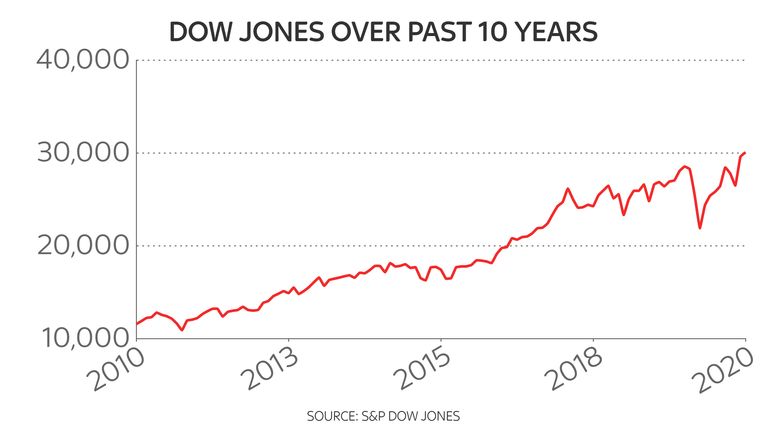

The Dow Jones Industrial Average has breached the 30,000 point barrier for the first time in its history as global stock markets continue their fightback from the coronavirus crisis.

Market analysts said the rally this month on COVID-19 vaccine hopes, coupled with several other factors to boost values.

The main element was the signal that Donald Trump could abandon his fight to stay in the White House through an order for his team to co-operate on the transition of power to Joe Biden following this month's presidential election.

Investors were also impressed by the Democrat president-elect's decision to nominate former chair of the Federal Reserve, Janet Yellen, as his Treasury Secretary.

It helped, too, that Boeing shares took off - part-boosted by news from regulators that the grounded 737 MAX was on track to return to the skies above Europe in January.

The recovery for share values across the world this month reflects expectations that economic damage inflicted by the pandemic will be limited next year by the availability of a growing number of vaccines that are entering the final stages of development.

As such, Brent crude oil was up almost 4% on Tuesday - trading at more than $47 dollars a barrel.

The FTSE 100, in London, has lagged the recovery witnessed in the United States since February's rout for values and remains 15% down in the year to date.

However hopes surrounding a possible Brexit deal by the end of the year, coupled with the vaccine element, have helped the index make up 15.2% this month alone.

It ended the day 1.6% higher at 6,432 points with virus-ravaged energy, travel and financial stocks all benefiting.

Airlines were boosted by news of a new air passenger testing regime to shorten quarantine periods.

But the scale of the challenge facing the FTSE becomes clear when its lifetime high - just above 7,900 points - is viewed in the rear view mirror.

The FTSE has been hurt during the crisis by its deep exposure to mining giants and lack of technology firms - the latter being companies that have helped the S&P 500 almost reach new milestone highs.

The Dow Jones is weighted by share price and not the market capitalisation of its constituents, as is the case in London.

It breached the 25,000 points barrier in January 2018 - less than a year after it achieved 20,000.

Trading volumes are widely tipped to shrink from Wednesday as the US Thanksgiving holiday begins, with US markets closed all day on Thursday and open only for a few hours the following day.

Neil Wilson, chief markets analyst at Markets.com, said of the landscape: "We're seeing some big risk-on moves this afternoon in the market which we can attribute to some very favourable pre-Thanksgiving flows off the back of Trump giving the green light to the transition, news that Janet Yellen is heading to Treasury and vaccine positivity increasing.

"Uncertainties about next year are being cleared out of the way and the vast liquidity put is still positive even if this all looks like it's a little exuberant."