VT: If You Could Only Invest In One ETF For The Long-Run

VT provides exposure to over 8,800 stocks with a goal of complete diversification across global equities.

VT is a good low-cost and easy way to invest passively in stocks with a long-term time horizon.

Investors that already hold U.S. stocks may find VT offers only limited benefits of portfolio diversification since the fund includes a large allocation to widely held mega-cap companies.

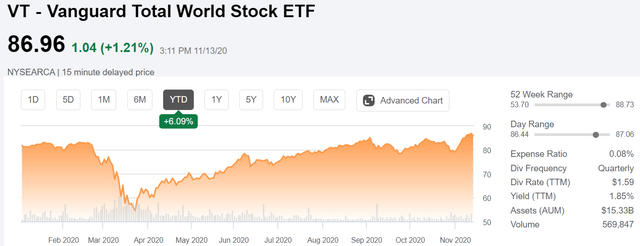

The Vanguard Total World Stock ETF (VT) tracks the universe of stocks across developed and emerging markets through a portfolio of over 8,800 holdings. With an expense ratio of just 0.08%, VT is an easy low-cost way to capture a passive exposure to global equities as an asset class with a long-term time horizon. In essence, investing in VT is all you need to be completely diversified in stocks. That being said, investors should note that the fund may not make sense if you already hold other broad market index funds. VT's relatively high concentration in U.S. stocks and mega-cap leaders limits the fund's potential for adding diversification to the existing portfolio. Overall, VT is a quality fund that serves its purpose and performs as expected, but we believe investors can do better through a combination of other ETFs targeted towards separate market strategies.

(Seeking Alpha)

VT Background

The VT ETF tracks the 'FTSE Global All Cap Index' which is a market-cap weighted index representing the performance of the large, mid, and small-cap stocks globally. According to the index methodology, stocks are screened for invertibility and liquidity to ensure that the underlying positions are tradeable. Simply, every publicly-traded stock in the world meeting certain requirements ranked by market capitalization is to be included in the fund at a proportion relative to their market value.

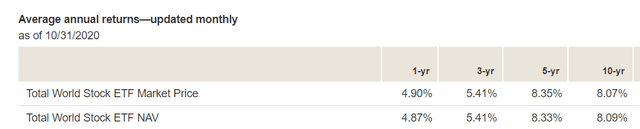

The idea of the fund and allure of the strategy is that by capturing exposure to the entire universe of all available equities, investors can approach a completely diversified portfolio, eliminating company-specific risks. In theory, the performance of the VT should correspond to the market risk of equities as an asset class. Over the last decade, the fund has returned on average 8.1% per year.

(Vanguard)

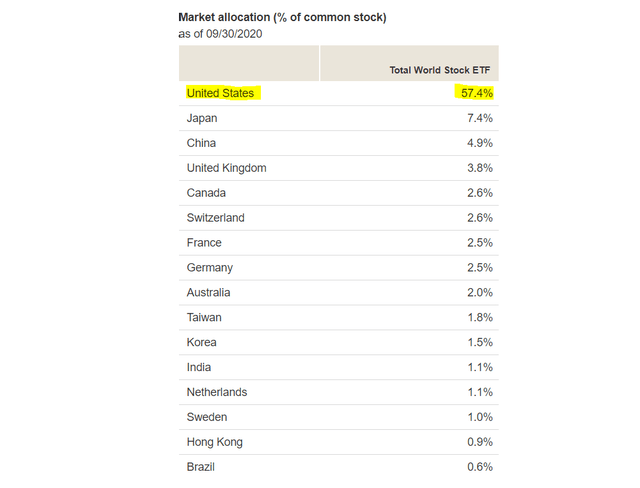

Given the size and importance of the U.S. equity market, the VT fund includes a 57% allocation to U.S. stocks while the remaining 43% is in foreign companies. Japan stocks with a 7.4% allocation followed by China at 4.9%, United Kingdom at 3.8%, and 2.6% in Canadian companies round out the top 5 countries most represented in the fund.

(source: Vanguard)

A Diversification First Approach

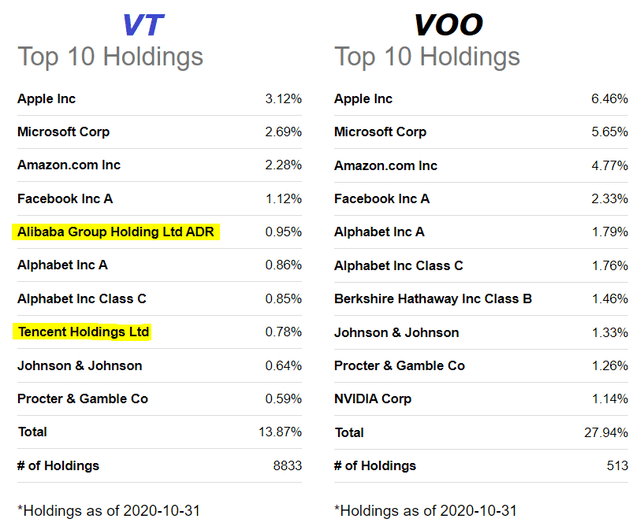

Returning to our original point. VT is as close to a completely diversified ETF as you'll find in the market. The problem we see is that most investors own more than just one equity fund or hold a portfolio of several individual stocks. If, for example, you already own the Vanguard S&P 500 ETF (VOO), which is Vanguard's version of (SPY), adding an allocation to VT would effectively overweight the U.S. stocks within the S&P 500 while the allocation to foreign stocks would be underweighted compared to their true representation among a global portfolio.

If we consider that the approximate 60/40 balance allocation between domestic and international stocks is optimal according to the VT composition, adding the ETF to an existing portfolio would tilt the overall exposure away from the correct diversified balance.

To visualize our example, consider the top-10 holdings of both VT and VOO. Based on their market capitalization, Apple Inc. (AAPL), Microsoft (MSFT), Amazon.com Inc. (AMZN), and Facebook Inc. (FB) are the top holdings in both funds. For investors that already own these stocks either individually or through another ETF like the Invesco NASDAQ-100 (QQQ), the diversification benefit of adding VT is limited. The only foreign stocks among the top positions in VT are Alibaba Group Holdings (BABA) and Tencent Holdings (OTCPK:TCEHY) which together represent just 1.7% of the fund.

Our argument here is that since the VT fund is already perfectly diversified across global equities according to the methodology, any deviation from the strategy by overweighting certain markets or sectors through other equity securities results in the fund losing its intended purpose. Adding VT to a portfolio that already includes an S&P 500 Index fund adds too much additional exposure to the mega-cap tech names which goes against its purpose.

A Better Alternative to Add International Diversification

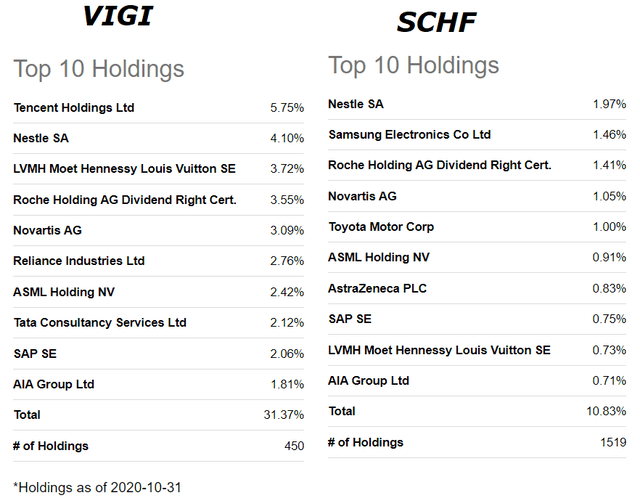

Investors that are looking to diversify may be better off buying an international stock ETF to complement their existing portfolio of U.S. stock holdings. We highlight the Schwab International Equity ETF (SCHF) and the Vanguard International Dividend Appreciation ETF (VIGI) as two alternative funds that offer more targeted diversification to international equities.

(Seeking Alpha)

No fund is perfect but the SCHF ETF with an expense ratio of just 0.06% with its portfolio of developed market equities serves its purpose well. The fund is diversified across over 1,500 stocks and importantly does not include any U.S. companies. Last year, we covered VIGI, and here reiterate it as our favorite ETF to gain exposure to international stocks with its fundamentals-based strategy. VIGI with an expense ratio of 0.2% screens stocks for dividend growth history which helps filter out financially weak companies. Dividend growth has been recognized as a driver of equity excess returns historically. The result is that the fund has been able to outperform most benchmarks with a diversified portfolio of over 450 foreign stocks.

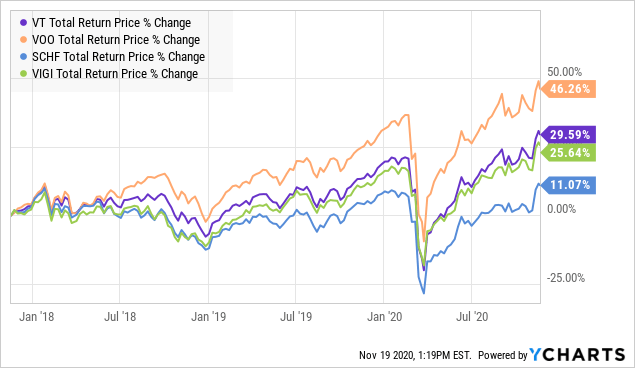

Over the past three years, the Vanguard S&P 500 ETF is up 46%, compared to a 30% increase in VT, 26% return in VIGI, and 11% from SCHF. Clearly, the S&P 500 has benefited from its exposure to market-leading high-growth tech names which also boosted the return for the VT fund over the period. In this regard, VIGI's 26% return is even more impressive considering it achieved that result without any positions in the mega-cap tech stocks.

Data by YCharts

Data by YCharts

Analysis and Forward-Looking Commentary

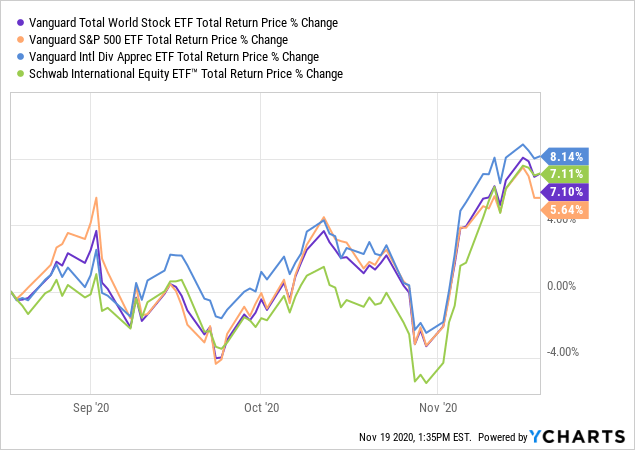

With a goal of diversification, looking at the historical returns is just for reference purposes. We're more interested in how these funds can perform going forward. In a scenario where foreign stocks outperform U.S. companies significantly, possibly driven by a weaker U.S. dollar, we would expect SCHF and VIGI to outperform VOO. VT would likely also outperform VOO but have a more balanced return, held back by its position in the U.S. companies. That's the case we find the current market environment. Over the past three months, VIGI is up by 8.1% followed by SCHF and VT up by 7.1%, and VOO trailing with a 5.6% return.

Data by YCharts

Data by YCharts

The current market development is the anticipation of a COVID-19 vaccine among several candidates to be widely available and distributed over the next year. If successful, the pandemic should effectively end and global macro conditions can begin to normalize. What we've seen in the market in recent weeks is a rotation across sectors and asset classes beginning to price in a stronger path in global growth going forward. In this environment, we believe foreign stocks are well-positioned to outperform in the near term and the VT fund should be supported by these macro drivers.

Final Thoughts

The attraction of the VT fund is its diversification and passive approach to equity investing. If you could only buy one fund, VT offers exposure to all market segments based on their corresponding market capitalization and relative importance. The approach should provide positive returns over the long run consistent with equities as a global asset class.

On the other hand, investors that are looking for exposure to international stocks may be better off focusing on a foreign-stock specific fund like VIGI or SCHF that can add more targeted diversification. Keeping in mind that the ~60/40 between U.S. and foreign stocks is the baseline in the VT ETF, investors can follow that benchmark by building their own portfolio with a combination of stocks and ETFs to remain diversified across global equities.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.