XBiotech: New Q1 2021 Clinical Announcement, 9M 2020 Confirmed Short-Term Janssen Revenues, 2022 Is Uncertain, +28% Upside

XBiotech Inc. is a clinical-stage biopharmaceutical company focused on developing safer/more effective therapeutics through human-based monoclonal antibodies.

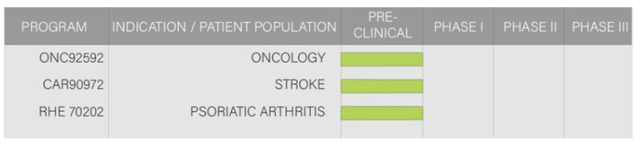

XBiotech's pipeline consists of 4 candidates with 3 in the pre-clinical phase. Starting 1-2Q 2021, XBiotech aims to re-enter the clinic with more than one new anti-IL-1a therapy.

XBiotech made an interesting transition in 2019 with its first revenue streams starting Q1 2020 reaching $38.7M at 9M 2019 with $238M in cash, enough for 2-4 years of runway.

XBiotech aims to disclose a long-anticipated progress update in Q1 2021 regarding new anti-IL-1⍺ therapies that are being pushed into the clinic.

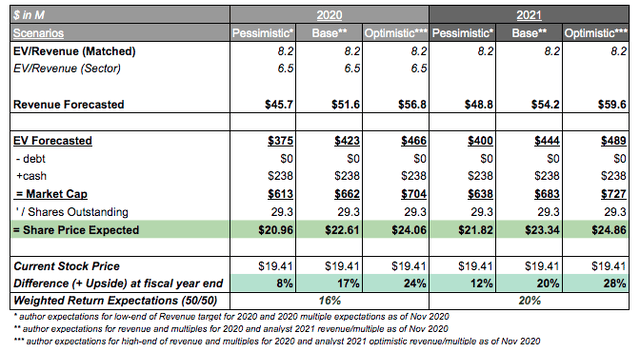

In summary, the author projects conservatively XBiotech Inc. as a "buy" at a 2-year price target of $24.86 (+28% upside).

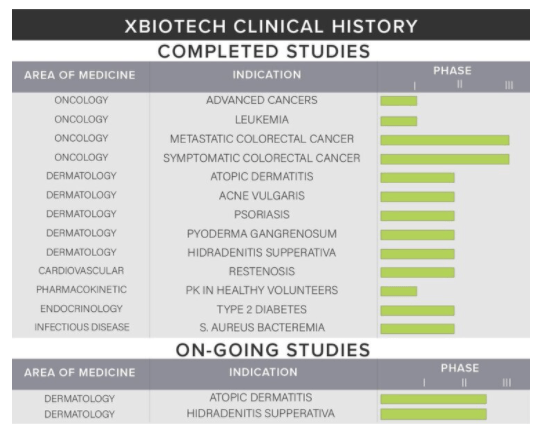

Graphic Source: XBiotech Inc.

Introduction: What is XBiotech Inc.?

XBiotech Inc. (XBIT) is a clinical-stage biopharmaceutical company focused on developing safer/more effective therapeutics through human-based monoclonal antibodies.

Founded in 2005 in Canada and now headquartered in Austin-Texas, XBiotech has grown to 89 employees with revenue achieved in 2020 for the first time in the past 3-years reaching $38.7M, primarily from manufacturing and clinical trial services.

Products/Pipeline: XBiotech's development pipeline consists of 4 candidates with three in the pre-clinical phase. Starting 1-2Q 2021, XBiotech also aims to re-enter the clinic with more than one new anti-IL-1a therapy (non-dermatological) that investors are eager to see after the recent 4Q 2019 $750M sale of Bermekimab (anti-IL-1alpha monoclonal antibody) and all its associated rights alongside key employees. Additionally, during 4Q 2020, XBiotech announced they are developing a new therapeutic candidate, FLUVID™, which aims to treat combination illnesses between influenza and COVID-19. Investors are watching closely. This comes after their previous announcement of a new potential licensing agreement with BioBridge Global (April announced initial partnership) which will allow BioBridge to utilize XBiotech's testing technology for COVID-19 antibody detection, an addition to an earlier COVID-19 therapeutic partnership established and the Aug 2020 FDA EUA approval for COVID-19 Convalescent Plasma as a COVID-19 treatment.

Management: CEO: John Simard founded and has led XBiotech since its inception in 2005. He is a biological manufacturing specialist who holds over 300 method/composition patents related to cancer antigens, cancer/infectious disease immunotherapies, and related to human antibodies, all core-specialties of XBiotech. He previously founded CTL ImmunoTherapies Corp. and AlleCure Corp. which merged in 2001 forming MannKind Corp. (MNKD), another promising company the author recently wrote on here. Simard possesses extensive scientific experience.

Share price change under his leadership (IPO 2015 @ $22.94): -16.5%

Strategy: XBiotech's stated strategy is to "fundamentally change" the development and commercialization of drugs while becoming a leading biopharma company specializing in human-based antibodies, which the company terms, True Human™ antibodies. Over the next two years, their cash basis is very strong with capital from the Janssen Transaction which brought in $675M in upfront cash with an additional $75M tentatively held in an escrow account (releasable 2Q 2021). This transaction also offers up to $600M in potential milestone payments (no royalty option) related to Bermekimab thus generating enough cash for R&D and sufficient to enable an expanded pipeline which is currently under research. Their medical focus is on anti-inflammatory therapies utilizing their human-derived True Human™ antibodies in areas excluding dermatology (for anti-IL-1a), according to the 4Q 2019 Janssen Transaction. XBiotech's core goals in the short term are as follows:

- Continue to advance their pipeline of antibody therapeutics and to initiate new strategic clinical programs

- Find new uses for their True Human™ antibody therapies utilizing their expertise and proprietary platform

- Continue to leverage their biological manufacturing technology

Financial position: XBiotech has made an interesting transition in 2019 with its first revenue streams starting Q1 2020 of $12.7M. As of 9M 2020, XBiotech has achieved unaudited revenues of $38.7M of which clinical trial service revenue represented the majority (65%) and manufacturing revenue representing the minority (35%), both coming from Janssen, a subsidiary of Johnson & Johnson (JNJ). FYE 2020 revenue estimates are conservative at $51.6M. XBiotech operates with no debt and since the Janssen transaction, a cash cushion as of 9M 2020 of $238M, enough for 2-5 years of a runway on top of positive retained earnings of $95M. Trailing cash burn is -$70M and the 3-year average CFO+CAPEX was -$23M still highlighting significant liquidity to maintain and expand operations as expected.

Investment thesis: Though not as overly optimistic as most, the author sees XBiotech as one of the few underfollowed emerging biotech stories with great upside and a reasonable valuation. After the Janssen transaction confirmed XBiotech's anti-IL-1⍺ platform and trigger share repurchases (+1 potential in 2021), it remains a waiting game for more late-stage promising therapeutics with a hopeful royalty structure on the future partnerships. The Janssen transaction provided a short-term boost to what was a desperately cash-strapped company providing clear revenue for 2-years and cash for several more. Developments within the pipeline remain to be disclosed in 1Q 2021, but it seems the Chief Scientific Officer Shivaswamy remains confident and investors would be reasonable to do the same, especially after the promising COVID-19 therapeutic activity. The following report will go into more detail with the above factors associated with XBiotech's future, but, in summary, the author projects XBiotech as a "buy" at a 2-year price target of $24.86 (+28% upside).

Pipeline & partnerships: Strong Janssen partnership and new potential for more in 2021.

Graphic Source: XBiotech Inc.

Graphic Source: XBiotech Inc.

XBiotech has been busy since 2005 across a variety of therapeutic end-points and applications with several studies completed outlined above showcasing a competitive advantage of experience across various areas of medicine ranging from oncology to infectious diseases based on their antibody platform. The two ongoing studies mentioned in the graphic above are being run for Janssen in exchange for clinical service revenue on their 2-year contract following their 4Q 2019 sale of the investigational therapeutic, Bermekimab (anti-IL-1alpha monoclonal antibody for dermatological purposes).

The basis of many of XBiotech's new potential therapeutic candidates utilizes XBiotech's True Human™ monoclonal antibodies which are derived from human beings in contrast to animal/engineered antibodies. The key differentiation is the safety factor with the potential for more effectiveness. XBiotech is translating this science into product candidates targeting inflammatory and infectious diseases with the underlying manufacturing technology necessary for the low-cost and timely launching of new products. This comes from their fully-integrated development capabilities in their 48-acre headquarters in Austin, Texas which cover non-clinical, clinical, and manufacturing with expansion plans for a new infectious disease 30K sq. ft. R&D facility. The following sections will cover XBiotech's future pipeline across 3-key areas.

Promising Therapeutics (1): Interleukin-1⍺

Graphic Source: XBiotech Inc.

Reasonably understood to be the key catalyst that has changed XBiotech's trajectory starting Q4 2019, Janssen's $750M acquisition of all rights to XBiotech's investigational Phase 2 therapeutic Bermekimab (anti-IL-1alpha monoclonal antibody), it's dermatological indications, and several key employees highlights the potential value of what XBiotech has done in the arena of anti-IL-1⍺ antibodies. The Interleukin-1⍺ therapeutic lines have been substantiated by the Janssen transaction and it seems investors will now have to wait to see what is unveiled in Q1 2021, with XBiotech stating their plans to re-enter the clinic with "more than one additional anti-IL-1⍺ therapy" starting early 2021.

The science behind these IL-1⍺ therapeutics is based on blocking interleukin-1⍺, a substance known to cause dangerous inflammation which if uncontrolled leads to a variety of medical complexities including cancer, stroke, and arthritis amongst others. It is a promising specialty within XBiotech.

Next Update: Q1 2021 anti-IL-1⍺ therapies clinical initiation announcements

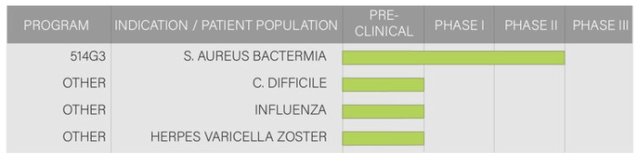

Promising Therapeutics (2): Infectious Diseases

Graphic Source: XBiotech Inc.

Since 2019, XBiotech's capabilities in infectious diseases have grown stemming from its ability to rapidly harness genetic information for anti-virus neutralizing antibodies from the blood of successfully arrested immune responses. These are then transferred to supplement patients currently battling these diseases all by utilizing their fundamental expertise in monoclonal antibodies. The applications are vast covering viral and bacterial infections (therapeutically or prophylactically) opening the door to further opportunities aided by their large cash-basis and full-development to novel manufacturing capabilities enabling rapid scaling for commercial transition, if clinically successful or acquired.

XBiotech is currently targeting the below diseases:

1) Herpes varicella-zoster (Chickenpox) will be targetted potentially in aging and contrast, infant populations with unmet applications for shingles

2) C. difficile bacteria, a deadly intestinal infection, targetted through a novel oral-therapy with the potential differentiating factor being a major cost-reduction (price at -75% as compared to the existing market using injectables)

3) Inlufenza, a widely known virus that killed +34K in 2018-19, has been analyzed by XBiotech and a proposed therapeutic has been identified. Utilizing the same antibody transfer mechanism outlined above, XBiotech aims to harness their findings and apply it across a variety of pathogenic influenza strains with the key potential product differentiator being XBiotech's therapeutics' ability to bind virus particles at their surface and utilize white-blood cells to facilitate clearance thus enhancing the immune system's future ability to protect the body

4) Staphylococcus Aureus (S. Aureus) is an existing clinical product of XBiotech, having already run a Phase 1/2 double-blinded placebo-controlled clinical study for patients with s. aureus bacteremia. S. aureus has a unique immune evasion mechanism, but XBiotech's True Human™ antibody therapy trial showed a 52% reduction in the rate of serious adverse events and a 30% reduction in hospital stay duration as compared to the placebo. S. Aureus incidents have a key driver within the opioid epidemic from the sharing of needles. It is the second leading cause of death for end-stage renal disease patients undergoing hemodialysis.

Other therapeutic updates:

- 4Q 2020: XBiotech announced they are developing a new therapeutic candidate, FLUVID™, which aims to treat combination illnesses between influenza and COVID-19. Investors are watching closely.

- 3Q 2020: XBiotech announced that they are working towards a new licensing agreement with BioBridge Global (April announced partnership) which will allow BioBridge to utilize XBiotech's testing technology for COVID-19 antibody detection, an addition to an earlier COVID-19 therapeutic partnership established following the Aug 2020 FDA EUA approval for COVID-19 Convalescent Plasma as a COVID-19 treatment.

For more information on updates regarding science and priorities of the therapeutic line, please see XBiotech's clinical publications here.

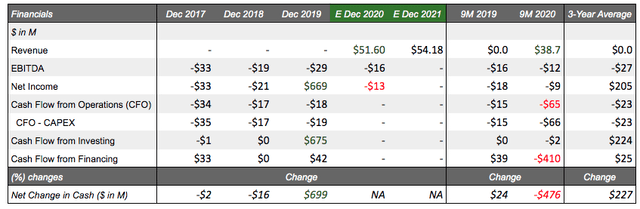

Financial position: Short-term revenues, unlikely profitability

Table Source: Self Created | Data Source: Seeking Alpha - XBIT

Revenue/costs: On a revenue basis, XBiotech has produced stellar results in 9M 2020 producing $38.7M in revenue (Clinical trial service revenue: 65%, Manufacturing: 35%). Author expectations for 2020 project revenue to hit $51.6M with comparable analyst expectations unavailable for this emerging growth company. The growth in manufacturing revenues ($13.5M as of 9M 2020) is attributable to the quarterly fixed payments from the clinical manufacturing agreement between Janssen and XBiotech for the manufacturing of Bermekimab for Janssen's use in clinical trials which is expected to expire on Jan 1, 2022. Concerning clinical trial service revenue, XBiotech is currently providing clinical trial operation services ($25.2M) to Janssen for the completion of two continuing Phase 2 studies evaluating Bermekimab in Hidradenitis Suppurativa (acne inversa) and Atopic Dermatitis (Eczema) which equate to pass-through costs plus a 30% markup (shown above in Pipeline and partnerships section).

All in all, $600M in potential milestone payments is a respectable sum, but the deal concluded with worldwide, royalty-free, and fully paid-up terms representing what seems to be no royalty rights, putting investors back into a precarious position for XBiotech to source another breakthrough candidate (though currently underway - Q1 21' announcement). In either case, XBiotech hopes to use the proceeds from the Janssen transaction and its associated short-term revenues for expanding their IL-1a targeting and infectious disease product lines.

Some reports have cited potential profitability in 2020 or 2021 following exceptional results in 2019; however, this does not appear to be the case when you extrapolate 9M 2020 results forward projecting net loss per the year of -$13M, led by weak gross profit margins on manufacturing (14.42%) and clinical trial services (17.76%, lower than 30% markup). These margins are pre-R&D expenses incurred, though conversely have strongly decreased in 2020 (-55%) which may be attributable to the Bermekimab team/costs transition to Janssen. In any case, investors should be aware of the short-term nature of these revenues and what they actually represent.

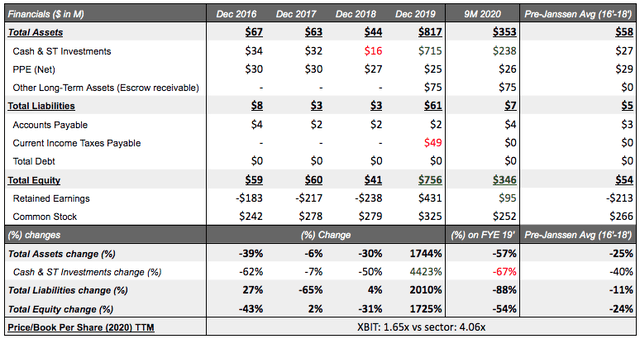

Balance sheet composition: Enough cash with open-ended share repurchase potential

Table Source: Self Created | Data Source: Seeking Alpha - XBIT

In biotech, the critical factor is if the company has enough liquidity to cover its pipeline's progress between milestone payments (if any). XBiotech saw a large cash infusion from the Janssen transaction (+$675M) increasing its desperate cash position in 2018 from $16M to $715M in 2019. XBiotech then underwent an over-subscribed botched modified Dutch auction tender offer in Feb 2020 repurchasing 14M shares (33% of common shares) at $30 worth $420M (ex fees) from shareholders and is still considering additional share repurchases. Regardless of what transpired, looking forward, 2021 offers another $75M cash infusion (escrow) on top of $0 outstanding debt leading XBiotech to be in a strong position with $238M in cash to expand their pipeline and make significant clinical progress. This clearly enables further upside for investors. With average cash pre-Janssen being $27M, it doesn't seem unlikely to witness another share repurchase, but timing is uncertain; however, XBiotech retaining their stock in-house seems to align shareholders with business actions and makes a strong positive signal for medium-term investors.

Valuation: Upside is clear, but post-2022 is uncertain

Table Source: Self Created | Data Source: Seeking Alpha - XBIT

Valuations are always complex, particularly when the most basic multiple (Price/Sales) has no analyst projections and sales started 1Q 2020. However, on a rough conservative analysis, the author has projected revenues to FYE 2020 and to FYE 2021 (+10% revenue growth) allowing investors to understand the upside (+16% in 2020) on a roughly conservative basis. Investors can be confident of double-digit upside with a margin of safety due to relative EV/Revenue comparison between sector (6.5x) and XBiotech multiples (8.2x) highlighting a minimal premium. It seems XBiotech is still in a conservative valuation as compared to the industry discounting its large cash position and promising pipeline. Investors should be aware though that 2022 marks the potential end of Manufacturing revenue though may be compensated by a higher-cost Phase 3 trial if Janssen continues outsourcing clinical service management to XBiotech and no competitors are sourceable. Another potential is for further partnerships in 2021 which are far likelier following the publicity from the IL-1a antibody sale. In any case, it seems likely that investors still have upside potential. The author expects conservatively a +28% 2-year upside potential for XBiotech leading to a stock price of $24.86.

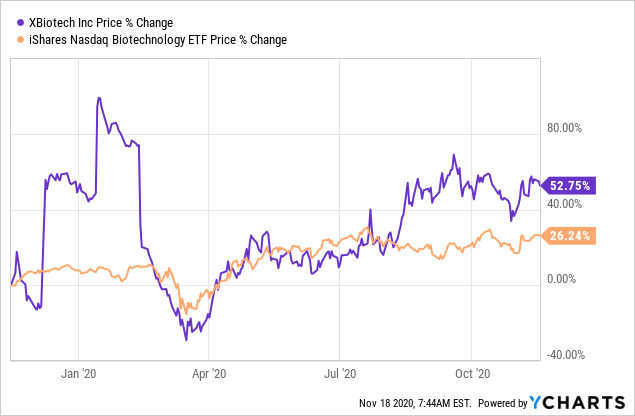

Data by YCharts

Data by YCharts

Upcoming Catalysts:

- Q1 2021 anti-IL-1⍺ therapies clinical initiation announcements

- 2021 partnership announcements expected

- Q2 2021 $75M escrow cash accessible and its potential repurchase activities to follow

- Q1 2022 Janssen service contract termination/renewal

Conclusion:

After contrasting the short-term benefits of the Janssen transaction, and the potential impact a substantiated biological platform presents, it seems reasonable to say that investors are safe with their existing investments in XBiotech as of 3Q 2020 and for new investors, it seems like a reasonable investment for the next 2 years. 3Q 2020 showed that the XBiotech is well-capitalized for future expansions with their anti-IL-1⍺ therapies (ex dermatology) and have clear strength in their financial position. New partnerships should be watched for as a potential second catalyst towards promising advancements in therapeutics and several upcoming catalysts in 2021 will present short-term upside.

In summary, the author projects XBiotech Inc. as a "buy" at a 2-year price target of $24.86 (+28% upside).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.