Camden Property Trust: Top-Tier Play In Apartments

Camden Property Trust saw FFO decline by only 3% in the quarter.

The balance sheet is underleveraged, but it is unclear if Camden Property Trust will increase leverage to boost acquisition activity.

Shares don’t trade cheaply, but there might be more upside in this yield-hungry environment.

Camden Property Trust (CPT) has reported strong financial results despite the COVID-19 backdrop. CPT has been able to maintain occupancy rates, while experiencing minimal deterioration in leasing rates. The REIT maintains one of the strongest balance sheets in the sector. Shares still yield in excess of 3%. While CPT is no longer as great value as it has been earlier this year, the stock remains an attractive option for those looking to add some quality to their portfolio.

High Quality At A High Price

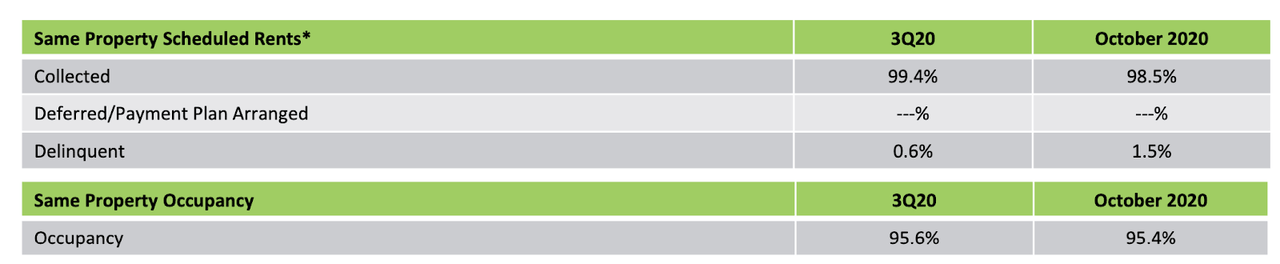

COVID-19 has negatively impacted substantially most real estate sectors, but the financial impact to CPT has been more than manageable. Rent collection was strong at 99.4% in the third quarter, and occupancy rates declined 70 basis points to 95.6%:

(Source: November Presentation)

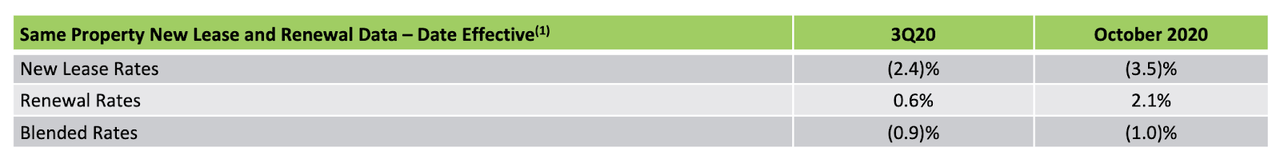

CPT generated a negative 0.9% blended leasing spread in the quarter, as both new and renewal leasing spreads struggled:

(Source: November Presentation)

Historically, CPT has been able to derive renewal rates around 5%:

(Source: November Presentation)

The decline in occupancy, negative leasing spreads, and uncollectible rent led FFO to decline 3.1% to $1.25 per share. CPT normally reports strong growth, but such a marginal decline is hardly the end of the world.

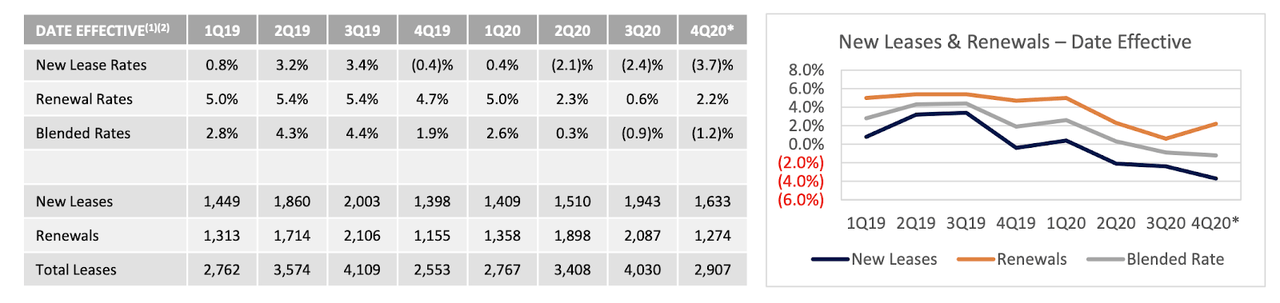

Perhaps CPT was able to perform so strongly due to lack of exposure to San Francisco nor New York, two regions hit particularly hard by the pandemic:

(Source: November Presentation)

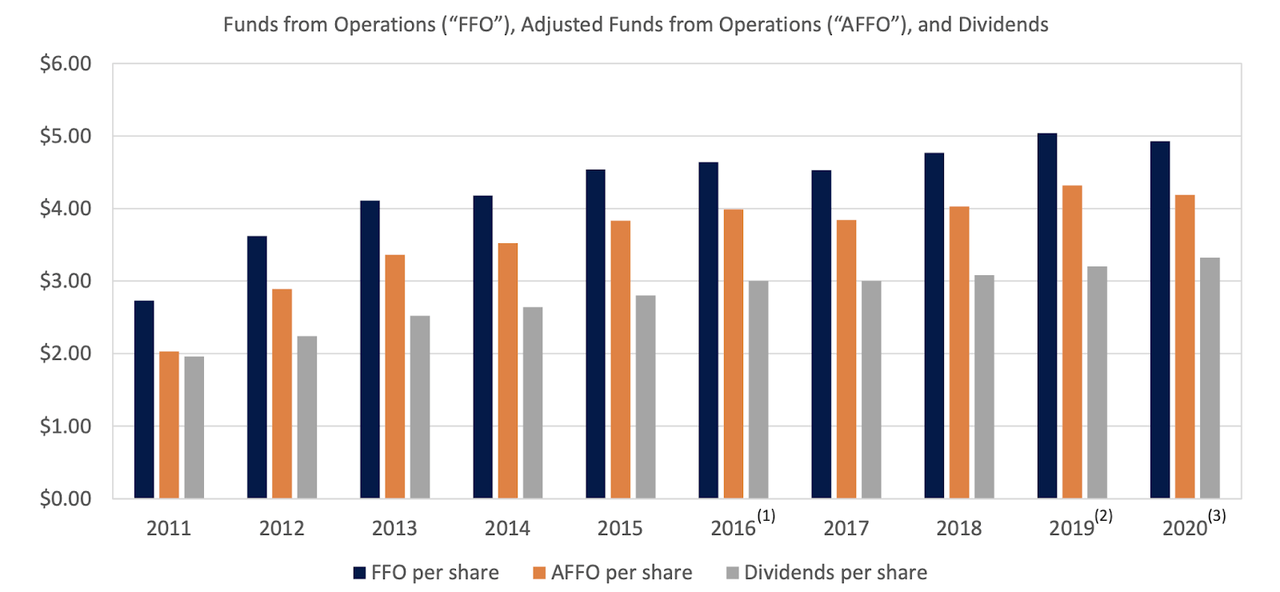

I see no evidence that would suggest impairment of the long-term growth thesis. It is important to remember that CPT has been able to grow cash flows and its dividend at a consistent pace over the past ten years:

(Source: November Presentation)

Recent news regarding potentially effective vaccines may suggest that CPT can quickly return to growth in the next several quarters.

Balance Sheet Analysis

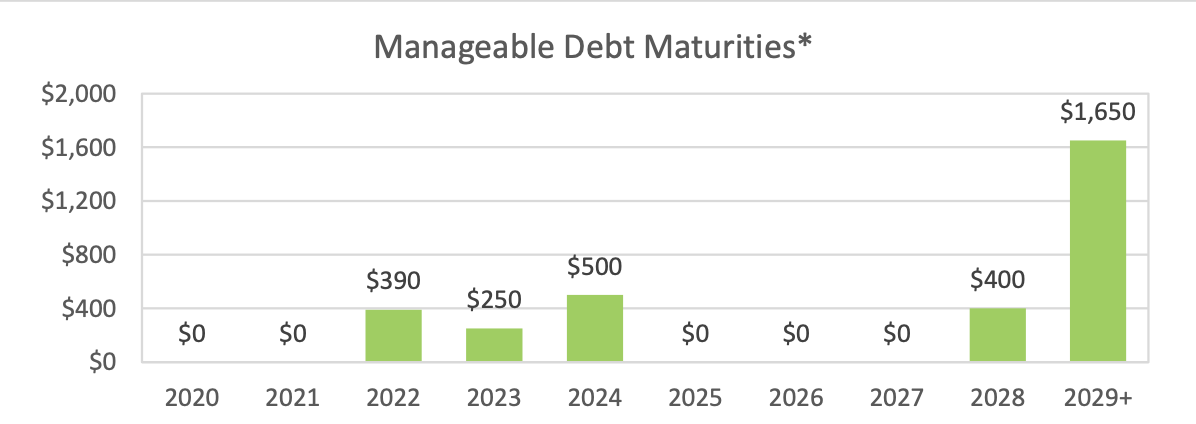

CPT has one of the best balance sheets in the sector, rated A- or equivalent by the credit rating issuers. CPT has ample liquidity with $441 million in cash on the balance sheet plus $888 million available under its credit facilities. CPT has no near-term debt maturities:

(Source: November Presentation)

Debt-to-EBITDA stood at 4.5 times as of the latest quarter, up from 3.9 in the prior year primarily due to reduced cash flows. Even at the higher level, CPT can arguably ramp up leverage for acquisitions, if possible. That said, I haven’t seen material weakness in apartment property values (and this is validated by the fact that most apartment REIT stocks also trade at healthy multiples). If anything, CPT might be able to enter the markets of San Francisco or New York if the price is right, but in my opinion, odds are not high for CPT to find high-quality apartment real estate at distressed prices.

Valuation and Price Target

CPT has guided for 2020 FFO of $4.93 at the midpoint. At recent prices, shares trade at just over 20 times FFO and a 3.3% dividend yield. Dividends have grown around 3-4% over the past couple of years. Shares are by no means cheap, but CPT is typically viewed as a “bond-equivalent” or “bond-replacement” type stock. Currently, the 10-year Treasury trades at a 0.87% yield and the 30-year Treasury trades at a 1.62% yield, so a 3.3% dividend yield with solid growth still may be appealing in this environment. I can see shares trading at a 2.8% dividend yield, which would represent a stock price of $118, representing roughly 18% total return upside.

Risks

Past returns might not continue into the future. While CPT has delivered strong rent collection this year, it is possible that collection rates may dip moving forward for a variety of reasons - for example, the lack of a stimulus bill. While I view COVID-19 as having only near-term impact on CPT’s financials, a deterioration in rent collection may prevent multiple expansion in the near term.

It is possible that the pandemic has long-lasting impact that prevents CPT from raising rents as aggressively as in the past. The company is priced for growth, and lack of growth would lead to significant multiple compression. I could see the stock trading down to $74 if growth slows down in 2021, representing 15 times FFO.

CPT isn’t particularly cheap. In the absence of multiple expansion, the REIT is unlikely to deliver returns greater than 6-7%. If Wall Street begins to shift away from its yield-hungry appetite, then CPT may be revalued to a higher dividend yield. Over the long term, shares can still deliver positive returns, but such an outcome would lead to disappointing near-term returns.

Conclusion

2020 will prove to be a throwaway year for CPT, but even then, the year wasn’t so bad. With FFO declining by only 3% in the latest quarter, shareholders cannot really complain, as CPT has proven its defensive and high-quality nature. While CPT appears underleveraged, I do not anticipate the company increasing leverage to acquire new properties. Shares do not trade cheaply, but there may be upside if the yield can compress closer to US Treasuries.

Discover More High Conviction Ideas

Subscribers to Best of Breed to get access to my top high conviction ideas and full access to the Best of Breed portfolio. Exclusive Best of Breed content includes industry deep-dives, broad market coverage, and high conviction picks.

Elevate your investments with Best of Breed.

Become a Best of Breed Investor Today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.