NMI Holdings: An ROE Star In The Attractively Priced Mortgage Insurance Industry

I have a $35 price target on mortgage insurer NMI Holdings, up about 50% from the current price.

The housing industry is remarkably strong, building on a decade of undersupply and careful mortgage underwriting.

NMI stands as a conservative underwriter with a large amount of excess capital.

A few weeks ago I recommended – again! – mortgage insurer MGIC Investment (NASDAQ:MGIC). While I didn’t mention MGIC’s other industry peers, I intended the piece to be a general industry recommendation. I admit that basically all mortgage insurers looked the same to me. But after listening in to the NMI Holdings (NASDAQ:NMIH) (National Mortgage) investor conference call last week, I feel obliged to single out this company for special mention. I am impressed with NMI’s focus on return on equity, which should pay dividends – pun intended – over the next few years for shareholders. I recommend the stock as a buy with a $35 price target.

Before I get to NMI’s specifics, I’ll quickly review the big picture positives for the mortgage insurance industry.

Mortgage insurance industry positives – positive housing market supply/demand

The primary driver of mortgage industry earnings and stock prices is the level of claims payments. Private mortgage insurance claim payments are in large part driven by home prices. Falling home sales and prices increase both the quantity and severity of mortgage defaults.

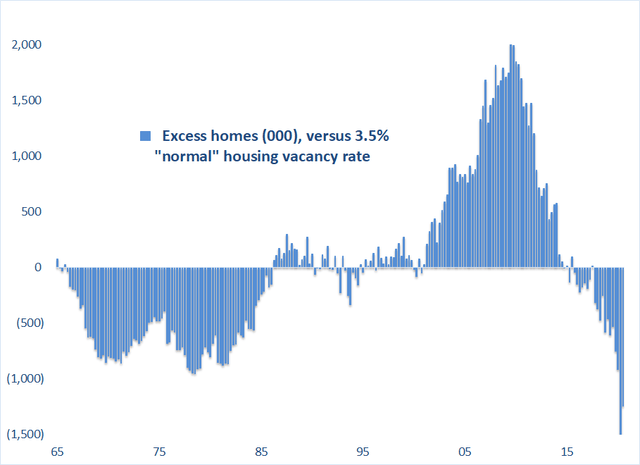

The sharp decline in GDP and rise in unemployment caused by COVID should logically have reduced home sales and home prices, right? Wrong, as we have learned. For example, the S&P/Case Shiller National Home Price Index was up 6% year-to-date through August. Part of the reason is a quick societal shift towards suburban and rural living in response to COVID. But another critical part of the story is a significant and growing housing shortage, as illustrated here:

Source: Census Bureau

Basic economics tells us that when demand exceeds supply, prices go up.

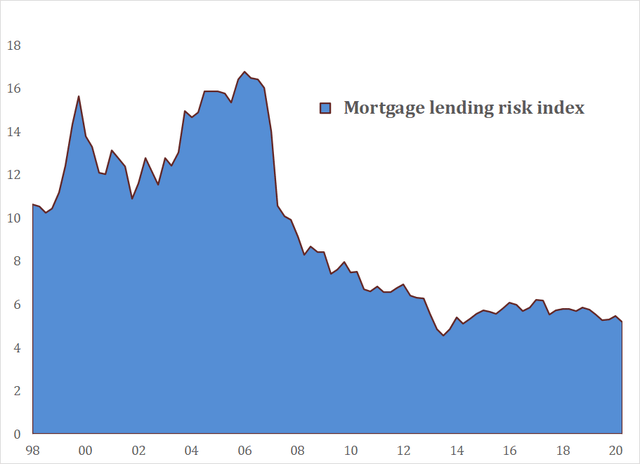

Mortgage insurance industry positives – conservative home mortgage underwriting standards

The other main contributor to mortgage defaults and insurance claims is weak underwriting standards – giving loans to borrowers with low credit scores, high debt levels, low downpayments, etc. But this chart shows that mortgage underwriting standards have been quite conservative since 2009.

Source: Urban Institute

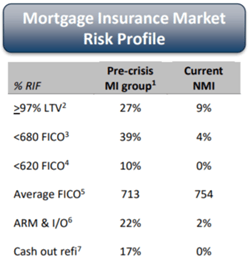

More evidence of the dramatic improvement in mortgage credit is this comparison of the credit risk exposures of peers MGIC and Radian (NYSE:RDN) back in ’07 to NMI today:

Source: NMI Holdings presentation

The payoff for the conservative lending is evident in the low credit problems to date from the pandemic. The federal government made the decision to defer, and hopefully minimize, homeowner defaults due to COVID by creating a payment forbearance plan through Fannie Mae, Freddie Mac and the FHA. By June 7, 6.4% of Fannie/Freddie loans were in forbearance. But:

- That ratio fell to 3.4% by November 8 and appears to be trending still lower.

- 46% of the loans in forbearance never missed a payment or were paid off by a property sale.

- 53% have resumed full or partial mortgage payments.

- Only 1% are unresolved or in default.

Mortgage insurance industry positives – the upside of the pandemic

The downside of the pandemic is clear – a sharp rise in the unemployment rate and a much more fragile economy. Claims payments will be notably higher over the next five years than without the pandemic. But the pandemic also created three positives:

- Even more conservative underwriting standards. For example, from Q1 ’20 to Q3 ’20, NMI reduced by half or more the share of its new business with less than a 680 FICO, a greater than 45% debt-to-income ratio and a 3% downpayment.

- Insurance premium price increases of about 10%.

- A huge wave of high-quality new business with likely high persistency. About 30% of NMI’s insurance book was originated over the past two quarters, since the credit tightening and price increases. Because mortgage refinancing activity remains strong, within two quarters, half of NMI’s insurance in force will be at these better terms. And the average mortgage rate on the new book will be close to 3%, meaning there is a good chance that it won’t get refinanced away for a long time.

The National Mortgage ROE story

As a conservative underwriter, NMI gives up earnings for capital. So, while its numerator in the ROE calculation is low, so is the denominator. The result was a 21% return on shareholders’ equity last year, a high ratio for an insurance company, and top of the range for a mortgage insurer. Let’s see how NMI did it, and how it might look in 2022 when – fingers crossed – COVID is behind us.

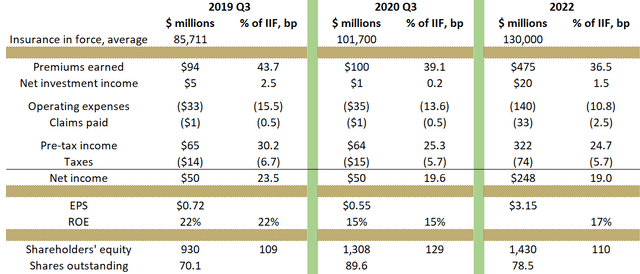

This is a summary of NMI’s operating earnings for Q3 ’19 (pre-COVID) and Q3 ’20, plus my forecast for 2022 Note that I include columns for income as a percent of NMI's insurance in force (IIF):

Source: NMI financial statements

Let’s review the details.

Insurance in force. NMI is the smallest of the six mortgage insurers but the fastest growing. The table shows that its insurance in force – the face value amount of home mortgages insured – grew by 19% year over year (YoY). NMI argues that the fast growth is driven by early technology adoption and an intensive sales effort. Another reason might be lower prices on some high quality business than its peers, since NMI’s average insurance premium earned is lower than peers.

I assume 15% growth next year and 10% in 2022, slowing as NMI matures. I assume industry growth of 6-8% for both years, which could be conservative. The mortgage insurers’ market is nearly exclusively Fannie/Freddie loans, which have grown by over 10% year-to-date.

Premiums earned rose only 6% despite the 19% business growth. That’s because as NMI reduced the credit risk it is willing to take, it accepted lower premium rates. Makes sense. I expect modest further erosion in its pricing.

Net investment income fell sharply for two reasons. For one, lower market interest rates means that NMI earns less on its investment portfolio. Second, NMI sharply increased its borrowings to strengthen its capital base in response to COVID. I expect a recovery in investment income because NMI will keep growing investment assets but not its debt.

Operating expenses rose slightly from a year ago despite both a bigger base of business and a sharp increase in new business. Part of the modest increase was because, like other firms, NMI limited travel and entertainment expenses. I expect little or no increase in operating expenses by 2022 because of technology changes. For one, NMI just put in place a low-cost way of delivering to its customers its automated pricing model. Second, experience during the pandemic has made NMI and its customers more comfortable with online sales and management of mortgage insurance. Hence, fewer salespeople and support staff are likely.

Claims paid. Note that I use a “cash” income statement; I track and forecast NMI’s actual cash claims payments, rather than including non-cash accruals for future losses. So far, COVID hasn’t increased claims payments, which remain remarkably low. I am becoming increasingly confident that claims payments will remain low in 2022, based on:

- The continued strength of the housing market.

- Tighter underwriting standards by the whole mortgage industry.

- The government’s recognition that allowing a wave of foreclosures will seriously damage the economy, so forbearance extensions or other measures are likely if a recession recurs.

- NMI maintains reinsurance agreements on nearly all its businesses. Reinsurers will absorb much of NMI’s credit costs if the U.S. economy slips back into recession.

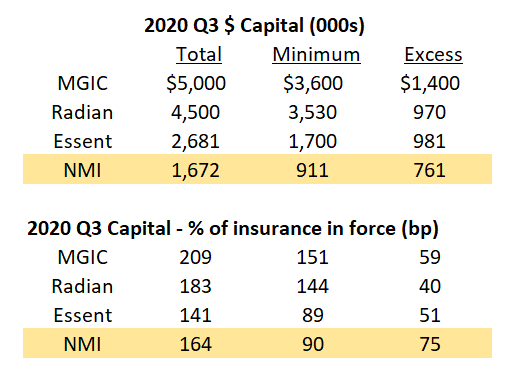

Shares outstanding. This is a big opportunity for NMI. Maintaining a conservative credit risk profile should have two payoffs for investors. One is more stable earnings. The other is less capital required by the business to protect against a period of high claims payments. But how much less? Return of excess capital to investors should be a major driver for NMI’s ROE and EPS and therefore stock price over the next few years. To show you why, here’s a table summarizing the regulatory capital requirements for NMI and its peers at the end of Q3 ’20:

Sources: Company reports

First, look at the minimum capital ratios for the four companies. NMI’s is low because as a new entrant it doesn’t have insurance policies written in the pre-’09 bad old days. Then look at the excess; NMI has the most excess capital, because it responded to news of the pandemic by issuing $230 million of stock and $700 million of debt this past spring.

Now, let’s look forward to 2022. I assume that:

- Claims payments increase but not dramatically.

- NMI’s insurance in force grows to $130 billion. The portfolio risk characteristics should improve because of the current tightened underwriting standards.

- NMI earns about $400 million over the next two years, taking its regulatory capital to $2.1 billion, or about 160 bp of insurance in force.

- With COVID risk abating and the portfolio credit risk lower, NMI’s minimum capital ratio should decline from 90 bp at present towards its 74 bp ratio of a year ago. Let’s say 80 bp.

If these assumptions are reasonable, then NMI will be sitting on about $1 billion in excess capital. There is absolutely no reason for NMI to hold that much. I assume that NMI uses $300 million to buy back stock, which reduces its share count by 12% from the current level.

Summing up – My target price two years out is $35

Using my assumptions from above, this is what NMI should look like in 2022:

- EPS of $3.00 or more.

- A book value of $18.25.

- Substantial excess capital of $700 million.

- An ROE of 17%.

- Stability in forward earnings because of low credit risk, strong reinsurance protection and lower than average loan prepayment risk.

- An ability to distribute about half or more of forward earnings to shareholders. That means a $1.50 dividend, 6% annual share repurchases or more likely some combination of both.

Disclosure: I am/we are long NMIH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.