Sigilon Therapeutics has filed to raise capital via an IPO.

The firm is developing treatments for blood disorders and other diseases.

SGTX has produced intriguing preclinical study results for its lead candidate for the treatment of Hemophilia A.

Quick Take

Sigilon Therapeutics (SGTX) has filed to raise $100 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is a clinical stage biopharma developing treatment candidates for rare blood disorders and other diseases.

SGTX has produced intriguing preclinical results with its lead candidate for the treatment of moderate-to-severe Hemophilia A.

I’ll provide a final opinion when we learn more IPO details from management.

Company & Technology

Cambridge, Massachusetts-based Sigilon was founded to develop its Shielded Living Therapeutics platform which uses advanced techniques to create therapeutic molecules for the treatment of rare blood disorders, lysosomal storage diseases and endocrine diseases.

Management is headed by Rogerio Vivaldi Coelho, MD., who has been with the firm since 2018 and was previously EVP and Chief Global Therapeutics Officer at Bioverativ until it was acquired by Sanofi in 2018.

Below is a brief overview video of Sigilon's approach:

Source: Alliance for Regenerative Medicine

The firm's lead candidate, SIG-001, is being developed to treat patients with Hemophilia A.

The potential advantage of the drug is that it would avoid life-long repeat intravenous administrations in favor of being 'administered intraperitoneally, with each dose to have a duration of three to five years.'

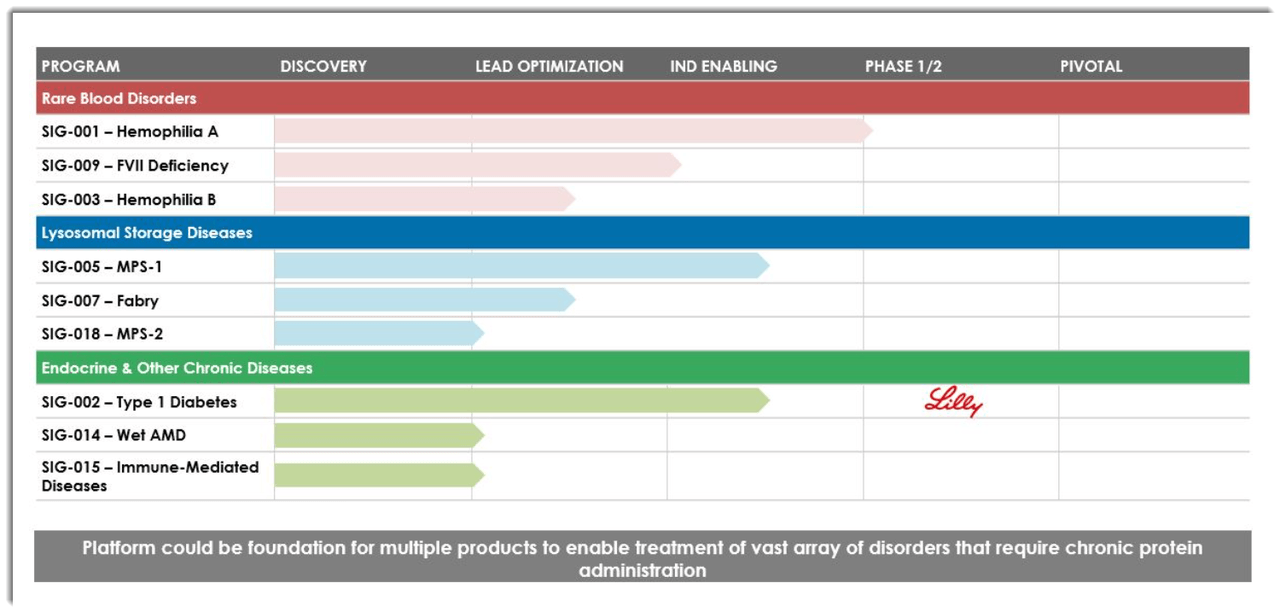

Below is the current status of the company’s drug development pipeline:

Source: Company S-1 Filing

Investors in the firm have invested at least $117 million and include Flagship Pioneering, Eli Lilly and Company (LLY) and others.

Market & Competition

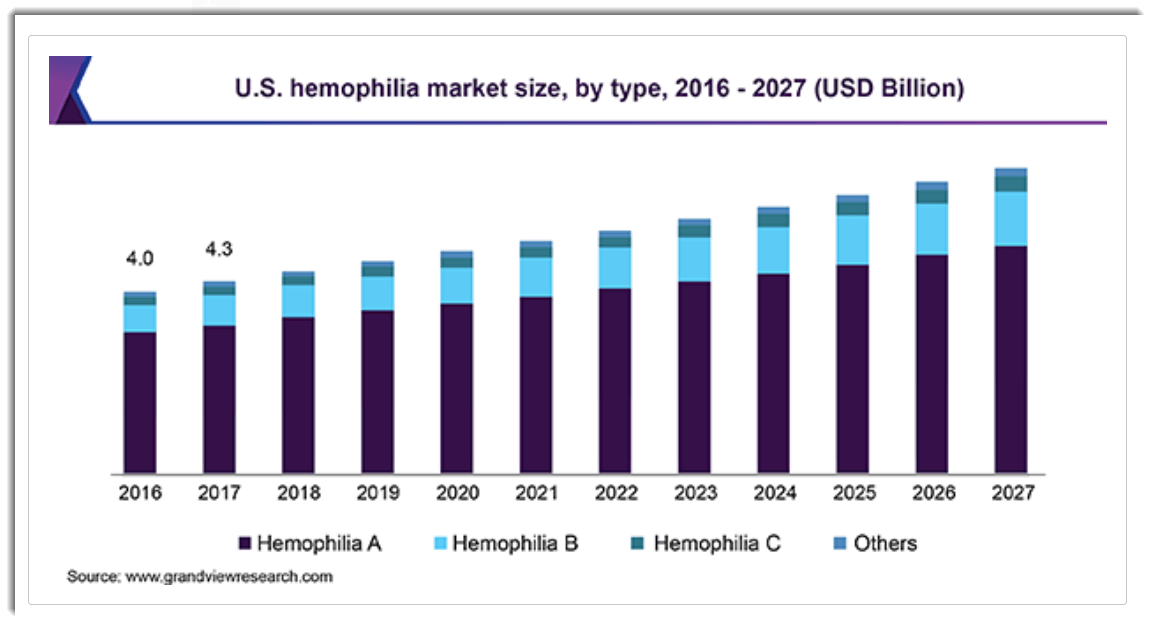

According to a 2020 market research report by Grand View Research, the global hemophilia (all types) market was valued at nearly $12 billion in 2019 and is expected to reach $18.1 billion by 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of 5.5% from 2019 to 2027.

Key elements driving this expected growth are increasing awareness campaigns and supportive initiatives by governments such as early screenings of children.

Also, the availability of limited treatment therapies is encouraging further R&D efforts by newer organizations.

Below is a graphic showing the historical and future projected U.S. market size for various hemophilia types:

Major competitive vendors that provide or are developing related treatments include:

Bayer (OTCPK:BAYRY)

CSL Behring

Roche (OTCQX:RHHBY)

Novo Nordisk (NVO)

Octapharma

Pfizer (PFE)

Sanofi (SNY)

Takeda Pharmaceuticals (TAK)

Amicus Therapeutics (FOLD)

BioMarin Pharmaceutical (BMRN)

Ultragenyx Pharmaceuticals (RARE)

Others

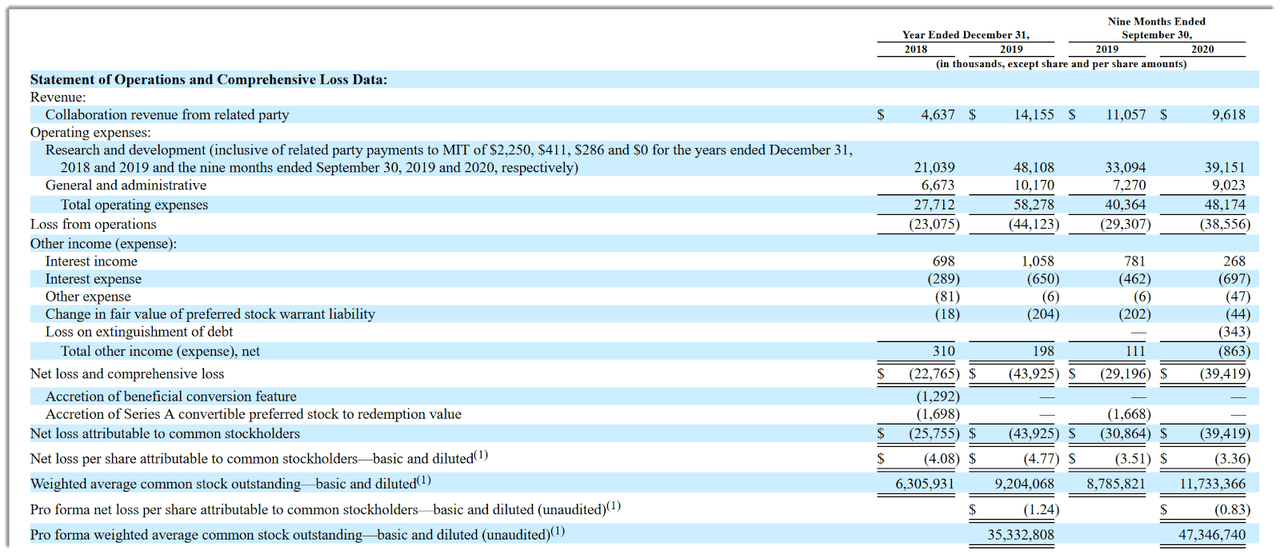

Financial Status

Sigilon’s recent financial results are atypical of a clinical stage biopharma in that they feature material collaboration revenue from its collaboration with Eli Lilly & Co.

Below are the company’s financial results for the past two and ¾ years (Audited PCAOB for full years):

Source: Company registration statement

As of September 30, 2020, the company had $62.6 million in cash and $74.8 million in total liabilities. (Unaudited, interim)

IPO Details

Sigilon intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final amount may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

to progress our Phase 1/2 clinical trial and ongoing development for SIG-001 for treatment of Hemophilia A;

for IND-enabling studies and the potential initiation of clinical studies for certain of our current programs;

to continue to scale our GMP manufacturing processes for our lead candidates SIG-001 and SIG-005;

for continued advancement of our platform technologies and discovery-stage research for other potential programs; and

the remainder for working capital and general corporate purposes.

Management’s presentation of the company roadshow is not available.

Listed bookrunners of the IPO are Morgan Stanley, Jefferies, Barclays and Canaccord Genuity.

Commentary

Sigilon is seeking funding to advance its pipeline into and through early stage trials.

The firm’s lead candidate, SIG-001, is being developed to treat certain types of hemophilia.

The market opportunity for hemophilia treatments is substantial and expected to grow at a moderate pace in the years ahead.

The firm has developed a collaboration with Eli Lilly & Co., which paid Sigilon a large up front payment for participation in its Type 1 diabetes treatment discovery program and also invested in the company’s equity.

The firm’s preclinical work with its lead candidate indicated ‘dose-dependent, durable levels of FVIII and no safety or toxicology signals,’ so its candidate has had promising results.

When we learn more details about the IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.