Wanda Sports Group Cash Offer Shows Potential 18% Return With Upside Kickers

Wanda Sports Group is evaluating an offer from its controlling shareholder that may result in an +18% return to shareholders from the current price.

However, unlike many M&A scenarios, there may be substantial medium-term upside, should the deal not occur.

Hence, this may be a company with fundamental upside as we emerge from COVID-19 in 2021-22, but the offer may present an attractive and relatively quick near-term catalyst.

It appears there are multiple ways to win with this investment. Either the offer goes through for an 18% gain, or it is increased or withdrawn, which may lead to further upside for the business.

Wanda Sports Group (WSG), which manages sports media rights and operates sports broadcasting, appears dramatically undervalued and has a cash offer at an 18% premium to the current price from its controlling shareholder. Either the offer succeeds, which seems the most likely outcome. However, should the offer fail or be improved, then the returns to shareholders may increase. Hence, this is potentially a heads you win, tails you win more situation for investors.

The Offer Being Evaluated - $2.50 Cash Per ADR From Controlling Shareholder

Here is the relevant part of the September press release, a non-binding offer of $2.50 per ADR. Since then, on October 6, 2020, the company formed an independent committee to evaluate the deal, and on October 23, 2020, appointed independent advisors to the committee.

BEIJING, Sept. 30, 2020 /PRNewswire/ - Wanda Sports Group Company Limited (the "Company," and together with its consolidated entities, "Wanda Sports Group") (NASDAQ: WSG), a leading global sports events, media and marketing platform, today announced that its Board of Directors (the "Board") has received a preliminary non-binding proposal letter, dated September 30, 2020 (the "Proposal Letter"), from Wanda Sports & Media (Hong Kong) Holding Co. Limited (the "Proposing Buyer"), a wholly-owned subsidiary of Dalian Wanda Group Co. Ltd., to acquire all of the outstanding Class A ordinary shares of the Company (the "Class A Ordinary Shares"), including American depositary shares representing Class A Ordinary Shares ("ADSs," with every two ADSs representing three Class A Ordinary Shares), for US$2.50 in cash per ADS, or US$1.67 per Class A Ordinary Share (the "Proposed Transaction").

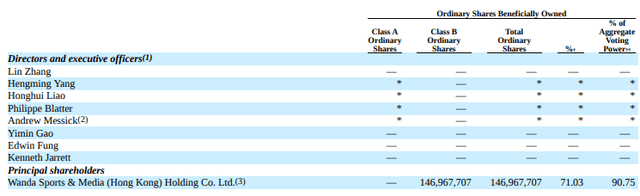

Most importantly, the entity making the offers owns 71% of the shares and 91% of the voting power, per the company's most recent 20-F.

Hence, we have a base case of a cash offer for 18% upside. However, I would argue it gets better.

If The Deal Fails...

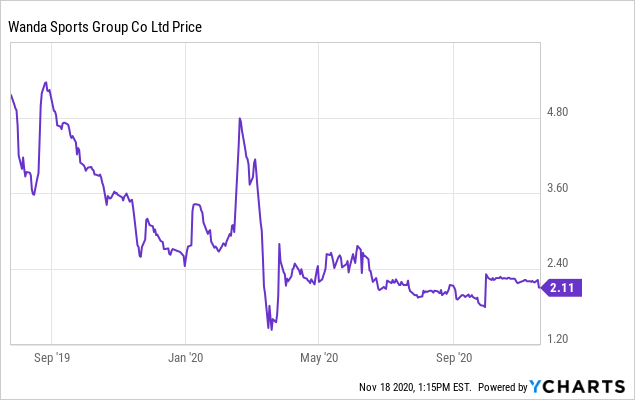

It does seem the deal is likely to succeed. However, there may be further upside over the medium term if it does not. Note for investors, this has been nothing short of a blood bath. The company listed shares a little over a year ago at $8 per ADS. That itself was reduced from a $9-11 target range. The company then fell in value on its first day of trading, and it's been broadly in decline thereafter.

Data by YCharts

Data by YCharts

A Primer On The Business

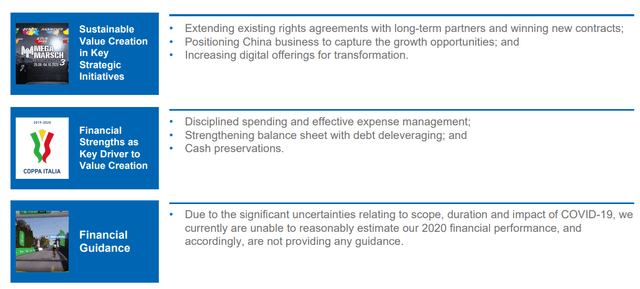

WSG owns Infront Sports & Media, which is a sports rights and advertising agency and benefits from many sporting events, including the World Cup and other soccer rights, and the Winter Olympics. Then, the company also offers media production and broadcasting services for sporting events. Finally, WSG has sold its IRONMAN business this year, but still operates some mass participation events from legacy businesses. Below are the company's main initiatives, while acknowledging the impact of COVID-19.

(Source: Company Q2 Presentation)

Valuation

In March, the company sold its IRONMAN business for $730 million. SA author Glass Half Full did some valuation work on the company, suggesting EBITDA without the IRONMAN business of approximately $220 million. An 8x multiple appears reasonable for this sort of sports and media business, suggesting an EV of $1.76 billion post COVID-19.

The most recent June balance sheet shows $769 million of interest-bearing liabilities and $188 million of cash, for a net debt total of $581 million. That implies an equity value of $1.2 billion, or $8.8/share, with 139 million shares out, a 250% premium to the currently proposed offer price.

Hence, as the recent IPO pricing of $8/ADR last year suggests, this business should likely be valued well above the offer price. To make the offer price reflective of the valuation (for the purposes of illustration), you would have to use a ~4x EV/EBITDA multiple or increase business liabilities by around ~$800 million. Neither assumption appears realistic.

With these sort of numbers, you might wonder if there is fraud, and the company's disclosures are somewhat opaque, plus it lost a German soccer contract in questionable circumstances this summer, so that is perhaps a potentially risk to the thesis.

As a further sanity check on the valuation, Infront Sports & Media was acquired by WSG from Bridgepoint in 2015 for 1.05 billion euros ($1.2 billion at today's exchange rate). Importantly, WSG owns other assets beyond Infront, so private transactions are supportive the valuation too.

An Increased Offer?

There is also the chance that the committee requires the controlling shareholder to increase the offer, given the company does appear extremely undervalued today on most rational valuations and, indeed, last year's IPO pricing. This may also reduce legal risks for the acquiring party. This may be viewed as something of a "takeunder," given the extremely low valuation compared to history, private market valuations and comparative valuations. Hence, that could contribute to upside, though, remember the "improved offer" scenario is not necessary for the thesis to work. This company is not trading above the offer price, it is trading below it.

Scenarios

It appears likely that the apparently low-valuation offer is accepted given the power of the controlling shareholder making the offer. However, it is possible the offer is improved or withdrawn entirely.

| Scenario | Price | Probability |

| Current cash $2.50/ADR offer accepted | $2.50 | 70% |

| Offer improved to better reflect underlying valuation | $4.00 (approx.) | 15% |

| Offer withdrawn/rejected (medium-term valuation) | $8.00 (approx.) | 15% |

This framework yields an expected value of $3.55/ADR, with modest upside from the deal being accepted the most likely outcome. The price at the time of writing is $2.11/ADR.

Now, of course, should the offer be rejected, it will not be plain sailing, and the shares could well trade down in the near term, but long term it appears the business is worth around the $8/share price that it IPO'd at in 2019.

Bear in mind that the offer came in in September, and many businesses have rallied on vaccine news since then. Given WSG's exposure to sporting events such as the World Cup and Winter Olympics, it too would likely trade up, should COVID-19 pressures ease. The rescheduled soccer World Cup is expected in summer 2021 and the Winter Olympics in early 2022. WSG should materially benefit from both events.

Conclusion

At face value, WSG offers an attractive 18% return to a potential cash offer. However, this may be the relatively rare opportunity where, should the deal not occur, there may be further upside. It is also possible that the offer price is increased. In addition, the offer was received 7 weeks ago, so a decision from the reviewing committee may be close.

Disclosure: I am/we are long WSG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not intended as investment advice. Author's stock positions may be updated without notice. No warranty is given on the accuracy of the information in this write-up or that it will be updated. Investing involves risk of permanent capital loss.