Saratoga: 8% Yield, 23% Discount, And Inflation Protection

Saratoga's NAV has stabilized and is rising once again.

Credit quality remains strong.

The dividend has begun to rise once again.

Management has a track record of poor communication, you need to be aware of this.

Co-produced with Treading Softly

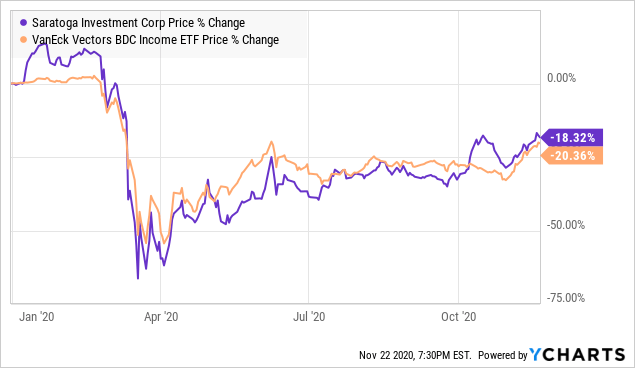

During the COVID-19 shock within the United States, loan values suffered strongly, and drove down more BDCs' common share price as investors were worried about a massive wave of defaults. Saratoga Investment Corp. (SAR) which yields 8% saw its portfolio NAV dip and investors selling its common shares.

Data by YCharts

Data by YCharts

To ensure its stability and liquidity, SAR skipped paying its March dividend – which is the fourth quarter of its fiscal year. This allowed SAR to outperform the BDC index VanEck Vectors BDC Income ETF (BIZD) YTD.

A Brief Overview

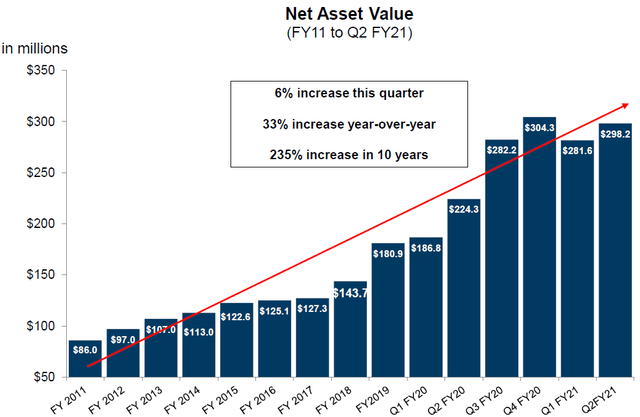

Prior to 2020, SAR had steady and strong NAV (net asset value) growth. 2020 caused its NAV to stumble, not due to sudden losses, but due to adjustments to the market value of the loans.

Source: SAR earning slides – Q2-FY2021 (October 8, 2020)

With this most recent quarter, loan values have recovered and likewise, its NAV per share has recovered as well.

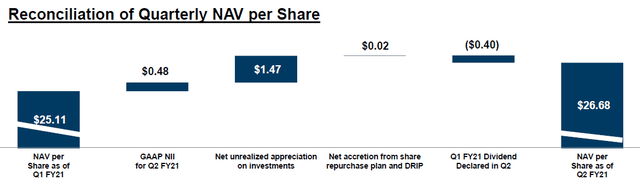

Source: SAR earning slides – Q2-FY2021 (October 8, 2020)

We can easily see where the NAV per share benefitted from $1.47 worth of unrealized gain. Loan values have risen sharply since their fall in March and we expect further unrealized appreciation from loans within SAR's portfolio.

SAR actively reduced its total share float, which again helped to boost its NAV per share by $0.02. Historically, SAR has seen its share count rise each quarter as it traded above NAV or due to its DRIP program. SAR paid out $0.8 million in dividends but bought back $1.6 million worth of shares. Here investors should note that increasing share count when the stock trades above NAV is beneficial to current shareholders as it increases the NAV per share. Also when SAR does stock buybacks when the stock trades below NAV is also very accretive to shareholders. This is a great management that knows how to navigate in both good and bad times.

SAR has an extremely reliable and strong portfolio of investments and we have little concern over their quality and performance.

Debt and Interest Squeeze

SAR has historically had a high level of cash on hand to make investments with. SAR's portfolio of loans is largely floating rate loans, so when the Federal Reserve cut rates due to COVID-19 and its economic impacts, the company felt it directly.

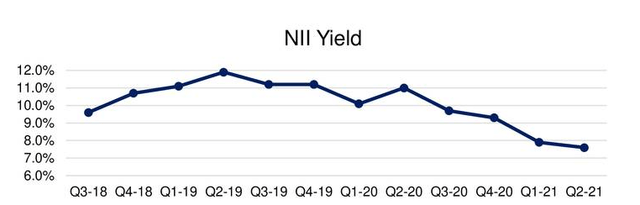

Source: SAR earning slides – Q2-FY2021 (October 8, 2020)

Its Net investment income, NII, yield has been squeezed from reduced income due to interest rate cuts and the structure of its debt.

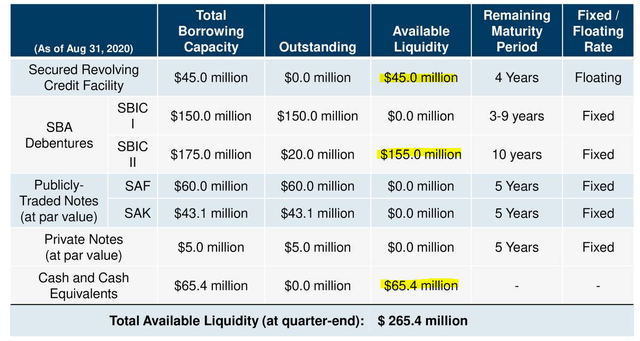

Source: SAR earning slides – Q2-FY2021 (October 8, 2020)

SAR has mostly fixed-rate debt which did not benefit from interest rate cuts. Its only floating rate debt is its revolving credit facility which remains untouched.

SAR has a large sum available in its second SBA. Both SBA debentures are issued at the treasury interest rate at the time, so this debt is extremely cheap compared to its two baby bonds.

The benefit from SAR covering its current dividend with excess NII above its payment is that as interest rates recover, SAR's income will also. SAR can continue to grow and make investments without issuing new shares in the current low rate environment.

SAR's cash on hand would easily fund additional buybacks for shares or new loan originations.

Inflation Protection Built In

With SAR's debt fixed in cost and its loan portfolio having overwhelmingly floating rates, SAR has built-in protection for inflation. How so? Inflation drives prices up and the value of the dollar down. To squash or control inflation, interest rates are driven up by the central bank - the Federal Reserve. When this occurs, as we expect in the next 2-3 years, SAR's earning power on its loans will increase but its debt will remain unchanged. This allows its revenue to rise in tandem with rates and inflation.

As inflation hits, SAR's ability to not only pay dividends, but raise them will increase. SAR's earnings are as compressed as we can expect them to be in the current low to no rate environment.

The Dividend

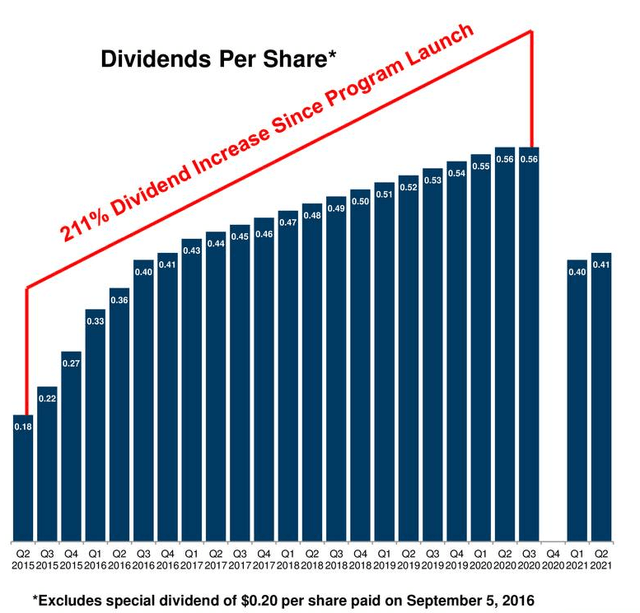

Source: SAR earning slides – Q2-FY2021 (October 8, 2020)

SAR's dividend history has been one of strong growth and reliability until it suddenly pumped the brakes when COVID-19 hit. Management did not articulate clearly what it was thinking which soured SAR for many investors.

Since that time, SAR has returned to issuing dividends and resumed its dividend growth pattern. We have received multiple questions about SAR's missed payment from the last fiscal year. As a BDC, SAR must pay out at least 90% of its taxable income to maintain BDC status. However, Congress also determined that BDCs must pay out at least 98% of capital gains and 98.2% of ordinary income to avoid an additional excise tax.

This tax is 4% of the money not distributed. So if a BDC makes $100 of taxable ordinary income and only distributes $90 to shareholders, it satisfies the requirements to be a pass-through entity like a REIT, or CEF. However, since it did not distribute an additional $8.20, it will be forced to pay a 4% tax on the undistributed $8.20.

So many BDCs happily pay this tax. Why? Because paying 4% to retain capital to reinvest vs. issuing new shares for 8% in SAR's case makes sense. SAR's plan is to retain the excess money per share and use it opportunistically. SAR historically does not maintain any spillover on its balance sheet, so this is a new step for it.

Looking Forward

With SAR now actively reducing its share count and still having a large pool of cash available, backed by cheap debt, we see the last few quarters as the low point in SAR's current earnings power. Management's slow-to-communicate choices have impacted shareholders' confidence in it, allowing SAR to trade at a large discount vs. its premium of the past.

Investors should continue to add to their SAR positions as we expect SAR's NAV to move back towards breaking the $27 per share level and its market price to continue to recover as SAR resumes building a history of dividend growth.

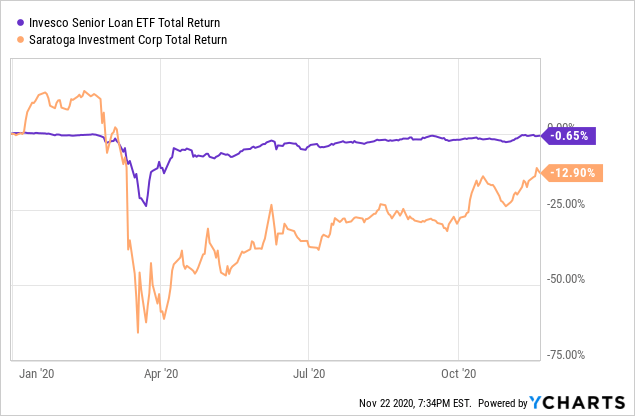

Data by YCharts

Data by YCharts

Since SAR's earnings release with NAV as of August 31st, loan values have continued to improve towards PAR. SAR fell harder and faster than loan values really would suggest it should have. Investors can buy a strong income vehicle at a large discount. This is not an opportunity to miss.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 in Dividend Stocks

HDO is the largest and most exciting community of income investors and retirees with over 4,400 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting +9% yield, our bond and preferred stock portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long SAR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Preferred Stock Trader all are supporting contributors for High Dividend Opportunities.