Pliant Therapeutics: An Early Stage Company With Important Collaborations

PLRX has a pipeline targeting various fibrotic diseases.

It has in-licensed technology from the UCSF, and collaborations with Novartis.

Strong cash and pipeline make this a good one for the watchlist.

Pliant Therapeutics, Inc. (PLRX) is a clinical stage biopharmaceutical company that was founded in 2015 to target fibrosis based on technology developed at the University of California-San Francisco. The company has 70 employees and operates out of San Francisco, California. The company’s lead product candidate is PLN-74809 indicated for the treatment of idiopathic pulmonary fibrosis (“IPF”) and primary sclerosing cholangitis (“PSC”). PLN-74809 is also being evaluated for treating COVID-19 associated acute respiratory distress syndrome (“ARDS”). Pliant’s second lead candidate PLN-1474 is being evaluated in stage F3/F4 liver fibrosis associated with nonalcoholic steatohepatitis (“NASH”). PLN-1474 is now a part of the company’s collaboration with Novartis (NVS).

News/Catalysts

Pliant announced 3Q 2020 financial results and business updates on 11/10/2020. Bernard Coulie, M.D., Ph.D., President and CEO of Pliant, reflected on the progress made “despite the challenges related to the COVID-19 pandemic." The company closed a successful IPO, advanced their clinical programs across four indications, and further strengthened their leadership team. The company ended the quarter with a strong cash position to advance the pipeline, and fund the operating & capital expenditure requirements into 2023. Pliant has multiple data readouts beginning in 1H 2021.

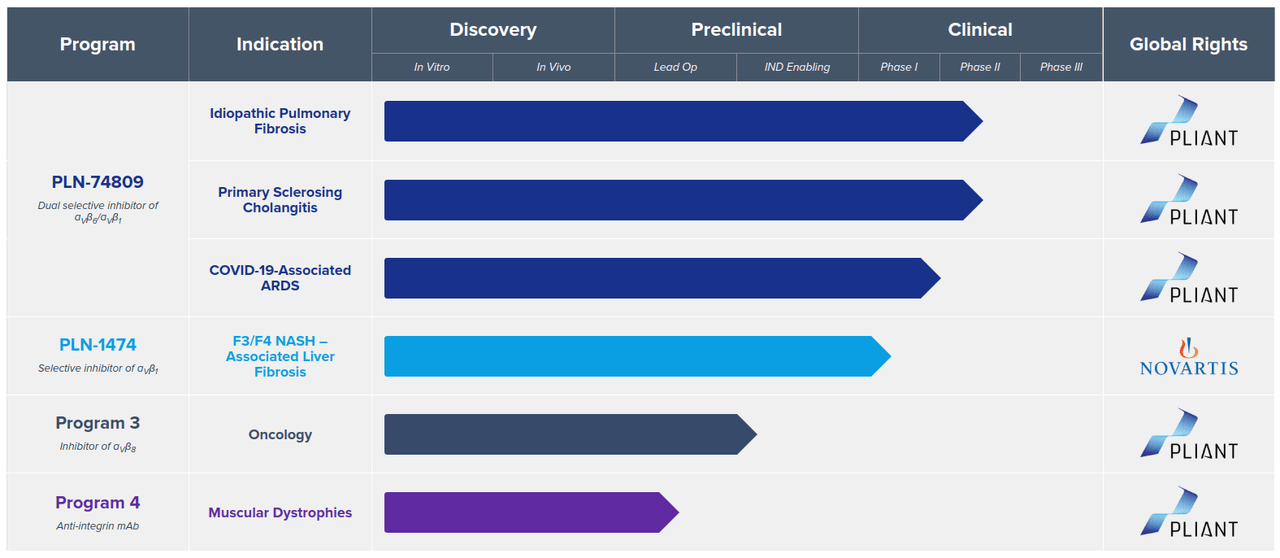

Pipeline

Pliant’s drug development programs for a range of fibrotic diseases focus on “tissue-specific integrin modulation and TGF-β1 signaling inhibition.”

(image source: company website)

The lead product candidate PLN-74809 for IPF and PSC is a small-molecule, dual selective inhibitor of integrins αVβ1/αVβ6. These integrins cause upstream activation of TGF-β1 that promotes growth of fibrotic tissue. Inhibition of these integrins blocks TGF-β1 activation, preventing the growth of fibrotic tissue within the lung and bile ducts. Two phase 2a trials in patients with IPF and one phase 2a trial in patients with PSC are currently enrolling, with data readouts expected in 1H 2021.

The second candidate, PLN-1474, is an oral, small-molecule, selective inhibitor of the integrin αVβ1 that activates TGF-β responsible for end-stage liver fibrosis in NASH. Currently, a phase 1 trial in healthy volunteers is being conducted. Pliant had entered into a license and collaboration agreement with Novartis for global rights to PLN-1474 in October 2019. After Phase 1, Novartis will assume responsibility for all future development, manufacturing and commercialization.

Science/Platform

In fibrosis, normal tissue repair pathways become dysregulated, which causes excessive buildup of collagen, aka scar tissue, thickening and stiffening the affected organs. This leads to irreparable damage and eventual organ failure. Pliant developed in vivo assays to “interrogate the biology of fibrosis and uncover pathways and potential targets.” Healthy and fibrotic human tissue is examined to create a database of gene and protein expression across a host of fibrotic diseases. This database informs target selection and provides biological evidence for the indications to be chosen. A library of over 7,000 integrin binding molecules is then screened for activity against the target. The library can also be used to select “off-the-shelf” potential candidates. Pliant uses live human fibrotic disease tissue in preclinical testing of identified development candidates/compounds for antifibrotic activity.

This product discovery engine differentiates the company’s approach of bridging from animal models to human patients, thereby reducing risk in clinical testing. The company has discovered compounds to “address fibrosis in a variety of organs and conditions, including the lung (“IPF”), liver (“PSC”, NASH and liver fibrosis), kidney (renal fibrosis), skin (systemic sclerosis and keloids), muscle (Duchenne muscular dystrophy) and the gastrointestinal tract (intestinal fibrosis in inflammatory bowel disease).” The global license on PLN-1474 taken by Novartis validates Pliant’s powerful integrin development platform.

Market

The company states in their latest 10-Q that IPF is estimated to affect approximately 140,000 patients, while PSC is estimated to affect approximately 30,000 to 45,000 patients in the United States. Both IPF and PSC are orphan indications. The global IPF market was $1.6 billion in 2016, and is estimated to cross $3.5 billion by 2023, at a CAGR of 11.9%. The global PSC market is estimated to reach $140.4 million by 2023.

The Novartis agreement on PLN-1474 global out-license is worth half a billion dollars in the development stage and mid-single-digit to low teens tiered royalties on product sales. Novartis will also fully reimburse the research & development. The collaboration extends to three additional integrin targets, with remainder of wholly-owned pipeline remaining unencumbered.

In-license

Pliant entered into an exclusive, worldwide license agreement (“UCA”) in August 2015, with the Regents of the University of California (“UCR”) for the use of certain patents and technology relating to αvß1 compound in fibrosis indications. Pursuant to the UCA,

“the company is obligated to (i) make a non-refundable upfront license fee payment of $0.4 million and annual license maintenance fee payments of $10,000 per year beginning on the first anniversary of the UCA escalating to $25,000 per year thereafter (II) make royalty payments to the UCR of 3% of net sales of a therapeutic licensed product or 1% of net sales of a method of use licensed product, subject to an annual minimum of $1.0 million, (III) make milestone payments up to an aggregate of $18.2 million to the UCR upon the occurrence of certain events, (iv) make a milestone payment based on the number of outstanding shares and a price per share as defined in the UCA within 30 days of the closing of an IPO or change of control, and (V) reimburse the UCR for prosecution and maintenance expenses of the licensed patents without limitation.” (Ref: 10-Q)

Consequent to the IPO in June 2020, the company made a $2.4 million milestone payment to the UCR. If the company sublicenses its rights under the UCA, it is obligated to pay the UCR a percentage of the total gross proceeds received in consideration of the grant of the sublicense, which total amount would be first reduced by the aggregate amount of certain research and development related expense incurred by the company. The UCA will remain in effect until the later of,

“(i) the expiration or abandonment of the patent rights licensed under the UC Agreement, or (II) ten years from the date of the first commercial sale of the first licensed product under the agreement.”

Research agreement

Pliant entered into a development and option agreement with Adimab LLC in October 2018 (“ALA”). Under the ALA, Adimab will use its proprietary platform technology to research and develop antibody proteins for the company’s selected biological targets, using a mutually agreed upon research plan. During a so-called “discovery term,” Pliant and Adimab grant each other a “non-exclusive, non-sublicensable and/or non-transferable license” of their respective intellectual property. During such discovery term, under various terms of agreement, Pliant is obligated to,

“(i) make a nonrefundable upfront license fee payment for access to Adimab’s technology; (II) pay Adimab at an agreed upon rate for each full-time employee (“FTE”) during the research period; (III) make additional payments upon the company making other research related elections; (iv) pay up to a dollar amount in the low double digit millions for the achievement of certain research and development milestones for each research target program which can vary by target type; (V) make royalty payments to Adimab on company net sales of its products covered under the ALA, subject to varying royalty payments on certain product types.”

During the nine months ended 9/30/2020, Pliant accounted for $0.1 million under ALA. During the three and nine months ended 9/30/2019, amounts accounted under ALA were nil and $0.4 million, respectively.

Patents

As stated in the company’s 10-Q (linked earlier in this article), Pliant’s current licensed patents covering companion technologies, licensed from UCSF, are expected to expire in 2036. The company also owns pending patent applications covering proprietary technologies or product candidates that if issued as patents are expected to expire from 2037 through 2040.

Competition

Pliant has received U.S. orphan drug designation for PLN-74809 for IPF and PSC indications. There are companies that are targeting the treatment of various fibrosis indications by inhibiting various parts of the TGF-ß pathway. These include large companies with significant financial resources such as AbbVie Inc. (NYSE:ABBV), Biogen, Inc. (NASDAQ:BIIB), Bristol-Myers Squibb Co. (NYSE:BMY), FibroGen, Inc. (NASDAQ:FGEN), Galapagos NV (NASDAQ:GLPG), Gilead Sciences, Inc. (NASDAQ:GILD), Indalo Therapeutics, Inc., and Novartis AG. However, there are no companies with an orally bioavailable small-molecule, selective integrin inhibitor in clinical development. Also, the FDA recently issued a “safe to proceed” letter in relation to Pliant’s plans to evaluate PLN-74809 in COVID-19-related ARDS, for which a phase 2a trial was recently initiated. COVID-19 and ARDS are highly saturated and competitive spaces presently, so any commercial benefit the company gains in due course may be considered a bonus.

Financials

Pliant’s stock price was $28.62 as of 11/20/2020, slightly above the midpoint of the 52-week range of $19.43 to $35.63. The company’s market capitalization is $1.02 billion on 35.48 million shares outstanding. Major shareholders are institutions with 41.04%, PE/VC firms with 29.10%, hedge funds with 9.56%, corporations 6.75%, and insiders 2.90%, while the public has 10.66%.

Pliant had revenues of $57.05 million in fiscal 2019. To date, all revenue that has been accounted is from the company’s collaboration and license agreement with Novartis. The revenue estimates for 2020 and 2021 are $41.95 million and $6.55 million, respectively. The company has current assets of $294 million (cash $55.2 million and short-term investments $238.8 million) as of 9/30/2020. Cash burn in fiscal 2019 was $58.3 million, while it is $74.8 million in the TTM. As noted earlier in this article, the company estimates that the existing cash, cash equivalents and short-term investments will enable them to fund the operating expenses and capital expenditure requirements into 2023.

Risks

As of 9/30/2020 and 12/31/2019, Pliant had an accumulated deficit of $98.8 million and $76.3 million, respectively. The company’s “approach to drug discovery and development in the area of fibrotic diseases, with an initial focus on tissue-specific integrin modulation and TGF-ß signaling inhibition, is unproven and may not result in marketable products,” as it has not yet been clinically proven to yield results.

The company uses live human fibrotic tissue samples to evaluate product candidates, before advancing them into the clinic. This method serves as a bridge between animal models and clinical proof-of-concept. However, there is no guarantee that the positive pre-clinical results will be replicated in a clinical trial environment. Moreover, studies utilizing human tissue samples may be subject to institutional and government human subject privacy policies that may vary by territory.

Bottom-line

The company’s unique approach may give it the benefit of first past the post. The Novartis deal gives the company a comfortable position to operate from. Current price level offers a decent opening considering the impending data readouts of 1H 2021.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.