Quest Diagnostics: Not Just A COVID Play, Shares Are A Buy

Quest Diagnostics has seen strong revenue and earnings bumps due to COVID-19 testing.

While the pandemic won't last forever, I see management setting up the company for long-term success.

Plus, it should benefit from the secular growth in health care spend due to a growing senior population. Shares are attractively priced.

Diagnostics testing providers have been net winners during this pandemic, with results being driven by the influx of COVID-testing this year. This includes Quest Diagnostics (DGX), which is one of the two largest clinical testing providers in the U.S., with a 17% YTD return on its share price. While the pandemic won’t last forever, I believe the company has sustainable advantages that can carry it into the long term. In this article, I evaluate what makes Quest an attractive buy at the current valuation, so let’s get started.

(Source: Company website)

A Look Into Quest Diagnostics

Quest Diagnostics provides diagnostic information services based on both routine/non-routine, clinical, and pathology testing. This includes testing for predisposition to illnesses, diagnosis, treatment, and monitoring of cancers and other diseases. Its diagnostics insights reveal avenues for identification and treatment of diseases, and helps healthcare providers to improve their care management. Quest annually serves one in three adult Americans, and half the physicians and hospitals in the U.S. It has 47K employees, and in 2019, generated $7.7B in revenue.

Quest continues to outperform, with both revenue and earnings beating analyst expectations in Q3’20. Revenue improved by 42% YoY, to $2.79B, and adjusted EPS grew by 145%, to $4.31. This was, of course, driven by the high volume of COVID testing that the country has seen, including drive-through sites across the country at CVS (CVS) and Walmart (WMT). During Q3, Quest performed 9.9M molecular tests and 1.5M serology tests. The results were also driven by a recovery of base testing volumes, as healthcare systems resumed non-urgent care and elective surgeries during the third quarter.

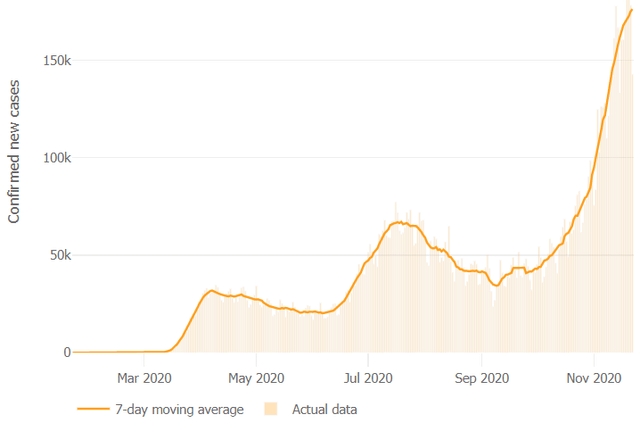

Looking forward, I see continued strength in Quest’s business, given the surge in the number of COVID cases since the end of September. As seen below, the U.S. has unfortunately surpassed 150K new daily cases per day in November, with recent new daily cases hitting around the 180K mark. As such, Quest should have more than enough business on its hands to sustain strong growth through the rest of the year.

(Source: Johns Hopkins University)

While the high volume of COVID-testing has been great for Quest’s business, the risk is that the newly developed COVID vaccines will dampen demand for testing. According to a report on November 23rd, the current plan is for vaccines to begin on around the 11th or 12th of December, with the aim of attaining a 70% immunization rate by May of 2021. This “would allow for true herd immunity to take place.” As such, I see Quest’s COVID-related windfall profits as having a limited lifespan.

However, I don’t see management as simply twiddling their thumbs as they wait for that to happen. For one, they could use their profits to expand their M&A strategy. This could further extend Quest’s scale and profitability in a post-COVID world. This is supported by management’s comments during the last conference call:

"Our M&A pipeline remains strong. Since the second quarter, we close our acquisition of Mid America Clinical Laboratories, referred to as MACL, which is Indiana, and we did a couple two small tuck-in acquisitions. Our recent acquisitions have been performing well during the pandemic; for example, our Memorial Hermann outreach acquisition announced earlier this year, as well as this recent MACL acquisition have driven growth in both COVID-19 testing and our base business. We’ve also seen growth in advanced diagnostics from our acquisition of Blueprint Genetics.”

Quest is also making its processes more efficient. As seen below, it is reducing complexity in the way it sources its testing supplies, from 6 suppliers down to 1 supplier, with the expectation of $35M in annual savings.

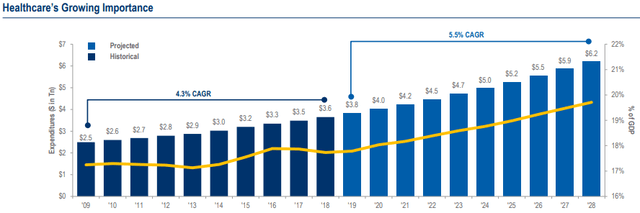

Lastly, Quest is working to expand its relationships with health plan providers and healthcare systems, and it has seen hospital reference testing volumes return to growth. In the long term, I see Quest benefiting from the secular growth in healthcare spend due to the rising senior population. According to the U.S. Census Bureau, the 65+ age group is growing faster than the general population, and by 2030, 1 in 5 U.S. residents will be over the age of 65. As seen below, healthcare spend is expected to grow at a 5.5% CAGR through at least 2028, with it equating to over 21% of U.S. GDP by that time.

(Source: Centers for Medicare & Medicaid Services)

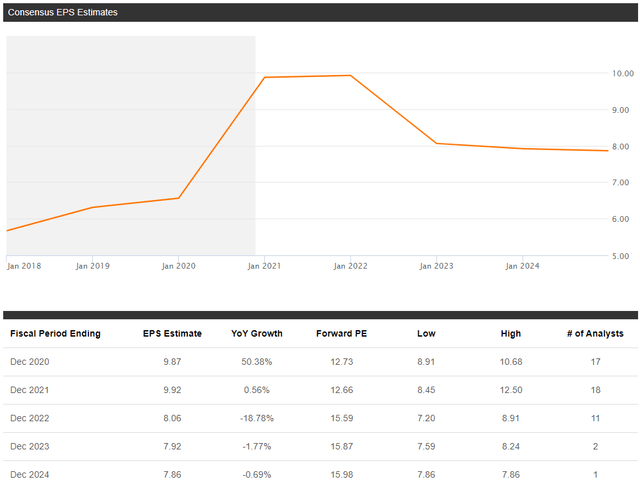

Turning to valuation, it’s fairly clear that analysts don’t expect Quest’s COVID-related windfall to last forever, with earnings peaking next year. As seen below, based on the current price of $125.61, the forward P/E does not go above 16 through 2024.

(Source: Seeking Alpha)

As such, I find the valuation to be reasonable, especially considering the secular tailwinds from the growing senior population, cost savings initiatives, M&A and partnership strategies with healthcare providers that management has in place. Analysts agree that the shares are undervalued, with a consensus Buy rating (score of 4.2 out of 5), and an average price target of $141.

Investor Takeaway

Quest Diagnostics has seen substantial growth in its business stemming from COVID-testing. While this isn’t expected to last forever, especially considering the positive vaccine news, I see management putting the capital to good use, with its M&A strategy, expanded partnerships, and cost savings initiatives.

In the long term, I see Quest benefiting from the secular growth in healthcare spend due to the growing senior population. I find the current valuation to be reasonable, with forward P/E not exceeding 16 based on earnings estimates through 2024. Plus, while the 1.8% dividend yield is not high, it is very safe at a 23% payout ratio, with a 10.5% 5-year CAGR. Buy for growth and future income.

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.