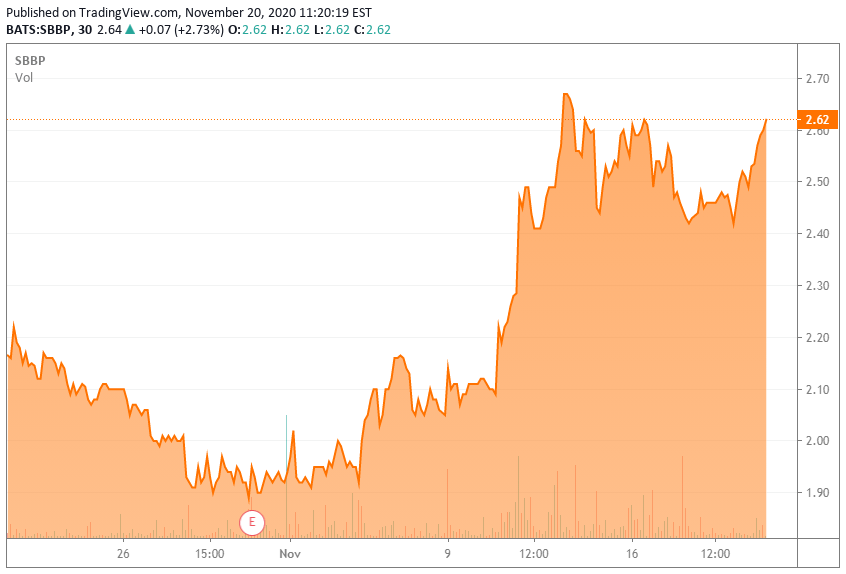

Strongbridge Biopharma: $2.50 Biotech Stock Finally Seeing Some Momentum

The shares of small-cap biopharma concern are finally seeing some momentum as they rally off oversold levels.

The company posted better-than-expected Q3 results in late October and have some potential catalysts on the horizon in 2021.

We revisit this $2.50 biopharma name and update our investment thesis on it given recent news and events.

"One believes things because one has been conditioned to believe them." - Aldous Huxley, Brave New World

Today, we revisit a small-cap biopharma name with significant potential since late last year. The shares seem to be garnering some momentum as they bounce off multi-year lows. The company recently posted better-than-expected quarterly results and appears set up to enjoy a much better 2021. We update our investment thesis on the stock given recent news around this concern below.

Company Overview

Strongbridge Biopharma (SBBP) is based out of the Keystone State and is focused on building up a franchise to address rare diseases, which is comprised of its rare neuromuscular and endocrine treatments. It has one fully owned product called KEVEYIS on the market. The company is working on another wholly-owned compound, RECORLEV, which is in late-stage development and has the potential to be a much larger contributor to the company's success than KEVEYIS. The stock currently has an approximate market cap of $175 million and trades just over $2.50 a share after a recent rally.

Q3 Highlights

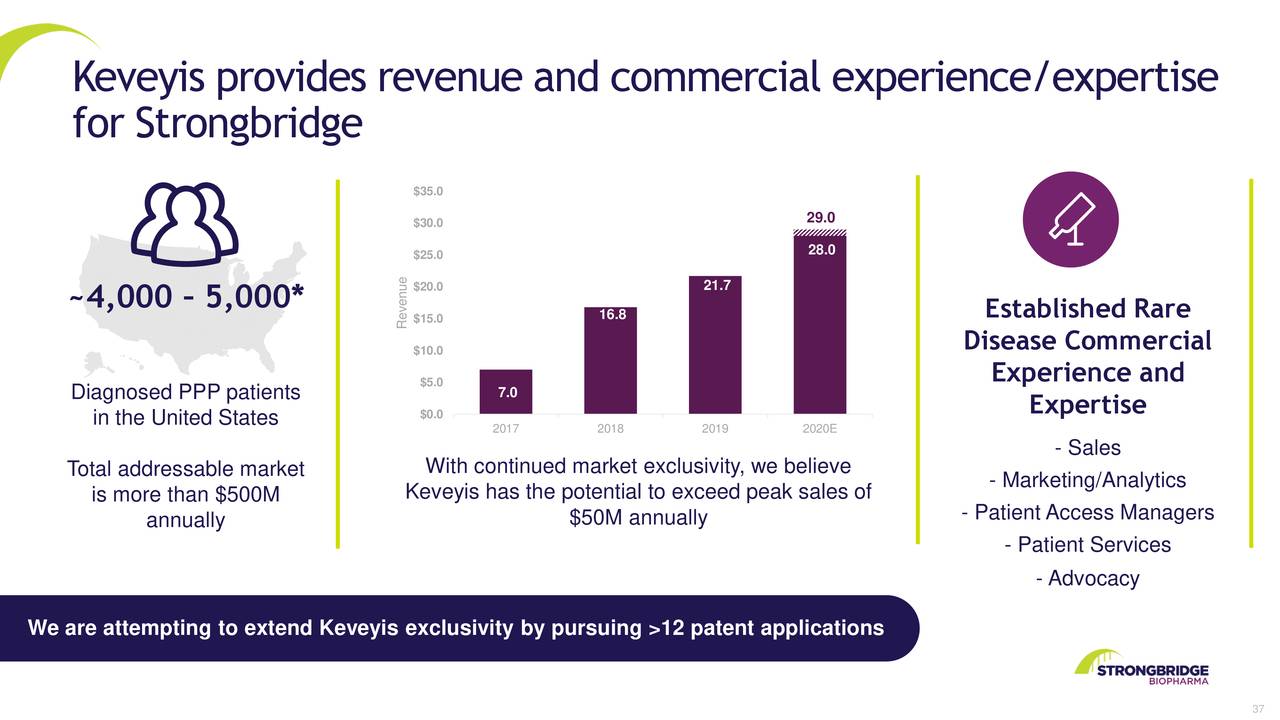

KEVEYIS produced $8.1 million in revenues during the third quarter. This is a 42% increase over the same period a year ago. Given the challenges presented by the ongoing Covid-19 pandemic, it was an impressive performance. The company provided KEVEYIS full-year 2020 revenue guidance of $28 million to $29 million during the earnings conference call.

Source: Company Presentation

Source: Company Presentation

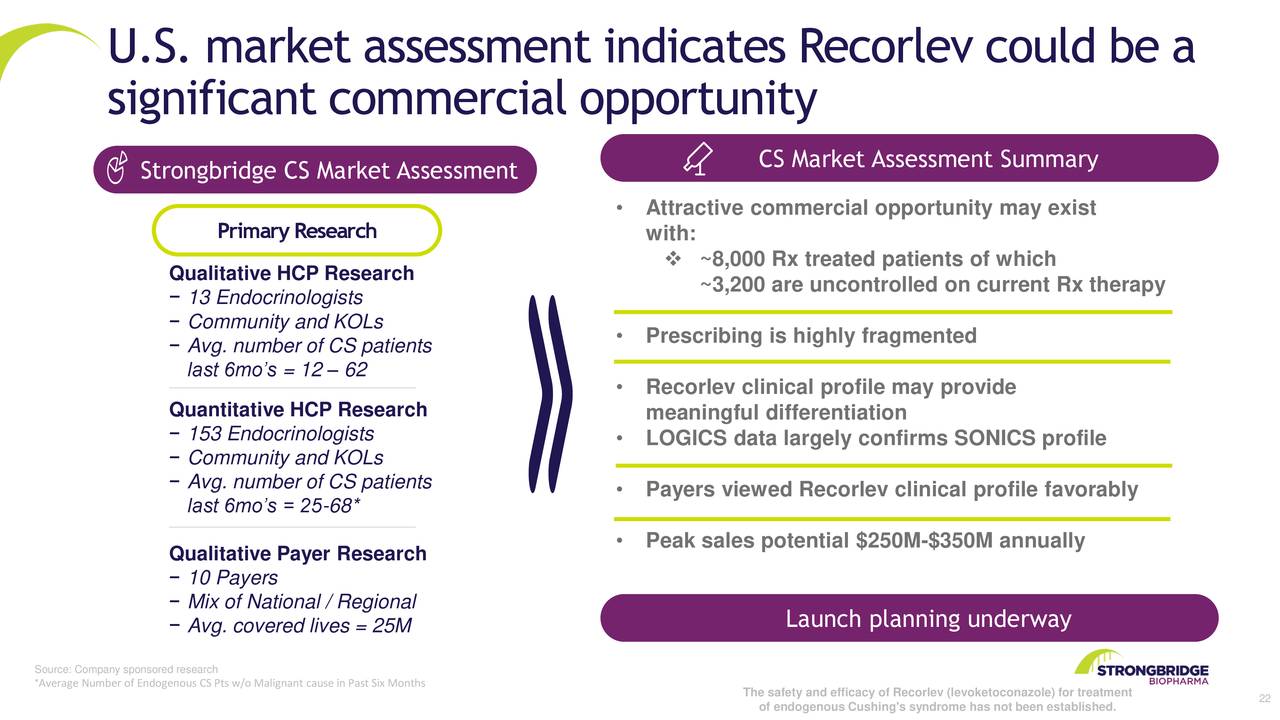

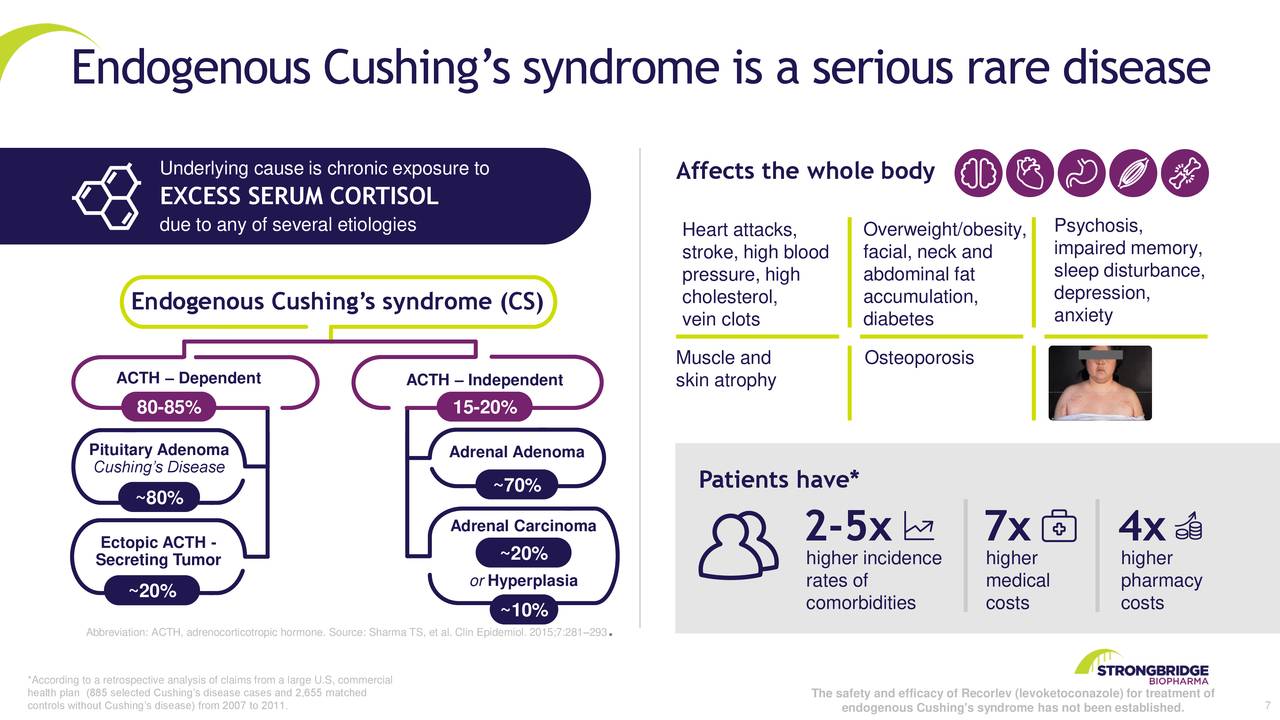

More importantly, the company is advancing towards marketing approval or RECORLEV after several hiccups within that journey over the years. This is targeting the Endogenous Cushing's syndrome market, which the company has as annual $2 billion market, and it aims to garner considerable market share (see above) within provided RECORLEV garners FDA approval.

Source: Company Presentation

Potential Catalysts In 2021

Source: Company Presentation

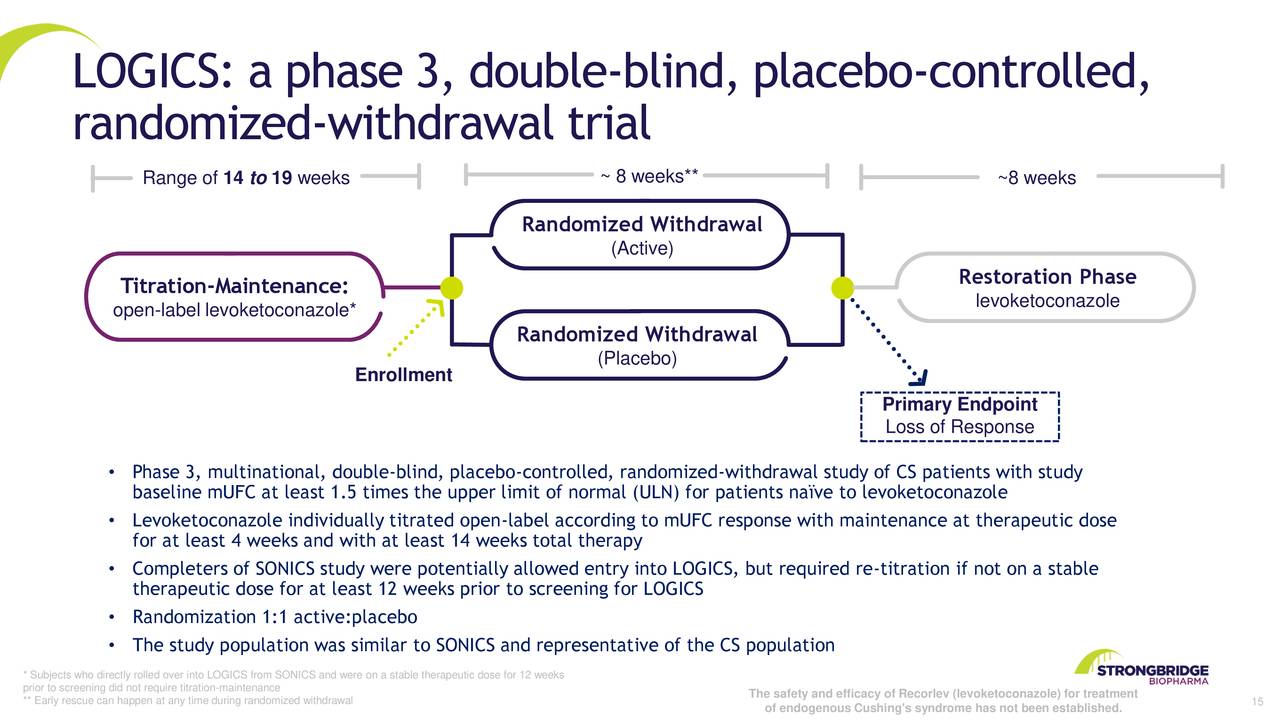

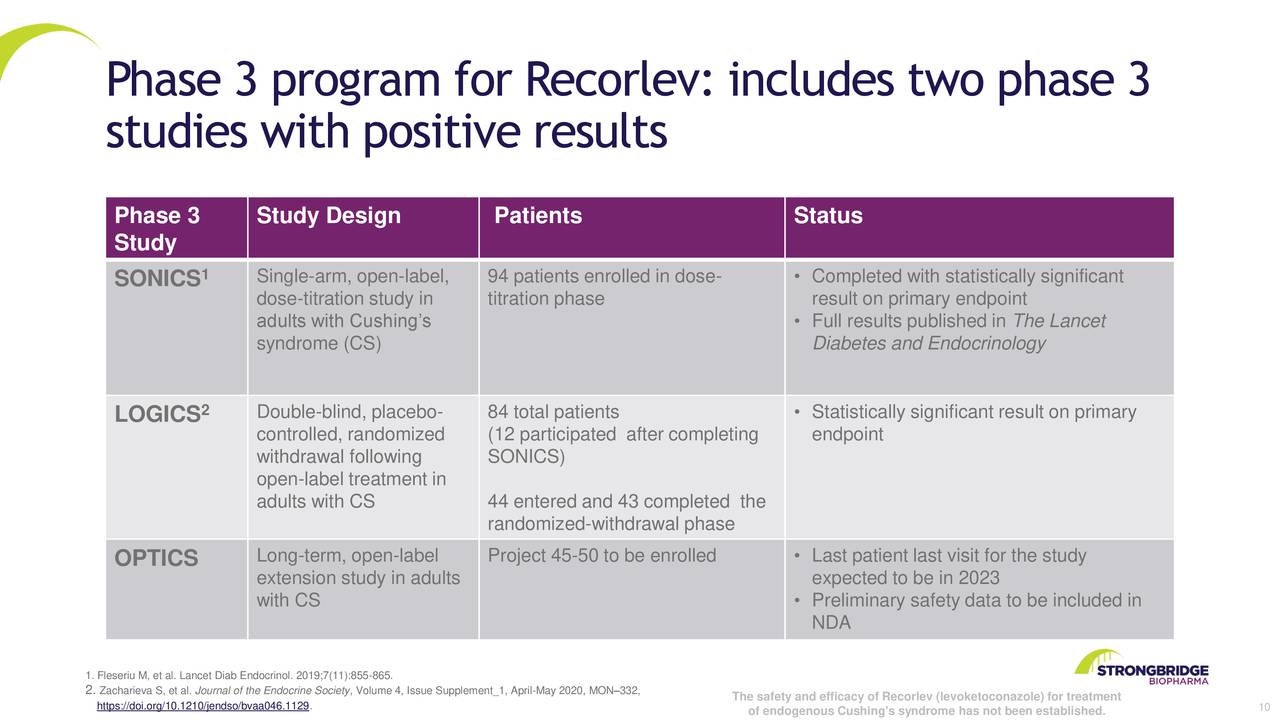

In early September, Strongbridge reported positive and highly statistically significant top-line results from its Phase 3 LOGICS study. This trial met its primary and secondary endpoints and also showed the compound was well-tolerated and met safety criteria. This should be the last significant hurdle before the company submits a marketing application or NDA for RECORLEV in the first quarter of 2021. Assuming a 10-month PDUFA period, the drug should be approved either late next year or hit the market in the first half of 2022.

Source: Company Presentation

Balance Sheet & Analyst Commentary

Since Strongbridge posted Q3 results in late October, JMP Securities ($7 price target), H.C. Wainwright ($10 price target) and Oppenheimer ($8 price target) have all reiterated Buy ratings on the stock. The company raised some $25 million in new capital in September via a secondary offering and ended the third quarter with just over $80 million in cash on the balance sheet. Management guided this should be sufficient to fund all activities through the first quarter of 2023.

Verdict

The company is well-funded at the moment. It has one product on the market that should do just less than $30 million in overall sales in FY2020 and management believes this compound's peak potential sales should be around $50 million annually. Strongbridge has another late-stage candidate, RECORLEV, that has substantially higher peak sales potential of at least several hundred millions annually and that could hit the market in early 2022 if all goes according to plan.

The stock also enjoys strong analyst support at the moment. In addition, insiders have never sold a share since the company came public and have been frequent buyers of the shares over the year, especially Bruce Kovner who is a beneficial holder in Strongbridge. I think their faith will be rewarded in the year ahead as the stock appears to have a favorable risk/reward profile at current trading levels.

"The sad truth about humanity...is that people believe what they're told. Maybe not the first time, but by the hundredth time, the craziest of ideas just becomes a given." - Neal Shusterman, UnWholly

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.

Disclosure: I am/we are long SBBP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.