Collegium Pharmaceutical: Another Quarter Of Record Revenue Reinforces Long Thesis

Collegium Pharmaceutical recently reported their Q3 earnings with a beat on EPS and revenue.

Despite some serious COVID-19 headwinds, Collegium was able to record another quarter of growth and increase their cash on hand while paying down debt.

I believe the company has laid the groundwork for a strong 2021 and beyond. As a result, I still see COLL to be worthy of a buy at these prices.

Collegium Pharmaceutical (NASDAQ:COLL) recently reported their Q3 earnings report with a strong beat on EPS and revenue. Collegium reported another strong quarter with a record net revenue of $79.2M, which is an 8.5% increase over Q3 of last year. This increase was headed by $32.1M in net revenue from Collegium’s flagship product, Xtampza ER. The company was able to report another profitable quarter and was able to increase their cash on hand, plus, pay down some of their debt. It appears the company has been able to fight back against the COVID-19 headwinds in 2020, and their recent success reinforces the long thesis. As a result, I am placing COLL on my “pull-back list” just in case the market volatility spikes over the next few months and provides an opportunity to catch an unjustified sell-off.

Source: COLL

I intend to review the company’s Q3 earnings and highlight a few key points that support my bullish outlook. In addition, I discuss my leading downside risk and how I intend to manage my COLL in the near term.

Q3 Performance

Collegium reported a strong Q3 with multiple positive metrics to make note of. First and foremost is the company’s record total product revenue of $79.2M, which led to a net income of $11.3M in Q3. Xtampza ER had another solid quarter with $32.1M in revenue, which is an increase of 21% from the Q3 of last year. Nucynta revenue came in at $47.1M, which is a 1% increase from the Q3 of last year and a 6% increase from last quarter.

In terms of OpEx, the company reported $28.6M for Q3, which was a 10% decrease from last quarter. What is more, the company was able to use some of their profit to repay $25M of their term loan. In terms of cash, the company finished Q3 with a cash balance of $165.4M, which was up from $145.7M at the end of Q2.

All of these positive trends led to Collegium recording their third consecutive quarter of profitability on a GAAP basis, all in the middle of a pandemic.

Source: COLL

Q3 Highlights

Collegium also had several other notable highlights that should have a significant impact in the near-term and the long-term outlook for the company. First and foremost, Collegium settled their Teva (NYSE:TEVA) litigation which will prevent a generic Xtampza ER launch no earlier than September 20, 2033.

In addition, the company was able to make significant progress with payers and secure exclusive formulary wins that will cover an additional 7M commercial and Medicare Part D lives. Starting in January, Xtampza ER will be the exclusive ER oxycodone for over 92M commercial and Part D lives.

For the Nucynta franchise, Collegium reported they have been able to improve rebates with several plans and elected not to renew some inherited contracts that will not be favorable.

If all goes well, the exclusive formulary wins will help Xtampza ER’s numbers, and the Nucynta franchise will continue to provide a steady source of revenue. In addition, the generic settlement should prevent generic encroachment for the next decade which will set the stage for long-term success for Xtampza ER.

COVID-19 Headwinds

Admittedly, I was concerned about Collegium’s prospects during the initial outbreak of COVID-19. However, the company did report an increase in Xtampza ER’s total prescriptions for Q3 over Q2, and Nucynta was able to increase the prescriber base for both ER and IR. Indeed, the company has had some success during COVID-19, but the pandemic continues to create headwinds that the company will have to battle in the coming quarters. In fact, the company estimated that weekly in-office patient visits are down about 20% since the start of COVID-19, which will hinder some new-to-brand patients and writers. The company reported that their in-person calls are still down about 40%, so we can’t expect the company to report explosive growth for Q4.

Aiming For The Top

My investment thesis is centered on Xtampza ER becoming the leading ER oxycodone in the U.S. market, and that idea still remains in play. It appears the company has laid the groundwork to ramp up Xtampza ER in 2021 by securing new exclusive and parity wins across 12M lives. As other oxycodone brands continue to deal with their involvement in the opioid epidemic, Collegium is stepping in to provide an alternative product to a starving market. If all goes well, Collegium will continue to record year-over-year growth and eventually cross $500M in revenue (Figure 1).

Figure 1: COLL Estimated Annual Revenue (Source: Seeking Alpha)

At this point in time, I don’t see any reason why Xtampza ER will not become the market leader in oxycodone ER, and Collegium will be able to hit the Street's estimates.

My Plan

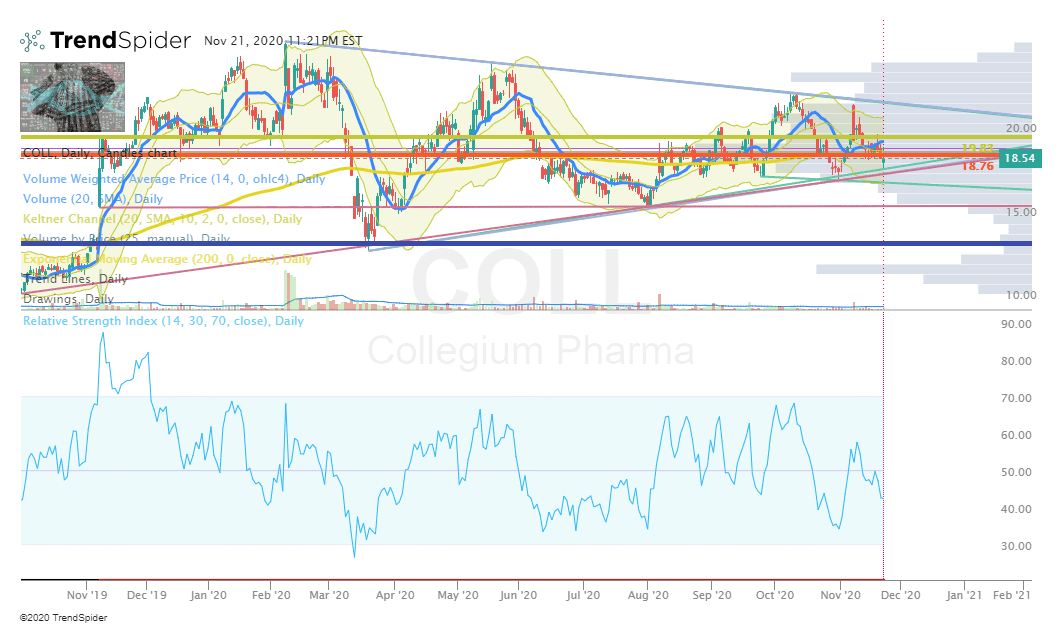

COLL has been a great play thus far, and I am looking to add to my position if the market is willing to provide me with the opportunity. Looking at the daily chart (Figure 2), we can see the share price moving into a pennant and is settling onto previous support.

Figure 2: COLL Daily (Source: Trendspider)

I am waiting to see if the share price is willing to break down through the pennant and settle near the $11 per share volume shelf. If it does, I will be looking to add once the share price establishes a higher low. If the share price breaks out of the pennant, I will look to employ some near-term and long-term call options. Overall, I plan on holding the majority of my position for five years in anticipation Collegium is able to become a market leader in pain management and cross $500M in annual revenue.

Disclosure: I am/we are long COLL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.