Early Black Friday Present For Your Portfolio: Simon Property Group

While consumers have shifted to online shopping, malls will still be an important venue.

SPG has had years of disciplined property and capital management, which makes it well positioned to manage the second wave of COVID-19.

SPG has opportunistically acquired iconic brands that will help it outperform peers and compete with online retailers.

Unlike most REITs, SPG has ample cash and credit to weather further shutdowns without needing additional capital.

Editor's note: Seeking Alpha is proud to welcome Portfolio Navigator as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Overview

This week, we look at Simon Property Group (NYSE:SPG) as a potential source for outsized returns. SPG's stock is down by more than 50% from its highs, but its revenues, occupancy, and other key metrics are down considerably less. More importantly, rent payments are picking up from the second quarter, and rental rates have grown year over year. As we are starting to see on the horizon the end to the pandemic, SPG is poised to return to its pre-crisis levels. Secondarily, SPG's yield of 7.0% should attract income-oriented investors and provide a similar tailwind for the stock that was seen following the Financial Crisis. Putting it all together, SPG has the potential for strong double-digit returns over the next couple of years.

Introduction

Consumers have been laser focused on online retailers with much of their attention on the likes of Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and other online consumer portals. In the midst of this shift, investors have shunned all mall REIT stocks for fear of the end of the brick-and-mortar retailer. Unfortunately, this has been a classic case of “throwing out the baby with the bathwater”. More importantly, reading through last week’s earnings announcement from Simon Property Group, the company is fully ensconced in its recovery from first half of the year, while the stock price has not yet begun to see its own recovery. Shifting exposure from e-commerce to SPG could be a good move in your portfolio for both the near term and for years to come.

Source: Simon Property Group, 2019 Property Portfolio

Striving for Excellence

Simon Property Group is in a strong position today, in large part due to the leadership team’s disciplined approach to managing their properties in both good and weak times. Over the past decade, while many of their competitors were haphazardly growing their retail footprint, the management team at SPG was culling their malls to maintain the highest quality properties. This approach resulted in the company offloading their B-malls and strip malls in favor of higher end retail solutions. They achieved this divestiture of the smaller properties in their portfolio through a spinoff into a new company, Washington Prime Group (NYSE:WPG). They also selectively launched new malls in areas where there was high end demand for large chain retailers and premium consumer products. Lastly, the leveraged their balance sheet to acquire marquee properties from their competitors. As a result of these changes, they became the dominant landlord for brick-and-mortar retail across the United States. With the COVID-19 Crisis, the efforts of the management team to build this high-quality retail footprint was largely ignored by investors as the stock price was cut by more than 50%. This stock price move is clearly overdone and misses the recovery they are starting to see across their retail footprint.

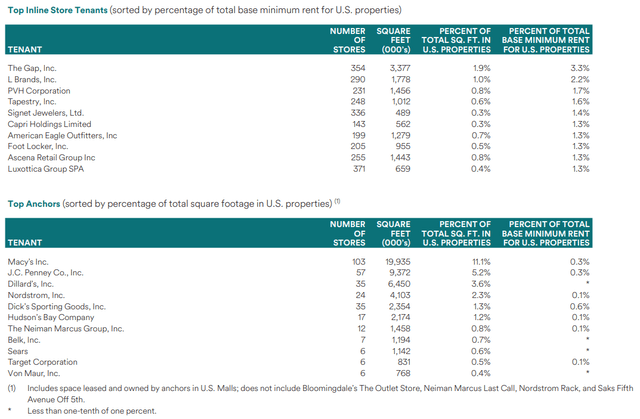

Tenant Concentration Risk

One of the main drivers for the company is their approach to building a well-diversified portfolio around their tenants. For the most part, the anchor stores in their properties are owned by the retailers and do not contribute materially to the financials of SPG. This leaves the rest of the mall to be leased out and managed by the company. Since the management team has reshaped their portfolio to be A-malls, these tenants tend to be larger corporations that run well known stores like Gap, Banana Republic, Zara, H&M, etc. Fortunately, for the SPG, most of these larger corporations have continued to pay their rents. For those that have not, the management team has been successful in the courts to receive their back rent. Secondly, from a numbers perspective, any single tenant is less than 5% of the company’s revenues. As some of these retailers opt to restructure through a bankruptcy or permanently shut down their business, their individual impact on SPG’s lease revenue will be small.

SPG U.S. Malls and Premium Outlets Top Tenants Q3 2020

Source: Simon Property Group, Third Quarter Earnings Supplement, November 9, 2020.

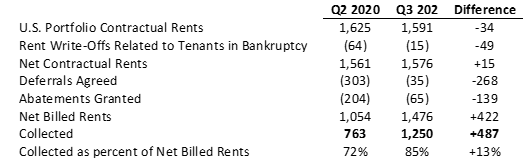

Third Quarter Earnings: Signs of Recovery

While Simon Property Group has positioned the company for long-term growth, the near term has been exceedingly challenging. Quarantines across the country have been tough for malls, and SPG has been no exception. Interestingly, for SPG, it appears that most of the challenge is behind the company. Specifically, all but one of their mall locations across the United States are currently open. More importantly, SPG has collected 85% of its rents for the third quarter, compared to only 72% for the second quarter. Digging a little deeper into these numbers, the picture is even brighter. While revenues for Q3 were 2% lower ($1,625 million versus $1,591 million), the level of write-offs and abatements were significantly lower than in the second quarter. As a result, Net Billed Rents rose by $422 million from $1,054 million in the second quarter to $1,476 million in the third quarter. Most importantly, as of November 6, collected rents rose nearly 64% from $763 million in the second quarter to $1,250 million in the third quarter.

Simon Property Group QoQ Net Billed Rents in Millions

Source: Simon Property Group, Third Quarter Earnings News Release, November 9, 2020.

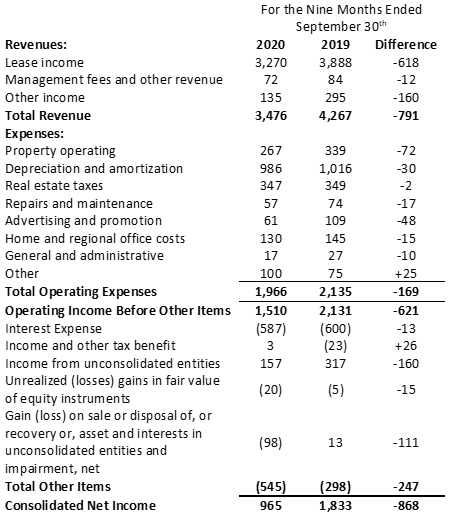

While the quarter-over-quarter growth for SPG is impressive, it is also important to compare how the company is doing from one year ago, when there was no pandemic. When looking at the financials for the first nine months of 2019 compared to 2020, there are the obvious notable declines, but there are a number of bright spots too. For example, while revenues have declined by nearly 19% ($791 million), the company has been able to reduce a number of their operating expenses by more than 20%. Looking at the bottom line, earnings have declined by nearly 50% comparatively. If this was due to properties permanently closing or large levels of vacancies across their properties, it would justify the roughly 50% decline in SPG’s stock price. Fortunately, as noted above, the company is starting to see a recovery. One such data point is SPG’s occupancy rate, which was 91.4% as of September 30th, compared to 94.7% at the same time in 2019. This meager decline of a little more than 3% is much less than investors would expect, given the 50% decline in SPG's stock price. Lastly, another key indicator is the base rent per square foot. This is important as a high occupancy rate can sound good on the surface, but if it is due to heavy rent discounts, the story becomes less compelling. Fortunately, SPG has not only been able to avoid a decline in their base rent per square foot, but it has actually risen 2.9% over the past year.

Unaudited Consolidated Statement of Operations in Millions

Source: Simon Property Group, Third Quarter Earnings Supplement, November 9, 2020.

Fortitude to Last: Strong Capital Position

Most importantly, with a recovery starting to take shape, SPG is in an enviable capital position. One of the biggest challenges for REITs is they are required to distribute most of their earnings to shareholders in order to maintain their advantageous tax status. The result is that most REITs have to turn to the capital markets, either by issuing additional debt or equity, for growth capital or to finance revenue shortfalls. Interestingly, SPG has done an excellent job of building a capital position over the years, while staying within the guidelines for REITs. As a result, the company currently has more than $9.7 billion of liquidity on their balance sheet. This consists of $1.5 billion of cash on hand and an additional $8.2 billion on its revolving credit facility. To put this in revenue terms, SPG’s third quarter revenue was $1.06 billion compared to $1.42BN from a year ago - this equates to a shortfall of $0.36BN. If SPG were to continue to have a revenue shortfall of roughly $0.4 billion, their current liquidity would plug this gap for more than six years without the need to raise additional capital from the public markets.

Opportunistically Positioning for the Long Term

In addition to SPG’s envious capital position, management has also been proactive in positioning their company to remain dominant in the future. This has consisted of a two-pronged approach: Upgrading and enhancing their retail footprint and acquiring iconic retail brands that have failed.

The management team has thoughtfully used the closing of their properties to make repairs and upgrades as needed. Additionally, the development plans for their existing and new properties have continued to stay on track or even move up the timelines to launch. Many of their new development projects, both in the United States and internationally, are slated to complete by the end of 2021. The result of this activity should be lower maintenance costs over the medium term and more compelling properties for consumers to shop.

On the acquisition front, Simon Properties has been systematically acquiring failing brands across their properties under the Simon Property Authentic Retail Concepts (SPARC) umbrella. This is the hidden gem within SPG’s portfolio of assets. Most recently, SPARC has acquired Brooks Brothers and Lucky Brands, and is in the process to acquire most of JC Penney’s assets. This creates an additional venue for growth as SPG can utilize these iconic brands across their brick-and-mortar footprint, as well as online to deliver popular and nostalgic brands to consumers. One answer that SPG may have to Amazon’s continued growth is to begin selling these brands through the Amazon channel. Interestingly, this is no different than Apple leasing spaces in SPG’s malls for their unique retail stores or even Amazon or Peloton (PTON) doing seasonal pop-up stores in SPG’s premium malls.

Risk Considerations

While Simon Property Group is poised for outperformance, it is always prudent to evaluate potential risks. Thankfully, SPG is in a strong capital position, one that should enable the company to weather the current brick-and-mortar environment, but there are other potential risks to consider. These risks fall into three main categories: tenants, geography, and consumer behavior.

SPG has a very diversified portfolio of tenants who are mostly large corporations. This has enabled SPG to navigate the pandemic better than most of its peers as these tenants have long term leases and can't make many adjustments from year to year. Still, it is prudent to evaluate if leasing terms were to change significantly. Currently, SPG has benefitted from favorable courts that have ensured these tenants continue to pay rent. If this were to change, or a number of these retailers opted to go through bankruptcy to break their leases, it could have a material impact on revenues for the near to medium term. Assuming the lows of 72% of rent collected in the second quarter of 2020 as the worst case scenario, this would justify a stock that is down roughly 30% from its highs.

Geography is another major potential risk for SPG. Constructing a mall is a multi-year endeavor and is based on both the current demographics in the region and future projections. One lasting impact from COVID-19 is that a number of people have moved to less densely populated areas or even other parts of the country. Once the United States begins to re-open, it will be important to follow how this shift may have impacted the consumer communities around SPG's properties. If a number of people have left these areas, SPG may have to lower rents or even shutter properties.

Lastly, consumer behavior is another major consideration. Consumers have gotten increasingly comfortable with most of their retail purchases arriving at their doorstep. One big uncertainty is the amount of shopping that will shift back to malls after the pandemic is over. If there is a weak return of the consumer to SPG's properties, they may be required to lower rents to appease tenants.

Potential for Outperformance

Longer term, Simon Property Group also has compelling prospects. Historically, the management team has been able to deliver double digit annual returns to shareholders since going public. As the world begins to recover from the current pandemic, arguably, SPG has the potential to return to its historical growth rates. More compelling is that SPG also has an attractive dividend with a current yield of 7.0%. This should provide a strong tailwind to the stock price as income starved investors are looking for high quality companies that pay an attractive dividend in order to replace their lost portfolio income due to historically low yields in bonds. This same phenomenon occurred following the Financial Crisis more than a decade ago. At the time, SPG’s investors benefited from this trend as they earned more than a 50% return in 2009 and nearly 30% gains for each of the next three years. Arguably the current environment is better for SPG as the company is valued at a much steeper discount and bond yields are even lower this time.

Overall, SPG continues to look attractive due to its strong capital position and its ability to acquire iconic brands through its Simon Property Authentic Retail Concepts umbrella. The tailwinds of the historic low rate environment and the eventual end to the pandemic bolster the potential for SPG. When comparing Amazon and Apple, which are both near all-time highs, versus SPG, which is almost half of its valuation 12-months ago, which do you think has more compelling stock price appreciation potential over the next twelve months and beyond? As we enter what is traditionally the holiday retail period, SPG is just the Black Friday gift for your portfolio that has the potential to deliver outsized gains for years to come.

Disclosure: I am/we are long SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.