Rare Opportunity To Get On The BABA Train

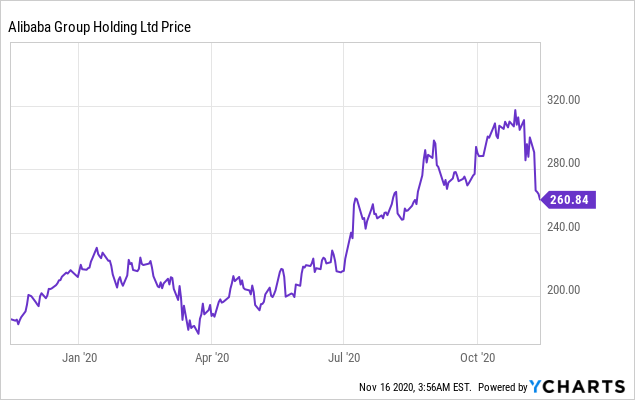

Alibaba's shares are down 18% over the last two weeks, creating a buy on dips opportunity.

33%-owned Ant Financial's valuation has taken a big hit on new online micro-lending rules, but the impact should be much less than the steep decline we've seen in Alibaba shares.

Anti-monopoly rules and growth vs. value rotations should not impact the long-term growth prospects of Alibaba.

As of the time of writing, Alibaba (BABA) is down around 18% over a span of about two weeks from its recent highs. That has been a result of three issues. First, the Chinese regulators' announcement of new draft rules relating to online micro-lenders, which resulted in the postponement of the Ant Financial IPO (Alibaba owns 33% of Ant Financial) and likely a steep cut to Ant's valuations. Second, the Chinese government’s announcement of more stringent anti-monopoly rules relating to Internet companies. Third, the rotation away from Tech and into Value stocks on the back of positive news regarding the coronavirus vaccine.

In my opinion, only the first issue (affecting Ant Financial) will have a real negative impact on Alibaba, which in share price terms, I would quantify at around US$23/share or about 7% of its recent high of US$317. However, the back-to-back flow of negative news around Alibaba, amplified by the media’s barrage of coverage around developments relating to the company as well as the Ant Financial IPO, has created a big swing in sentiment that has resulted in the stock being sold off too sharply. This is a rare opportunity to get aboard the BABA train. Let me walk through each of the three issues in more detail.

Data by YCharts

Data by YCharts

Issue #1: New Draft Rules for Online Micro-Lenders and Ant Financial’s IPO

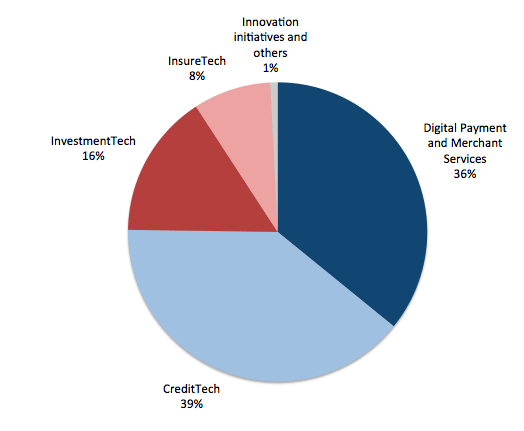

The China Banking and Insurance Regulatory Commission (CBIRC) and the People’s Bank of China (PBOC) announced on November 3, 2020, new draft rules for online micro-lenders, which includes Ant Financial as well as Tencent’s WeBank. The impact on Alibaba here is via its 33% stake in Ant Financial, which was scheduled to IPO on the Hong Kong and Shanghai Stock Exchanges on November 5 (now postponed). Online lending, or what Ant terms as its CreditTech segment, accounted for about 40% of its revenues in 1H2020. While Ant Financial does not disclose its segmental profit margins, the CreditTech segment is part of a larger Digital Finance Tech segment (which also encompasses InvestmentTech and InsureTech), which Ant said in its IPO filing had higher margins than the more well-known Payments segment. So, from a profits perspective, the CreditTech segment likely accounted for >40% of profits for Ant Financial.

Source: Ant Financial IPO Prospectus

What did the new draft rules stipulate? Here are some of the key rules that impact Ant:

- Online micro lenders need to provide at least 30% of the loan quantum, compared to the 1-2% that they are providing at the moment, with bank partners providing the rest.

- Borrowing amounts for individual borrowers will be limited to RMB300,000 or one-third of average income for the last 3 years.

- Borrowing amounts for SMEs cannot exceed RMB1 billion.

- Online micro-loans cannot be used for investment purposes, which include purchases of financial assets as well as the financing of property purchases.

These rules will impact Ant from two perspectives. First, loan growth will likely slow due to the more onerous criteria and limits. Second, Ant’s return on equity will diminish as it needs to provide more capital if it is to continue being a co-lender; if it chooses to shift to a pure loan facilitation model, its take rate (share of profits with the bank partners) will likely decline.

To expand on the second point, online lenders like Ant currently utilise a co-lending model for the majority of its loans because being co-lenders allows them to provide a range of credit assessment services, including credit risk screening and monitoring, which then allows them to charge a higher fee to bank partners. Word on the street is that Ant’s take rate with the banks is about 30-35%, versus the low single-digit take rates being charged by pure loan facilitator partners. In other words, Ant brings home the bacon by providing the credit assessment functions for the banks. Now, Ant has two choices: i) continue being co-lenders but increase its capital contribution from just 1-2% per loan to >30%, which would lower returns on equity; or ii) stop being co-lenders, which will likely mean that regulators don’t allow it to provide credit assessment services, which would then lower Ant’s take rate significantly.

What does that mean in terms of valuations and the impact to Alibaba? The easiest way to make a guess at this is to assume that Ant takes the second route mentioned above (switch to pure loan facilitation). In this case, if its take rate drops from 30-35% to a low single-digit percentage, it would be safe to assume that CreditTech profits would be more or less wiped out. Given that CreditTech likely accounts for >40% of Ant’s profits, this means that valuation could drop by at least 40%. Add in the lower loan growth impact, and I would guess Ant’s overall valuation should decline by at least 50-60%. Alibaba has a 33% stake in Ant, and Ant’s valuation during the IPO book-running process (before the new draft rules were announced) was US$313bn. Assuming a 60% cut to valuations, that translates to a US$187.8bn hit, of which Alibaba’s share would be US$62.6bn. With 2.745bn diluted shares outstanding, that translates to a ~US$23 per share negative impact to Alibaba.

Issue #2: New Draft Anti-Monopoly Rules for China’s Internet Sector

In typical Chinese one-two punch fashion, the State Administration for Market Regulation (SAMR) announced a few days later new draft anti-monopoly rules for the internet sector. The new rules were relatively broad-brush and vague, focusing on the prevention of predatory pricing and exclusivity agreements (which Alibaba and JD had taken flak for in the past; as they were essentially asking merchants to choose between one or the other), as these actions stifle competition.

Why do I think the impact will be minimal? Well, the whole reason why China’s Internet giants engaged in some of these practices in the first place was to gain market share. But the key word here is ‘giants.’ With market share now at relatively high and stable levels (e.g. Alibaba accounts for 60% of China’s e-commerce GMV), the need for further market share gains is diminished, and consumers have also gotten used to using these platforms by now and are thus sticky. Meanwhile, predatory pricing, from what I understand, is no longer a common practice. Therefore, my guess is that ending exclusivity agreements will not make big waves for the e-commerce players as it would not change consumer buying behaviour very much.

Issue #3: Cyclical rotation into Value and out of Tech/Internet

I’m not going to try and time the market rotations here, but what I will say is that if you are a long-term investor, the case for growth remains strong not only because of the long growth runway for secular growth themes like e-commerce, but because the case for value is weak. Take the Oil & Gas sector for example. While more vaccine discoveries and the availability of the vaccine in 2021 would provide a boost to oil demand in the near term, and hence some welcome tailwinds for Oil & Gas stocks, in the long run the transition to clean energy is relentless and we are seeing governments step up the aggressiveness of their carbon-neutrality targets; the Biden win will only amplify this given the US’s huge role in global energy demand. There’s no fighting it.

I therefore see the recent rotation out of tech and into cyclicals/value as an opportunity to buy quality stocks like Alibaba on dips.

Key Risks

Regulatory and competitive concerns would be the biggest risk to the investment thesis for Alibaba.

In terms of regulatory risk, some examples could be: i) if new regulations emerge that limit the use of consumer data in targeted advertising, that would reduce the effectiveness of Alibaba's ads and advertisers might look to other platforms instead; ii) if there is a regulatory clampdown on the other segments of Ant Financial's FinTech business, namely InsureTech and InvestmentTech, then growth of those businesses could slow and reduce the valuation of Ant Financial further.

In terms of competition risk, the main battleground between Internet players in China is now the lower tier cities, where internet and e-commerce penetration remains low, and incomes are also lower, yet a rising middle class and the resulting consumption upgrades make these cities an important source of future growth. If competitors like JD.com or Pinduoduo increase marketing spend significantly, Alibaba would be forced to do so as well, which would depress near-term earnings.

Recommendation

Alibaba shares are down US$57 or 18% from the recent peak as at the time of writing. The long-term case for Alibaba, in terms of growth in its e-commerce, Cloud, and payment businesses remains intact. The fundamental share price impact, as mentioned above, should be closer to just 7% or around US$23 per share, which seems overdone. Take this chance to get on the BABA train and buy this stock on dips.

Disclosure: I am/we are long BABA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.