COVID-19 Vaccine Paves The Path For Welltower's Stock To Return To All-Time Highs

COVID-19 has had a major impact on Welltower's Senior Housing Portfolio with revenues down nearly 20% year over year.

With a bevy of viable vaccines coming to market, this portion of the portfolio is poised to quickly recover, and the stock price with it.

Welltower has also successfully used this period to strengthen their balance sheet, pay down debts, and reposition their real estate portfolio.

Welltower's above market dividend provides a secondary tailwind for the stock in this low rate environment.

Overview

This week we are looking at another compelling company, Welltower (WELL), a healthcare REIT that has been a good performer until the pandemic. While Welltower has done a fine job managing through the pandemic, their revenues are down notably and the stock has reacted accordingly, down a little more than 21% on the year as of the time of writing. Fortunately, Welltower's businesses are poised to recover quickly, once the pandemic is in the final stage. With a viable vaccine on the horizon for COVID-19, now could be a good time to add some WELL to your portfolio.

Introduction

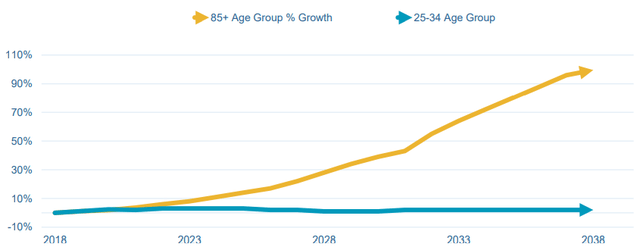

Welltower (WELL) is one of the largest REITs in the United States, but is often overlooked by investors due to the complexity with its medical portfolio. At a high level, Welltower is positioned to benefit from the aging population in the United States (and abroad). Specifically, the population of 85+ year-olds is expected to grow at a rapid rate over the next 20 years and tends to be the segment that spends the most on health care costs. For this demographic trend alone, Welltower deserves serious consideration as a core holding in a portfolio.

Projected Growth Rates for the Senior Population

Core Businesses

Welltower is a well diversified health care REIT focused on the senior citizen segment of the market. The primary focus for the company has been on senior housing facilities, with a secondary focus on medical facilities to treat seniors, including long-term care, post-acute care, outpatient medical, and health systems. The company has been successfully expanding both segments, with an eye to balancing the portfolio over time. As a result, their breakdown on an In-Place NOI basis has shifted over the past two years from 66% senior housing / 34% medical facilities to 57% senior housing / 43% medical facilities. Having both residential and treatment facilities in their portfolio, Welltower management has successfully leveraged two of the major needs for senior citizens to successfully grow the company.

Welltower Portfolio Composition by In-Place NOI

Source: Welltower Business Update, November 2020.

Residential Facilities

Welltower's housing facilities have been the bedrock of their portfolio. These facilities include independent living, assisted living and memory care and are designed for the affluent resident. While Welltower is based in the United States, they do have properties in Canada and the United Kingdom. Given their resident profile, their properties tend to be well maintained and have higher-end features and activities that are expected and valued by residents. This approach to the business creates a number of benefits:

- First, since the average resident is more than 75 years old, these tend to be their last home. As such, potential residents have very high standards for their residence. The focus Welltower brings to each property to deliver a premier operation helps to successfully attract new residents.

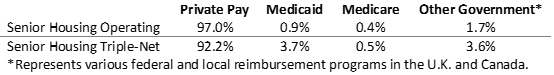

- Second, Welltower residents tend to pay for their housing costs out of pocket. This is in part due to most residents downsizing from a larger property and/or having prudently saved during their life to have a significant retirement portfolio. This translates to a 97.0% private payment rate for their Operating portfolio and a 92.2% rate for their Triple-Net properties. For shareholders, this is a tremendous benefit as the company is not dependent on payments from government programs (Medicaid, Medicare, etc.).

Facility Revenue Mix as of September 30, 2020

Source: Welltower Business Update, November 2020.

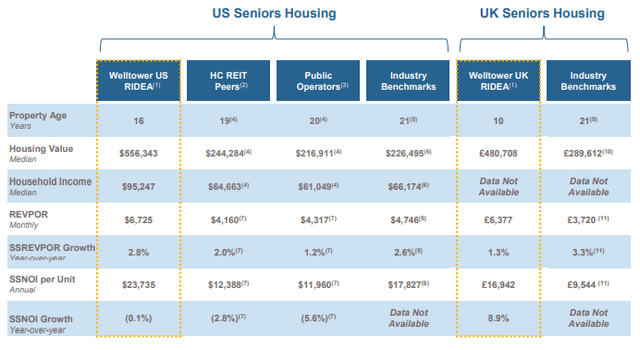

- Third, Welltower's properties tend to command a premium in the marketplace as they are both newer and high-end. As a result, the company is able to achieve a higher margin per unit, and also keep maintenance costs low compared to peers.

Operating Results Compared to Peers

Medical Facilities

To complement the company's residential properties, Welltower has developed a portfolio of medical care facilities. These are primarily focused in the areas of long-term care, acute care, outpatient, and health systems. Although a smaller portion of the business, these operations have created an opportunity for faster growth compared to residential. This is due to much shorter stays/higher turnover for customers. Comparatively, the average length of stay on the housing side of the portfolio is approximately seven years.

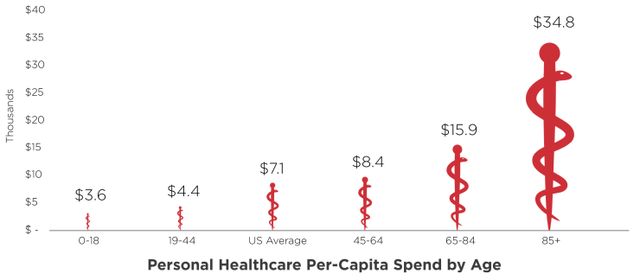

Additionally, by growing the medical side of the portfolio, Welltower is well positioned to serve the needs of their residents and potential future residents. When looking at the personal healthcare spending per-capita by age (see chart below), the highest segments are 65-84 year-olds and people 85+ years old. Not only does this create a strong secondary revenue stream for Welltower, but it also creates a potential pipeline of new residents.

Health Care Spending by Age Group

Impact of COVID-19

Welltower has been a solid business that is well diversified from both a geographic and property mix standpoint. Unfortunately the one market that the company is built to serve, senior citizens, represents the largest risk cohort for the COVID-19 pandemic. Accordingly, all of the company's business lines are impacted due to the pandemic.

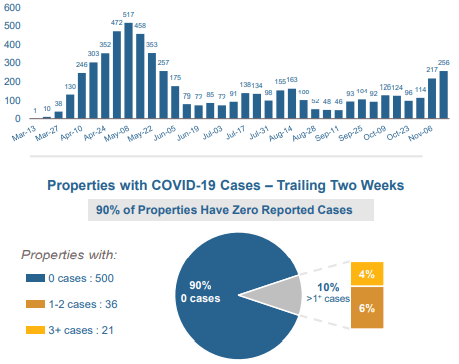

Understandably, the senior housing portfolio has been much stronger in the past. At the end of 2019 the occupancy rate was above 86%, which has declined to 78.4% as of the end of October. While rent collections are holding steady at 98%, the decline in residents is a hit to revenues which are down nearly 20% year over year. This decline in occupancy is a result of large numbers of "Move-Outs", which tragically for many residents means they have passed away. Fortunately, property operators have done a great job of containing the spread of the virus and are currently only seeing COVID-19 cases in approximately 10% of their properties on a trailing two week basis (see chart below). Additionally, with updated cleaning, eating, and quarantine procedures in place, the company is accepting new residents in 96% of their communities.

Resident COVID-19 Cases - Trailing Two Weeks as of November 13, 2020

Source: Welltower November Business Update.

Surprisingly, the medical side of the portfolio has not seen a decline thanks to nearly all tenants staying current on rents. Using the most recent third quarter numbers, revenues from this segment have grown by more than 1.5% over the past twelve months. This translates to a 93.6% occupancy rate and approximately 99% of rent due for Q3 has either been paid or deferred until the end of the year. Similar to the housing portfolio, enhanced cleaning and maintenance has enabled all buildings to be open.

Recovery Upside

With a vaccine on the horizon, Welltower is well positioned for a recovery. Since Welltower's occupants are predominantly senior citizens or medical professionals, they are on the priority list to receive the vaccine early-on. This should make Welltower an early beneficiary in what hopefully will be the final stage of the pandemic.

Since the start of the pandemic, Welltower management has been actively involved with major health organizations such as CVS Health Corporation (CVS), Walgreens Boots Alliance, Inc. (WBA), as well as the NIH's Warp Speed team to quickly bring new treatments and ultimately a viable vaccine to their residents. When the senior citizen population is been mostly vaccinated, Move-Ins should pick back up and occupancy should come back to its recent levels of 86%+.

While the medical side of the portfolio has not seen a decline due to the pandemic, the number of elective procedure should pick up materially. This is anticipated as many people have been opting to delay these procedures until the virus is no longer a concern. This pent up demand should boost occupancy rates higher and also result in a noted rise in rents. This should be a direct benefit to their outpatient medical facilities (23% of the portfolio) as well as a benefit for some of the other facilities in the medical side of the business. It would be reasonable to see the revenues from these businesses grow faster than the current anemic rate of 1.5% for the next year or two.

Hidden Gem - Capital Management

In addition to positioning the company for the aging population, Welltower's management team has also done an excellent job of managing their capital. This translates to both a strong balance sheet and property portfolio:

- Welltower's balance sheet as of the end of October had nearly $5.2 billion in liquidity, consisting of $2.2 billion in cash, and an undrawn credit facility of nearly $3.0 billion. Additionally, the company expects to receive another $214 million in cash for assets that are marked for sale as of September 30th.

- The management team has also done a great job of managing their properties by strategically selling underperforming assets and either acquiring or building new properties to enhance the overall portfolio. As of the end of the third quarter, Welltower had acquired 22 properties, was in development for another 49, and had sold 113 for a net investment impact of more than $2 billion coming to the company.

- Lastly, the management team has leveraged the proceeds from a number of their asset dispositions to pay down debt. As a result, in the third quarter alone Welltower extinguished or defeased $855 million in debt.

Welltower's strong position in this challenging time has enabled the company to use the current environment to strengthen their balance sheet and improve their portfolio of properties. As a result, the company is poised for outsized growth following the end to the pandemic.

Dividend

One last driver for Welltower is its dividend. From a REIT perspective, it is fairly low with a current yield of 3.78%. The management team has also historically seen the dividend as a source of capital. For example at the end of 2016 management decided to keep the dividend steady, instead of the consistent raise each year, in order to fund a second senior living facility in New York City. The management team went to the dividend again in May of this year and cut it by 30% to $0.61 per quarter. Despite this activity, Welltower is still an interesting dividend stock for two reasons. First, it is required to distribute a large portion of cash flow to shareholders to receive the special tax treatment of a REIT. Secondly, with a balance sheet in a stronger position and a significant retooling of the the portfolio of properties, management may opt to make an outsized dividend increase in the near term.

The presence of an above market dividend yield from a company with a strong balance sheet creates a strong external tailwind for the stock. This is due to income oriented investors searching for ways to replace lost income from their bond portfolios. This phenomenon occurred a little more than a decade ago during the Financial Crisis. As a result of the Federal Reserve's actions to bolster the economy, interest rates fell to historically low levels. At the time, income oriented investors were faced with the same challenge as today. Their solution to this challenge was to invest in high quality dividend stocks to replace lost income. This translated into strong investor demand for high dividend stocks as rates remained low. Today we are seeing even lower interest rates than in the Financial Crisis, and given the impact of the pandemic, these rates are expected to remain low for years.

Risks

Investing in Welltower is not without risk. The company could be facing a major challenge if the vaccine is not as successful as in initial trials or does not provide protection for a long enough period of time. If that is the case, the model of senior citizens living in apartments may be challenged for the foreseeable future. While the end result may be permanently heightened levels of cleaning and air filtration, the ongoing additional cleaning expense and the cost to retrofit housing facilities will not be trivial.

Another major risk for Welltower is the location of its properties. In recent years, the company has focused on building luxury facilities in a number of major cities. They saw this marketplace as one of the most underserved ones for the senior community. The company had been investing heavily in these markets for years and were starting to see success. If consumer preferences have shifted, and seniors no longer want to live in these locations, Welltower may need to take a large write-off on these assets.

Conclusion

COVID-19 has been tough for most companies, and Welltower was confronted with many of the challenges from this pandemic. Fortunately the management team was able to adapt and is now in a strong position to recover once a vaccine becomes widely available. Additionally, Welltower has used this time to strengthen both their balance sheet and portfolio of properties. As a result, when the pandemic winds down, Welltower should be able to produce compelling returns for investors over the medium term.

Disclosure: I am/we are long WELL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.