Virpax Pharmaceuticals Readies $15 Million IPO Plan

Virpax Pharmaceuticals has filed proposed terms for a small IPO.

The firm is developing reformulations of existing, approved drugs to improve their performance.

While I wish Virpax well, I haven't seen the "reformulation" strategy produce major successes, so I'll watch the IPO from the sidelines.

Quick Take

Virpax Pharmaceuticals (VRPX) has filed to raise $15 million in an IPO of its common stock, according to an S-1 registration statement. The firm is developing a pipeline of pain management formulations.

VRPX is pursuing a "reformulation" strategy, which I have not seen working for other firms doing the same, so I'll pass on the IPO.

Company and Technology

West Chester, Pennsylvania-based Virpax was founded to create new formulations for the use of existing, approved drugs for various forms of pain management applications.

Management is headed by founder, Chairman and CEO Anthony Mack, MBA, who was previously founder of SCILEX Pharmaceuticals and ProSolus Pharmaceuticals.

Below is a brief overview video of an interview with founder, Chairman and CEO Anthony Mack:

(Source: Proactive)

The firm's lead product is a topical spray for chronic osteoarthritis of the knee using existing approved diclofenac as the active pharmaceutical ingredient. VRPX also has other pain management rights to develop improved delivery techniques and modalities.

Management believes that its topical spray film delivery technology provides stronger adhesion benefits in areas "around joints and curved body surfaces."

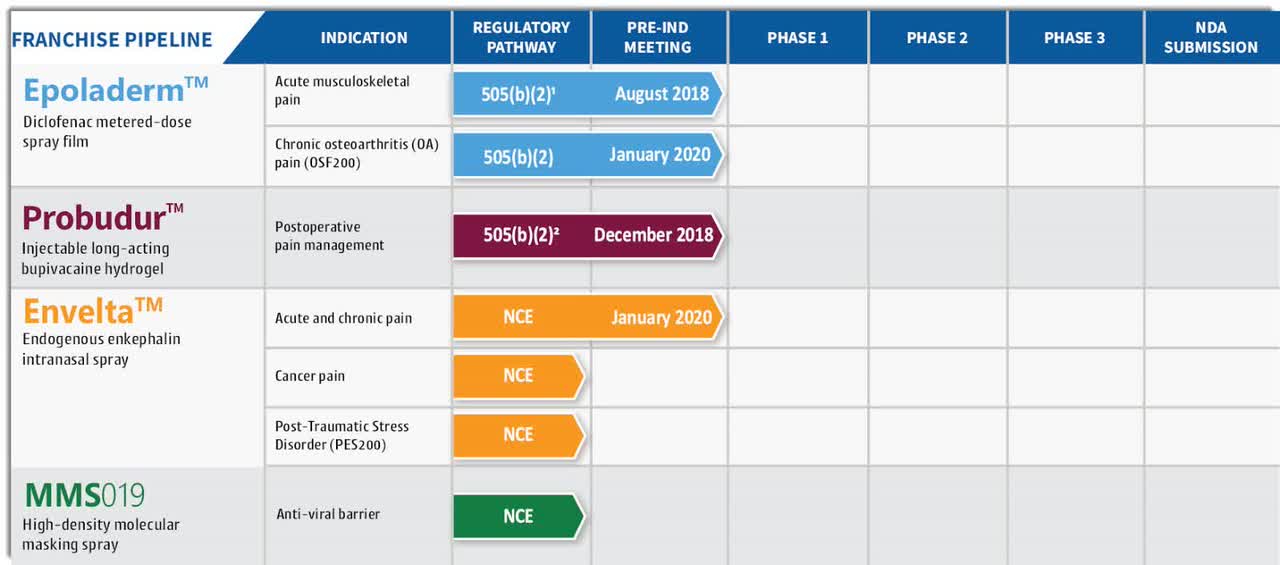

Below is the current status of the company’s drug development pipeline:

(Source: Company S-1 Filing)

Investors in the firm have invested at least $6 million.

Primary Market and Competition

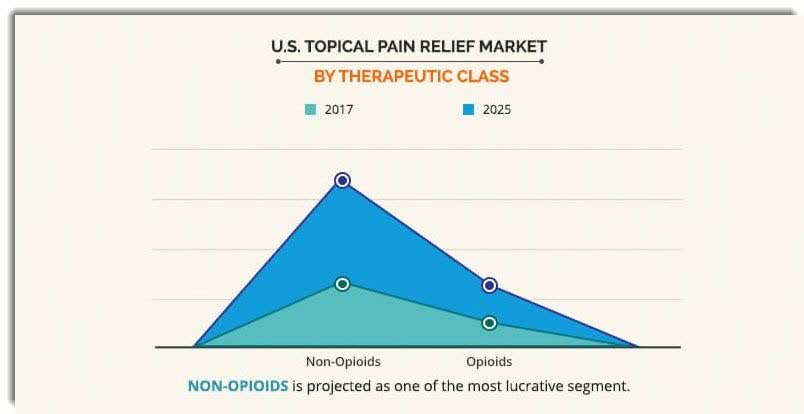

According to a 2019 market research report by Allied Market Research, the U.S. topical pain relief market was approximately $2.7 billion in 2017 and is forecast to exceed $3.7 billion by 2025. This represents a forecast CAGR (Compound Annual Growth Rate) of 6.0% from 2018 to 2025. Key elements driving this expected growth are a rising need for pain relief as the U.S. population ages and experiences greater pain of all types.

Also, topical pain relief products may cause lesser side effects than oral products but have the potential to cause greater skin irritation at the point of application.The non-opioid class of drugs is expected to grow its market share at a much faster rate than the opioid class, as the graphic indicates below:

(Source: Allied Market Research)

Major competitive vendors that provide or are developing related treatments include:

Financial Status

Virpax’s recent financial results are typical of a life science firm in that they feature no revenue and material G&A and R&D expenses associated with its product development efforts.

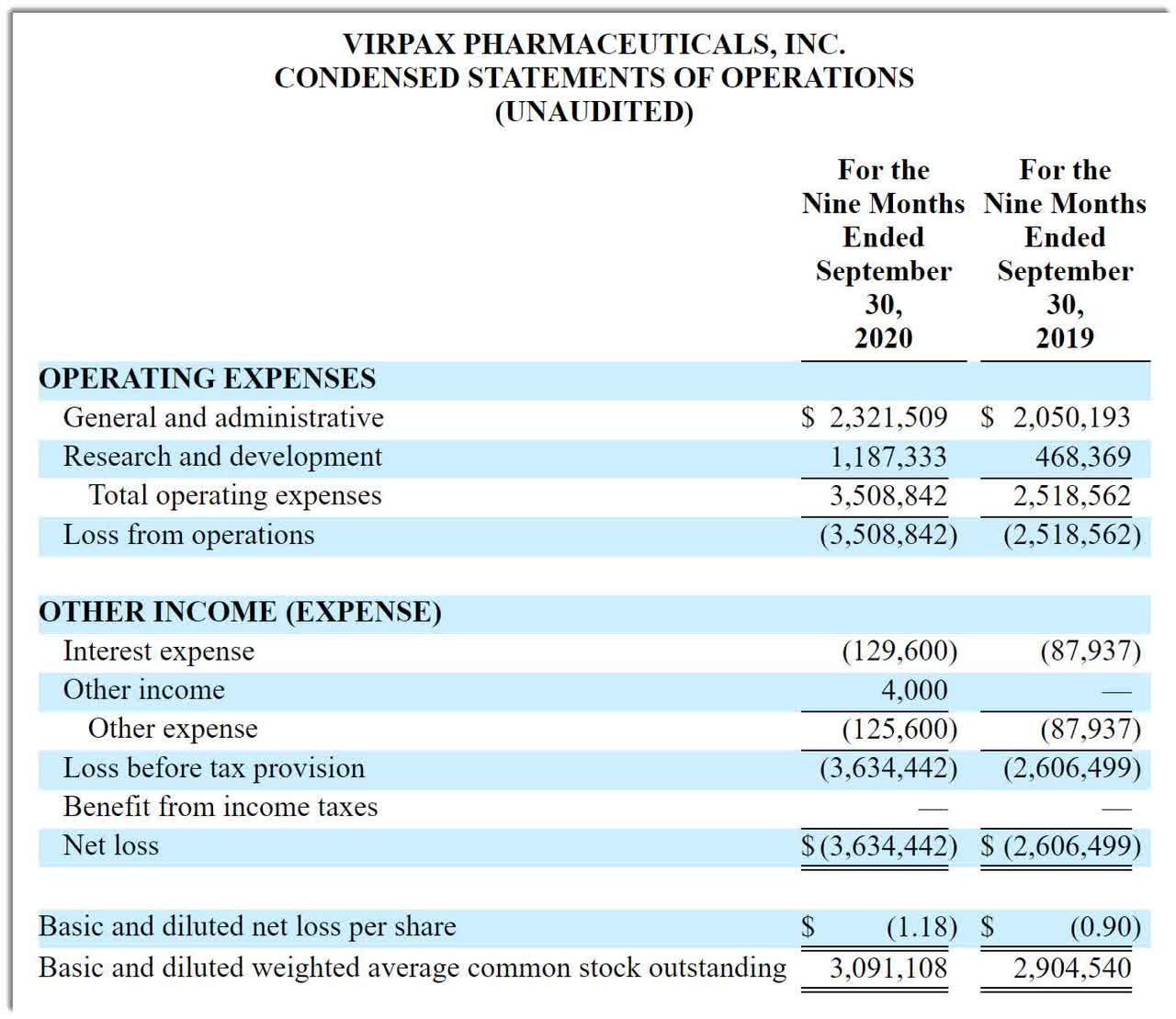

Below are the company’s financial results for the first nine months of 2020:

(Source: Company registration statement)

As of September 30, 2020, it had $256,505 in cash and $4.3 million in total liabilities. (Unaudited, interim)

IPO Details

Virpax intends to raise $15 million in gross proceeds from an IPO of its common stock, selling 1.36 million shares at a proposed midpoint price of $11.00 per share. No existing shareholders have indicated an interest to purchase shares at the IPO price - a frequent feature of life science IPOs.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $50.9 million, excluding the effects of underwriter overallotment options. Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 30.24%.

Management says it will use the net proceeds from the IPO as follows:

- approximately $8.0 million for research and development activities related to Epoladerm;

- approximately $1.8 million for research and development activities related to Probudur;

- approximately $0.6 million for research and development activities related to NES100;

- approximately $0.5 for the repayment of the RRD Notes (as defined below); and

- approximately $2.3 million for working capital and general corporate purposes.

Also, per management:

"Based on our current projections, we believe the net proceeds of this offering will fund our operations for at least 12 months after the closing of this offering. We expect the net proceeds from this offering to fund Epoladerm through the submission of an NDA, and Probudur and NES100 through the submission of an IND."

Management’s presentation of the company roadshow is not available.

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary

Virpax is seeking funding to advance its pipeline of reformulation technologies through the trials process. The firm’s lead candidate is a typical spray formulation of diclofenac and promises to improve pain reduction for chronic osteoarthritis of the knee. The market opportunity for topical pain medications is substantial and expected to grow at a moderate rate over the medium term.

Management has disclosed no research collaboration agreements with major pharma firms. Also, the company’s investor syndicate includes no mainline life science venture capital firms or pharmaceutical companies.

As to valuation, management is asking IPO investors to pay an enterprise value of $50.9 million at IPO. This is significantly lower than the typical range for life science IPOs. VRPX is thinly capitalized, with the IPO providing only 12 months of runway at the most.

I’ve seen other companies with reformulation strategies go public, but haven’t seen significant success in the approach yet. I don’t know whether I haven’t given them enough time to succeed, or whether the "reformulation" approach doesn’t provide enough reward for the risk. In any event, I'll watch this IPO from the sidelines.

Expected IPO pricing date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.