Sprott Gold Miners ETF: Should See Outperformance Once The Bottom Is In

The ETF is set up in a way where it gives extra weighting to the miners making money.

It focuses more on the larger firms compared to other funds.

We expect a bottom here in the fund in the next few weeks at most.

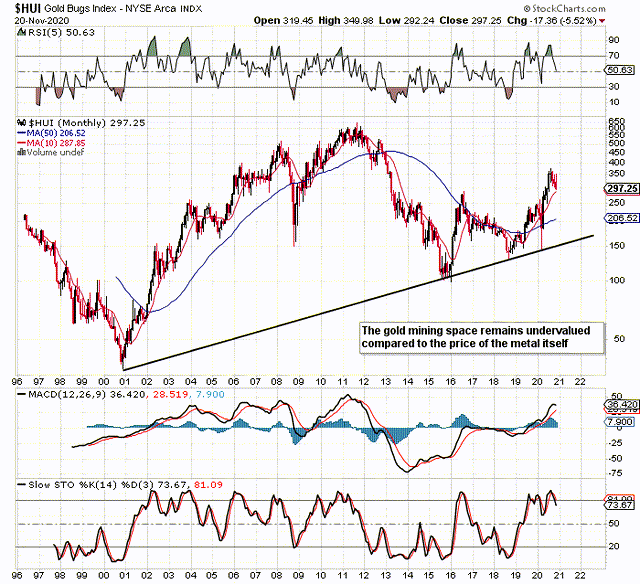

If we go to a long-term chart of the Gold Bugs Index ($HUI), we can see that the gold mining sector is still nowhere near its bull market highs of 2011. Gold topped out at well over $1900 an ounce in September 2011 and just recently surpassed this number this year. The mining sector has failed to follow through, which means we most definitely have an undervalued asset class on our hands. Although investing in individual mining companies bring different risks to the table (such as the shutting down of a mine, for example, due to COVID-19 or a labour strike, etc.), there is no getting way from the fact that mining companies as a whole remain more undervalued than bullion at the moment.

One can minimise risk by investing in an ETF, for example, which holds a basket of companies in the same sector. Yes, an aggressive second wave of the virus would be detrimental to many miners, but again, investing in a basket of companies decreases the risk that operations would be stopped in 100% of the holdings.

The Sprott Gold Miners ETF (SGDM) is a sound way for investors to invest in this space for the following reasons:

- The net total expense ratio comes in at 0.5%. This ratio is lower than its GDX counterpart.

- The fund should outperform in a sustained bull market. The reason being is that preference is given to the companies with the highest top line growth, highest free cash flow yield, and lowest debt-to-equity. This is done every quarter with the fund's weighting system when the portfolio's holdings get rebalanced. Earnings growth is what predominantly moves stocks on Wall Street. SGDM is set up to take advantage of this as much as possible within the portfolio.

- The “large cap” nature of SGDM also minimises risk to a large degree. At the end of the latest quarter, the miner with the lowest market cap came in just under $1 billion. In fact, only 16.6% of the portfolio's holdings have a market cap of under $2 billion. Suffice it to say, the fund predominantly focuses on proven mid-cap and large-cap miners. This definitely brings stability to the investment.

What really could ignite the precious metals space as well as funds such as SGDM is the fact that inflation could significantly pick up once a meaningful percentage of the population become vaccinated. Base money has been significantly increased by central banks in recent years, and especially so due to the pandemic-induced lockdowns this year. However, much of this freshly printed currency remains sitting in bank deposit accounts. A post-pandemic society definitely brings potential for velocity (circulation of currency) to increase, as fear would subside significantly. A vastly increased amount of currency chasing the same (if not limited amount of goods and services) would undoubtedly bring upside pressure on prices of goods and services.

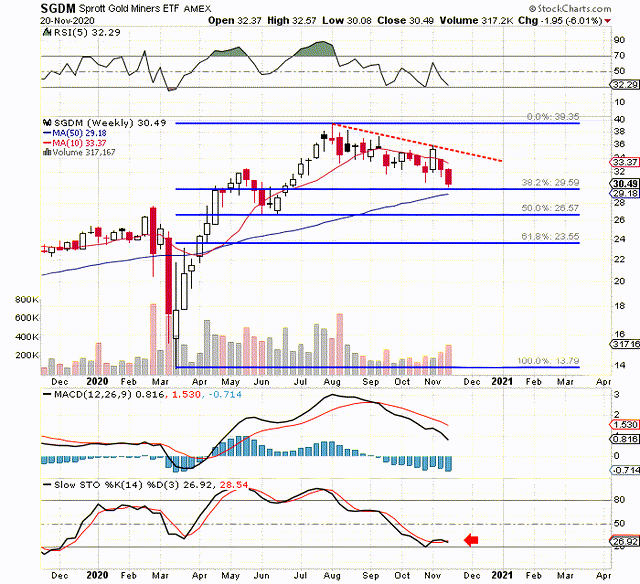

If we go to the weekly chart of SGDM, we can see that shares are only now dropping to the first intermediate Fibonacci level (38%). This intermediate decline has been long (going on 4 months in duration), but we cannot say that it has been steep. To call the bottom here, we would be looking for a weekly swing low, as well as an increase above the 10-week moving average of approximately $33.37. The 38% retracement level could very well put an end to this intermediate decline. We state this because the slow stochastics in SGDM have now reached oversold levels, which are indicative of intermediate bottoms, as we can see below.

If we go to the daily chart, we can see that the 200-day moving average in SGDM put a stop to the recent decline, which is encouraging. We will definitely get a bounce here, as shares remain oversold. The question is whether last Thursday's low will mark the intermediate bottom in the gold mining sector. We are now well over 30 weeks into this intermediate cycle, so we are definitely in the timing band for a bottom. If one wanted to preempt the move, one could add initial positions if the price can break through the 10-day average, and then more aggressively if the down-cycle trend line is breached to the upside. Given the length of this intermediate decline, we may not get our bloodbath phase. Either way, investors should wait for a convincing swing, preferably on strong volume.

Therefore, to sum up, SGDM is an attractive vehicle to play the rest of this bull market in precious metals. It specifically focuses on the larger miners, and its expense ratio of 0.5% is competitive in the market place. Furthermore, the underperformance of the mining complex in recent years means SGDM should outperform gold bullion for the duration of this bull market. Let´s see what the next few trading sessions bring.

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not not stop until it reaches $1 million.

-----------------------

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SGDM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.