Share markets in India are presently trading marginally lower.

The BSE Sensex is trading down by 81 points, down 0.2% at 43,871 levels.

Meanwhile, the NSE Nifty is trading down by 33 points.

Tata Motors and Mahindra & Mahindra are among the top gainers today . BPCL and Hero MotoCorp are among the top losers today.

The BSE Mid Cap index is trading up by 0.6%

The BSE Small Cap index is trading up by 0.5%

--- Advertisement ---

India's Next War

Recently, both China and Pakistan have started amping up tensions at the border.

So, now India faces a possible 2-front war scenario.

And this calls for a heavy deployment of future-ready and highly advanced weapons at our borders.

We are talking next generation tanks, guns and even high-tech equipment like drones.

Now unlike in the past where all this money was spent with foreign companies, now, it's being redirected to Indian companies.

For a few Indian defence companies...this is a mega growth opportunity.

And for investors... it's a rare opportunity to make potentially huge gains as select defence companies see their growth, and therefore stock prices, potentially shoot up.

Especially, one stock, which we call India's #1 defence stock.

It's a potential 10x opportunity in the long term.

Learn more about this new and huge opportunity...

------------------------------

On the sectoral front, stocks from the auto sector are witnessing most of the buying interest.

On the other hand, stocks from the IT sector are witnessing most of the selling pressure.

US stock futures are trading lower today, indicating a negative opening for Wall Street indices.

Nasdaq Futures are trading down by 55 points (down 0.5%), while Dow Futures are trading down by 145 points (down 0.5%).

The rupee is trading at 74.34 against the US$.

Gold prices are trading down by 0.5% at Rs 50,515 per 10 grams.

Don't Miss: This Potential 10x Opportunity in the Long Term

In global markets, gold rates edged lower today even as coronavirus cases continued to surge in many parts of the world. On the domestic front, gold prices in India also edged lower, tracking muted global cues. On MCX, gold futures today fell 0.4% to Rs 50,546 per 10 grams, extending losses to the third day.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani talks about how you can end the year with trading profits, in his latest video for Fast Profits Daily.

In the video below, Vijay shares a way to find out which stocks are good for trading at this time.

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is DHFL.

Lenders to troubled Dewan Housing Finance Ltd (DHFL) are looking at a repayment strategy for 55,000 fixed deposit (FD) holders as part of a resolution plan.

According to the minutes of a meeting of the Committee of Creditors (CoC) held last week, the lenders are looking at various scenarios to distribute the proceeds of the funds received from the new investor.

This includes distribution under the waterfall mechanism or under pari-passu distribution mechanism or setting aside some amount of the outstanding claims for small investors.

According to the waterfall mechanism under the Insolvency and Bankruptcy Code (IBC), secured creditors have to be paid fully before any payments can be made to unsecured financial creditors, who in turn, have priority over operational creditors. The pari-passu distribution mechanism gives equal priority to all creditors, and the proceeds are distributed in proportion to their debt.

Most lenders, however, favour a distribution plan where the CoC sets aside 5% of the claim amount for small investors, unsecured financial creditors and operational creditors, with the remaining resolution amount being distributed across secured creditors under the waterfall mechanism.

The consensus of all CoC members is not final as lenders remain divided over how much amount should be allocated to unsecured financial creditors that represents a small portion of CoC voting share.

How this pans out remains to be seen. Meanwhile, stay tuned for all the updates from this space.

At the time of writing, DHFL share price was trading up by 4.9% on the BSE.

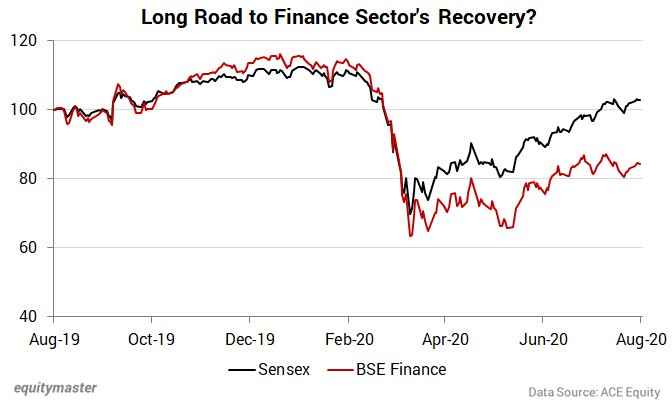

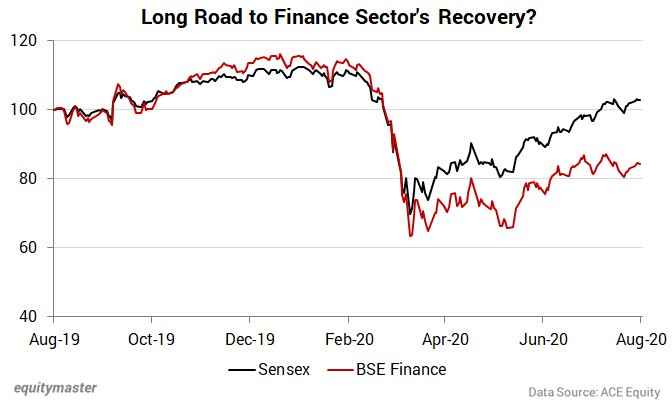

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

Moving on to news from the software sector...

Shares of Tanla Platforms, previously known as Tanla Solutions, jumped to a record high after its promoter and other investors acquired a stake in the cloud communications provider.

According to data available on the exchanges. Promoter Mobile Techsol acquired 1.7 million shares, or 1.3% stake of the company on November 17 at Rs 391.3 apiece.

Besides, Singapore-based Amansa Investments picked up more than 4 million shares, amounting to a 3% stake at Rs 391.3 apiece.

American Funds Insurance, too, acquired a 6.3% stake, or 8.6 million shares, at Rs 391.3 apiece, the data showed.

The shares were sold by Banyan Investments. The public shareholder sold an 11% stake, or 15 million shares, at Rs 391.3 apiece.Shares of Tanla Platforms are locked in an upper circuit of 5% at Rs 435.7 apiece. The stock is up for the fifth straight day. The rally began since Tanla Platforms was included in the MSCI India Domestic Small-Cap Index on November 12.

The stock had hit a 52-week low of Rs 37.1 on March 25, but since rebounded more than tenfold.

We will keep you updated on all the news from this space. Stay tuned.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

What else is happening in the markets today? Dig in...

HDFC BANK share price has hit a 52-week high. It is presently trading at Rs 1,419. BSE 500 Index is up by 0.4% at 16,780. Within the BSE 500, HDFC BANK (up 0.3%) and ADANI GAS (up 17.1%) are among the top gainers, while top losers are LAKSHMI VILAS BANK and SUZLON ENERGY.

Nov 18, 2020 02:28 PMFEDERAL BANK share price is trading up by 5% and its current market price is Rs 61. The BSE BANKEX is up by 1.7%. The top gainers in the BSE BANKEX Index is FEDERAL BANK (up 5.3%). The top losers is YES BANK (down 0.2%).

Nov 18, 2020 01:50 PMTATA POWER share price is trading up by 5% and its current market price is Rs 61. The BSE POWER is up by 1.1%. The top gainers in the BSE POWER Index are TATA POWER (up 5.0%) and ADANI TRANSMISSION (up 5.5%). The top losers are POWER GRID (down 0.3%) and TORRENT POWER (down 0.8%).

Nov 18, 2020 01:50 PMTATA MOTORS DVR share price is trading up by 7% and its current market price is Rs 74. The BSE AUTO is up by 2.5%. The top gainers in the BSE AUTO Index are TATA MOTORS DVR (up 6.6%) and M&M (up 10.2%). The top losers are EXIDE INDUSTRIES and CUMMINS INDIA (down 0.4%).

Nov 18, 2020 01:48 PMSPICEJET share price is trading up by 11% and its current market price is Rs 65. The BSE 500 is up by 0.2%. The top gainers in the BSE 500 Index are SPICEJET (up 10.6%) and WABCO INDIA (up 10.5%). The top losers are CEAT. and SUN PHARMA ADV. RES. .

Nov 18, 2020 09:30 amIndian share markets open flat. The BSE Sensex opened up by 62 points, while the Nifty is trading up by 13 points.

View More Indian Share Market NewsIn this video, I present my top 5 ideas for traders this festive season.

Nov 11, 2020Investing in this smallcap could open doors of huge, long-lasting wealth.

Nov 13, 2020Why I admire the approach that Richa uses to zero in on stocks with huge upside potential.

Nov 10, 2020Keep me in your thought's dear viewers!

Nov 9, 2020Ajit Dayal warns us on the dangers of the power of money in politics.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!