Lineage: OPC1, VAC2, And OpRegen Are Making Progress With Several 2020 Catalysts, 48% Upside

Lineage Cell Therapeutics, Inc. is a clinical-stage biotech company focused on developing therapeutics for degenerative retinal diseases, demyelination-related neurological conditions, and cancer-related conditions.

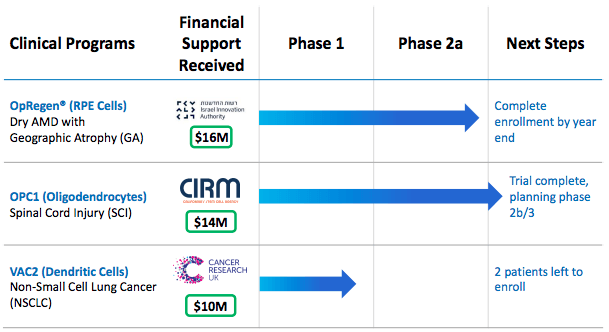

Lineage's clinical pipeline is based around three programs OpRegen (Phase 1/2a) for AMD, OPC1 (Phase 2b/3) for SCI, and VAC2 (Phase 1) for NSCLC with a combined $40B potential market.

Lineage's cash basis is sufficient through 2022 with operations funded by divestitures of AgeX and OncoCyte shares on top of a low cash burn rate and agency financial support.

Lineage held an updated Nov. OpRegen data presentation showing "clinically meaningful outcomes, particularly for those with earlier-stage disease [states]" and affirming partnership talks are advancing alongside next steps with the FDA.

Lineage Cell Therapeutics is a conservative "buy" at a 2-year price target of $1.88 (+48% upside).

Graphic Source: Lineage Cell Therapeutics, Inc.

Introduction: What is Lineage Cell Therapeutics?

Lineage Cell Therapeutics, Inc. (NYSEMKT:LCTX) is a clinical-stage biotech company focused on developing therapeutics for degenerative retinal diseases, demyelination-related neurological conditions, and cancer-related conditions.

Over the course of its 30 years, Lineage has come to use its 53 employees to specialize and develop platforms out of its "terminally differentiated" human cells sourced out of pluripotent and progenitor cells with three allogeneic cell-therapy programs underway: OpRegen, OPC1, and VAC2. Lineage had revenues in 2019 of $3.5M, net income of -$11.7M, and a recent market cap of $190.5M (Nov. 2020) trading 15% above its 52W average.

Products/Clinical Trials: Lineage's clinical pipeline is based around three programs OpRegen, OPC1, and VAC2. OpRegen is a Phase 1/2a retinal pigment epithelium cell replacement therapy aiming to treat advanced dry age-related macular degeneration ("AMD") with geographic atrophy ("GA"). OPC1 is a Phase 2b/3 oligodendrocyte progenitor cell therapy for acute spinal cord injuries ("SCI"). Finally, the third program, VAC2, is a Phase 1 dendritic cell immunotherapy for non-small cell lung cancer ("NSCLC").

Customers/market: Lineage's pipeline is targeting a combined global market of approximately $40.4B (2022) with an average CAGR of 8.37%. Dry AMD, approximately 90% of the AMD market, is expected to reach $10.5B by 2022 with a 7.9% long-term CAGR. Acute SCI is anticipated to reach $3.4B with a 3.8% LT CAGR, and NSCLC, the largest potential market for Lineage, is forecasted to reach $26.5B with a large LT CAGR of 13.4%.

Management: CEO, Brian Culley, MBA, joined lineage during its downward spiral serving as Lineage's CEO since Sept. 2018. He holds +25 years of business and scientific experience having served previously for 1-year (2017-2018) as interim CEO of Artemis Therapeutics (OTCQB:ATMS) and 7 years (2010-2017) as CEO of Mast Therapeutics until its merger with Savara, Inc. (SVRA). He has specific expertise in Business Development.

LCTX share-price change under his leadership: -50% (CAGR: -29%)

Strategy: Lineage is taking a narrow but open approach to development with its core therapeutic heavily supported (+16M in outside support) being OpRegen, and its most diverse platform being VAC2 (+14M) which benefits from the VAC platform's wide use-cases (cancer + infectious disease vaccines) with short-term medical-condition expansions in 2020-2021. Their stated goal is to become the "leading cell-therapy company" through developing allogeneic or “off-the-shelf" treatments derived from pluripotent cell lines while maintaining an efficient and cost-effective business model. Lineage's management seems to not only care about being the leading cell-therapy company but also protecting shareholder value by selling non-target stock ownerships instead of conducting dilutive equity issuances on its own stock creating cash enough through to 2022. In the near term, their stated near-term activities include:

- complete enrollment in the Phase 1/2 study of OpRegen for dry AMD with GA focused on safety and efficacy data; [COMPLETED]

- expand commercial capabilities of the OPC1 manufacturing process (e.g. scale, purity, etc.);

- evaluate VAC2 - NSCLC efficacy clinical data/evaluate the early exercise option for CRUK data; and

- increase partnership opportunities with a focus on accelerating clinical progress and to enable further sources of non-dilutive capital.

Financial position: Lineage is currently operating with a sufficient cash basis of $38M (9M 2020) above the 3-year average and seemingly sufficient for its small targeted pipeline. Additionally, Lineage management has stated that they are now funded through 2022. Revenues are primarily sourced from royalties and grant revenue. The latter being almost equally funded by the Israel Innovation Authority ("IAA") for the development of OpRegen and the NIH. Revenues amounted to $3.5M in 2019 and are estimated at $1.95M for 2020. Shareholder dilution has thankfully been non-existent for the past 3 years with operations funded by divestitures of AgeX (AGE) and OncoCyte (OCX) shares on top of a low cash burn rate and financial support from various agencies/organizations.

Investment thesis: Lineage Cell Therapeutics is a focused biotech that offers a safe approach to biotech investing due to its mid-stage pipeline and managerial focus on shareholder value/operational cost basis. With $38M in cash, sufficient partnerships, and enough capital to sustain through to 2022, Lineage is simply a buy-and-hold for investors. Lineage touts an innovative cell transplantation approach for a wide range of medical conditions, offering significant IP protection and a manufacturing focus that may unlock further shareholder value. Lineage's three clinical stage programs target a combined +40 billion-dollar market, with a non-competing product for Dry AMD which in November showed positive clinical results emphasizing a promising upside catalyst. They've taken steps for consistent data publication finding a promising retinal tissue restoration case for AMD, promising 2nd-level motor function resumption in 33% of SCI patients, and potent immune response for their Phase 1 studies. 2020 additionally offers investors multiple short-term catalysts, including the December update for OPC1 and the Q4 update on completing dosing for the ongoing VAC2 NSCLC trial alongside OpRegen partnership/FDA discussions. All in all, if the investor agrees with the science, it's a matter of waiting to realize the returns after each trial announcement in 2020 with Q4 being a quarter time to follow.

In summary, the author projects Lineage Cell Therapeutics as a conservative "buy" at a 2-year price target of $1.88 (+48% upside).

Pipeline & partnerships (expanded):

Graphic Source: Lineage Cell Therapeutics, Inc.

Promising Candidate(1): OpRegen® is a Phase 1/2a retinal pigment epithelium cell replacement therapy aiming to treat advanced dry age-related macular degeneration ("AMD") with geographic atrophy ("GA"). If FDA approved, it would be the first therapeutic for dry AMD, and the company is racing to reach that goal. Age-related macular degeneration is a common eye disorder that causes impaired central vision and is the leading cause of blindness in patients over 60. OpRegen is based around direct transplantation of functioning retinal pigment endothelium cells into the patient's eye. The ongoing open-label clinical trial has completed enrollment in the Phase 1/2a clinical trial (trial Link), and the updated interim results were presented on Nov. 15th, 2020, at the AAO.

- Estimated Primary Completion Date: December 2020

- Estimated Study Completion Date: December 2024

Updated November Interim Data Results: Lineage presented their new data on November 15th for their Phase 1/2 clinical trial for OpRegen. Patient coverage included 20 patients with 8 in Cohort 4 ("C4"). Cohort 4 includes patients with vision as high as 20/64, versus the first 3 cohorts comprising those who are legally blind with "best-corrected visual acuity of 20/200 or worse". C4's 8 patients treated with the new "thaw-and-inject" formulation and 4 doubling with Gyroscope SD system showed improved baseline vision and smaller areas of geographic atrophy. There were improvements in visual acuity statistically significant at the 9 and 12-month marks with 24-month maintenance on a portion of the population. Including slower GA growth in the first 6 patients of C4, there existed a positive trend up to the 24-month mark (24-month data available). Adding on to previous studies, structural improvements remained in the retina and a decrease in drusen density evidencing durable OpRegen cell engraftment and, in some, a continuation into the 4-year mark. Immunosuppression was not necessary beyond the operational recovery period. Together, the interim data results showed positive toleration in all patients with data on four more November treated patients expected to show similar results in visual acuity in the coming months.

CEO, Brian Culley, came out commenting that the interim results showed "clinically meaningful outcomes in dry AMD patients with GA, particularly for those with earlier-stage disease". This evidences a target population. Brian Culley outlined the next steps highlighting that, given enrollment has been completed, Lineage's focus will now be on collecting safety and efficacy data from the most recent patients, advancing partnership/investor conversations, and exploring options for later-stage clinical development including FDA conversations of next steps.

For further results from the updated interim data, please see either the simplified version here or the expanded full-length update here.

Next Update: Final four November OpRegen patient data in 4Q 2020 and potential partnership announcements

Promising Candidate(2): OPC1 is a multicenter Phase 2b/3 oligodendrocyte progenitor cell therapy for acute spinal cord injuries ("SCI"). Partially funded by the California Institute for Regenerative Medicine ($14M), it aims to provide additional upper limb & finger function for patients with SCI. The OPC1 therapy is injected into the spinal cord with OPCs providing electrical insulation for the nerve axons in the form of a myelin sheath. OPC1 currently has both the Regenerative Medicine Advanced Therapy Designation ("RMAT") & the Orphan Drug Designation from the FDA.

Results from the clinical trial thus far have indicated a strong safety profile, 96% durable engraftment through 1-year post-injection, no evidence of adverse changes to the 24-month mark, no decline in motor function from years 1 to 2, 95% patient strong motor recovery in upper extremities at 1 year, and finally, a 5 of 6 cohort-2 significant motor improvement, emphasizing escalating dosages increasing effect. The results thus far indicate moving on to further evaluation in a randomized controlled study with planning for Phase 3 underway as of Nov. 2020. Lineage has also indicated that they intend to begin considering partnership opportunities as well as continued external grant funding. The open-label Phase 1/2 clinical trial can be found here, with a summary/analysis of results here.

Next Update: planned for early Dec 2020.

Promising Candidate(3): VAC2 is Lineage's promising Phase 1 cell therapy from Lineage's VAC platform that targets non-small cell lung cancer. VAC2's clinical trial is being funded and ran by Cancer Research UK ("CRUK"), the world's largest independent cancer research charity. Presently, VAC2 is dosing in the ongoing NSCLC clinical trial with 2 remaining.

The VAC platform started with VAC1, which was comprised of autologous dendritic cells ("DCS") that provided "proof-of-concept" for the rollout of VAC2, which is Lineage's allogeneic product candidate. The VAC platform is based on large-scale production of mature immune cells - dendritic cells ("DCS") which are manufactured and loaded with a tumor antigen for treating cancer or with a viral antigen for infectious diseases creating a targeted immune response. Lineage hopes to expand the VAC platform (e.g. VAC 3, 4, 5, 6) this year through 2021.

The open-label Phase 1 clinical trial for NSCLC can be found here, with a summary of plans/expected results here.

Next Update: Q4 2020 for the announcement of complete dosing in the ongoing NSCLC clinical trial.

Other therapeutic updates:

- Lineage is aiming to find a commercialization or development partner for Renevia, a three-dimensional scaffold designed for adipose tissue transplants (Granted CE Mark in Sept. 2019).

- Lineage may apply its allogeneic dendritic cell therapy capabilities to a COVID-19 vaccine.

For more information on updates regarding clinical trial results, priorities of the therapeutic line, amongst others, please see the latest November Update Presentation and for OpRegen's Phase 1/2 interim study results see the Nov. 15th, 2020, webcast.

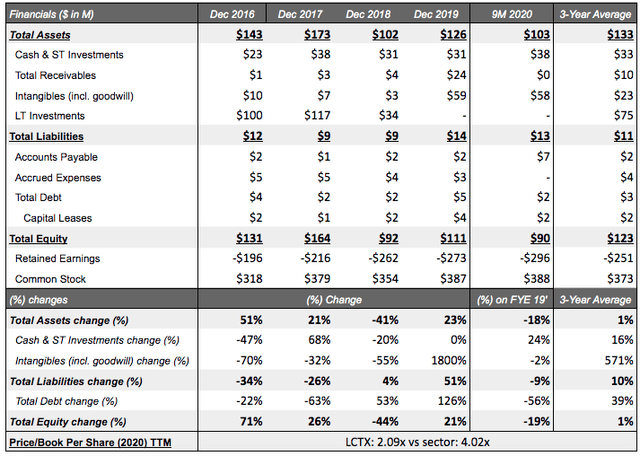

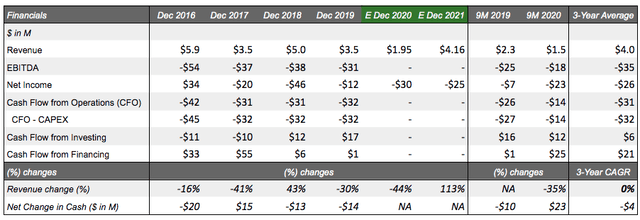

Financial position (expanded):

Table Source: Self Created | Data Source: Seeking Alpha - LCTX

Table Source: Self Created | Data Source: Seeking Alpha - LCTX

Revenue/costs: With Lineage confirming they have capital resources through 2022, short-term revenue targets become less impactful than their underlying partnership announcements and milestone targets met. This reduces the stress of volatile revenues, which delivered a 0% CAGR between 2017 and 2019. It is important to note that, like all other biotechs, profitability has not been reached with net loss projections for 2020 increasing to -$30M, but improving to -$25M in 2021, highlighting the company's aim of cost reductions without sacrificing efficiencies, though largely impacted by a surge in revenues in E2021 to $4.16M (+113% y/y).

Balance sheet composition:

Table Source: Self Created | Data Source: Seeking Alpha - LCTX

On a financial basis, Lineage comes off as stable, with a minimal amount of debt at $2M (9M 2020) and cash of $38M aided by the +$24.6M payment from the Juvenescence promissory note. Lineage has stated that they are now funded through 2022, which in the author's view is interpreted as stable milestone-funded partnerships and a lower cost basis than historical operations. As stated above, shareholder dilution has been purposely non-existent for the past 3 years with operations funded by divestitures of AgeX and OncoCyte shares on top of a low cash burn rate and the financial support from various agencies/organizations (e.g. IAA, CRUK, CIRM).

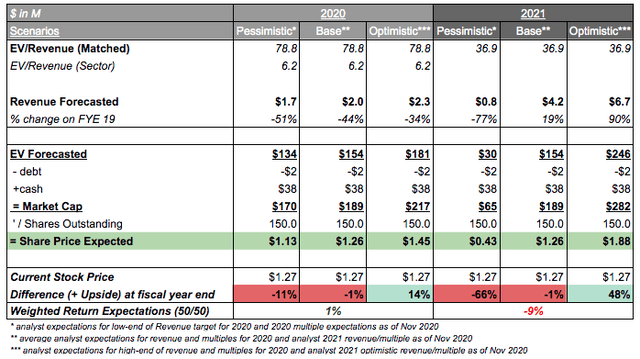

Valuation:

Table Source: Self Created | Data Source: Seeking Alpha - LCTX

Table Source: Self Created | Data Source: Seeking Alpha - LCTX

Incorporating the average analyst expectations across the 4 analysts following LCTX, it can be seen that 2020 equally weighted outlines a slightly optimistic note (+1%), with the downside in 2021 highlighting higher risks (-9% weighted). It is the author's opinion that with consistent updates and the higher safety profile of Lineage's therapeutics, an optimistic scenario is more likely highlighting +14% in 2020, post-November/December updates, and a +48% upside by 2021 under the condition of expanded VAC offerings and a smooth phase 3 initiation on OPC1. The above optimistic scenarios are rather conservative in nature, and actual results can exceed expectations, particularly due to the early-nature of clinical progress and the potential $40.4B market that is being targeted across the pipeline.

The author expects an optimistic scenario playing out for LCTX of +14% in 2020 and +48% potential by 2021 as conservative.

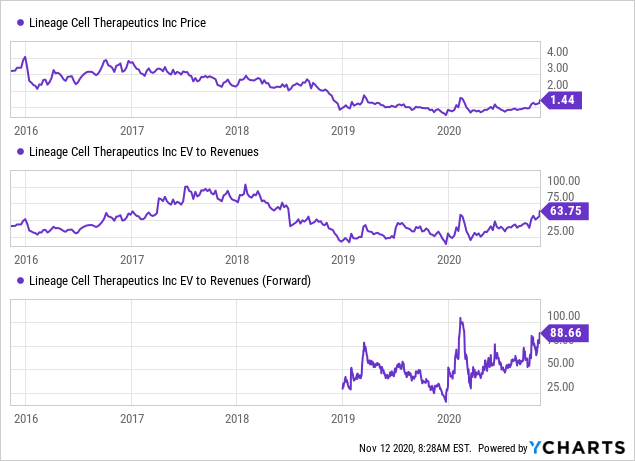

Data by YCharts

Data by YCharts

Upcoming Catalysts (1-12 months):

- Dec. 2020: Update for OPC1

- Q4 2020: Discussions for device and manufacturing with FDA

- Q4 2020: Completing dosing for ongoing VAC NSCLC trial

- Q4 2020/Q1 2021: Update on partnership and FDA talks regarding positive OpRegen interim data

- Q1 2021: Completing patient enrollment for VAC NSCLC trial

For further updates, see Lineage November Presentation.

Conclusion:

In summary, though less exciting than most biotech advancements, LCTX seems on track for a smooth but slow march toward clinical trial success. The relatively new management seems ready for maintaining a no-dilution policy under a cost-conscious strategy involving grant funding and promising new partnerships, further aided by promising OpRegen interim data. Financially, Lineage is stable and able to operate through 2022 giving runway for what is deemed a middle-stage clinical pipeline. LCTX is still a few years away from any real product developments but is on track to make it through clinical trials with high safety and an escalating dosage level proving effective.

To conclude, the author projects Lineage Cell Therapeutics as a conservative "buy" at a 2-year price target of $1.88 (+48% upside).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.