The market seems to be getting exactly what it hoped for - Biden as president and a split Congress.

This is what has propelled growth names back towards highs after a brief dip.

I believe BST remains an attractive option for investors who are looking for monthly income, in addition to the growth potential.

Written by Nick Ackerman, co-produced by Stanford Chemist

BlackRock Science and Technology Trust (BST) has been having an incredible run this year, as it invests in tech names. This is the area of the market that investors can't seem to get enough of. While valuations could be stretched at this point, the fund just hit another catalyst: Biden as president with a split Congress. First, the uncertainty of the whole election is a factor. As we know, the market does not like the unknown. The second part of this catalyst is that with a split Congress, it is unlikely that we'll see large and dramatic changes to taxes or regulations.

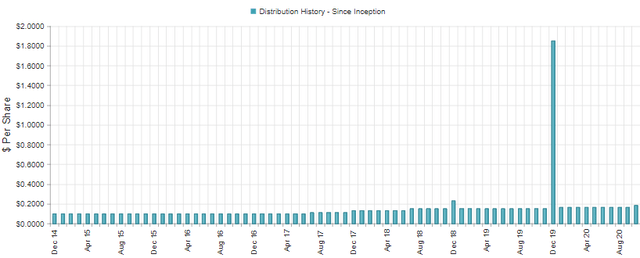

This plays well into exactly what BST is holding. The fund holds all the large-cap tech names that have been leaders for years. Additionally, it will employ an options writing strategy on positions in its portfolio as well. This can limit upside due to positions being called away. However, it can generate premiums that can be used to pay out a strong distribution. In the case of BST, the strong returns of the tech sector have helped the fund also raise its distribution. Since launch, the fund started at $0.10 per month in 2014, and a recent boost just brought this up to $0.187 per share per month.

I believe this makes BST the perfect candidate for growth and income potential. The objective is "providing income and total return through a combination of current income, current gains and long-term capital appreciation."

(Source)

How BST invests is: "under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology (high growth science and technology stocks), and/or potential to generate current income from advantageous dividend yields (cyclical science and technology stocks)."

This results in the fund holding a lot of large-cap, U.S.-based tech investments. These provide not only an opportunity for growth, but general stability as well. That being said, they do hold some assets outside of the U.S. too. The greater flexibility to invest where the managers see fit can be a good thing, as they aren't restrained. This is also one of the differences between BST and the BlackRock Science and Technology Trust II (BSTZ). BST will invest in generally larger companies, where BSTZ invests in the smaller names.

BST has grown to be quite a sizeable fund. It just surpassed $1.090 billion in total managed assets. It doesn't utilize leverage, so no greater risk is taken there. The total expense ratio of the fund is 1.08%.

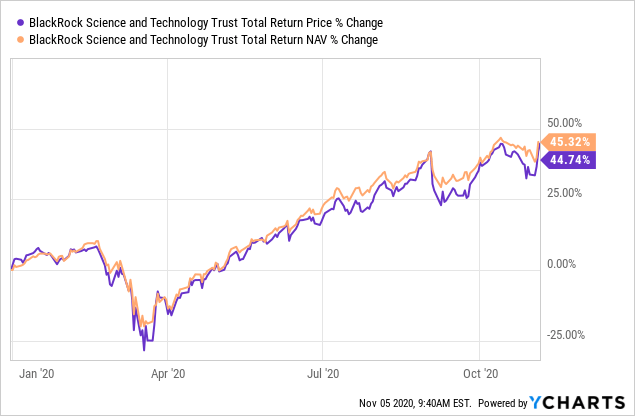

Performance - Recent Dip Reversing

I put another piece together where I covered several tech funds. This was back around September. The dip came and went quickly. It was then followed up by another dip in October. However, the latest catalyst we discussed above is moving this sector up again. Which is exactly what we have seen with the last few days. This has resulted in very brief periods of opportunity, though one would have to be quick.

While it isn't ideal to buy just as a fund shoots up on recent news, it is definitely worth keeping a close eye on, as these dips don't appear to last long.

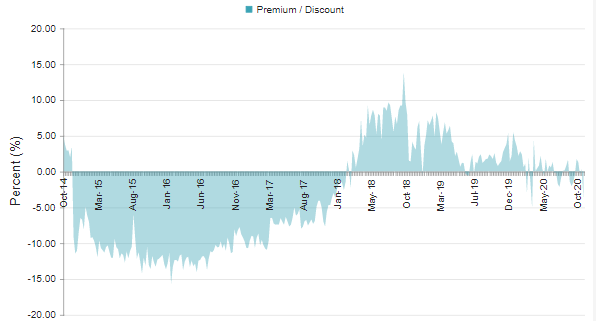

One thing that also hasn't happened with BST for a couple of years now is getting a great discount on the fund. It has traded consistently around NAV or at premiums. That does put the latest premium of 1.49% just over the average of the past 1-year period of 0.81%. Over the longer-term 5-year period, we do see a bit of a discount at 2.34%.

(Source: CEFConnect)

This is certainly much different than where the fund was trading after it launched around 2017. In 2017, it started a trend where it would see the fund hitting some incredible premium levels. Since moderating out a bit since 2018, I do feel more confident in the latest valuation. That isn't to say that tech itself isn't overvalued, but we did just have the correction in tech. If history tells us anything, it is that we shouldn't expect another correction being right around the corner. That being said, history isn't always the perfect predictor going forward. Situations change and the market will act accordingly, possibly providing a more opportunistic time for buying.

The dip we got in March would certainly be enticing.

Distribution - A Welcome 13% Boost

Since BST's performance has been so strong, it has been able to keep the distribution growing. At the same time, it has been appreciating at price quite rapidly as well. This is rare among most CEFs, as they pay out almost all of their earnings that they take in. In the case of BST, it has been able to pay out an attractive distribution and grow at the same time.

The current yield of the fund comes to 4.76%. This was after a 13% boost recently. This was the 5th time that BST was able to raise its dividend as well, another rarity in the CEF space. This is due to, once again, not retaining earnings and paying out everything that is taken in. That works out to raising the distribution 87% since inception in late 2014.

(Source: CEFConnect)

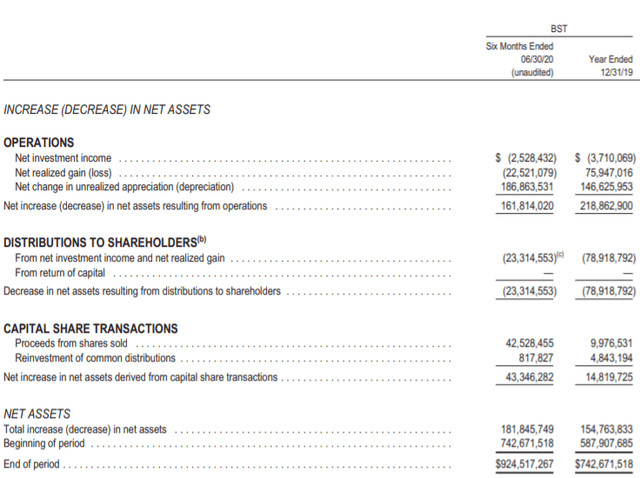

Due to the nature of tech investing, the fund doesn't take in much in the way of net investment income. Instead, it will rely significantly on capital gains. Capital gains that can continue pouring in just as long as management can continue making the right calls and investing in the right names.

Older tech names have been starting to focus on capital return plans with increasing dividends. However, buybacks also take up a significant portion of their capital return programs. Most newer tech names retain all of their earnings and revenue to continue to fuel growth - that is, if they have any revenues at all. Though BST's positions are more skewed to the older tech names that do have earnings and profits.

(Source - Semi-Annual Report)

BST has only classified long-term capital gains in its distribution for 2019 and 2018. However, this report is a perfect example of why return of capital might show up. As we can see, the fund has been on absolute fire on a YTD basis due to unrealized appreciation. Though it took and realized losses in this report. It isn't to say that through the end of the year, or even now, that the fund hasn't switched this to realized gains. It is just that of this latest report, the final tax classification could include some, and it wouldn't be anything to worry about.

Additionally, we see that BST has been able to take full advantage of an at-the-market offering due to its premium pricing. This can be a good thing, as it is a way to raise capital in an accretive manner. In the last 6 months alone, the fund was able to raise over $42 million in assets from selling shares.

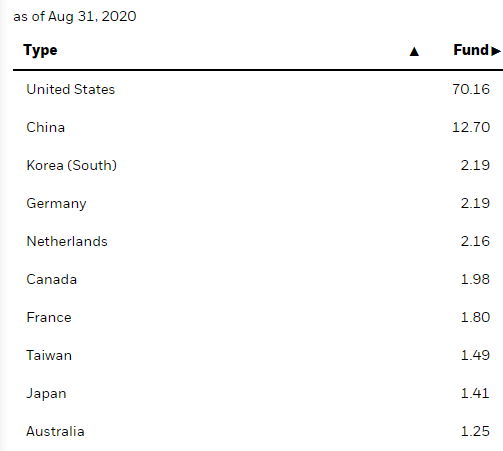

Holdings - Large-Cap, Mostly U.S.-Based

The primary geography of its portfolio is U.S. companies. However, China is also at a somewhat meaningful amount. The remaining country allocations would hardly make a dent in the performance on their own though. The portfolio also isn't confined to holding U.S. companies. If managers feel that the greater opportunity is elsewhere, then they are free to invest in other locations. However, what we do know is that many of the leading tech companies were U.S.-based in the past. That has certainly helped BST become the fund it is today.

(Source: Fund website)

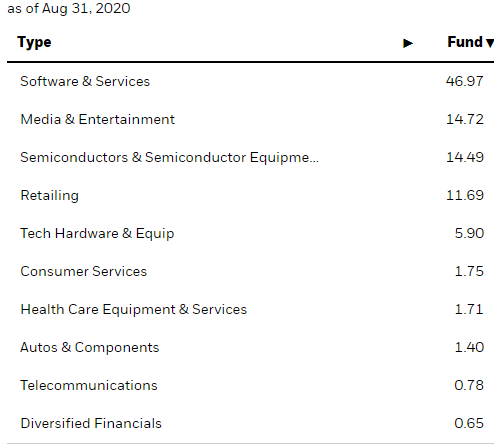

If we break the portfolio down to sectors, we see that it is overwhelmingly invested in "software and services." "Media and entertainment" comes in second, but is close to the same allocation that "semiconductors and semiconductor equipment is." It is then interesting, as the fund holds various other names that are classified under "diversified financials" and "telecommunications." Of course, even these other subsectors are tech-related, just at first blush, they wouldn't appear to be what we would necessarily expect.

Again, I believe this is positive, as it means the managers are given flexibility. They are able to think outside the box to find greater opportunities than what might be thought of.

(Source: Fund website)

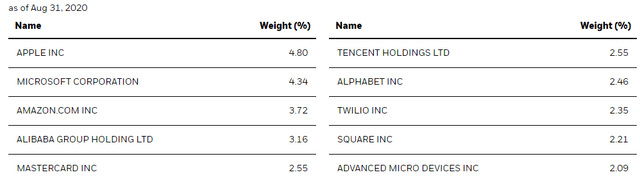

Looking at the top ten holdings of BST, it would appear that the fund holds many names that most investors will be familiar with. These are widely followed stocks that appear in many portfolios. They are the names that are the most relevant in how we live our lives.

(Source: Fund website)

Apple (AAPL) and Microsoft (MSFT) firmly at the top of the list, with over 9% of the portfolio's assets just in those two names alone. This is followed by Amazon (AMZN), another name that I'm sure all investors are familiar with.

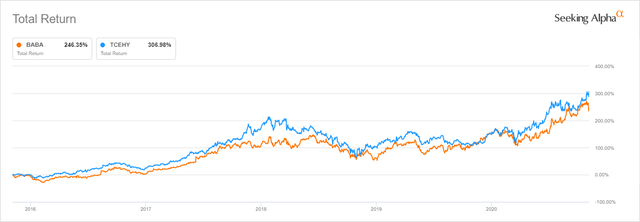

In the top ten, we do also see Alibaba Group (BABA) and Tencent Holdings (OTCPK:TCEHY). TCEHY is traded OTC, and BABA trades on the NYSE. However, these are both companies based in China. While they aren't based in the U.S., I would assume many investors are familiar at least somewhat with these names. These two appear in many financial discussions and are stocks that have performed incredibly well over the years.

Both of these companies are tech-related - of course, that is how they ended up in BST in the first place. They operate through several segments; BABA "through its subsidiaries, provides online and mobile commerce businesses in the People's Republic of China and internationally."

TCEHY is a multinational conglomerate that operates in the tech space through various segments; it "provides value-added services (VAS) and Internet advertising services in Mainland China, the United States, Europe, and internationally. The company operates through VAS, FinTech and Business Services, Online Advertising, and Others segments. It offers online games and social network services; FinTech and cloud services; and online advertising services, such as media, social, and others advertisement services."

These larger tech names have been under constant pressure from various government entities around the world. They have been dealing with antitrust investigations, and that has seemingly done very little to dampen share prices.

In fact, some analysts and investors believe this would be a good thing. Potentially, yet again, another catalyst for the tech space. A breakup in the tech sector of companies could actually unlock value for some of these names. The idea is that these smaller segments of the tech companies could deliver more specialized and focused approaches. It would also unlock portions of the company that experience higher growth. This would mean investors could buy these individual companies that have higher growth; they wouldn't be dragged down by the slower business lines.

All that being said, we can revert back to the previous discussion in this article. That a divided Congress and the Biden administration will have a tougher time making any changes. So, at least from that perspective, it is "status quo" for now.

Conclusion

BST remains a high-flying name, and brief dips are just that - brief. The tech correction we witnessed in September quickly rebounded, before taking another brief dip at the end of October. Well, now all of that seems to have been cleared out again with the thought of a Biden administration and a split Congress. This should result in things staying as they are, and that is a good thing for the tech sector and growth stocks. The clarity of the election being just about over is also helping the general sentiment as well. One thing the market hates is uncertainty, and gaining any clarity results in what we are witnessing - sharp moves to the upside.

The latest premium on the fund isn't outrageous and is worth considering here if you are a long-term investor. Additionally, BST remains one of the best choices for both growth and income in the CEF space. It might not give comparable performance to something like the Invesco QQQ ETF (QQQ), but QQQ doesn't pay you monthly at nearly 5% either. That is an important fact for many income investors and retirees. The 87% growth in that dividend since inception also doesn't hurt!

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long BST, BSTZ, MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was originally published to members of the CEF/ETF Income Laboratory on November 5th, 2020.