A dashboard with industry metrics in utilities.

Value and quality scores, and their evolution since last month.

A list of cheap stocks.

This article series shows every month a dashboard with aggregate industry metrics in utilities. Most of the companies used to calculate these metrics are holdings of the Fidelity MSCI Utilities Index ETF (FUTY). Therefore, this is also a top-down survey of FUTY.

Shortcut

If you are used to this dashboard series or if you are short of time, you can skip the first paragraphs (metrics definition and table) and go to the charts. However, reading everything once is necessary if you want to use the metrics for stock-picking purposes.

Base Metrics

We calculate the median value of five fundamental ratios for each industry: Earnings Yield ("EY"), Sales Yield ("SY"), Free Cash Flow Yield ("FY"), Return on Equity ("ROE"), and Gross Margin ("GM"). Our calculation universe includes large companies in the U.S. stock market. The five base metrics are calculated on trailing 12 months. For all of them, higher is better and negative is bad. EY, SY and FY are medians of the inverse of Price/Earnings, Price/Sales, and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable or non-available when "something" is close to zero or negative (for example, companies with no or negative earnings). We also calculate two momentum metrics for each group: the median monthly return (RetM) and the median annual return (RetY).

We use medians rather than averages because a median splits a set in a good half and a bad half. A capital-weighted average is skewed by extreme values and the largest companies. Our metrics are designed with a stock-picking mindset, not for index investing.

Value and Quality Scores

We calculate historical baselines for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated as the averages on a look-back period of 11 years. For example, the value of EYh for water in the table below is the 11-year average of the median Earnings Yield in water companies.

We define the Value Score (“VS”) as the average difference in % between two valuation ratios (EY, SY) and their baselines (EYh, SYh). FY is reported for consistency with other sector dashboards, but it is ignored in utilities Value Score to avoid some inconsistencies. The Quality Score (“QS”) is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh). The formulas are below:

VS =100*((EY-EYh)/EYh+(SY-SYh)/SYh)/2

QS =100*((ROE-ROEh)/ROEh+(GM-GMh)/GMh)/2

The scores are in percentage points. VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline. A positive score points to undervaluation, and a negative one to overvaluation (positive is good, and negative is bad). This interpretation must be taken with caution: the baseline is an arbitrary reference, not a supposed fair value.

Current Data

The next table shows the metrics and scores as of last week's closing. Columns stand for all the data named and defined above.

VS | QS | EY | SY | FY | ROE | GM | EYh | SYh | FYh | ROEh | GMh | RetM | RetY | |

Gas | -28.76 | -4.02 | 0.0410 | 0.5079 | -0.1008 | 8.39 | 37.81 | 0.0514 | 0.8100 | -0.0438 | 9.58 | 36.24 | 9.37% | -8.73% |

Water | -40.15 | 9.27 | 0.0280 | 0.1526 | -0.0315 | 10.42 | 56.80 | 0.0403 | 0.3039 | -0.0354 | 9.07 | 54.81 | 6.99% | 6.13% |

Electricity | -34.96 | 12.82 | 0.0447 | 0.3344 | -0.0617 | 10.45 | 44.78 | 0.0575 | 0.6389 | -0.0408 | 9.94 | 37.18 | 4.63% | -1.12% |

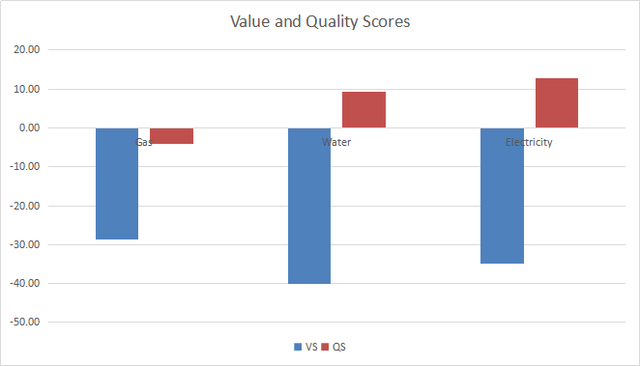

Value and Quality chart

The next chart plots the Value and Quality Scores by industries. Higher is better, and negative is bad.

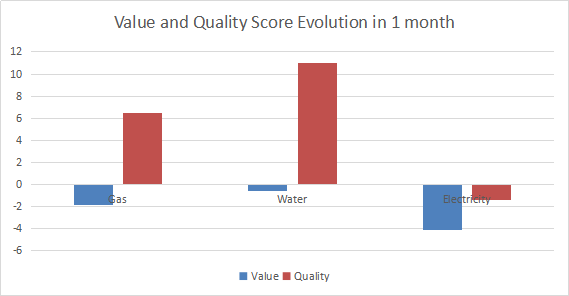

Evolution Since Last Month

Quality has significantly improved in Water and Gas. Valuation has slightly deteriorated in electricity.

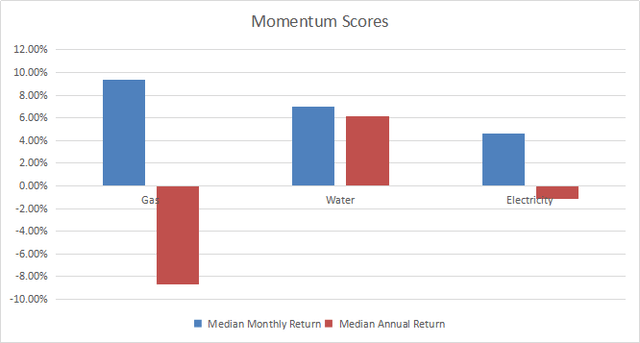

Momentum

The next chart plots momentum data.

The best performing large cap utilities companies in one month are: AES Corp. (AES), CenterPoint Energy Inc. (CNP), DTE Energy Co. (DTE), Edison International (EIX), and Southern Co. (SO).

Dashboard List

The list below was published for Quantitative Risk & Value subscribers several weeks ago based on data available at this time. These stocks were in the good half among their peers for three valuation ratios and ranked on higher return on equity. This is not investment advice. Do your own research before buying.

ALLETE Inc. | |

American States Water Co. | |

Black Hills Corp. | |

DTE Energy Co. | |

Entergy Corp. | |

Exelon Corp. | |

Hawaiian Electric Industries Inc. | |

New Jersey Resources Corp. | |

NRG Energy Inc. | |

NorthWestern Corp. |

Interpretation

Utilities industries are overvalued by 29% to 40% relative to their historical baselines. Water and electric utilities may partly justify it by a good quality score. The only group with both 1-month and 1-year momentum scores in positive territory is water utilities.

We use the table above to calculate Value and Quality Scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells that an electricity company with an Earnings Yield above 0.0447 (or price/earnings below 22.37) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time.

Our cheap stock lists are designed to outperform their sector benchmarks on the long-term. Quantitative Risk & Value (QRV) provides you with a realistic quantitative approach of market risk and sector-oriented value. Get started with a two-week free trial and see how QRV can improve your investing decisions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.