Clean Energy Fuels: Now May Finally Be Its Time

CLNE spiked 26% on November 23rd due to surge in rival PLUG shares.

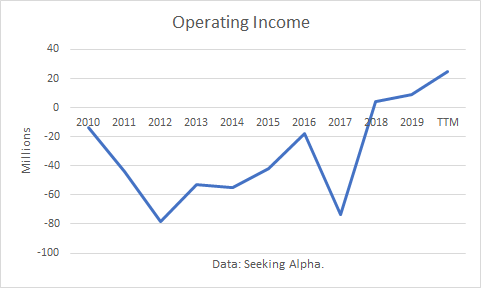

The company has had a long history and finally turned a profit in 2018.

Trailing 12 months profitability is rising.

Its renewable natural gas has a "negative carbon rating."

And fleets can switch to the fuel from gasoline or diesel.

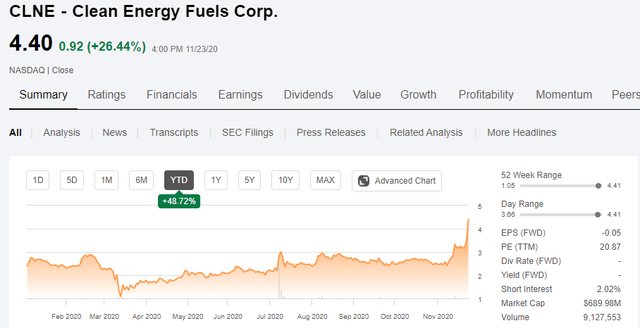

Clean Energy Fuels (CLNE) spiked 26.44% on November 23rd, to close at $4.40/share, its highest close since 2016. The stock is up 48.7% in the year-to-date.

Source: Seeking Alpha.

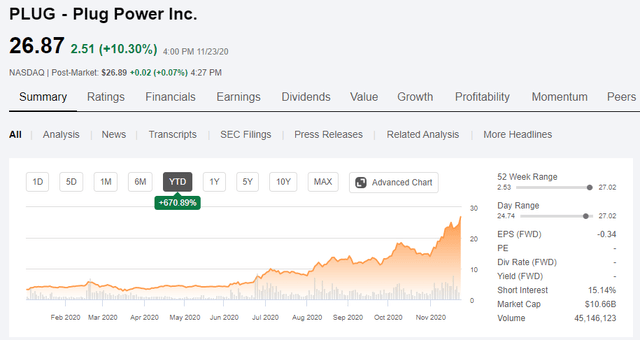

No company news appeared to support the spike. But one of its rivals, Plug Power (NASDAQ:PLUG), was "plugged" by Barron's over the weekend "one of this year's stock market standouts," a pioneer of clean energy supplies for forklifts, and its price surged. A week ago, Plug had announced a $750 million public offering of common stock. Plug is up 671% year-to-date.

Source: Seeking Alpha.

Corporate History

In 1996, T. Boone Pickens and Andrew Littlefair spun off a natural gas fueling business from Mesa Petroleum named Pickens Fuel Corp. In 1997, it moved to Seal Beach, California, and bought 33 natural gas fueling stations from SoCal Gas (SRE).

The company name was changed to Clean Energy Fuels Corp. and in 2007 it went public. The company partnered with Pilot/Flying J, a large truck-stop operator, and began building America's Natural Gas Highway™.

In 2013, it launched Redeem™ renewable natural gas.

Source: Clean Energy.

In 2017, it sold its upstream RNG business to British Petroleum (BP) and in 2018, Total SE (TOT) bought a 25 percent share. In 2019, the company signed a 7-year contract with UPS and increased its sales by 30 percent from 2018. The company reported operating profits of $4.4 million in 2018 and $8.9 million in 2019. Its 12-month trailing operating margin was $24.6 million.

The company currently operates over 530 natural gas fueling stations in 43 states and Canada, according to its website.

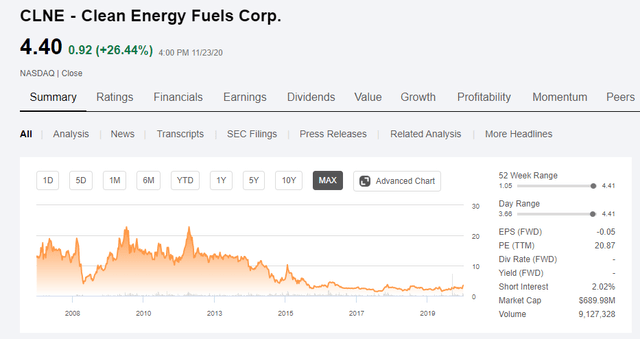

The company's share price had been as high as $21, but it had not become profitable until 2018, as noted above.

Source: Seeking Alpha.

Renewable Natural Gas

The company sells renewable natural gas ("RNG"), compressed natural gas ("CNG") and liquified natural gas ("LNG") and delivers RNG in the form of CNG or LNG for medium and heavy-duty vehicles. For public and private fleets, it provides operations and maintenance services.

Mr. Littlefair calls RNG "the future of clean energy." In third quarter conference call, he said,

It is truly a remarkable fuel that allows customers to easily chalk up big no inconvenience, they can switch their vehicle fleets from diesel, whether is a shuttle van in an airport, Refuse trucks or city buses or heavy duty trucks. Even if they are already operating on a regular blue CNG or LNG, we can switch them to Redeem without a blip in their operations, allowing them to reduce their carbon output more than what they were doing before.

Customers are responding. With the emphasis on ESG investing and pressure from regulators, politicians, investors and their customers, companies are looking at their entire supply chain to make reductions in their carbon footprints. Fortunately, Clean Energy can provide them an easy and cost-effective transportation fueling solution."

RNG is derived from methane, a greenhouse gas, and is displacing diesel and gasoline, and more of it will come from dairies and agriculture. The California Air Resources Board gives it a "negative carbon rating," sometimes over 300% minus.

Mr. Littlefair explained,

To put this in perspective, gasoline has a carbon intensity of 137 and diesel has a carbon intensity of 97. Even vehicles powered by electric batteries have a carbon intensity of 46 according to the California Air Resources Board. So, you can see that a minus 300 carbon intensity rating is why it catches the attention of companies seeking to reduce their carbon footprints."

And CLNE claims that the product is cost efficient, less expensive than competing fuels.

Source: Clean Energy presentation.

Conclusions

Clean Energy Fuels has been around many years and investors have seen their shares fall in value. However, the timing may finally be right for CLNE. Companies want as much negative carbon as possible because they want to apply those carbon reduction savings to reach their sustainability goals.

The price has spiked but at $4.40/share, it remains far lower than it has been, while the future needs for low carbon have never been clearer. And companies can conveniently switch to Redeem from diesel or gasoline.

To guide investors who are interested in profiting from outstanding opportunities in the energy sector, I provide a service on Seeking Alpha’s Marketplace oriented toward individual investors, Boslego Risk Services. A long/short Model portfolio is continuously updated, along with on-going analysis of the oil market.

I am now accepting new members to Boslego Risk Services and invite you to sign-up. There are monthly and annual pricing options as described here. You may also read reviews posted by members here.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CLNE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.