the economy has suffered a contraction of around a quarter of GDP in the first quarter of the current fiscal year.

the economy has suffered a contraction of around a quarter of GDP in the first quarter of the current fiscal year.Written by Abhishek Singh

The Indian government announced a complete nationwide lockdown on March 24 as a COVID-control measure. The sudden lockdown meant that the economy suffered from extreme demand and supply shocks due to the suspension of productive activities. Since the situation is unprecedented, and the economy has suffered a contraction of around a quarter of GDP in the first quarter of the current fiscal year, it is difficult to ascertain the flow of tax revenue and other receipts as well as the expenditure requirements of the government at the national and subnational level. In other words, the pandemic has changed the functioning and priorities of the governments at the Centre as well as state level.

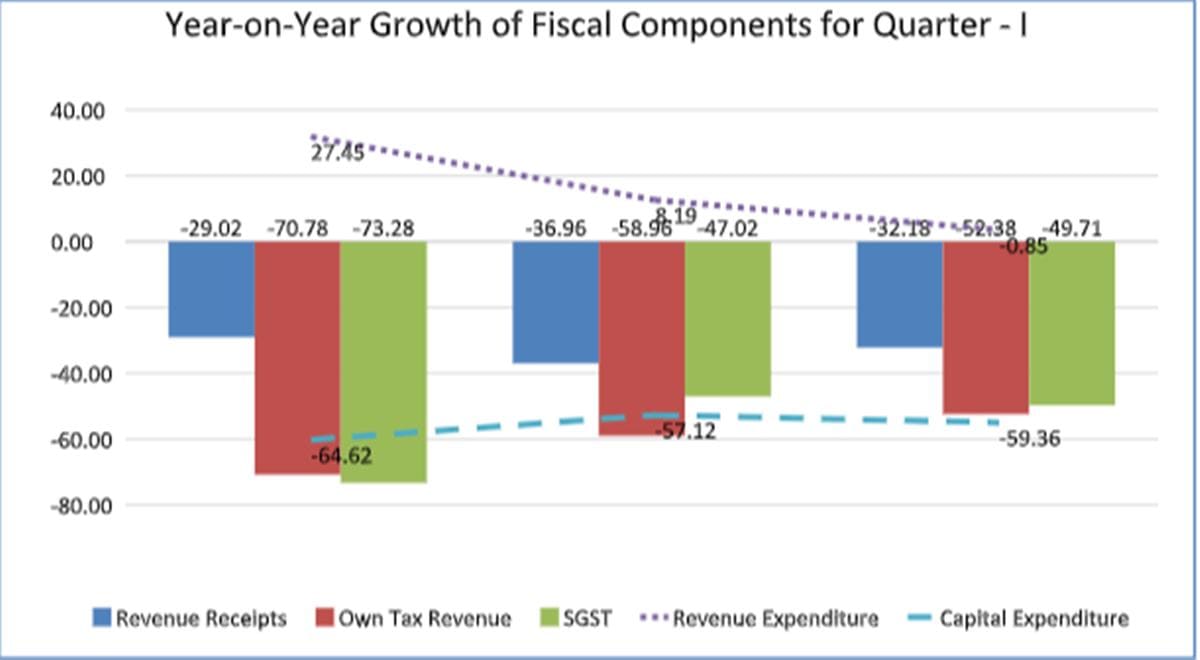

This article analyses the trend of revenue receipts, own tax revenue, collection of GST, revenue expenditure and capital expenditure for Quarter 1 and Quarter 2 of the current fiscal year (2020-21) based on monthly data released by Comptroller and Auditor General of India. The data has been collected for all states, except Bihar and Goa. With the suspension of economic activity nationwide, public finance has been under great strain. In particular, the revenue receipts of the state governments have taken a sharp hit.

During the first quarter of the current fiscal year, the largest contraction in revenue receipts has been experienced by West Bengal (72.07 per cent), Haryana (64.29 per cent), Uttar Pradesh (44.86 per cent). The contraction of receipts continues in the second quarter for most of the states. Here, it is important to mention that Andhra Pradesh is the only state that has shown a growth in the revenue receipts in the first quarter, with growth of 52.09 per cent in April 2020 as compared to April 2019. The decline came in the second month of the second quarter, 12.74 per cent in August and 14.56 per cent in September. The positive growth in the revenue receipts of Andhra Pradesh is mainly driven by the central grants to the state. Central tax devolutions are a major source of revenue receipts for states and range from 24 per cent to 29 per cent in Q1.

During the first quarter of the current fiscal year, the largest contraction in revenue receipts has been experienced by West Bengal (72.07 per cent), Haryana (64.29 per cent), Uttar Pradesh (44.86 per cent).

During the first quarter of the current fiscal year, the largest contraction in revenue receipts has been experienced by West Bengal (72.07 per cent), Haryana (64.29 per cent), Uttar Pradesh (44.86 per cent).

The decline in the revenue receipts of the states is mostly driven by the decline in own tax revenue. Nearly all the states have suffered a massive loss of own tax revenue: Kerala (81.73 per cent), Haryana (77.24 per cent), Madhya Pradesh (77.12 per cent), Punjab (76.25 per cent), Rajasthan (76.09 per cent), Tamil Nadu and Telangana (almost 76 per cent). Decline in OTR has mainly been driven by a decline in SGST collection of the states.

The lockdown suspended almost all economic activities in the economy, and as a result, states experienced a crunch in SGST collection as shown by the year-on-year growth rate in April 2020 as compared to April 2019: Kerala (54.67 per cent), Haryana (44.81 per cent), Rajasthan (51.87 per cent), Jharkhand (69.71 per cent), Gujarat (84.8 per cent), and West Bengal (66.52 per cent). The crunch in SGST collection as well as revenue has eased up as the economy is progressing towards unlock, except for Kerala where the decline became less severe in the start of the second quarter (34.91 per cent), only to become more severe at the end of the second quarter (69.67 per cent).

The case of Andhra Pradesh stands out again as even after lockdown, the collection of SGST has improved over the last year. In April 2020, right after the lockdown, when all the states registered a decline in SGST collection, Andhra Pradesh registered a growth of 13.77 per cent.

The collection in July 2020 was 113.53 per cent more than the collection last year. The decline eventually came in August 2020 (27.27 per cent) and September (32.81 per cent). The important observation here is that the decline in revenue receipts could have been even more severe if not for the central transfers to the states. The Central grants to the states registered a growth in April 2020 against April 2019, just after the announcement of lockdown. The grants for Quarter 1 of the current fiscal year registered a growth of 32.60 in June 2020.

The revenue expenditure has increased for all the states except for Madhya Pradesh, in which year-on-year growth rate in revenue expenditure has been negative throughout the first two quarters of the current fiscal year.

Jharkhand and Odisha registered a year-on-year positive growth in the revenue expenditure during April 2020 and May 2020. From June 2020 onwards, the revenue expenditure has shown a year-on-year decline till the end of the second quarter. The increased health expenditure along with incurring the committed expenditure has played a major role in positive growth in revenue expenditure of the states.

On the other hand, capital outlay has shown a negative year on year growth for all the states except for Andhra Pradesh, Kerala, Odisha and West Bengal. The capital outlay in Andhra Pradesh showed an impressive growth. In April 2020, the capital outlay in Andhra Pradesh was Rs. 2755.42 crore as compared to Rs. 116.16 crore in April 2019.

In Kerala, the year-on-year growth in capital outlay remains positive throughout the first and second quarter of the current fiscal year. In Odisha, the year-on-year growth is positive in the first quarter, but turns negative in the second half of the second quarter. The important point to note is that the rate of decline in capital outlay is slowing down towards the end of the second quarter for most states, as is the case with Rajasthan Due to declining receipts and increasing expenses, the revenue deficit across states has increased during the current year.

At the end of Quarter I of 2019-2020, all general states experienced a revenue surplus of Rs. 9,678 crore, while correspondingly, in 2020-21, the states have suffered a massive deficit of Rs. 151728.4 crore. Similarly, gross fiscal deficit (GFD) has also increased. While GFD, at the end of the first quarter of 2019-20 (in June 2019) was Rs. 51,845 crore, it was Rs. 176732.4 correspondingly in 2020-21. To meet the high fiscal deficit, the Centre has now allowed the state governments to raise funds through borrowings.

In current situation, there is an increasing need being felt, of the government intervention to uplift the economy out of the abyss, which would require increased public expenditure and better management of public finance. At a time when there is discord between the Centre and state governments over GST Compensation Cess, it needs to be seen what

recommendations come out of the kitty of the Fifteenth Finance Commission towards giving a roadmap for fiscal consolidation of states.

The writer was a consultant to the Fifteenth Finance Commission