Zentalis: An Interesting Small Molecule Oncology Developer For Your Watchlist

This is a pretty below-radar company with interesting candidates in its pipeline.

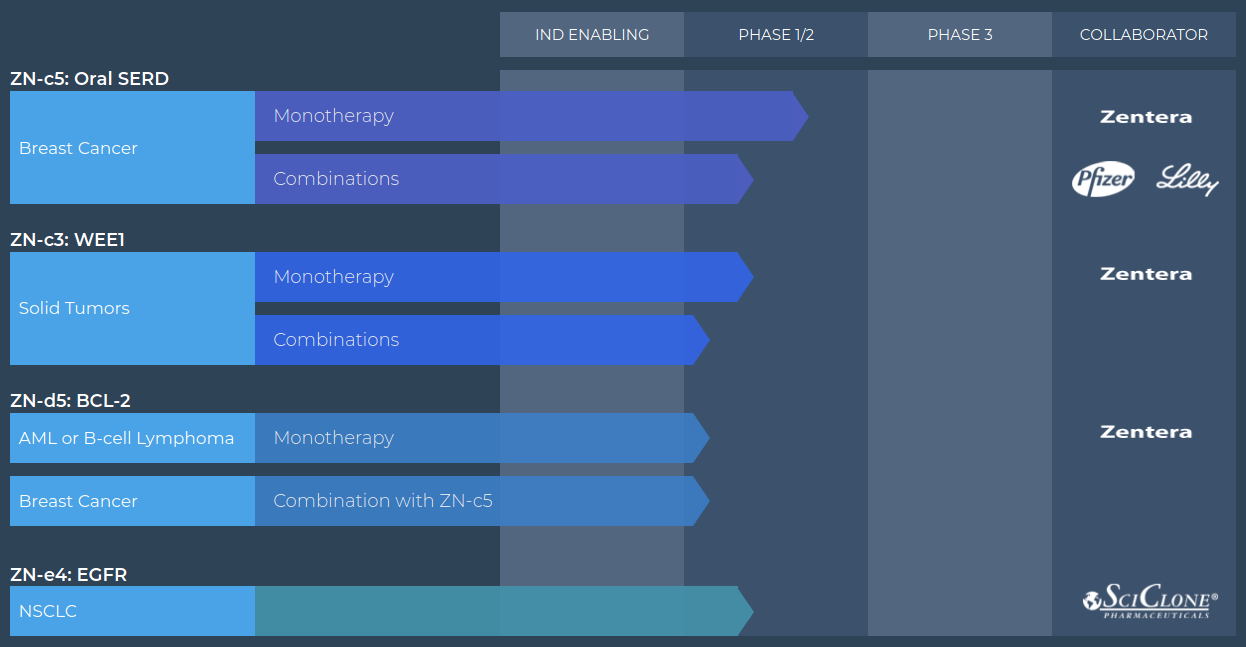

There are four programs in early stages right now.

The company has a long cash runway and looks pretty interesting.

Zentalis Pharma (ZNTL) is a recent IPO (April 2020) which develops small molecule cancer therapeutics. Lead product candidate ZN-c5 is an oral selective estrogen receptor degrader in phase 1/2 for metastatic breast cancer. Its other products are ZN-c3, an inhibitor of WEE1, a protein tyrosine kinase, in Phase 1/2 trial targeting advanced solid tumors; ZN-d5, a selective inhibitor of B-cell lymphoma 2 for the treatment of hematological malignancies; and ZN-e4, an irreversible inhibitor of mutant epidermal growth factor receptor in Phase 1/2 clinical trial for the treatment of advanced non-small cell lung cancer.

In 2020, the company launched its Chinese arm, Zentera Therapeutics, to develop and commercialize three Zentalis-discovered oncology candidates (ZN-c5, ZN-c3, and ZN-d5) in that country. “With experienced management, seasoned SAB, leading life sciences investors and large cap pharma partners, the company has potential for internal and third-party combination strategies across the product portfolio.”

Pipeline

Zentalis’s integrated discovery engine has produced 4 FDA-cleared INDs in 5 years.

(Image Source: Company website)

ZN-c5 - Oral SERD for breast cancer

ZN-c5 is an oral selective estrogen receptor degrader (SERD) targeting ER+/HER2- advanced or metastatic breast cancer. This specific breast cancer subtype affects over 70% of all breast cancer patients in the US, and is characterized by its reliance on the estrogen receptor (ER) for tumor growth and survival. Current standard of care includes hormonal therapies, with Fulvestrant, approved in 2002, being the only FDA-approved SERD. However, ZNTL claims that these therapies have limitations, and the differentiated product profile of orally administered ZN-c5 aims to overcome those.

The ongoing phase 1/2 trial uses ZN-c5 as a monotherapy. The phase 1 portion of the trial showed initial signs of efficacy and good tolerability, and a phase 2 will be initiated in 1H 2021. The company is investigating ZN-c5 in combination studies, including with palbociclib (Ibrance) through a clinical research collaboration with Pfizer (PFE), abemaciclib (Verzenio) through a clinical research collaboration with Eli Lilly (LLY), as well as Zentalis-discovered ZN-d5, our oral selective inhibitor of B-cell lymphoma 2 (BCL-2).

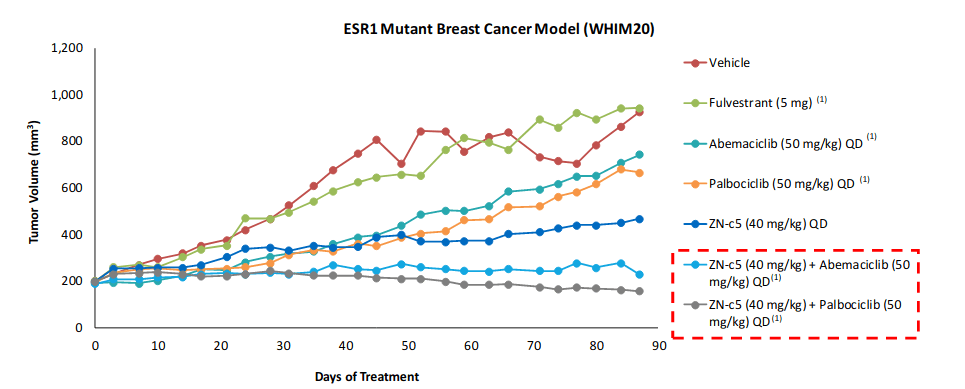

In preclinical studies, the molecule has shown robust anti-tumor activity both as a monotherapy and in combination with CDK4/6 inhibitors. These studies involved ESR1 (Estrogen Receptor 1) mutations, which commonly drive resistance - prevalence ranges from 11% to 39%.

(Image Source: Company presentation, November 2020)

As the diagram above shows, ZN-c5 in combination therapies with palbociclib (Ibrance sold by Pfizer) has an excellent tumor volume reduction profile in these preclinical studies.

ZN-c3 - WEE1 for solid tumors

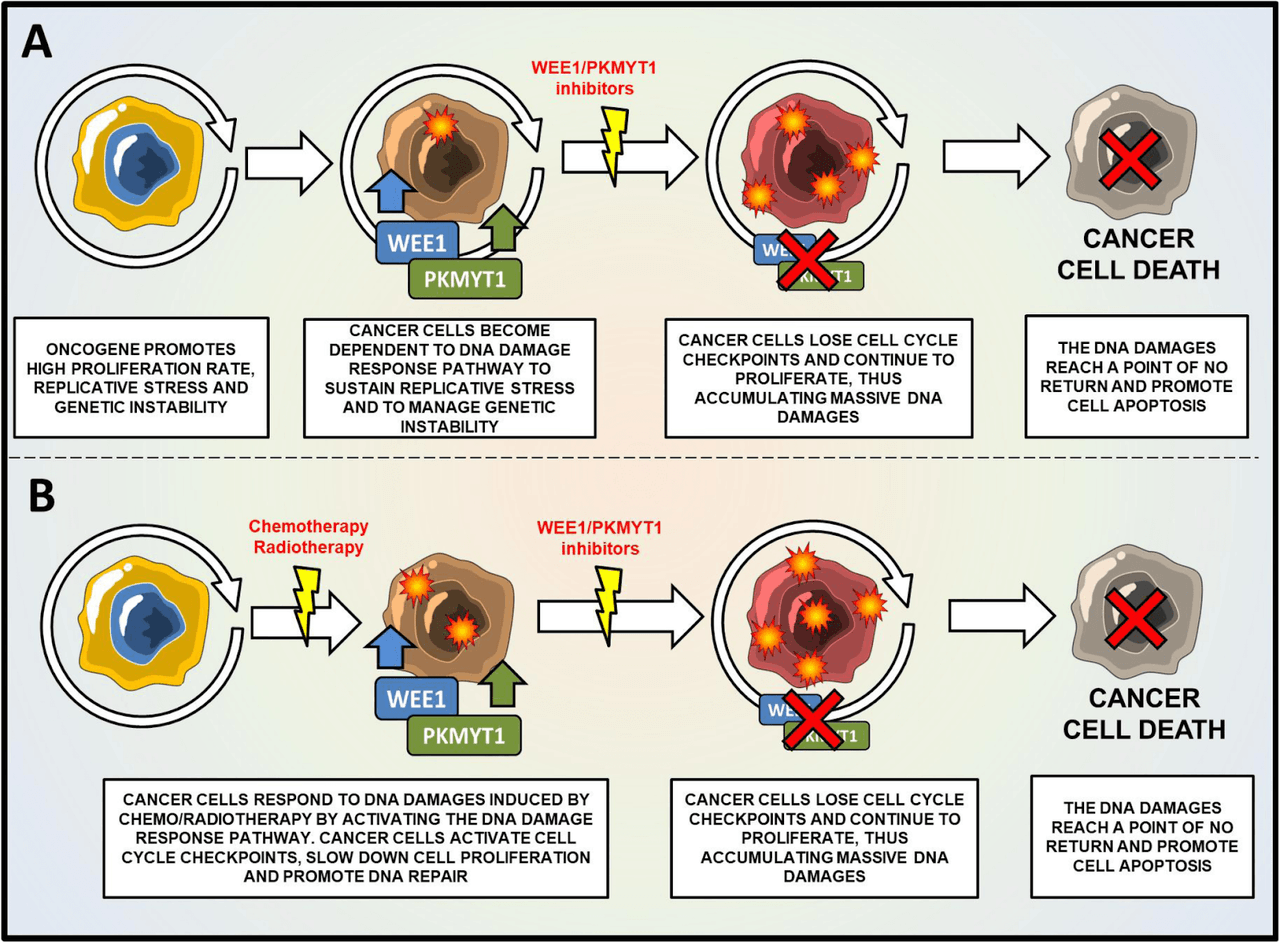

ZN-c3 is an oral inhibitor of WEE1 targeting advanced solid tumors. WEE1 is a nuclear kinase belonging to the Ser/Thr family of protein kinases, which acts as a DNA damage response protein. WEE1 plays “a crucial role in cell cycle regulation and DNA damage identification and repair in both nonmalignant and cancer cells.” Interestingly, the kinase family acts as an oncogene in a variety of solid and hematological tumors, and is overexpressed in them. High WEE1 expression is associated with “negative prognostic factors including lymph node involvement, induction of metastasis, increased biomarkers of proliferation (CCND1, Ki67, or CCNA1) and resistance to treatments (radiotherapy or chemotherapy).”

(Source: Journal of Hematology & Oncology)

Original Caption - “Mechanism of action of WEE1/PKMYT1 inhibitors for the treatment of cancer cells. a Schematic representation of WEE1/PKMYT1 inhibition as monotherapy. In cancer cells, oncogenes promote high rate of proliferation, replication stress and the over-expression of WEE1/PKMYT1 kinases. In this scenario, cancer cells need WEE1 and PKMYT1 to sustain replication stress and proliferation. The inhibition of WEE1/PKMYT1 results in the accumulation of DNA damages, the increase of genetic instability and induction of apoptosis. b Schematic representation of WEE1/PKMYT1 inhibition in combination with DNA damaging agents. Cancer cells respond to DNA damages by activating WEE1/PKMYT1 kinases. The inhibition of WEE1/PKMYT1 enhances the cytotoxicity of DNA damaging agents by inhibiting DNA repair and promoting cell cycle progression even in the presence of DNA damages. Therefore, cancer cells accumulate massive DNA damages until a point of no return.”

WEE1 inhibitors try to generate sufficient DNA damage in cancer cells, causing cell death or apoptosis, preventing tumor growth, and potentially even causing tumor regression. There are two main ones in preclinical studies - PD0166285 and Adavosertib - in monotherapy and combination studies targeting a number of tumors. Adavosertib is being developed by AstraZeneca (AZN) in over 30 phase 1 and 2 trials. Currently, there are no FDA-approved WEE1 inhibitors, and ZNTL claims that ZN-c3 has advantages over other investigational therapies with superior solubility, selectivity, and PK properties. Phase 1 data will be available in 2021. The company expects “to initiate a Phase 1b trial evaluating ZN-c3 in combination with chemotherapy in patients with advanced ovarian cancer in the second half of 2020, as well as a Phase 2 trial investigating ZN-c3 as a monotherapy in patients with uterine serous carcinoma in 2021.”

ZN-e4 - Targeting EGFR cancer pathway

ZN-e4 is an oral small molecule inhibitor of mutant epidermal growth factor receptor (EGFR) initially targeting NSCLC. This is a clinically validated approach; however, “FDA-approved third-generation inhibitor of EGFR still has toxicities, including skin rashes, associated with first- and second-generation inhibitors.” The company claims that ZN-e4 will have a better toxicity profile compared to them due to it being more selective, tolerable, and soluble. A phase 1/2 trial is in progress.

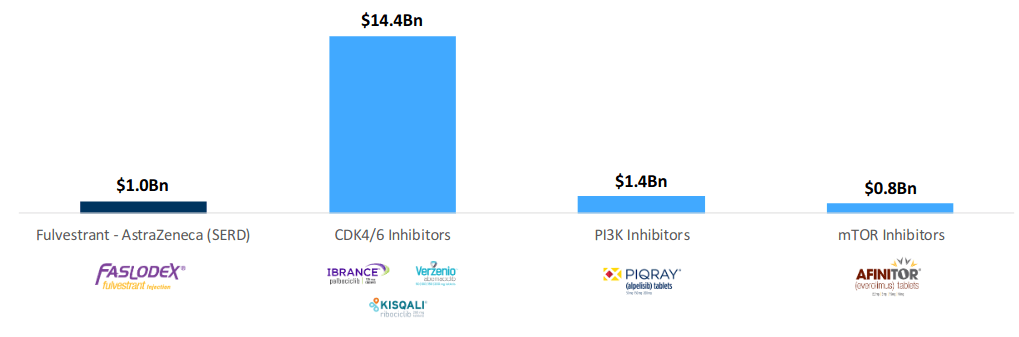

Market and competition

Oral SERDs target a large $1 billion+ market. In fact, Faslodex, the only approved SERD, has over $1 billion in sales.

(Image Source: Company presentation, November 2020)

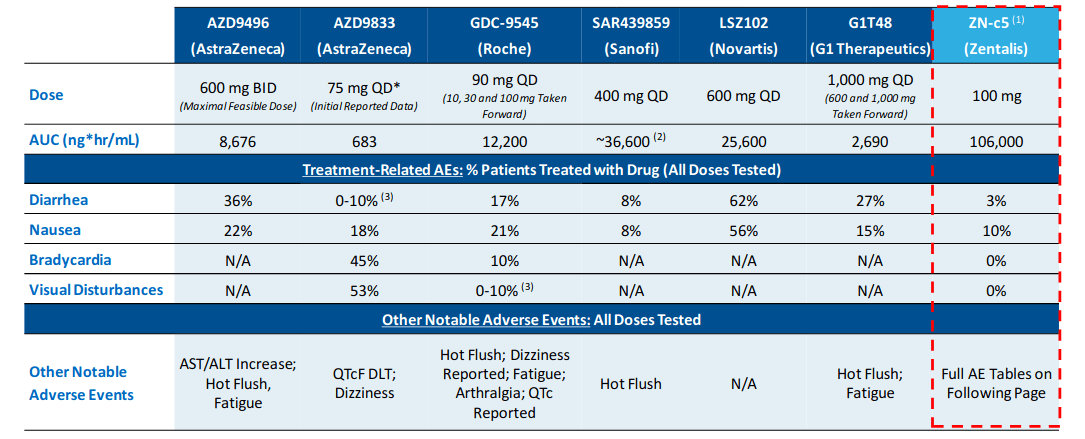

Below is a chart of potential oral SERD competitors and ZN-c5’s competitive advantage:

(Image Source: Company presentation, November 2020)

Recent developments

The company provided financial results and business updates on 11/9/2020. Here’s a selection of these updates:

Announced positive topline data from the Phase 1 monotherapy dose escalation trial of ZN-c5 showing clinical benefit rate of 40%; Based on this candidate’s favorable tolerability and encouraging anti-tumor activity, the company is preparing to initiate the Phase 2 trial in patients with ER+/HER2- advanced breast cancer in the first half of 2021.

In July 2020, entered into a clinical collaboration with Eli Lilly to evaluate ZN-c5 in combination with abemaciclib, a CDK4 and 6 inhibitor. Zentalis plans to initiate a Phase 1b open label, multicenter trial in patients with ER+/HER2- advanced breast cancer before year-end.

The Company is conducting a Phase 1/2 clinical trial of ZN-c3 in patients with advanced solid tumors and expects to report topline results from the Phase 1 portion of this trial in 2021.

In August 2020, Zentalis closed a follow-on offering of common stock resulting in gross proceeds of approximately $166.0 million.

The COVID-19 pandemic has caused disruptions to the Company’s development plans and research-stage programs, including delayed initiations, suspended enrollment at some clinical sites for new patients, and limited operations at its laboratory facilities. As a result, this pandemic may continue to impact Zentalis’ business, revenues, results of operations and financial condition.

Financials

Stock price: $39.73, midway in 52-week range of $22-59.32.

Market capitalization: $1.64 billion.

Shares outstanding: 40.61 million.

Shareholding: 53.72% - institutions, 26.91% - hedge funds, 9.69% - insiders, 9.69% public and others.

3 Wall Street analysts are very bullish and 2 are bullish, with a combined average rating of 4.59/5 a and price target of $45.20, increased from $44.80 in September 2020.

Cash balance: $367.44 million.

Debt: $1.9 million.

Cash burn: $46.8 million (fiscal 2019), $93.4 million (TTM).

“Zentalis expects that its existing cash, cash equivalents and marketable securities, which includes the net proceeds of approximately $155.2 million from the follow-on offering, will enable the Company to fund its operating expenses and capital expenditure requirements into 2023.”

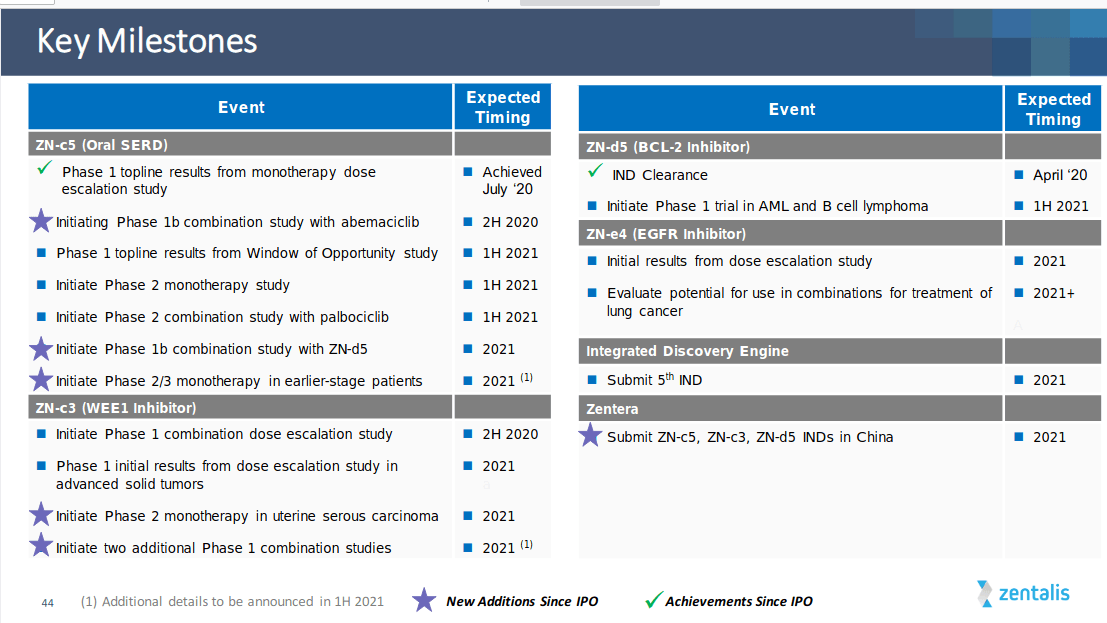

Key company milestones

(Image Source: Company presentation, November 2020)

Bottom Line

Zentalis Pharma is an early-stage, undercovered, well-funded and strong market capitalised company that is still flying below the radar of most investors. We see potential in its pipeline, especially the WEE1 inhibitor program, an area with little diversification but strong progress from AstraZeneca, known for its R&D prowess. Current prices are too volatile because of the recent IPO, but once things settle down, this may be a solid candidate for adding to one’s longer-term portfolio.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.