Autolus: Short To Medium-Term Clinical Catalysts May Drive Stock Price Upside

Autolus - a developer of next-generation programmed T cell therapies - has shown continued progress in advancing its anti-cancer pipeline.

AUTO1 has entered a pivotal trial for ALL and may achieve regulatory approval by 2022, while, for AUTO3, an outpatient cohort has been initiated in DLBCL.

Both lead assets have shown promising data with best-in-class potential as they address key toxicity issues observed with other T cell therapies, while demonstrating durable complete responses.

The stock has fallen significantly from all-time highs, but short to medium-term catalysts may breath life into the fundamental story again.

Expect clinical updates for AUTO1 in ALL, as well as for AUTO3 in DLBCL at ASH in early December.

Investment Thesis

Autolus (NASDAQ:AUTL) is a clinical-stage biopharmaceutical company active in the development of next-generation programmed T cell therapies to fight cancer. The company has developed proprietary programming technologies that allow for the engineering of precisely targeted and highly active CAR-T cell therapies that might have multiple advantages over existing therapies with respect to their overall clinical profile.

Its lead assets are AUTO1 and AUTO3 which are developed in clinical trials for treatment of acute lymphoblastic leukemia (ALL) and diffuse large B cell lymphoma (DLBCL), respectively. Both assets may have best-in-class clinical potential in their respective indications based on data presented so far, which show promising efficacy/safety profiles overall and address key concerns of already available CAR-T options that have shown incidences of cytokine release and neurotoxicities. Autolus has already started a pivotal trial for AUTO1 and expects multiple short to medium catalysts ahead. Full data for the ALL pivotal program is expected by end of 2021 with an approval targeted for 2022, and the start of the pivotal trial for AUTO3 may also begin as early as H1 2021.

The company expects to give further clinical updates for AUTO1 in adult ALL (ph 1 long-term follow data), as well as for AUTO3 in DLBCL (updates from ph 1 ALEXANDER study) at the American Society for hematology (ASH) in early December 2020. Investors should closely watch these updates as they may validate the potential best-in-class profile and commercialization potential of AUTO1 in ALL and AUTO3 in DLBCL, and function as short-term catalysts for share price appreciation.

Company overview

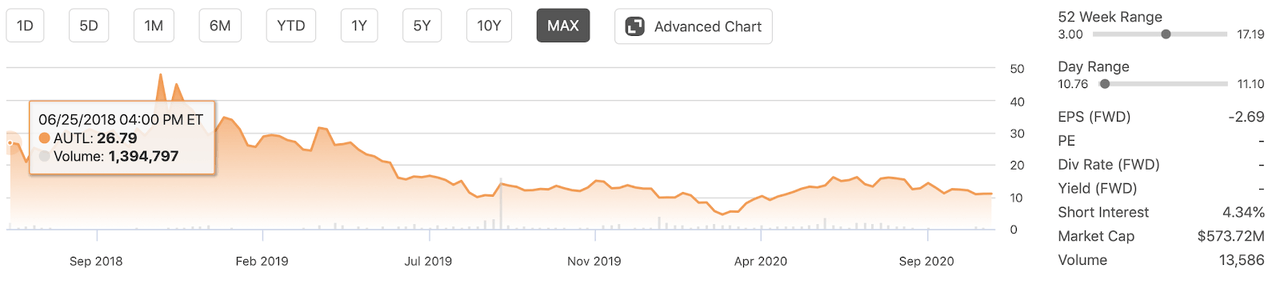

Autolus is a biopharmaceutical company that was spun out as a stand-alone company from University College London (UCL) in 2014. The company went public in June 2018 and sold 8.8 million shares at the time of its common stock at $17 per share collecting proceeds of approximately $150 million. The stock began trading significantly higher from the IPO price following the weeks after the IPO.

Source: Autolus Therapeutics plc (AUTL) Stock Price & Company Overview

As of early 2019, the company experienced some significant share price declines as manufacturing issues with one of its candidates arose. In consequence, Autolus stock declined all the way to a price of only $4 in early 2020. Although the company's stock price was able to recover some of its losses and, as of this writing traded, above $10, the stock is still trading significantly below its all-time high of $48, which was seen in November 2018.

As these issues are now seemingly behind the company, and sufficient cash is available on the balance sheet, investors can now focus with more certainty on the fundamental story again, which is solely about the promising cell therapy pipeline.

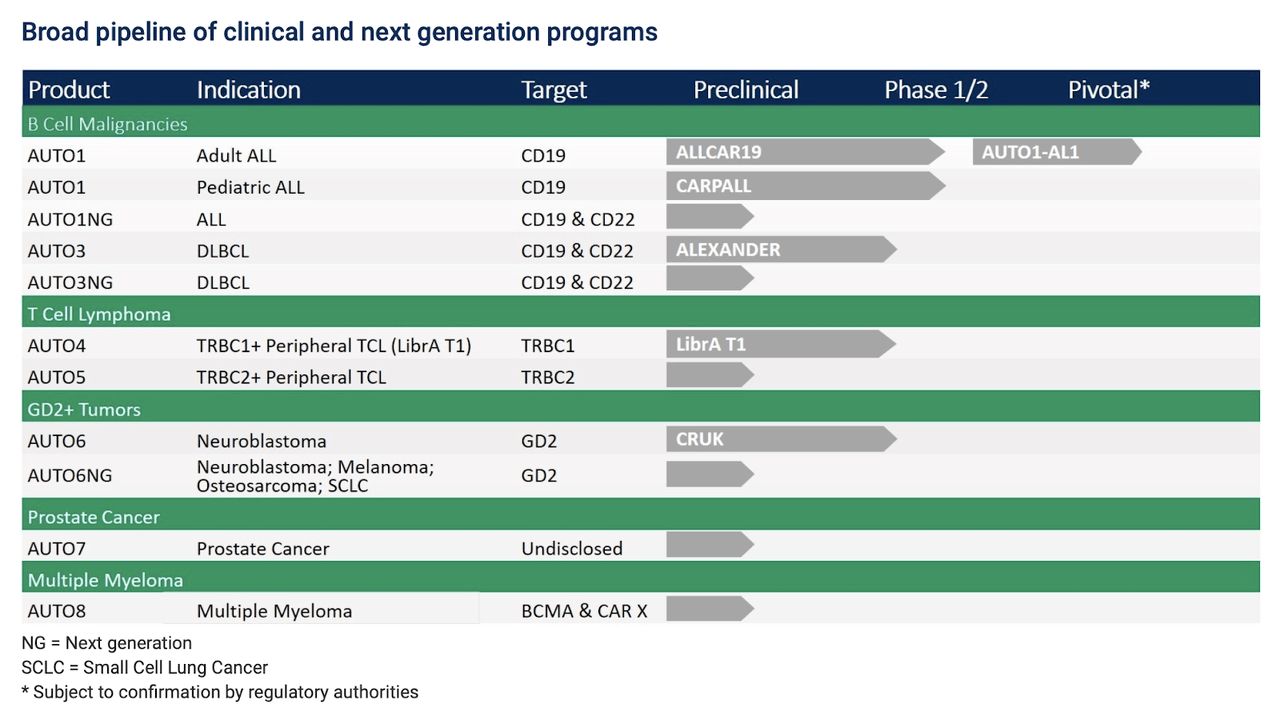

In fact, Autolus has a very comprehensive pipeline of therapies in clinical development for multiple hematological and solid tumors. Hence, the story is not solely about AUTO1 and AUTO3. But it is obvious that both assets are by far the most advanced in Autolus' pipeline.

Source: Autolus

Both its lead assets, AUTO1 and AUTO3, are programmed T cell therapies and are undergoing clinical trials in treatment of acute lymphoblastic lymphoma and diffuse large B cell lymphoma, respectively. Both indications have a significant unmet need, and current treatment options have had limited success in improving overall response rates, especially complete responses, which means the absence of any detectable remaining cancer cells in the body, while maintaining a manageable safety profile. I will provide some more details on the currently available CAR-T options already approved, but I will dive into some more details on AUTO1 and AUTO3 first, as details around the clinical profile and pharmacodynamics of both assets are important to understand their potential best-in-class profile and commercial opportunity.

Both assets have been designed by use of Autolus' proprietary cell programming technology to overcome some of the major safety limitations that current CAR-T cell therapies have shown, especially with respect to occurrence of cytokine release syndrome (CRS) and neurotoxicities (NT) which have been frequently observed with currently approved CAR-T therapies. Essentially, the company enhances patients' own T cells with powerful Chimeric Antigen Receptors (CARS) or T-cell receptors (TCRs) to reprogram them to better recognise and kill tumor cells.

AUTO1 is the most advanced asset and may see approval by 2022 in ALL

AUTO1 is a programmed T cell therapy that uses the CD19 pathway, which is the dominant component of a multi-molecular signaling pathway on the surface of B cells. Autolus says that AUTO1 binds with lower affinity for CD19 with the half-life of target interaction being 9.8 seconds for AUTO1, whereas for Kymriah a 21-minute half-life of target interaction was shown. Hence, AUTO1 seems to have less than 1% of the target interaction time. This argument may appear kind of irrational as one would think that the shorter the target interaction with the CD19 domain, the weaker the potency of inducing a cell-killing signal for T cells. However, the longer the half-life of target interaction, the more exhaustion in T cell activation can be induced, thus actually lowering the potency of the drug overall.

As recent data from AUTO1 has shown, the fast target binding off-rate may actually not only reduce T cell exhaustion but may also reduce overall toxicity rates and cytokine release as there is less prolonged activation of the AUTO1 binding domain with CD19, which may be a key differentiator to currently approved CAR-Ts. AUTO1 may induce prolonged treatment effects and improve T cell exhaustion overall, which could be beneficial in terms of durability of responses in patients, while reducing the overall risk of CRS or NTs due to its faster off-rate. AUTO1 is the most advanced program in Autolus' pipeline and the company has recently started a pivotal trial (AUTO1-AL1) in adult ALL. It is expecting full data by end 2021, assuming that no COVID-19 impacts are seen during enrollment and conduction of the clinical trial. That would mean AUTO1 could be ready for regulatory submission and approval in 2022. It is probably important to mention as well that AUTO1 has also been granted orphan drug designation for ALL by the FDA already.

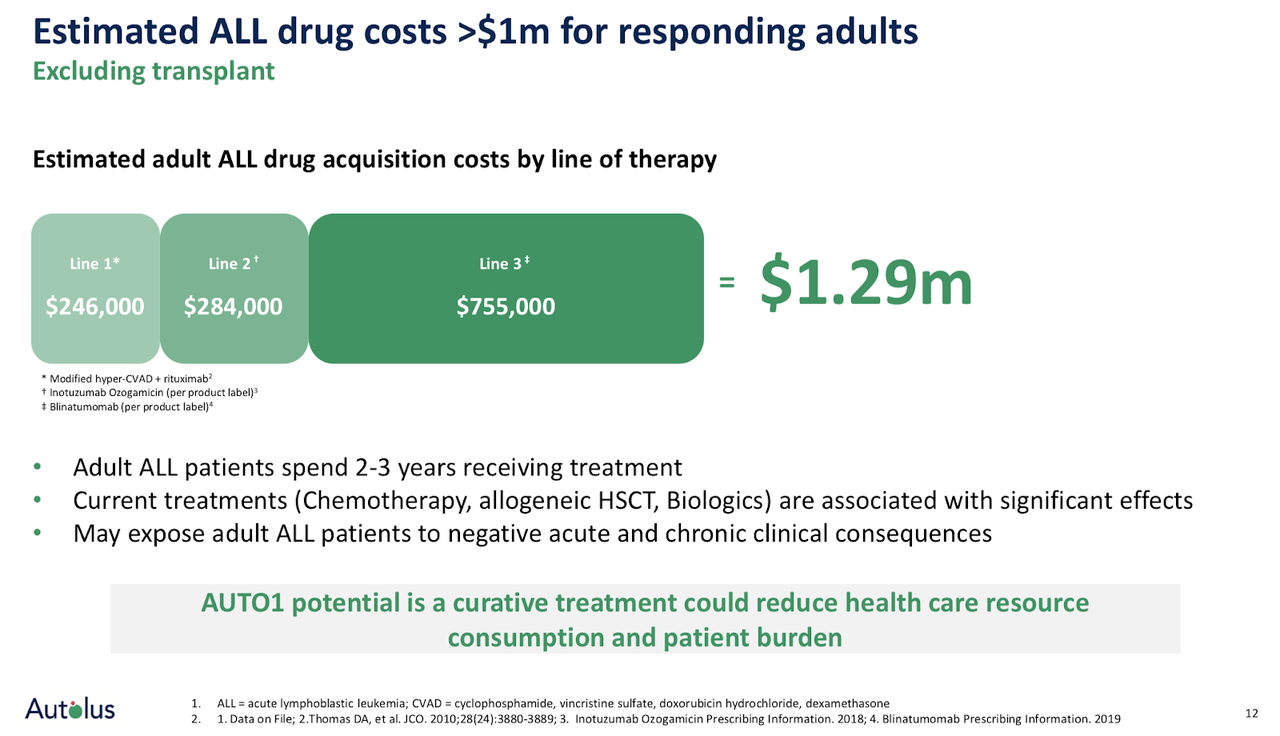

Unmet need and market opportunity in ALL

The unmet medical need in ALL is significant, and the opportunity for AUTO1 to become the standard of care in ALL is in the cards if data flow continues to be positive with respect to sustained efficacy and manageable CRS and neurotoxicity. There are an estimated 8,400 new cases of adult ALL diagnosed yearly worldwide. Current treatment options of chemotherapy combinations have shown up to 90% of adult ALL patients can achieve complete responses, but only 30% to 40% achieve long-term remissions. The median overall survival for patients is less than 1 year for patients with relapsed or refractory (r/r) ALL (Source: company presentation). Hence, the prognosis in both 1st and later lines of therapy with respect to achieving sustained clinical responses is far from good, and as patients progress into later lines of therapy after having experienced relapses, the prognosis is worsening, and costs are rising exponentially.

Source: Autolus company presentation

Therefore, any treatment that can show an early and sustained clinical response may become the de-facto standard of care, which is accompanied by a large commercial opportunity if you refer back to the >8,000 new yearly diagnosed cases of adult ALL from which only 30% to 40% achieve long-term remissions.

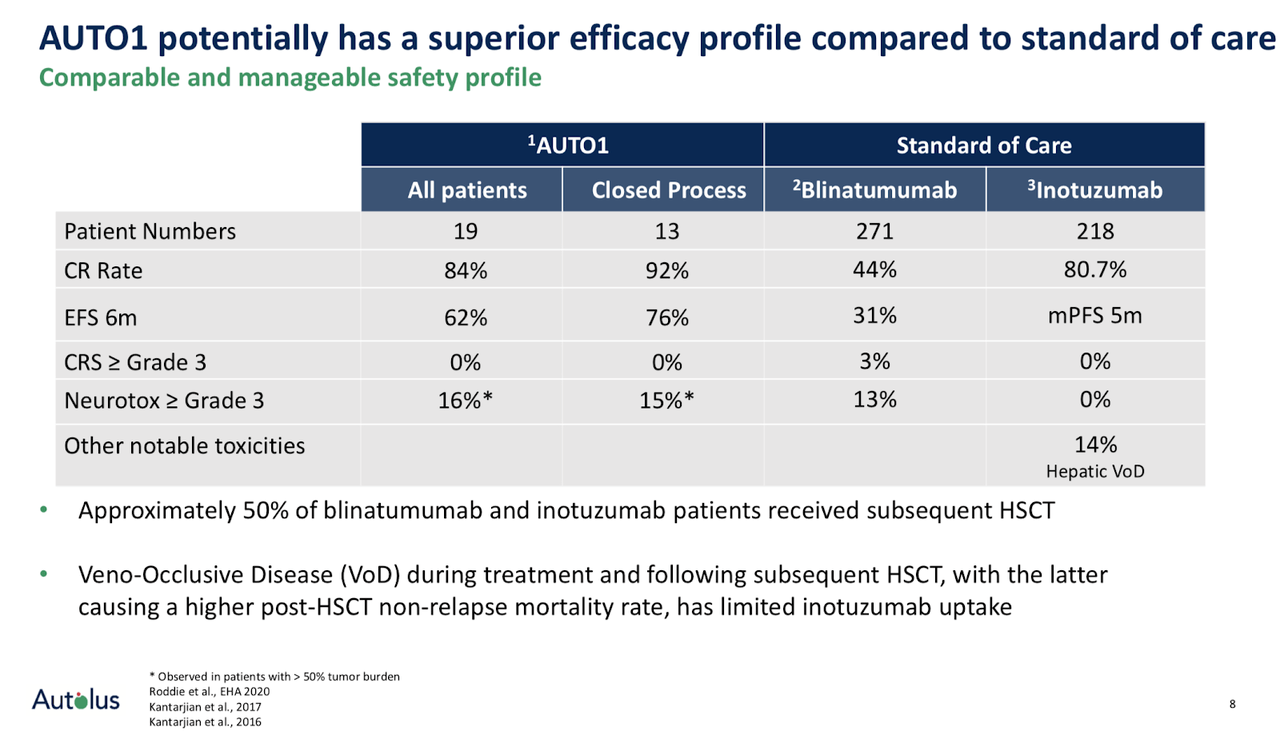

The current standard of care in ALL is typically composed of different chemotherapy regimens, which have their own respective side effects, such as low white blood cell counts, and have also not provided sustained complete responses in the majority of patients. Also, allogeneic stem cell transplants may be a treatment option. Some newer therapy options that are part of standard of care are blinatumomab, which is a bispecific, T cell-engaging agent that binds both CD3 and CD19, and inotuzumab ozogamicin, which is a monoclonal antibody that targets the CD22 pathway (Source: American Cancer Society). I am mentioning these two assets because blinatumomab also targets CD19, and secondly, because Autolus is providing comparative clinical efficacy and safety data for AUTO1 in its investor presentations. Both blinatumomab and inotuzumab have warnings in their respective FDA prescribing information with CRS and neurotoxicities mentioned for blinatumomab and potential increased risk for hepatotoxicity for inotuzumab.

AUTO1 may provide a comparable or better safety profile with respect to occurrences of CRS, neurotoxicities or hepatotoxicity when compared with overall safety event rates for blinatumomab and inotuzumab. However, at the same time, AUTO1 has a superior efficacy profile in terms of its complete response (CR) rate of up to 92% which the other compounds do not show. Especially with blinatumomab, the CR rate was only 44%.

Source: Autolus company presentation

It is worth to mention that also tisagenlecleucel (Kymriah) has been approved by the FDA for treatment of ALL, but only in patients up to 25 years of age which only captures a small proportion of the adult label. AUTO1 is also being evaluated in a ph 1 study in pediatric ALL, so AUTO1 would capture both the pediatric and adult treatment of ALL if approval is achieved.

AUTO3 may be best-in class for treatment of DLBCL

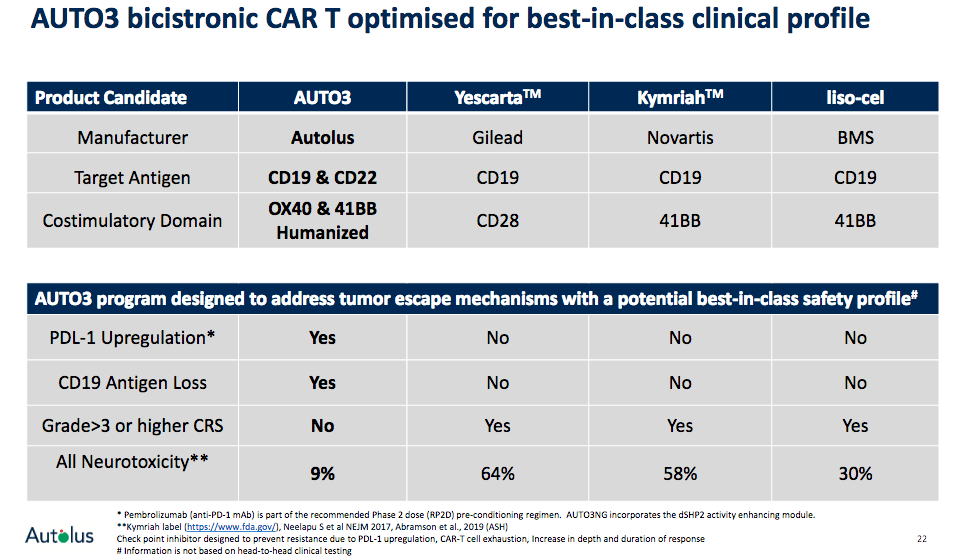

AUTO3 is a programmed CAR-T cell therapy with two antigen receptors targeting B Cell antigens CD19 and CD22. AUTO3's dual targeting mechanism is intended to enhance efficacy and minimize relapse due to potential antigen loss. AUTO3 is currently being tested in the ALEXANDER ph 1/2 clinical trial in patients with diffuse large B cell lymphoma (DLBCL) in both the inpatient and outpatient setting. While most other CAR-Ts are limited to the inpatient setting due to the high observed rates and severity of toxicities, mostly cytokine release syndrome and neurotoxicities, that require intensive patient management, AUTO3 is showing a promising clinical profile as both rates of CRS and NT have only been observed in few patients so far. Hence, Autolus claims that AUTO3 may be the best suited option for inpatient as well as outpatient use in DLBCL, thus addressing a large unmet need, as well as commercial opportunity. Only recently, a 20-patient cohort in the outpatient clinical setting was initiated in Q2 2020 to assess feasibility of treatment here.

As of this writing, only two other CAR-T therapies have been approved by the FDA for the treatment of DLBCL, which are tisagenlecleucel (Kymriah) from Novartis (NYSE:NVS) and axicabtagene ciloleucel (Yescarta) from Gilead Sciences (NASDAQ:GILD) (Source: Lymphoma Research Foundation). Both have shown incidences of CRS and neurotoxicities in their respective clinical trials, and they also carry warnings in their FDA prescribing information (see FDA prescribing information for Kymriah and Yescarta). Other CAR-T therapy options, i.e. lisocabtagene maraleucel are under development and may be granted approval for treatment of DLBCL soon (Source: drugs.com).

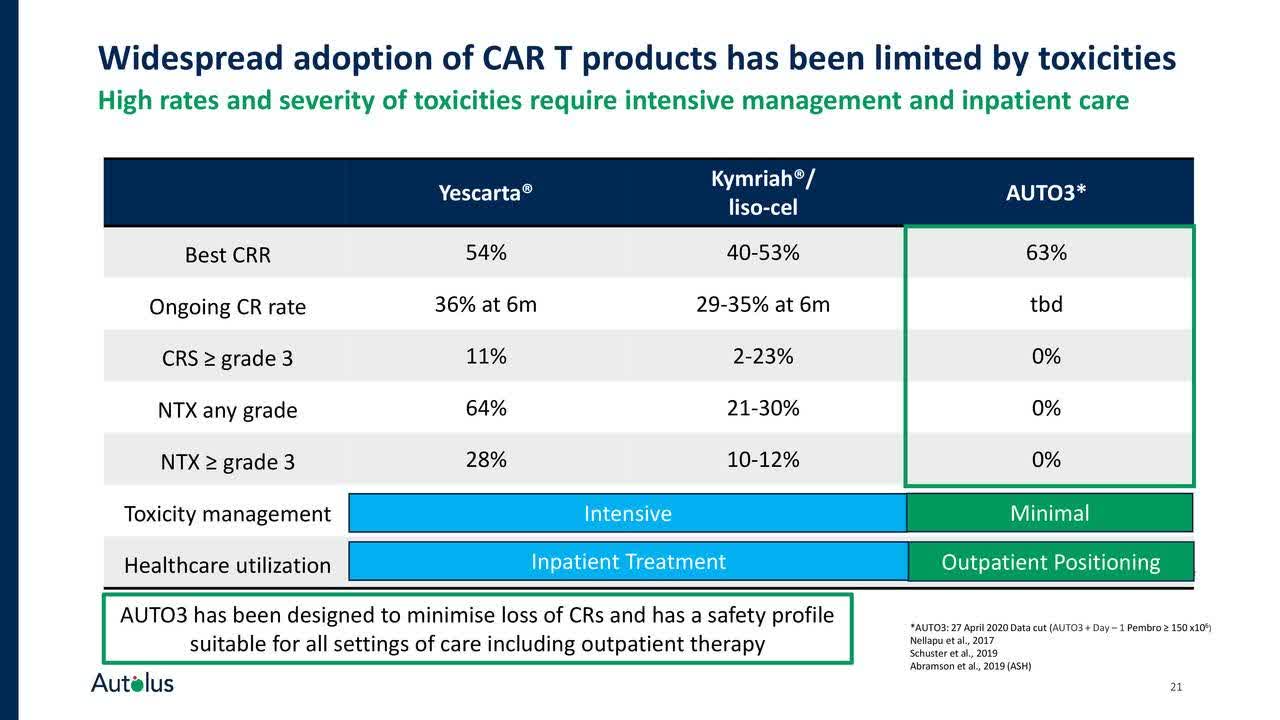

Data presented so far by Autolus support a potential best-in-class profile for AUTO3 in DLBCL both in terms of efficacy and high level of complete responses achieved, accompanied by a well-tolerated safety profile that may extend usage even into outpatient cohorts, as occurrence of CRS and neurotoxicities was very rare. In one of its more recent company presentations from June 2020, Autolus provided some insights on the potential differentiation of AUTO3 from other CAR-T treatment options:

Source: Seeking Alpha

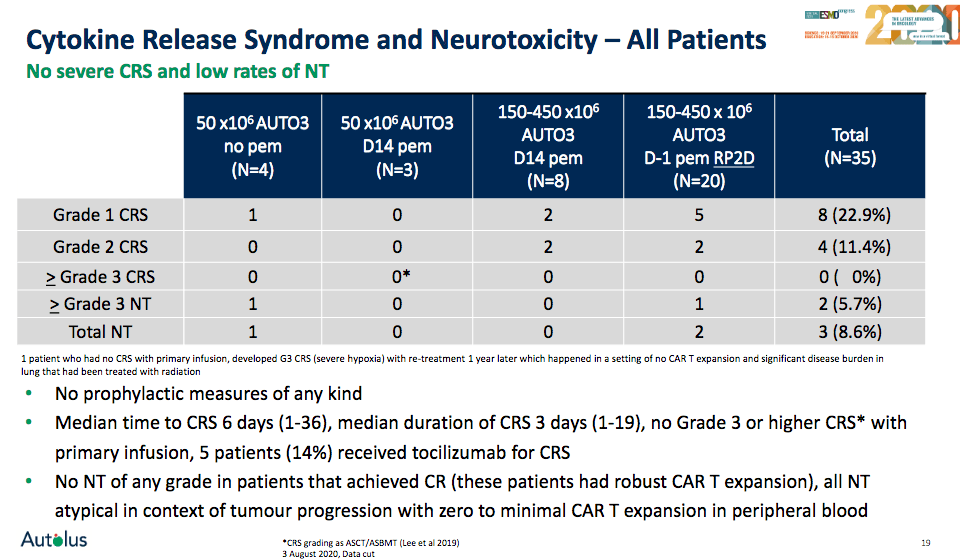

During the European Society for Medical Oncology (ESMO) congress from September this year, Autolus provided further updates on the efficacy and safety of AUTO3 with a high level of complete remissions and a promising safety profile from its ALEXANDER trial. Data was reported for the latest data cut-off date of August 3, 2020.

With respect to efficacy, the company reported that 35 patients have been dosed to date, and that 30 patients were evaluable within their completed cohort from the trial. The dosing cohort of ≥ 150 x 10*6 cells showed an objective response rate (ORR) of 71% and complete response (CR) rate of 64%. The data was confirmed also from across all dosing cohorts with an overall ORR of 68% and a CR rate of 54% for all evaluable patients.

It was also mentioned during the update that the observed complete responses were also durable, as 93% of the patients in whom a CR was observed did not have a relapse of their cancer. That data was based on observations from all dosing cohorts with a median follow-up of 6 months. Follow-up of patients with CR is still ongoing for most patients, so it will be very interesting to see further updates in the near future. The durability aspect for responses may be a very important clinical differentiator for AUTO3 that may support its positioning as a potential best-in-class therapy in DLBCL.

Source: Autolus company presentation

With respect to safety, the company continues to believe that AUTO3 has a "tolerable and very favorable safety profile" in comparison to already approved CD19 CAR-T therapies. Amongst the 35 evaluable patients from the ALEXANDER trial, AUTO3 was well tolerated, as no Grade 3 or higher CRS were observed. Amongst the 35 patients, three cases of neurotoxicity have been reported, with two of severity ≥ Grade 3. Among the 20 patients treated at the declared recommended ph 2 dose with pre-conditioning pembrolizumab, one patient had a ≥Grade 3 neurotoxicity, and the patient died as the disease progressed with multiorgan failure being reported.

Source: Autolus company presentation

Importantly, no event of neurotoxicity was reported in those patients that achieved a complete response. For patients that did report neurotoxicities, these adverse events were mostly seen in patients with disease progression and other confounding factors, as the company stated in its press release. AUTO3's efficacy profile with respect to complete response rates compares favourably with other CAR-T therapies in the field as the overview below illustrates. More importantly, the recent safety evaluation for AUTO3 showed a potentially superior safety profile with respect to occurrence of CRS and NTs, including those patients already included in the recent data cut-off for the recommended phase 2 dose level.

Source: Autolus company presentation

Unmet need and market opportunity in DLBCL

It is worth to mention that DLBCL has a large unmet need as it constitutes the most common type of Non-Hodgkin Lymphoma with approximately 20,000 new cases and a death rate of 1.8 per 100,000 men and women in the US every year alone (Source: National Cancer Institute). Patients on high dose chemotherapy regimens and, if appropriate, monoclonal antibody therapy, can achieve remissions but recurrence rates and side effects remain high, and patients receiving recently approved CAR-T therapies need to be intensively managed due to increased risk of CRS and neurotoxicities.

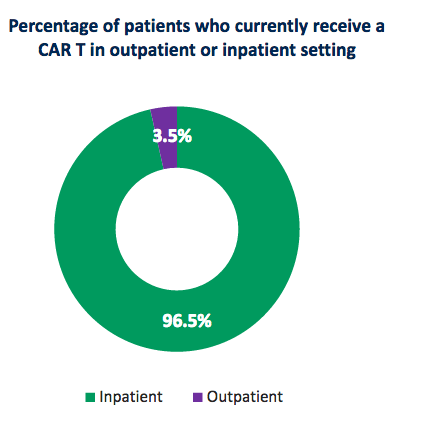

The potential for use of AUTO3 in both the inpatient and outpatient setting is highly important with respect to the commercialization potential of AUTO3. Autolus states that, currently, roughly 97% of patients who receive approved CAR-T therapy options are being treated in the inpatient setting where intensified management is required to manage patients due to frequently occurring toxicities.

Source: Autolus company presentation

However, the outpatient treatment setting represents the majority of the entire market potential for treating DLBCL, which is estimated to reach a size of almost $4.3 billion by 2022 (Source: AplusA Research). That is a huge market to tackle for Autolus, and data presented so far for AUTO3 allows for optimism that the company may actually capture a large share of that entire market, and most importantly, help patients suffering from the disease.

Conclusion on AUTO1 and AUTO3 potential

In summary, Autolus' proprietary cell programming technology may be able to address the shortcomings of currently available CAR-T options in both ALL and DLBCL as it is able to enhance their compounds' clinical profile with improved selectivity, enhanced activity with faster off-rates and lower T cell exhaustion, while minimizing the risk of antigen loss by targeting more than one type of B-cell antigen at once for AUTO3, i.e. CD19 and CD22. The company may capture a large market opportunity in both ALL and DLBCL, and even beyond, as it continues to develop its pipeline and progresses also into solid tumors. Just to put the short to medium opportunity for ALL and DLBCL into perspective, the currently available CAR-T therapies, Kymriah and Yescarta, have generated sales of $278m and $456m, respectively, for full year 2019. Despite these numbers, both have disappointed investors. One can only imagine what kind of revenues AUTO1 and AUTO3 may generate if everything plays out as planned and both are eventually approved in the near future.

The company expects to give further clinical updates for AUTO1 in adult ALL, as well as for AUTO3 in DLBCL (ALEXANDER study) at the American Society for hematology (ASH) in December 2020. These reports may provide short-term catalysts for the company's stock and investors should watch this event very closely, especially with respect to the question whether both assets can confirm the recently shown promising efficacy and safety profile.

Remaining pipeline

Irrespective of the fact that any disappointment around AUTO1 or AUTO3 would significantly dampen the short to medium-term prospects of commercialization, I am optimistic that the remaining pipeline can provide unexpected positive surprises as well. In fact, Autolus has a very comprehensive pipeline targeting both hematological and solid tumors.

Source: Autolus

AUTO4 is a programmed T cell therapy for the treatment of peripheral T cell lymphoma with a novel mechanism that enhances selectivity of the compound in killing the cancer while being programmed with a "safety switch" that is intended to allow management of toxicity by eliminating the T cells if a patient would actually experience adverse side effects such as neurotoxicities from the treatment. AUTO4 is undergoing a phase 1 study in TRBC1-positive peripheral T cell lymphoma.

AUTO6 is a programmed T cell therapy, which is being developed for the treatment of neuroblastoma in a planned phase 1 clinical trial sponsored and conducted by Cancer Research UK (CRUK). Early data has shown promising pre-clinical anti-tumor activity without neurotoxicity. AUTO6NG utilizes the same programmed CAR from AUTO6 and is further enhanced with Autolus' modular approach. AUTO6NG is targeting neuroblastoma, osteosarcoma, melanoma and small cell lung cancer amongst others and has shown high activity in-vitro and in-vivo in an SCLC tumor model already (Source: company presentation).

Interestingly, the company is also active in the development of allogeneic therapy candidates with the start of a phase 1 trial planned for Q1 2021. Unlike AUTO1 and AUTO3, which use autologous approaches, i.e. cells from the patient itself to modify them and re-insert in the body, allogeneic approaches use cells from donor patients. This is a very new approach and is expected to provide some advantages over autologous CAR-T therapies due to shorter turnaround and broader pool of donor cells, for example.

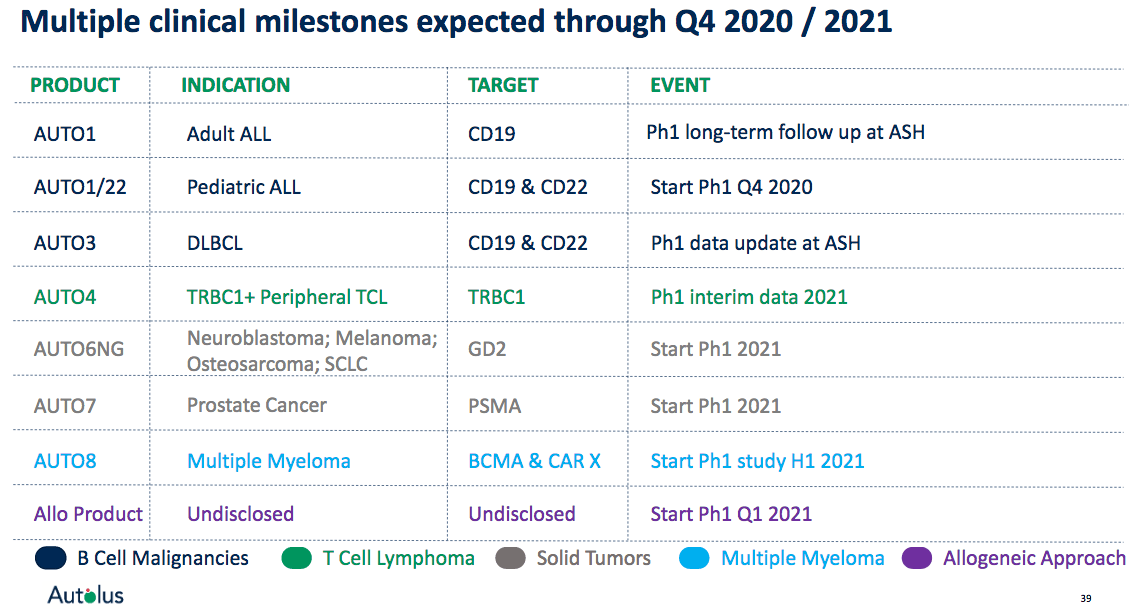

Autolus recently announced in its Q3 2020 earnings release that it will provide further updates on its broad clinical pipeline in the near future, which, among others, include the following highlights:

Initiation of a phase 1 study for AUTO1/22 in pediatric ALL (expected in Q4 2020).

Phase 1 interim data for AUTO4 in T cell lymphoma in 2021.

Initiation of phase 1 studies for AUTO6NG and AUTO7 in solid tumors in 2021.

First exploratory allogeneic program entering clinical development stage (expected around Q1 2021).

These upcoming milestones suggest that there may be multiple further catalysts ahead for the company, even beyond AUTO1 and AUTO3, that may drive share price performance higher in case of continued promising clinical data.

Source: Autolus company presentation

Risks

As with most clinical-stage biopharmaceutical companies, the major risk is that any of its lead assets, i.e. AUTO1 and/or AUTO3 may show disappointing clinical data. This would probably lead to continued pressure on the stock price. In my view, this is the most important aspect to watch for now.

Furthermore, the company may also surprise shareholders with some stock dilution via a potential equity offering that happens frequently for clinical-stage biopharmaceutical companies to improve their balance sheet. However, the company said in its recent third quarter 2020 financial results release that cash on its balance sheet is sufficient to fund operations into 2022, which would include several clinical milestones that may drive the share price higher.

Additionally, the ongoing COVID-19 pandemic may still have some larger implications on the recruitment and conduct of the ongoing or planned trials and may cause delays down the road, especially due to the complex nature of manufacturing programmed T cells.

Conclusion

Autolus' clinical development pipeline continues to mature and short to medium catalysts are expected that could drive the stock higher. I am especially eager to see the updates that will be presented at ASH in early December for both AUTO1 and AUTO3. If only one of both lead assets can prove its promising clinical data and get one step closer to achieving commercialization within the next 2-3 years, Autolus' current market cap of < $600 million as of this writing seems like a great undervaluation of the company's future prospects.

Furthermore, I expect the company has sufficient cash on hand ($178m as of September 30, 2020) to fund its clinical developments into 2022 which would include several milestones. This is important because it also leaves a margin of safety with respect to short-term stock dilution via potential equity offerings that happen in clinical-stage biopharmaceutical companies.

In the bull-case scenario, with AUTO1 and AUTO3 continuing to provide positive clinical data, I see Autolus' market cap expanding significantly from current levels with short to medium clinical catalysts at hand. Hence, the stock may find its way back to the all-time highs at $48 we saw back in November 2018. Any positive news may also trigger some serious M&A interest from larger pharmaceutical companies to enrich their immune-oncology pipelines.

In the bear scenario, if either one of the lead assets delivers disappointing data, the stock is likely to take another dip and recent stock price lows in the $4 range or even lower may be in the cards. In such a scenario, the remaining pipeline becomes much more important, and investors would likely need to remain patient for some while to see if the company can deliver another lead asset from its comprehensive pipeline.

Disclosure: I am/we are long AUTL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation or advise to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.