Tilray: Will Raise Money Diluting Shares Sending Stock Lower

Tilray beat on earnings in their latest results pushing up their stock;

Revenues remain flat-to-lower over multiple quarters despite epic increases in Canadian cannabis retail sales.

Cash On Hand is narrowing and the company will likely have to raise more cash, diluting their shares.

When Canada legalized cannabis in October 2018, a slew of companies started up looking for “Green Gold.” There were many startups getting involved wanting to cash in. Then, a few big-name cigarette companies and alcohol companies stepped in to expand their holdings and get involved in a new type of engine of growth; Constellation Brands (STZ) bought into Canopy Growth (CGC) and Altria (MO) bought into Cronos (CRON). This made headlines and lots of investors came to the table looking to follow suit. The stocks of many of these companies started to make exceptional gains.

At the time, I had a home in Colorado and California and saw firsthand the explosive growth and potential that Canadian companies could have. I started writing about some of these companies and following these stocks. I also started building up a portfolio of the ones I liked best. I was very bullish on the industry during that period of time.

Enter Tilray (TLRY), a company that never made the list of “The ones I liked best.” Oh, let me count the ways on which Tilray was an easy sell for me. Here are some of my articles from that period of time:

- Tilray Leverages Overvalued Stock In Retail Partnership

- Tilray Stock Major Short Squeeze Under Way

- Tilray Sell This, and How To Do So

There were many more articles.

Tilray’s initial stock moves were irrational, at best. My thesis on the articles above was largely the same: Tilray had no chance of ever being valued at the price the stock was trading at.

Unfortunately, I caught a major virus while traveling through Central America; I have a coffee business that gets me traveling throughout this part of the world. The virus took me down for 15 months. My stocks were liquidated via my trust. Once again, I get to look at investing in stocks but this time with a fresh perspective. I am very bullish on cannabis stocks right now; probably far more than before.

Enter Tilray, again. The company is still not on my list of “The ones I like best.” In fact, back then I was dead certain Tilray’s stock would fall from its highs. And it did. I believe the same still applies.

Stock Price

Here is a look at TLRY stock on a weekly basis showing the extraordinary moves the stock saw when it first went public:

(Data Source: Trading View)

Keep in mind, this was during a bit of a heyday for cannabis stocks. Tilray was caught up in this and their stock price went upwards to levels that could not be supported. As you can see, the stock is now trading below its IPO level; this is two years after the IPO first came out.

Recently

Here is a look at the very most recent stock price movements on TLRY:

(Data Source: Trading View)

The company announced some recent news and this pushed the stock back upwards. Since then the stock has settled back down and is moving mostly sideways.

I believe the stock will go lower.

In the meantime, the metric that pushed the stock upwards as it did was the announcement of a beat on EPS of -$0.02 (Beat by $0.19). Also, Tilray offered guidance of break-even or positive EBITDA for 2020.

Revenues

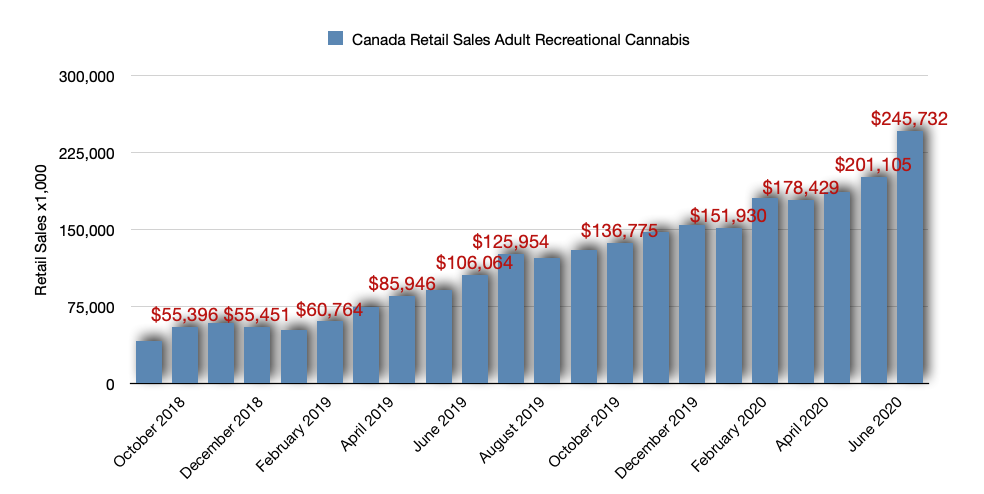

In Canada, cannabis is moving higher and higher. Here is a look at Canadian Retail Sales since its inception in October 2018:

(Data Source: StatCan - Author’s Chart)

You can see a continuous upward trajectory in the data here. This is all provinces. Within Canada, Tilray operates primarily in Toronto. As it is one of Canada’s largest provinces, Toronto’s retail sales of cannabis mirror the country’s as a whole. Many companies operating in Canada are seeing similar revenues.

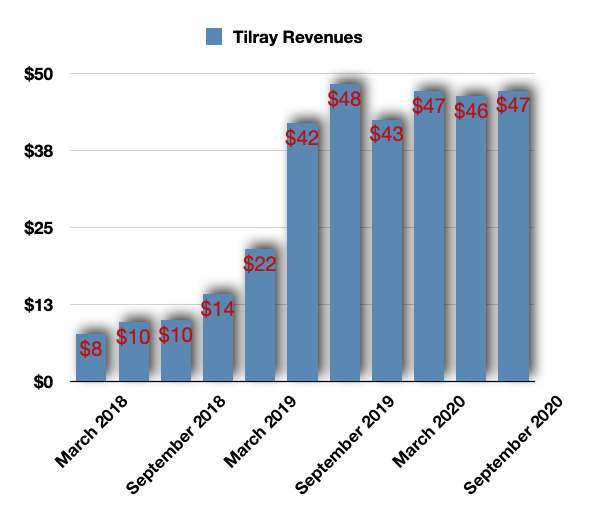

Which begs to question, what do the quarterly results of Tilray’s revenue look like?

Here is the latest data on Tilray’s quarterly data:

(Data Source: Company Data via Seeking Alpha - Author’s Chart)

While there was an impressive rise in revenues during 2019, there has largely been nothing impressive since. Keep in mind the data shown above on Canada’s retail sales. That is all companies selling in all provinces throughout Canada. A lot of the companies that I have been following have been showing surprising increases in revenues QoQ. Several of these companies have also become profitable or increased their profits because of the increases in revenue they have enjoyed.

But, not Tilray.

Profits

Gross Profits have also not been improving as shown here:

(Data Source: Company Data via Seeking Alpha - Author’s Chart)

This will erode future opportunities for Tilray. The main reason is that while the rest of the industry is increasing revenues, gross profits and net profits, Tilray is having to dip into their cash reserves to stay afloat.

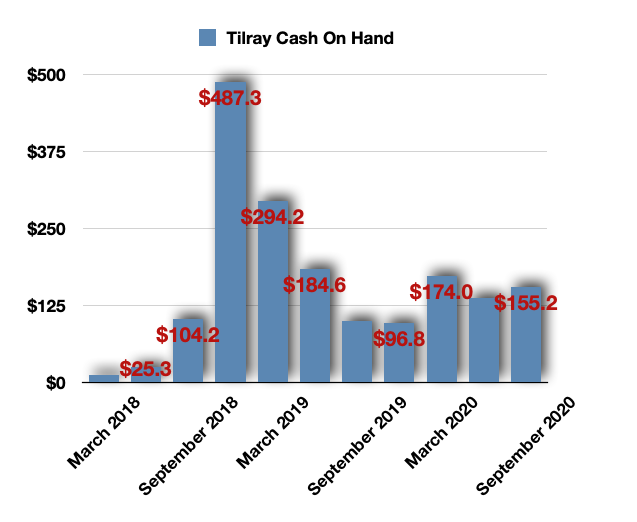

Cash On Hand

Tilray is burning about $20M annually because they are not profitable. They are said to be close to needing a cash raise; and I just read somewhere this puts their target price at half of today’s price. Here is their cash on hand:

(Data Source: Company Data via Seeking Alpha - Author’s Chart)

Tilray is reducing costs of SG&A and R&D from ~48M to ~$26M on an annual basis. This will help, of course. But, it is going to be a continual drain on their cash on hand as well as a future opportunity.

I believe the company could do a better job of increasing their revenues. Just keep in mind the expansion that the Canadian cannabis is seeing. In an era of expanding revenue that is being witnessed in Canada right now, I would like to see a company really focus on gaining market share and retaining customers through loyalty. Obviously, Tilray has sales; they have revenue. But, it is as flat as the state of Kansas.

Conclusion

I have never been a big supporter of Tilray. Their stock was far too high considering their potential during the initial big boon in cannabis. I was a big believer that their stock would come down; it has.

Now, during an epoch where cannabis is becoming readily accessible throughout Canada, Tilray should be focusing on gaining market share and winning customers. Canadian cannabis is moving higher and higher on a monthly basis; it is up 90% in just three months. However, Tilray’s revenues are as flat as plywood. I get that they are spending on development for future products. However, they have existing products now and those products should be solidified in the market. They are not. Flat revenues show us that.

Tilray is also likely to need a cash raise, which translates into a dilution of shares. That will kill the stock.

There are many reasons to not like Tilray. I don’t even want to say that they could become a great company in the future; this is the golden age for cannabis companies right now and we are seeing this in the results of other cannabis companies that are posting above-expectation revenues and profits. While Tilray did print a better EPS this quarter - a big plus - it was still negative. Tilray needs to focus on market share right now. They are missing out.

I am bearish on Tilray at the moment. I believe a future cash raise would slash their stock price almost in half. At the same time, not improving dramatically in the revenue area is a major negative for me, as well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.