Unitil For The Short Term And Maybe Beyond

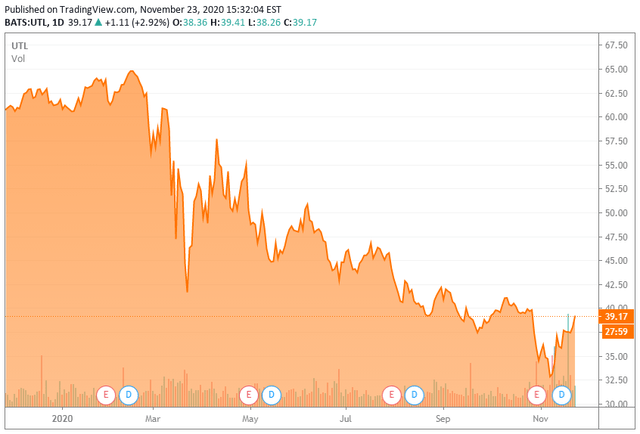

Investors in Unitil have suffered this year as the stock price declined.

Unfavorable weather and business conditions, as well as debt, have weighed on the stock price.

A colder winter, a return to more normal business conditions, and a new CFO offers the chance to see a significant rebound in the price of the stock.

Unitil Corporation (UTL) has had a tough year, and it has been reflected in the stock price. Opening the year at $62, the stock had fallen to around $33 in early November.

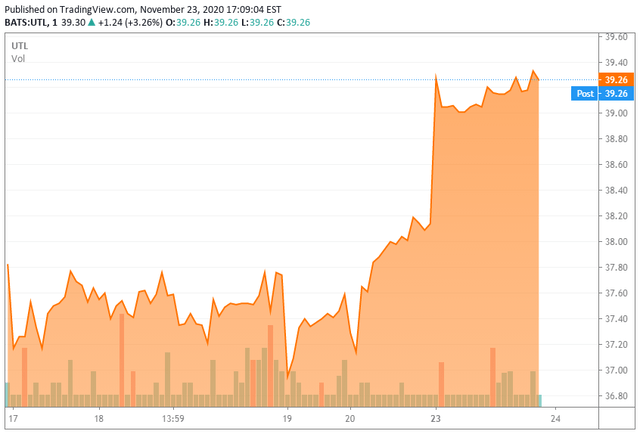

Since then, the stock has recovered to reach the $39 mark.

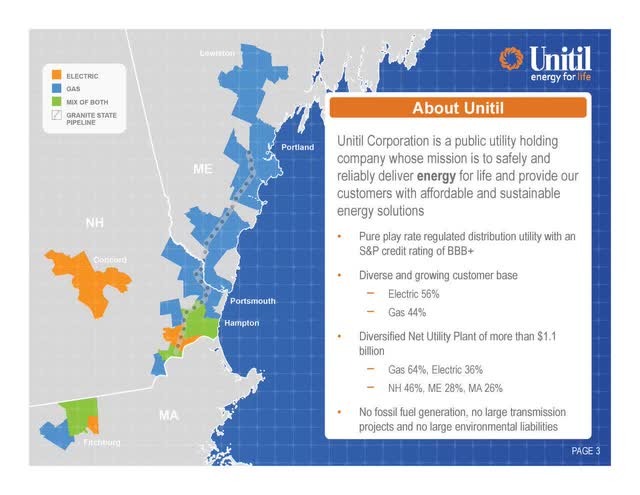

Unitil is a gas and electric distribution utility with no generating assets and only a relatively small gas transmission business. Since it is a small utility, its business is concentrated in parts of Massachusetts, New Hampshire, and Maine making it highly susceptible to economic cycles in that northeast area.

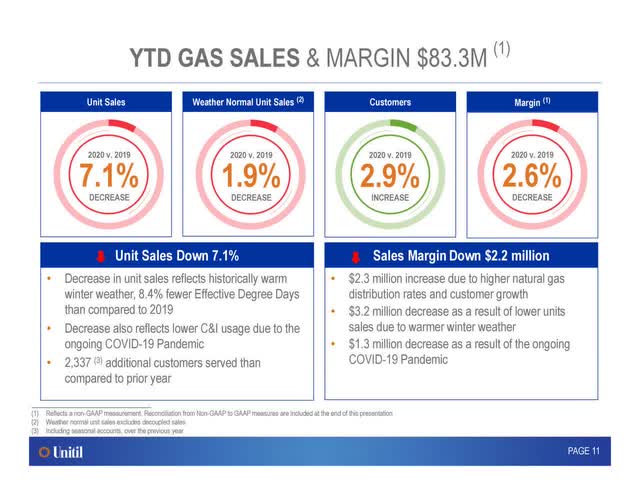

Source: Unitil Q3 2020 Presentation

Source: Unitil Q3 2020 Presentation

Just about everything that can go wrong for a company, with the exception of criminal behavior, has afflicted this small-cap utility.

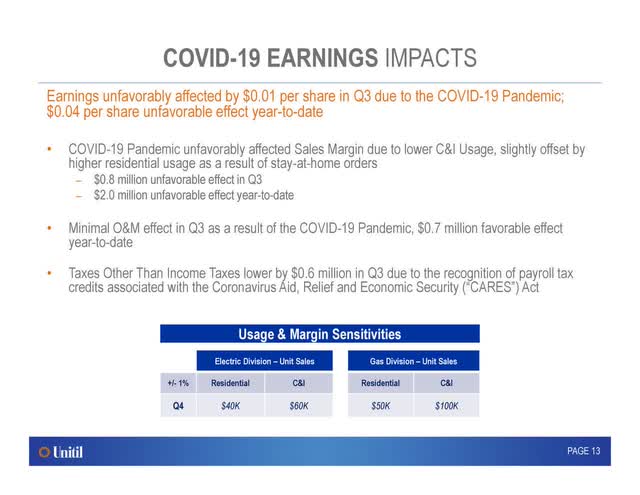

Warmer weather, shutdowns due to the Coronavirus, as well as moratoriums on shut-offs of nonpaying customers have affected revenue and profits.

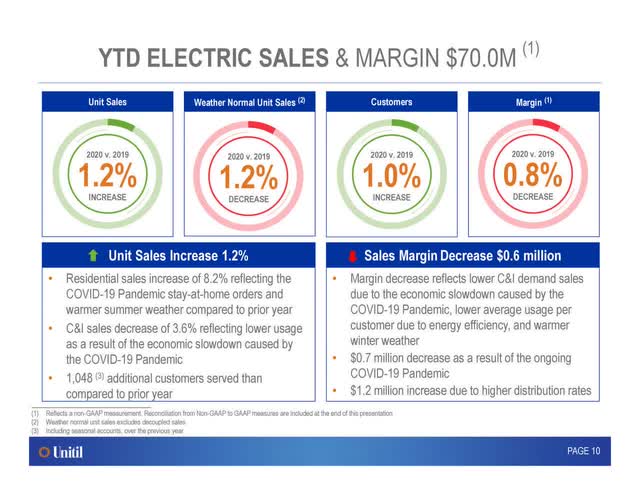

Sales of electricity and gas actually increased but margins remained under threat.

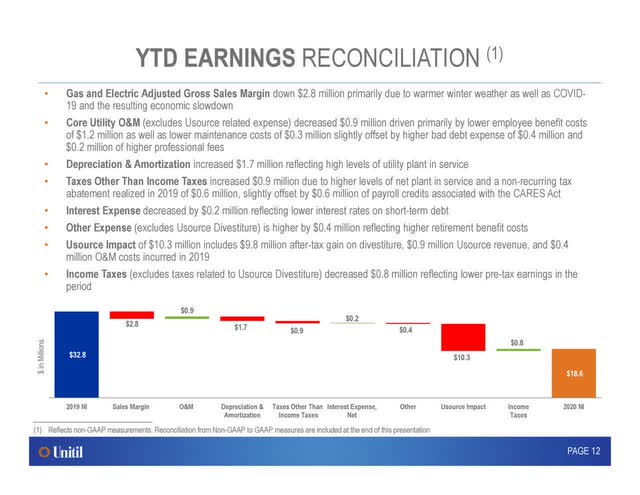

Source: Unitil Q3 2020 Presentation

Source: Unitil Q3 2020 Presentation

The company sold off its Usource energy consulting business to NextEra Energy (NEE) in 2019, with the resulting gain improving its 2019 results but making its 2020 comparisons look worse.

Source: Unitil Q3 2020 Presentation

Source: Unitil Q3 2020 Presentation

With all this bad news, why should investors even bother with this member of the Russell 2000?

Natural Gas Business

In 2019, revenue from Unitil’s gas operations was $203.4 million for 2019, which represents about 46% of Unitil’s total operating revenue. Natural gas sales margins were $122.2 million in 2019, or 57% of Unitil’s total sales margins.

In contrast, revenue from Unitil’s electric utility operations was $233.9 million for 2019, which represents about 53% of Unitil’s total operating revenue. Electric sales margins were $91.9 million in 2019, or 43% of Unitil’s total sales margins.

(Source: Unitil 2019 Annual Report)

Natural gas may represent less than half of the company’s operating revenue but it has a much larger impact on the company’s earnings. That is important to realize for two reasons:

- Natural gas has higher usage during the winter months resulting in the company’s business being much more dependent on colder weather.

- Commercial and industrial customers are large users of natural gas making the company’s profits more affected by any downturn in those companies’ businesses.

Lower usage of gas and electricity has directly impacted the company whose revenues are based on usage.

Last winter was relatively mild, as it was forecasted by the National Oceanic and Atmospheric Administration.

In addition, the economic slowdown brought on by the pandemic heavily affected businesses nationwide, including in New England with New Hampshire showing a 36.9% drop in GDP from the 1st to the 2nd quarters of 2020 and Maine recording a 34.4% decline.

For Unitil, the result was losses from commercial and industrial customers that could not be made up by increases in residential usage.

Source: Unitil Q3 2020 Presentation

Source: Unitil Q3 2020 Presentation

Debt

Not everything connected with the lower stock price can be blamed on weather and the pandemic. Unitil carries a relatively high level of debt, and because it is a smaller company, receives a less favorable interest rate than would be available to a larger company with more diverse operations to spread the risk.

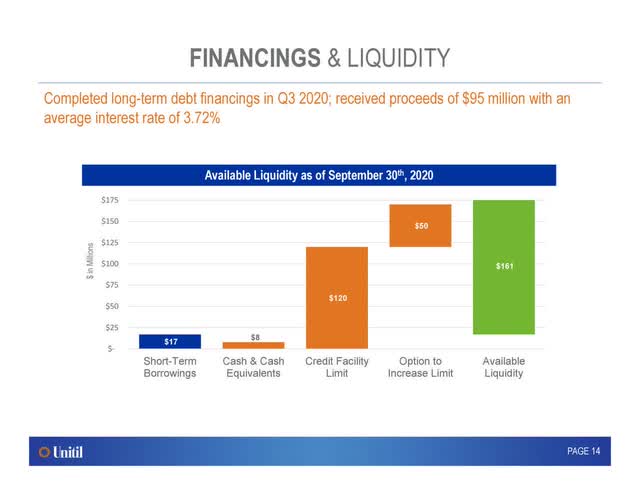

Source: Unitil Q3 2020 Presentation

Source: Unitil Q3 2020 Presentation

In 2019, the company ended the year with $437.5 million of long-term debt and $58.6 million in short-term debt. This compares to its $73.1 million in operating income.

Short-term tailwinds

We are now coming into the winter season, with the October-December and January-March quarters being the company’s most important time of the year for its revenue.

The expectation is normal precipitation (Source: NOAA), while the Old Farmers Almanac believes that the north will be colder than normal.

At the same time, while businesses may continue to suffer during the winter months, by the second quarter of 2021, it is hoped that the national recovery will be far enough along that businesses in New England would have resumed more normal operations increasing their need for both natural gas and electricity.

Longer-term opportunities

There is an ongoing push in New England to move businesses and households away from fuel oil and towards more sustainable sources of heating, and while natural gas remains important to the company, it also has significant electricity assets.

For households, natural gas will remain their source of heat for decades to come even as electrification reaches other areas such as transportation and businesses.

In its 2019 Annual Report, Chairman, President, and Chief Executive Officer Tom Meissner writes:

Electrification doesn’t specifically target natural gas; it targets all fossil fuels across the transportation and heating sectors, including fuel oil, propane, gasoline, and diesel fuel. Natural gas is but a small sliver of the fuel mix providing heat and transportation in our region, and is the cleanest alternative. As such, we continue to see an important role for natural gas as we ensure our customers have access to clean, reliable, and affordable transportation and heating options in the cold weather climate of northern New England.

Looking at New England today, most of the region is served by a combination of Eversource (ES), Avangrid (AGR), Algonquin Power & Utilities (AQN) and Emera (OTCPK:EMRAF) leaving Unitil the only small, investor-owned utility in the region with no generation operations. How long it can remain independent is up to how well the utility serves its shareholders.

In July, the company hired a new CFO, Robert B. Hevert, who came from the energy consulting firm of ScottMadden, Inc. It will be interesting to see what impact he has on the company’s operations going forward.

Conclusion

Investors in Unitil have been ill-treated by the stock this past year, but the small investor-owned utility has both challenges and prospects. A colder winter, a return to more normal business conditions, and a different approach by the new CFO may provide shareholders with the rewards they have missed up to now.

Disclosure: I am/we are long UTL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.