As long as earnings growth visibility remains, chances of a heavy selloff are unlikely but investors should be cautiously optimistic about the market and bet only on quality, say experts.

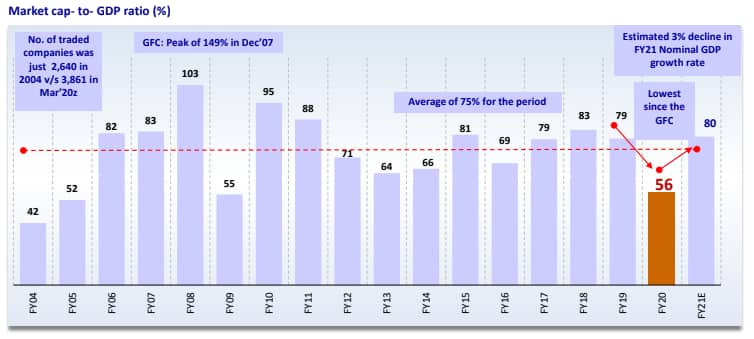

The Nifty50 has rallied by about 50 percent since March to hit new highs above 12,900 and is on course to cross 13,000 and beyond. The rally seen in the past seven-eight months has pushed the market cap-to-GDP number beyond 80, much higher than the long-term average of 75 percent.

The market cap-to-GDP ratio has been volatile as it moved from 79 percent in FY19 to 56 percent (FY20 GDP) in March 20 to 80 percent now (FY21E GDP), above its long-term average of 75 percent, Motilal Oswal said in a note. The Nifty is trading at 12-month forward RoE of 13 percent, which is below its long-term average of 13.8 percent, the report said.

The ratio, which is also known as the Warren Buffett indicator, compares the value of all stocks at an aggregate level to the value of the country's total output.

related news

A value above 100 percent indicates that the market is overvalued while a number close to 50 percent indicates that it is undervalued. The ratio is more applicable to developed countries and might not reflect the true picture for investors here in India, experts say.

The number that was hovering below the 60-mark by the end of FY20, weighed down by the outbreak of COVID, got pushed higher on news of business activity slowly returning to normal, green shoots in economic indicators, stable quarter results and expectations of a stimulus package from central bankers.

A number above 80 percent and the fact that Indian shares are trading in an unchartered territory suggest that some consolidation is in the offing, but a big correction was unlikely as earnings are showing signs of recovery, experts say.

“Current underlying trend of the market looks to be strong in the backdrop of a strong 36 percent earnings growth by BSE500 in 2QFY21 and positive commentaries shared by most of the companies. Additionally, favourable news flow regarding Covid-19 vaccine and possibility of additional fiscal stimulus in the USA are supporting the market rally,” Binod Modi, Head Strategy at Reliance Securities told Moneycontrol.

“While Mcap to GDP above 80 percent certainly raises concern about valuations, we should not forget that visibility of sharp earnings revival after GFS in FY10 took Mcap to GDP at ~100 percent."

As long as earnings growth visibility remained, chances of heavy selloff were unlikely, he said. However, investors should be cautiously optimistic about the market and bet only on quality.

Source: Motilal Oswal

The year 2020 has been a volatile year for Indian equity markets where investors witnessed more wealth destroyers than creators. Equities, as an asset class, may have given muted returns in the past two calendar year but could do well in the near future, experts say.

This is not the first time that the 80 percent mark has been crossed. We have been in this territory several times in the last 15 years though slight correction or consolidation post was seen after that but experts say the momentum could continue.

“It's correct that we have crossed 80% mark in market cap-to-GDP ratio and as of today it is currently about 84.5% based on FY20 GDP and 89.4% based on trailing 12 month GDP,” Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers told Moneycontrol.

“There are many aspects to which you should look at and not just get blinded out with one set of data. Some of which are a) what are other options to invest apart from equity: we already know globally we are into almost zero-interest rate regime in the developed world.”

Solanki added that after the total COVIS stimulus was already thrice of what was provided in 2008-09 and a lot of economic reports globally suggest that though "we have a de-growth in the current year, the rebound could also be fast".

What should investors do?

Investors should avoid looking at just one parameter to make decisions and should evaluate other quantitative parameters such as P/E, P/B and dividend yield.

“For a country like India, where unlisted businesses form a sizable portion of the economy, Mcap to GDP of 80 is relatively higher than developed economies where listed entities constitute a large portion of the economy,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities told Moneycontrol.

There are many factors that market participants use as per their comfort and understanding and there is no one-size-fits-all indicator for the markets.

“For broader valuations and momentum one could use like above market cap to GDP, PE and PB multiples, percent stocks above 200DMA, Median index Pair-wise Correlation etc,” Solanki said.

He added that factors like value, growth, dispersion can also be used as strategy.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.