Utilizing Call Options On High-Quality Companies To Maximise Potential Return

Developed strategy to boost returns by buying longer-term call options on prequalified, high-quality stocks on price pullbacks.

Identified several stock candidates for strategy based on historical stock price declines and times to recover to their previous high prices.

CHD and JKHY approaching accumulation points, and I started buying call options with the expectation that their share prices will go back to their previous highs.

Investment Thesis

If you have been following me, you will know that I have a brokerage retirement account where I invest in high-quality, dividend-paying stocks on pullbacks. (See previous article for details of the strategy.) The bulk of my funds are invested in a safe IUL (see blog for details on an IUL), so I like to take on a little more risk in my other retirement accounts.

One way that I have been increasing risk to boost returns is to buy longer-term call options on prequalified, high-quality stocks on price pullbacks. Recently, I bought call options on Church & Dwight (CHD) as well as Jack Henry & Associates (JKHY).

Church & Dwight

Church & Dwight develops, manufactures, and markets a broad range of consumer goods, including brands like ARM & HAMMER, Trojan, OxiClean, SpinBrush, First Response, Nair, Orajel, XTRA, L'il Critters, VitaFusion, Simply Saline, Flawless, Batiste, and Waterpik.

CHD is a rock-solid company as confirmed by their Value Line rankings.

Source: Value Line

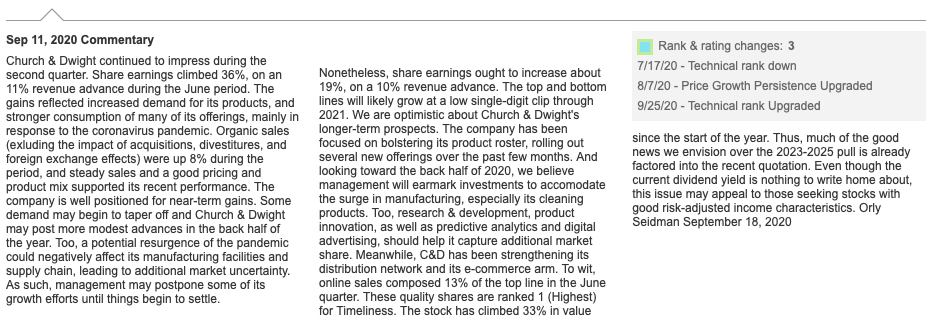

CHD's profit margin has been steadily increasing over the years.

Source: YCharts

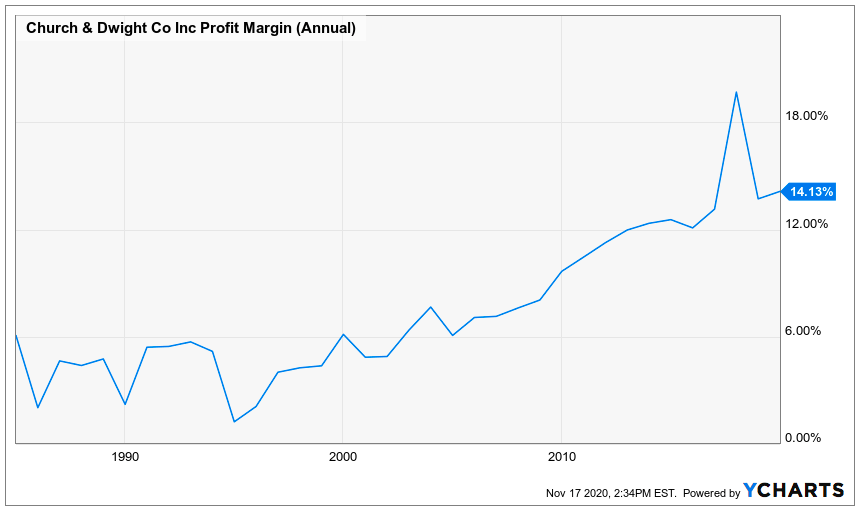

This profit margin expansion resulted in earnings that have appreciated at a CAGR of more than 13% between 1985 and 2019.

Source: YCharts

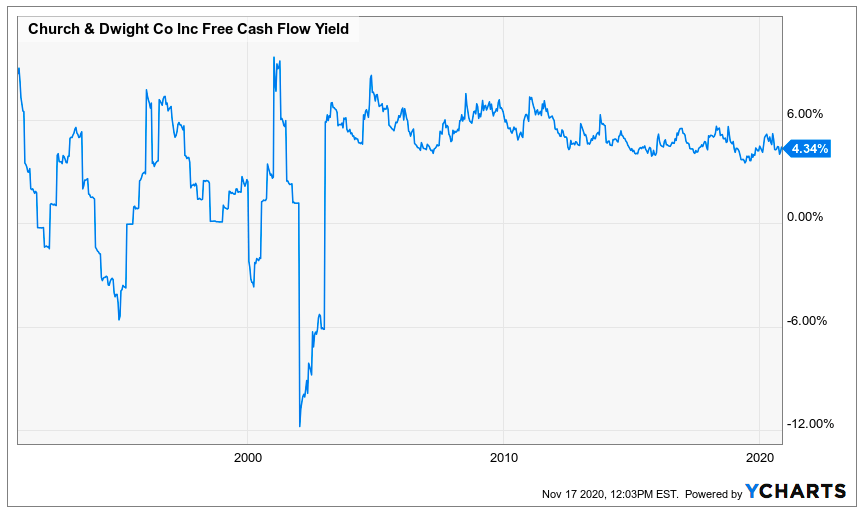

The company has also been a cash cow with the free cash flow yield currently at 4.3%.

Source: YCharts

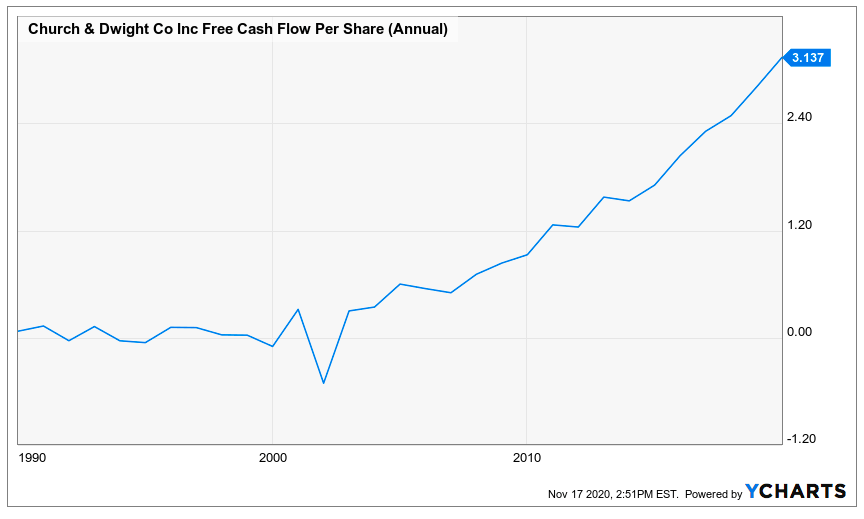

This yield has generated consistently increasing free cash flow per share.

Source: YCharts

Source: YCharts

At the end of the most recent quarter, CHD had total debt of just a little under $2B and cash of $550M.

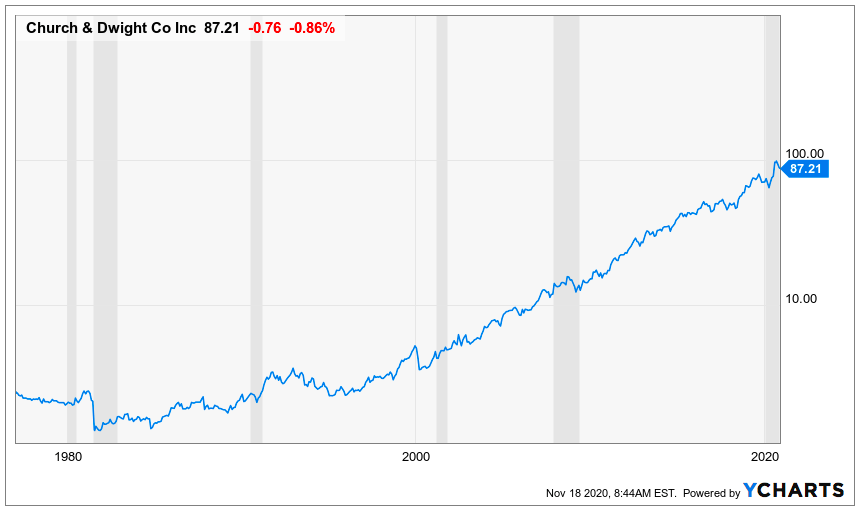

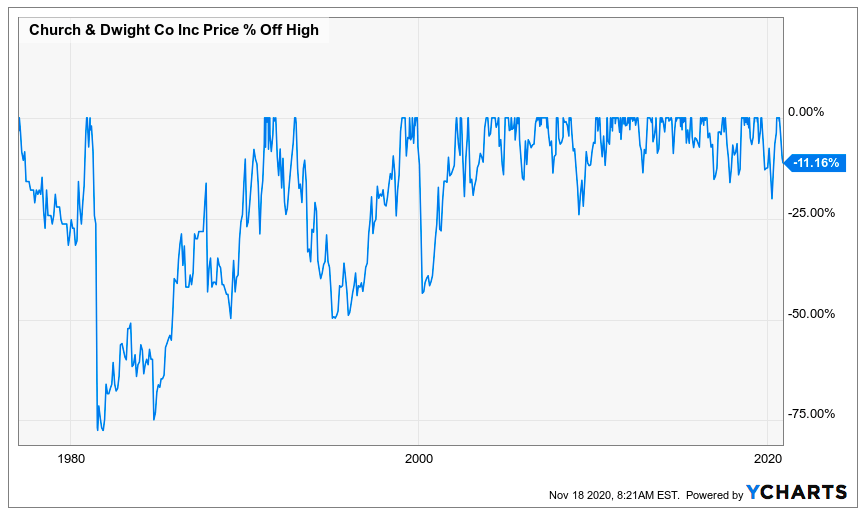

The following chart indicates the steady rise of the CHD stock price from 1977 to date.

Source: YCharts

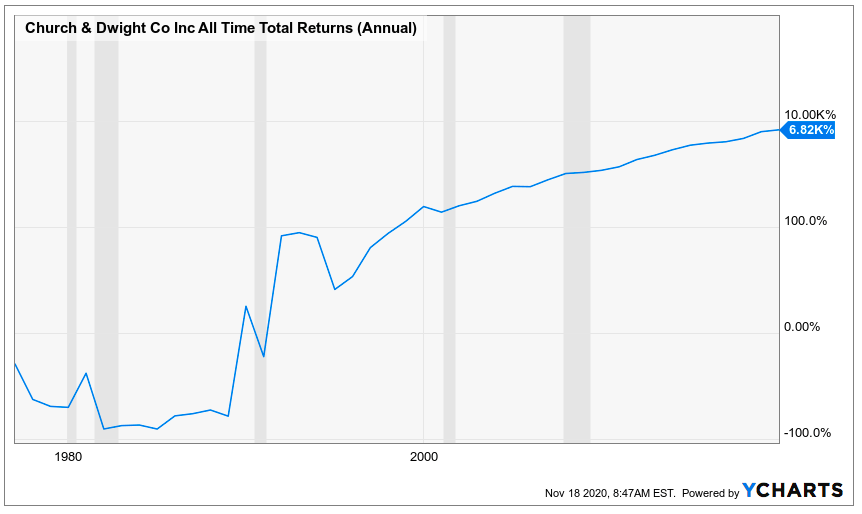

This rise in stock price relates to a total return (including dividends) on investment of more than 6,800% or almost 11% annualized all time total return.

Source: YCharts

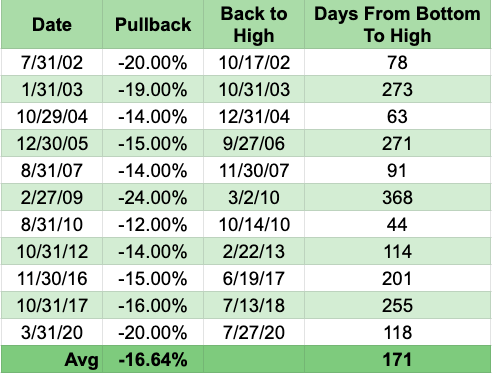

The following table summarizes CHD stock price pullbacks and the time it took the price to recover to the previous high from 2002 to date.

Source: Author's work with data from YCharts

The table was developed with data from the following chart that visually illustrated the pullbacks.

Source: YCharts

The table and chart indicate that the average stock price dip from the high to low point is about 17%, and it took approximately 171 days for the price to recover back to the previous high.

The last high point of $98 was reached on September 2, 2020, and since then, the price has dipped to the current price of $87, or 11% lower.

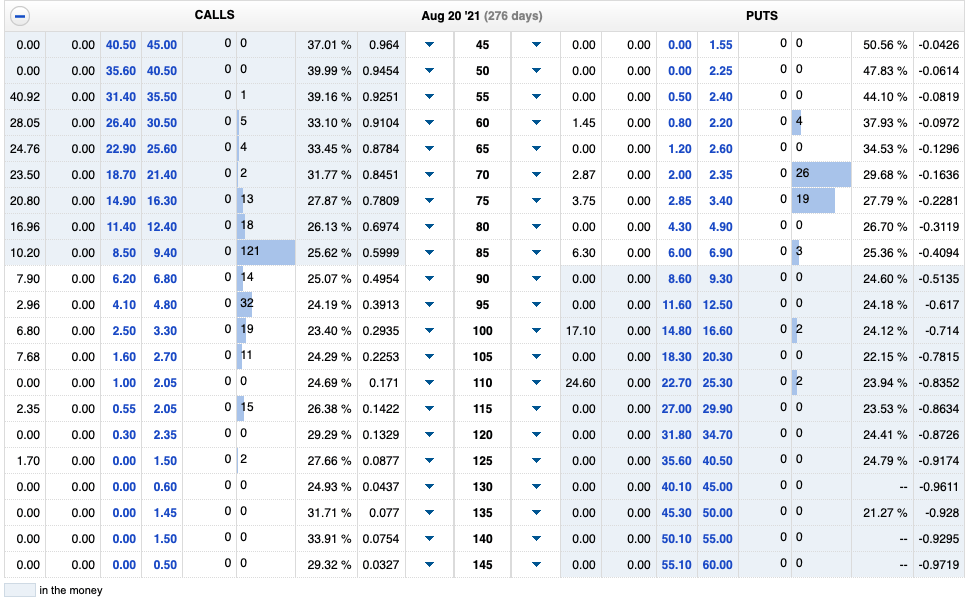

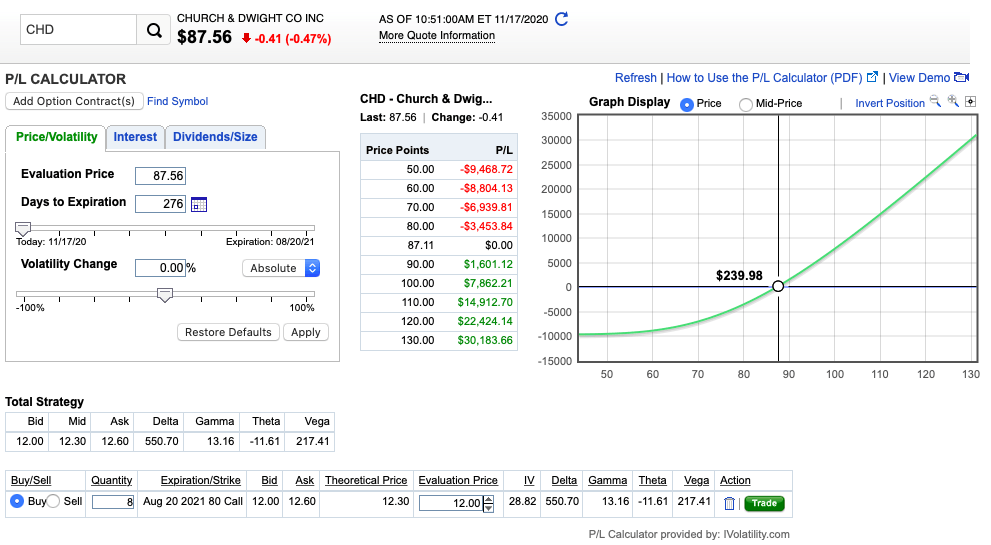

Based on my analysis discussed above, I decided to buy call options on CHD. The best timeframe that I could match in my Fidelity brokerage account with the 171 average days, was 276 days, or the August 20, 2021, calls.

Source: Fidelity

I picked the in-the-money strike price of $80 and bought it at a premium of $12. Notice that the trading volume is extremely low, so the spreads are wide.

Source: Fidelity

Based on my analysis, the expectation is that the CHD stock price should recover to around $97 before my call option expires, resulting in a profit margin of about 40%. The risk is, of course, that if the price drops and does not get back to at least $80, my call options will expire worthless.

Jack Henry & Associates

Jack Henry & Associates provides integrated computer systems and services to banks and other financial institutions. It has developed several banking application software systems that it markets, along with computer hardware, to financial institutions. In addition, it performs data conversion, software installation, and software customization for the implementation of its systems.

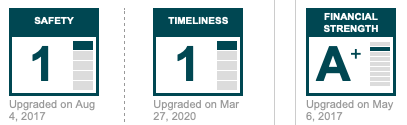

JKHY is a rock-solid company as confirmed by their Value Line rankings.

Source: Value Line

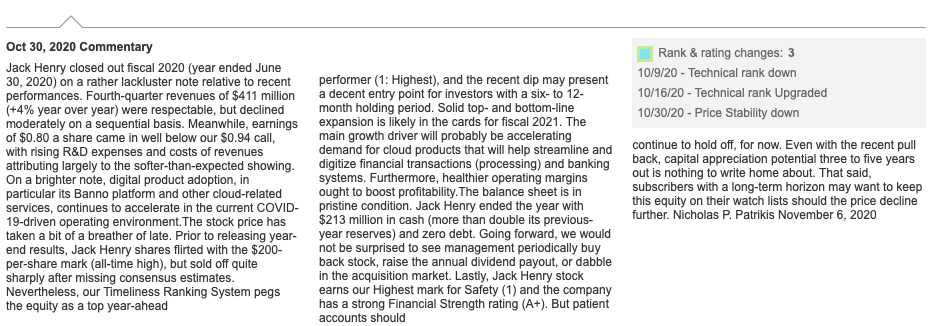

JKHY's profit margin has been steadily increasing since 2003 to the current margin of 17.5%.

Source: YCharts

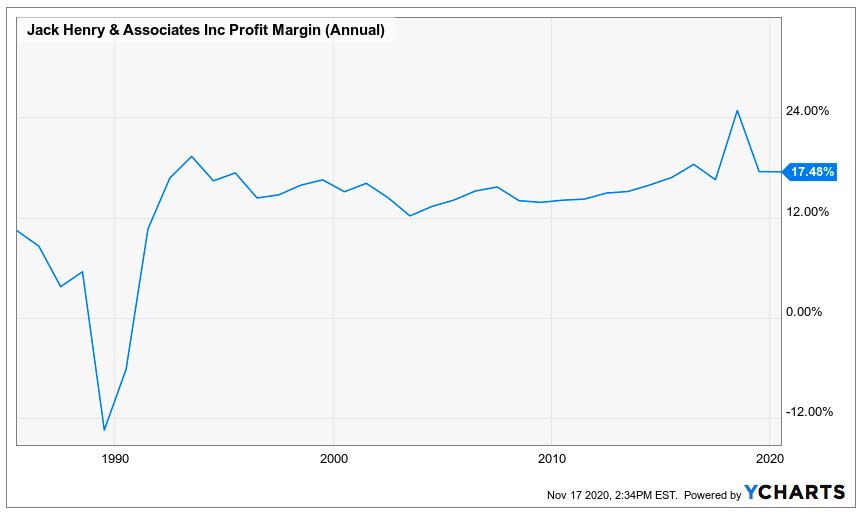

This profit margin expansion resulted in earnings that have appreciated at a CAGR of more than 18% between 1985 and 2019.

Source: YCharts

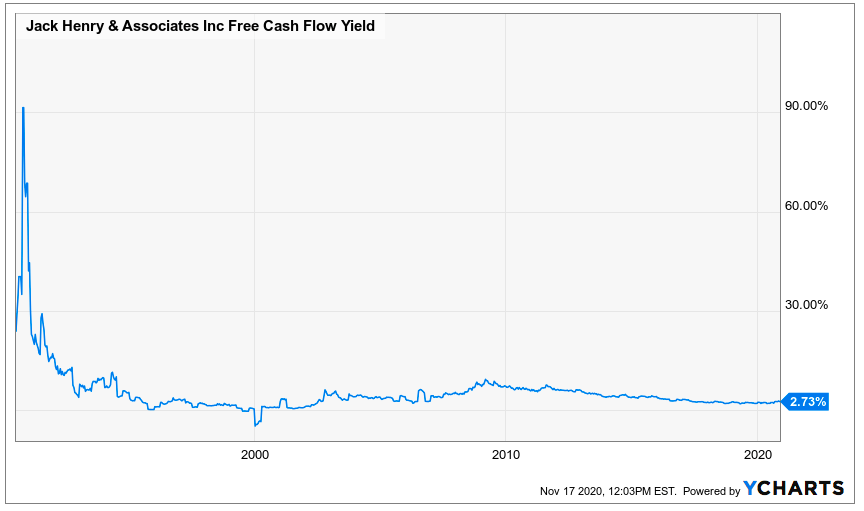

The company has also been a cash cow with the free cash flow yield currently at 2.7%.

Source: YCharts

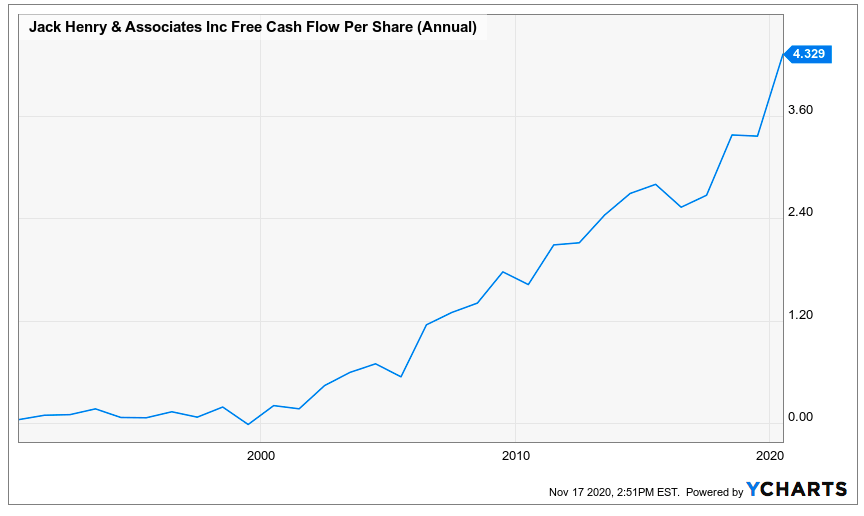

This yield has generated consistently increasing free cash flow per share.

Source: YCharts

The company has a pristine balance sheet. At the end of the most recent quarter, JKHY had total debt of about $70M and cash of $195M.

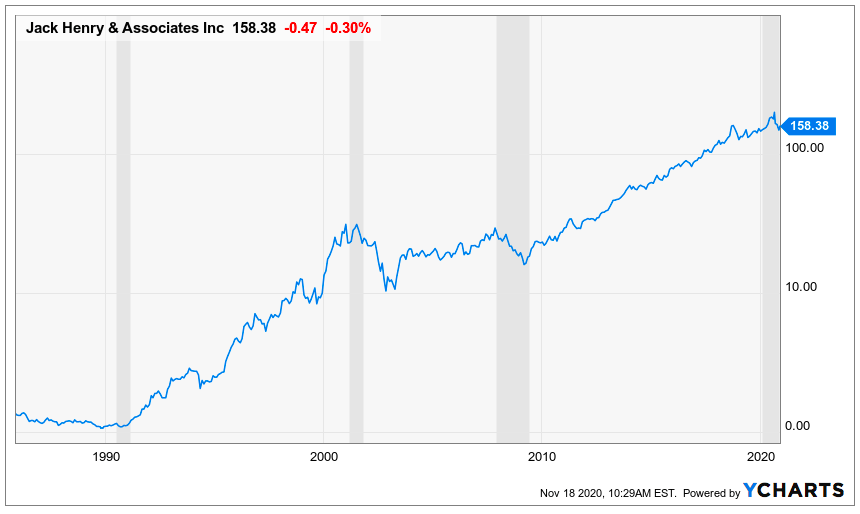

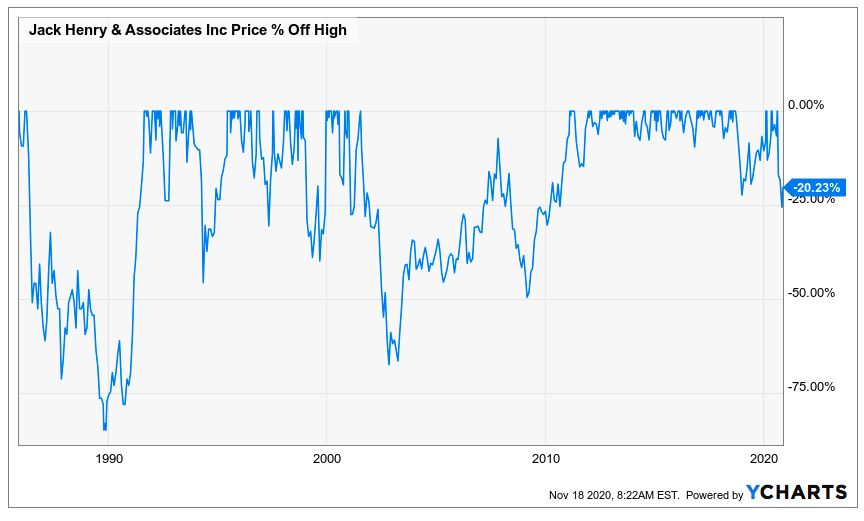

The following chart indicates the meteoric rise of the JKHY stock price from 1985 to date.

Source: YCharts

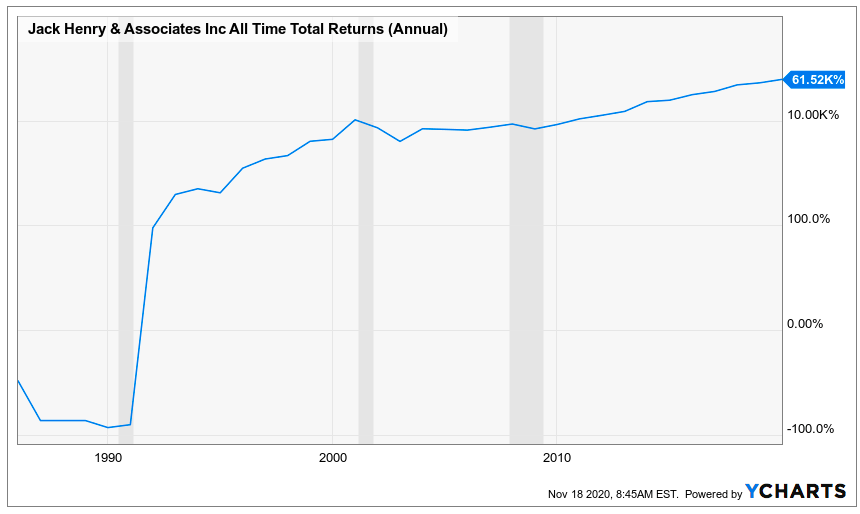

This rise in stock price relates to a total return (including dividends) on investment of more than 61,500% or almost 20% annualized all time total return.

Source: YCharts

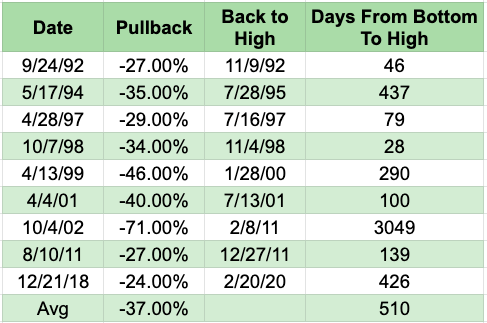

The following table summarizes the JKHY stock price pullbacks and the time it took the price to recover to the previous high from 1992 to date.

Source: Author's work with data from YCharts

The table was developed with data from the following chart that visually illustrated the pullbacks.

Source: YCharts

If you discard the 71% dip in 2002, the table and chart indicate that the average stock price dip from the high to low point is about 29%, and it took approximately 172 days for the price to recover back to the previous high.

The last high point of $199 was reached on August 17, 2020, and since then, the price has dipped to the current price of $158, or 21% lower.

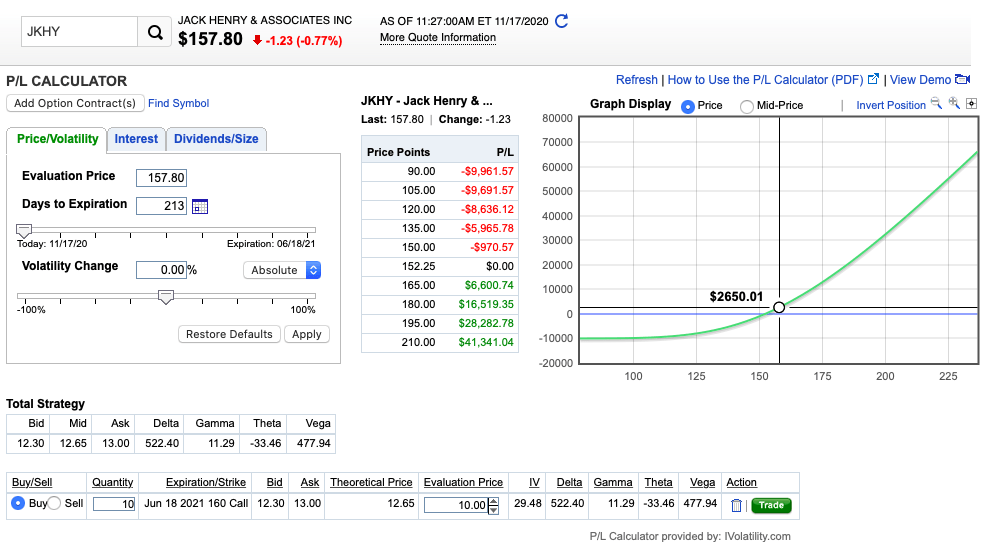

Based on my analysis discussed above, I decided to buy call options on JKHY. The best timeframe that I could match in my Fidelity brokerage account with the 172 average days, was 213 days, or the June 18, 2021, calls.

Source: Fidelity

I picked the slightly out-of-the-money strike price of $160 and have a limit premium buy order in for $10. Notice that the trading volume is extremely low, so the spreads are wide.

Source: Fidelity

Based on my analysis, the expectation is that the JKHY stock price should recover to around $187 by the time that my call option expires, resulting in a profit margin of about 200%. The risk is, of course, that if the price drops and does not get back to at least $160, my call options will expire worthless.

Disclosure: I am/we are long JKHY, CHD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.