Retractable Technologies: Little Is Known Other Than The Upside Potential

Retractable Technologies' shareholders have realised +580% upside YTD on the back of scale in unit volumes and key contract announcements.

The company announced a $84 million contract with the Department of Human Services back in May.

Operations have become more efficient, and inventory is converting to cash more efficiently and effectively.

Gross level earnings have ramped up ~270% YoY, with key product differentials maintaining attractiveness for their syringe segment safety.

We see a price target of ~$12.70, which demonstrates the additional upside yet to be reflected in shares today, in our view.

Investment Summary

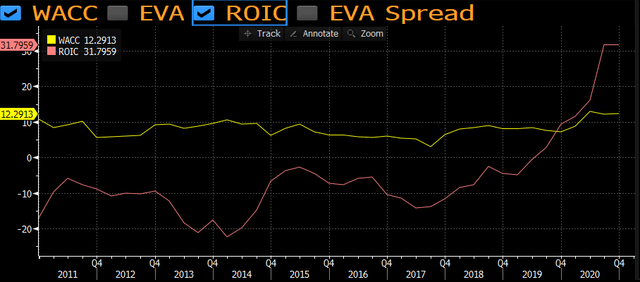

Certainly, Retractable Technologies (NYSEMKT:RVP) has flown under the radar of many this year, rewarding shareholders ~580% upside YTD without the media attention. With high ROIC outweighing the cost of capital, alongside sequential sales growth YTD, RVP is certainly worth consideration in our view.

Data Source: Author's Bloomberg Terminal

RVP develops and manufactures a suite of safety syringes and IV catheters for US and international markets, amongst other operations. The key products assist a wide scope of patient profiles, from diabetes to those requiring blood collection samples. The key differentiators in its product mix help mitigate the needlestick injuries that are sustained with hypodermic needle use. Over 320,000 needlestick injuries occur in the US each year alone, which ensures that RVP's products remain attractive to the end-users, be it clinicians or patient-centred. Q3 performance highlights the sequential growth RVP has experienced YTD and YoY, and here we link that performance to valuation and outlook for the company.

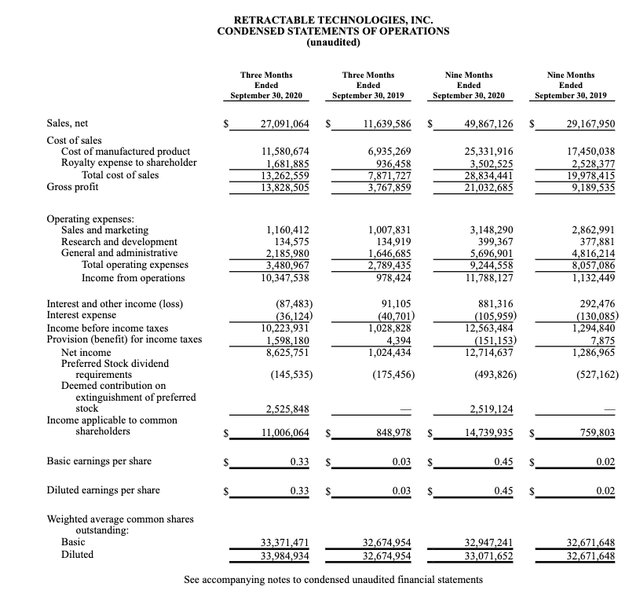

Q3 Earnings Analysis

The majority of the Q3 sales were domestic, with over 94% domestic contribution from US sales. ~78% of revenue volumes were attributed to US government links, which highlights the stability in RVP's earnings model. Unit sales increased markedly over the single-year period to date, with ~182% YoY increase in revenues from this segment alone. Back in May, the company announced a large delivery order under the Department of Human Services ("DOHS") contract for ~$84 million to supply automated retraction safety syringes. Even without this order, unit sales showed a 40% YoY increase; however, the Q3 portion of the DOHS contract delivered ~$13 million in top-line earnings for the company. Management has indicated that it expects incremental growth from this agreement over the coming quarters into 1H 2021.

On these revenues, the company realised a 267% YoY increase in gross earnings, which was driven by unit volumes and the DOHS order. RVP increased capacity and saw leverage from sales of higher-margin syringe sales in the product mix. As a result of the increase in capacity, operating leverage was stretched, with a 67% increase in COGS and ~25% increase YoY from operating expenses which surmounted to ~$3.5 million. Both of these figures were attributable to higher manufacturing costs associated with production scale, but were offset by strength in operating income of $10.3 million from the quarter, a sizeable 105% YoY increase from the same period in 2019.

Data Source: RVP 10-Q Nov 2020

The strengths highlight RVP's ramp in unit sales and value creation for shareholders this year. The company's path to profitability has been fulfilled, with a $10.6 million adjusted EBITDA contribution from Q3, that looks set to increase over the coming periods. Management has provided little colour on guidance, but based on the current trajectory and key contracts, like the one with DOHS, double-digit top-line growth is not an unreasonable expectation. We believe that the demand for syringe products will likely maintain its cadence well into 2021, thus, we would advocate investors to pay close attention to RVP's gross level and EBITDA level earnings over the coming quarters. We can see EPS increase significantly to $0.33, and we would anticipate earnings of ~$0.42 by 2H 2021.

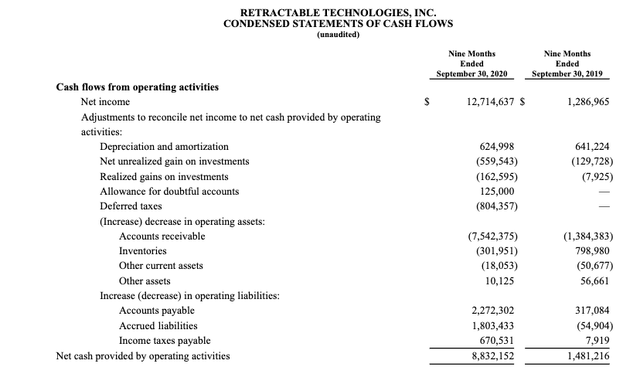

What is impressive in RVP's story is the efficiency to generate cash this year. We can see from the 10-Q filing that the net cash volume provided by operations grew by over $7 million YoY. The major contributions were from income, with an equally as significant increase in accounts receivable over this period. As such, inventory turnover increased from ~3x to over 5x this quarter, and the average days of inventory outstanding decreased to ~73 days from ~97 days quarter/quarter. Thus, the cash conversion cycle decreased by around 8 days to just over 74 days. We can see further evidence of the cash conversion via an -11% decrease to inventory to cash days, now at ~137 days. However, on the accounts receivable increase, the turnover on accounts receivable decreased to ~5.6x, which most likely reflected a slight increase in the days of sales outstanding, for more relaxed payment terms to purveyors. RVP can afford to do so given the size and timing comfort of the cash flows in the DOHS order. Overall, we see a significant improvement in the operating cycle for RVP, which has undoubtedly benefitted from unit volume increases this year, alongside key contract manufacturing agreements that have improved the conversion of inventory to cash.

Data Source: RVP 10-Q Nov 2020

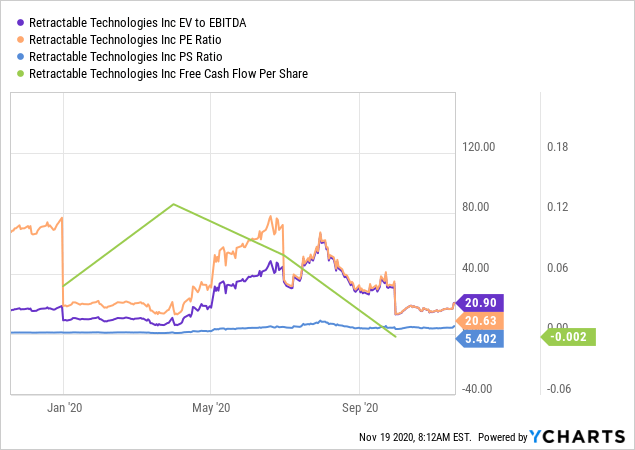

Valuation

Shares are trading at ~21x P/E and are at a premium of ~9x book value. Shares are also trading at ~5.5x sales on an EV level and almost 21x Q3 EBITDA. With large share price dispersion this year, valuations have kept up at a premium, although the market may be under-reflecting the asset value of RVP's operations into the valuations. Incredible ROIC of ~38% far outweighs the cost of capital of ~13%, which absolutely justifies the premium on valuation. Based on the growth in ROIC YoY from -0.2% to Q3 results, we believe that there is further room for share price appreciation in RVP's story. We are firm believers that the best companies can exhibit high ROIC and growth of this figure over time. Thus, although shares are trading at a premium, we believe that the valuation is justified on that front.

Data Source: Author's Bloomberg Terminal

Shares have around $0.66 in cash per share, with ~$1.44 in book value per share. Assuming the contract delivery order extends to 2025, the NPV of the contract segment discounted at 13% gives ~$2 per share. Additionally, we can see an EV per share of $6, and we would anticipate the value of unit sales over the coming periods, excluding the contract delivery, to surmount to ~$300 million at the base level in our model, the NPV of which using the same parameters gives ~$5 per share. Thus, using a sum-of-the-parts ("SOTP") framework, we see a price target of $13 over the coming 12 months. By that measure, there is further upside from these figures.

Using a multiples framework, we assign a 29.3x multiple to our EBITDA estimate based on EV/EBITDA forecasts, and apply this to our 2021 EPS estimate:

- 2021 EPS Estimate - $0.42

- 29.3x 2021 EBITDA Estimate x 2021 EPS = 29.3x0.42 = $12.30

Thus, we see a price target of $12.60 using a blended SOTP and multiples approach, which is about 25% upside on today's trading.

Data by YCharts

Data by YCharts

In Short

RVP has flown under the radar of many investors this year, but has given away over 500% upside YTD. We believe that further upside is likely based on our valuation approach, key contracts in place with the government, and key differentiators in its product mix that bolt safety on to product benefits. With the overwhelming strain on the US and international healthcare systems, RVP remains a key player to service demand schedules. Management does not give away much, only that margin and international revenues are subject to swings between periods due to a myriad of factors. Nonetheless, the valuation looks attractive, and the company consistently delivers high ROIC, which has grown superbly over the recent periods. We are firm on the belief that those names that deliver high ROIC above the cost of capital will continue to generate superior shareholder value. So much has been true YTD for RVP, as mentioned. Thus, we encourage investors to stay on top of the RVP story, especially considering the scale in unit production that is likely to occur with the DOHS contract fulfilment. We look forward to providing additional coverage.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RVP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.