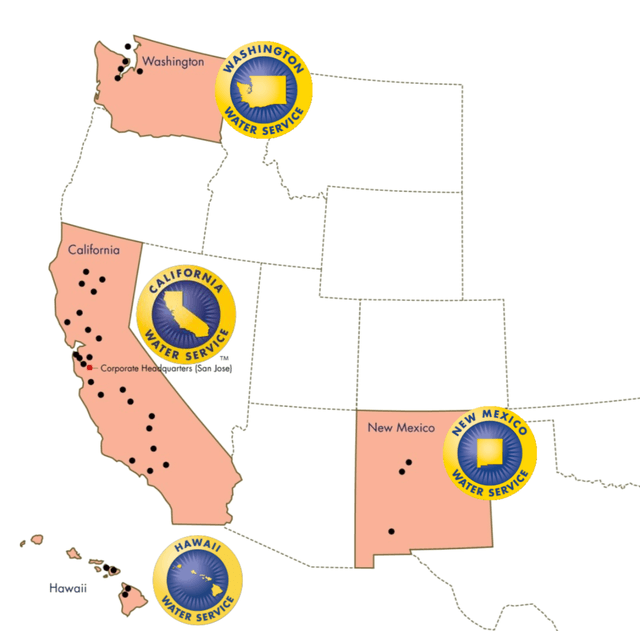

Source: California Water Service Group

Source: California Water Service Group

Overview of California Water Service Group

California Water was founded in 1926. The company is the second largest publicly traded water utility in the U.S. The company operates through four subsidiaries that are California Water Service (Cal Water), Hawaii Water Service (Hawaii Water), New Mexico Water Service (New Mexico Water), and Washington Water Service (Washington Water). California Water serves over two million people in 100 communities. Cal Water has about 484,900 customer connections. Hawaii Water serves about 5,000 water and wastewater connections on Maui and Hawaii. New Mexico Water serves about 8,300 water and wastewater connections. Washington Water services about 17,700 water and wastewater connections. Total revenue was $714.6 million in 2019.

Source: California Water Service Group Fall 2020 Investor Presentation

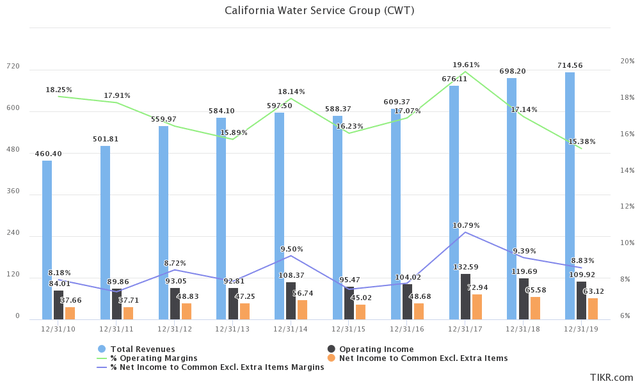

California Water Revenue Growth and Margins

As a regulated water utility, California Water tends to grow slowly. In the past decade, revenue has grown from roughly $460 million in 2010 to about $715 million in 2019. Net income has grown from ~$38 million to a little over $63 million. Operating margins and net profit margins were trending up as well but are more volatile. After peaking in 2018, they have declined over the past two years. The chart below shows revenue growth and margins.

California Water grows organically and through acquisitions. Organic growth for most utilities comes about by adding customers to the existing network. This is typically due to population growth and residential and commercial construction. From this perspective, California Water faces some challenges. California is no longer growing as rapidly as it once was. Hawaii is slowly losing population. But Washington and New Mexico are experiencing population growth. A risk is that California Water operates in areas that have been subject to periodic droughts in the past several years. This can lead to restrictions on water usage by consumers and businesses impacting the top line.

The real story though is that California Water is growing through acquisitions in its service areas. In 2020, the company expanded into Oahu with the acquisition of Kalaeloa Water Company. In 2020, the company also acquired 18,500 connections (Rainier View) in Washington. There are two more acquisitions that have been announced, including Gunner Ranch West in California and Animas Valley Water in New Mexico.

Most of these acquisitions are bolt-on additions, but they do enlarge the customer base. New customers will be a part of the rate base for years into the future and generate profit in a regulated industry. Acquisitions also provide an avenue for future growth as commercial and residential developments continue in the acquired area and the population grows. In general, the water utility industry is very fragmented. This provides a runway for future acquisitions and growth. On a negative note, California Water’s service area is widely spread out and divided across four states. This likely keeps margins lower as efficiencies from scale are not as easily attainable.

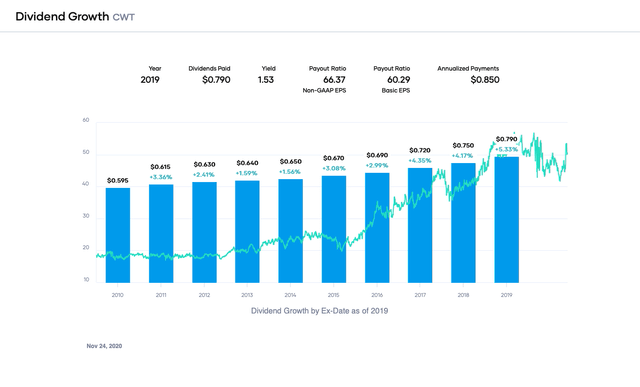

California Water’s Dividend and Safety

California Water has paid a growing dividend since 1967 making the stock a Dividend King. The current yield is about 1.7%. The most recent increase in the quarterly regular cash dividend was 7.6% to $0.2125 per share from $0.1975 per share. The forward annual dividend is now $0.85 per share. The annual dividend growth over the past decade is seen in the chart below. Most increases tend to be in the low single-digit range.

California Water’s dividend safety metrics are decent based on earnings, cash flow, and debt. In my opinion, there is little likelihood of a dividend cut or suspension. In addition, I believe that a dividend growing at a low single-digit rate annually is sustainable.

In 2019, the payout ratio was about 60%, which is a decent value and below my criterion of 65%. The payout ratio has been between 47% and 68% over the past decade. This is a good range although the high end of the range is over my threshold. This is most likely due to transitory issues as the payout ratio has gone down in following years. Looking forward to 2020, the annual dividend rate is $0.85 per share and anticipated earnings per share is $1.89. This gives a payout ratio of 45%, a solid value.

From the perspective of cash flow, the dividend is also safe. Operating cash flow was roughly $137 million in the LTM. Capital expenditures for utilities are generally higher due to the regulated nature of the business and are funded by debt. But the dividend required about $40.7 million so it can easily be paid from operating cash flow. The company does issue stock periodically, likely to fund acquisitions. Share count was 41.7 million at end of 2010 and was 48.5 million at end of 2019. This means that the cash required to pay the dividend increases each year. Notably, this has not adversely affected the payout ratio much except in 2013 when the share count jumped by about five million.

California Water has a reasonable debt position for a company of its size. In the LTM, the utility had about $113.3 million in cash and equivalents. This was offset by short-term debt of about $375.1 million, current long-term debt of ~$21.9 million, and long-term debt of approximately $785.1 million. Long-term debt is trending up due to acquisitions and capital expenditures. Interest coverage is low at about 3X and leverage is roughly 4.5X. Leverage seems high, but I compare the leverage ratios in the table below for other water companies and California Water’s is not excessive compared to its peers.

Company | Ticker | Leverage Ratio |

California Water Service Group | (CWT) | 4.5X |

(ARTNA) | 4.3X | |

(AWK) | 5.4X | |

(AWR) | 3.2X | |

(GWRS) | 5.9X | |

(MSEX) | 5.0X | |

(SJW) | 7.5X | |

(WTRG) | 8.5X | |

(YORW) | 3.5X |

Source: TIKR.com

Valuation of California Water

California Water is trading at a forward earnings multiple of about 26.7X at the moment, based on expected 2020 earnings estimate of $1.89 per share. The long-term average for P/E ratio over the past decade is about 26.4X. At the current earnings estimate and a 26X fair value estimate, we obtain a fair value price of $49.14 based on consensus earnings.

Applying a sensitivity analysis using P/E ratios between 25X and 27X, I obtain a fair value range from $47.25 to $51.03. The current stock price is ~100% to ~108% of my estimated fair value. The current stock price is ~$51.05, suggesting that the stock is slightly overvalued.

Estimated Current Valuation Based On P/E Ratio

P/E Ratio | |||

25.0 | 26.0 | 27.0 | |

Estimated Value | $47.25 | $49.14 | $51.03 |

% of Estimated Value at Current Stock Price | 108% | 104% | 100% |

Source: dividendpower.org Calculations

How does this compare to other valuation models? Morningstar is known to use a fairly conservative discounted cash flow model and provides a fair value of $44.18. The Gordon Growth Model gives a fair value of $28.33, assuming a desired return of 7% and dividend growth rate of 4%. An average of these three models is ~$40.55, suggesting that California Water is very overvalued at the current price.

California Water is a safe stock as a regulated water utility with low volatility. The 5-year trailing beta is -0.03, meaning that the stock is inversely correlated to the broader market. Morningstar gives the company a narrow moat though. Value Line gives the stock a Safety score of ‘3’, Financial Strength of B++, Stock Price Stability of ‘95’, and Earnings Predictability of ‘65’. These are all decent values. As for credit ratings, it has an ‘A+’ from Standard & Poor’s, which is investment grade.

Final Thoughts on California Water

I like water utilities since they provide ballast to portfolios during down markets as seen by the beta. I also like that the dividend is well covered and the utility is a Dividend King. That said, the stock is trading at a fair value to overvalued range at the current price. Investors seeking dividend growth have discovered water utilities years ago and stock prices and valuations tend to stay elevated. However, at the right price I would consider California Water. Currently, I am neutral on the stock.

If you would like notifications as to when my new articles are published, please click the orange button at the top of the page to "Follow" me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.