Luminex: Valuation Disconnect To The Downside; Remains In 'Show Me' Stage

Luminex has had a volatile year that reflects FDA headwinds and a rotation out of Covid-19 exposure.

Management had baked Covid-19 related sales into previous modelling but have downgraded FY2020 guidance by ~$5 million.

FY 2021 growth of ~15% is now guided, but we need more evidence of capacity away from Covid-19 exposure, especially in cadence of S2A placements.

Shares trade at a discount to peers on multiples, but ROIC < WACC and fair value skewed to the downside justify the low valuation.

We are neutral on the company, as they are in a "show me" stage and must provide evidence of sequential growth outside of Covid-19 exposure alone.

Investment Summary

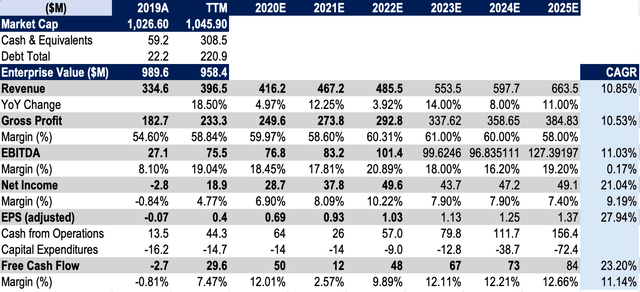

Recent years have been transitional in nature for Luminex Corporation's (LMNX) sequential top-line growth, with key client losses and a shift in their product mix. The former is true also on the back of headwinds from competition and margin pressure sustained via their clinical diagnostics segment. Balancing this scenario are upcoming catalysts via new product launches and meaningful product upgrades in their medical diagnostics ("MDx"), licensed technologies group ("LTG"), and sample to answer ("S2A") segments, and the fact that the market may be under-reflecting LMNX's post-pandemic cash flow potential.

Data Source: Author's Bloomberg Terminal

Shares have given away ~3% YTD, after a fairly wild ride over the several months, reaching a high of ~$41 in late July. Although the company seems well positioned to accelerate market penetration within its operating segment, there are execution risks that accompany the new product launches, alongside the fierce competition within that space. This also builds on the fact that investors are demanding more evidence of revenue volume outside of Covid-19 testing exposure. Shares are also trading at a discount to peers, but the valuation remains unattractive, balancing the neutral view in the same light of revenue potential. Thus, we firmly believe that LMNX is in a "show us" stage, and we are interested in the effect of key inflection points upcoming in the next 12 months.

The Longer-Term Outlook For Long-Term Price Change

1) Q3 Financials

Firstly, we find it essential to get a snapshot of LMNX's Q3 performance, especially in context of the volatile year shares have had on the charts. From the third quarter, the company announced revenues of $106 million, which beat consensus by ~$1 million. There was strength in the MDx segment, which grew ~98% contributing ~$60 million in revenues, and a small recovery from Q2 in the flow Cytometry segment, with ~$10 million in gross earnings, a -13% YoY decrease. We observed the S2A segment gathered just over $30 million in revenues, marked by a 600% YoY increase in the Aries segment, which was driven by underlying growth in Covid-19 assays. The above corresponded with ~$30 million in non-MDx revenues, which also showed ~130% YoY growth. Earmarking these results, however, was capacity limitations for the Aries segment, where ~$10 million in Covid-19 assays were unable to be shipped secondary to capacity restraints. As a result, management has guided at capacity expansion to fulfil Q4 commitments, with an aim to increase Aries' capacity to over 5 million annual tests by the end of FY2020.

Zooming in on the S2A segment, we've observed ~300 S2A placements this year, 87 of which occurred in the third quarter, a 180% YoY increase. The majority of the upside was from the Aries portion of the S2A portfolio as mentioned and around half of the 87 placements this quarter was a capital sale. Already YTD, the 300 placements is a ~50% YoY growth from 2019's total, and the cadence of placements is increasing for longer-term contracts (5 years, for example). Thus, the tail of asset returns is likely to increase on the back of these developments and adds weight to LMNX's performance outside of the pandemic, the kind of evidence we need. Furthermore, just over $35 million orders were booked for placements in the remainder of FY2020 from the Q3 exit. However, on closer analysis, we believe that this may be largely comprised of the unshipped orders that were limited due to capacity restraints earlier on.

2) Some upcoming Inflection Points To Consider

LMNX is still in the process of obtaining full approval for key Covid-19 viral target products. This includes the Verigene I standalone assay, and the Verigene II Flex and NxTAG syndromic panels, which target the SARS-2 virus. Management was expecting emergency use rights for all 3 of these candidates by now, but offsetting the application process is the FDA letter that was received by the company on 26th June for Verigene I. Thus, the entire approval is in limbo on the back of this setback; however, management is confident that all 3 will receive approval, albeit without any real colour on timeframes. Management has claimed capacity of around 2 million tests yearly in this segment, with ability to meet additional capacity should demand warrant so. Thus, investors should keep a close watch on the developments in the progression of the Verigene I and II and NxTAG applications over the coming months.

The company has also been guided to maintain its investment in test menu expansion in the S2A segment over the coming years. To illustrate, the company has made sound advancements in its xMAP platform via Intelliflex instillations. Back in July, the first of these systems were rolled out to several major clients, representing an appropriate milestone for these partners, by doubling the multiplex capabilities of the xMAP platform. One of the main benefits is in the serology application for Covid-19 detection, enabling dual-reporting to detect multiple Covid-19 antibodies within 1 test. Additional advantages lie in the wider dynamic range over the existing xMAP platform, whilst allowing capacity to measure 2 separate indications for 500-plex assays. Management also expects to commercialise this platform with partners by next year, which also adds to the tail of asset returns LMNX will enjoy. Management, therefore, expects several more clients to gain access to Intelliflex by the end of this year. There are other new launches in the works for LMNX; however, we believe that these form the crux of the near-term catalysts investors should pay most attention to right now.

3) Covid-19 Exposure Is Not As Exotic As It Seems

In the near term, LMNX will continue to see top-line growth from pandemic-related tailwinds, especially in upside from the Aries segment, via the capacity and demand in Covid-19 assays. However, management has lowered FY2020 guidance by $5 million, indicating ~$410 million in full-year results on the top. Furthermore, as mentioned above, headwinds from the Verigene and NxTAG segments (both of which are a Covid-19 viral target) offset the realisable near-term upside that LMNX had modelled earlier in the year. So much more is true considering Pfizer's (PFE) vaccine candidate that looks set for commercialisation over the coming period, provided certain outcomes and storage parameters are met. We remain skeptical of Covid-19's contribution to growth cadence for LMNX, and question the sustainability of the company's exposure here to their forecasts and value creation for shareholders. First of all, lowering guidance for FY2020 conflicts with the benefit that Covid-19 exposure should provide to the company. If Covid-19-related demand is at its highest, then LMNX should be one of the main beneficiaries of the upside here. Especially over the course of the coming 6-12 months. Second, the success of PFE's vaccine regimen places further doubts over the overall contribution of Covid-19 assays to LMNX's performance over the coming periods. Undoubtedly, general investment will spew funds towards successfully rolling PFE's candidate out to the entire world. Granted, there are still uncertainties and the vaccine race will likely remain on (for now). But, the question for LMNX is their capacity to widen capital allocation and increase return on capital employed from CAPEX in this segment. Based on uncertainties here, we believe that the risk/reward equation may be tilted towards the downside in this portion of the business.

4) Longer-Term Outlook Is Optimistic

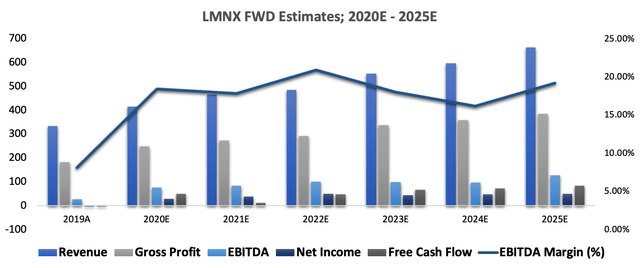

Whilst guidance was downgraded for FY2020, management did hint at ~15% sequential growth for FY2021 or ~$475 million for the year. Considering the upcoming inflection points and growth drivers, there is chance LMNX could ramp up underlying growth from 2020 on the back of these. The company is certainly better positioned now to increase operating leverage and the cadence of S2A placements over this time frame. One of the main drivers outside of Covid-19 lies within the Aries segment, especially as management aims to increase the growth engine by extending applications in this area of the business. Guidance over ~400,000 Aries test shipments has been provided for Q4, which will help drive sequential revenue volume for the next couple of periods. We have modelled a similar level of shipment volume in this segment over Q1 2021, alongside additional growth in other S2A, LTG and MDx segments across the next 12-24 months. From there, we see top-line growth at a CAGR of ~11% by 2025, alongside free cash expansion of ~23% by that same period. We view margin pressures being sustained over this period, however, operating margin will maintain in the double-digits with slight growth by 2025, in our opinion. This would be on the back of increased placements and the expanding customer base in the xMAP platform, including other drivers. We view peak sales of ~$664 million by 2025, slightly below consensus, and we are slightly behind management on 2021 totals, withholding Verigene and NxTAG at low double-digit contributions over this time, until additional flavour can be provided on the assay application status there.

Data Source: LMNX SEC Filings; Author's Calculations

Data Source: LMNX SEC Filings; Author's Calculations

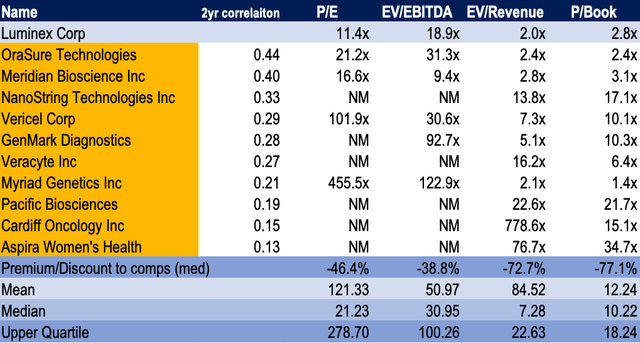

Valuation

Shares have been volatile this year on the back of FDA setbacks and less than appealing results in earlier quarters. However, shares appear to be trading at a discount to some of the peer group, but this seems clearly justified. Q3 ROIC of 3.36% below the cost of capital of 4.6% adds most weight to the discount, in our view. Companies that deliver consistently high ROIC will see a premium to their valuation that is more than justified, in contrast to the situation here. We believe that the traditional style of true "value" investing is subject to painfully long droughts, as names with low valuations typically elicit low returns on capital deployment. With those names, they may have a low valuation attached to them; however. they are certainly not undervalued. So much may be the case with LMNX, as we firmly believe they are in a "show us" stage that requires greater evidence to attach an undervalued label to the company. We can see that shares trade at ~50% discount on average to the peer group assigned; however, the disconnect of market price to underlying value is not apparent, in our view.

Data Source: Author's Bloomberg Terminal; Author's Calculations

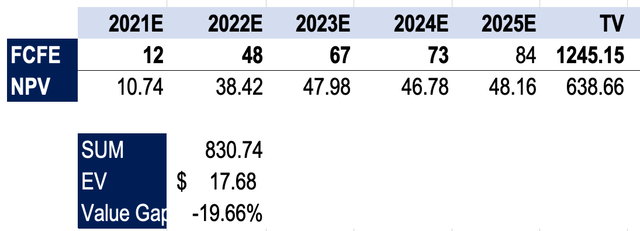

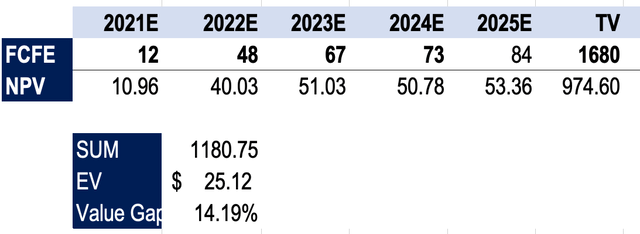

To highlight the above, discounting future FCFE estimates to today's value, we see a fair value range of ~$18-$25, as explained below. This certainly balances our neutral view. Furthermore, the logic of shares trading at a discount to peers on a multiples basis is extrapolated by this analysis, as the fair value is not reflected by the market's view of LMNX shares. We've limited our base model to 2025 to reduce forecasting risks, and as a reflection of the intense competition that LMNX faces in their MDx segment. However, investors should realise that when extending the forecasting period to 10 years out, the results remain largely similar on a DCF basis. We've discounted future FCF estimates using 2 scenario hurdle rates, one of the company's annual WACC of 9.5%, the other using the opportunity cost of holding securities with less risk (10-year treasury, 10-year S&P 500 return), at 11.77%.

DCF Model Scenario 1, Opportunity Cost as hurdle rate, base case:

Data Source: Author's Calculations

DCF Model Scenario 2, LMNX WACC as hurdle rate, base case:

Data Source: Author's Calculations

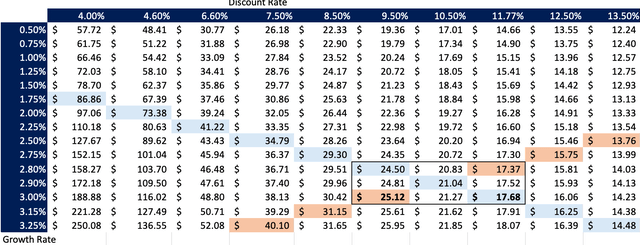

Investors can view where the sensitivity lies within our DCF model on the sensitivity matrix below. We encourage investors to pay attention to the box within the matrix, as this represents the upper and outer limits of our data set. There are no outliers within that box, thus it is appropriate to take the arithmetic mean. Doing so gives a fair value of $21.13, ~4% downside on today's trading (subject to change with publishing times). Thus, we believe this represents the underlying value of LMNX shares at this stage.

Data Source: Author's Calculations

Other factors to consider is that shares are currently trading at ~34x free cash flow, on a FCF yield of -0.27%. Shares are also trading at ~19x Q3 EBITDA, and there is only ~$1 in free cash per share. These figures align with the valuation narrative outlined above. Investors can view the potentials in pricing outcomes based on recent price dispersion, on the chart below. This is crucial information for longer-term investors in making entry decisions for LMNX shares. Thus, we encourage investors to have a good look at the chart below, to understand the range possible outcomes over the coming quarters.

Data Source: Author's Bloomberg Terminal

Further Considerations

On the charts, shares have bottomed below prices at the March selloff. Investors have not shown confidence by rewarding LMNX since the FDA letter in July. We can see the downward pressure on shares on the chart below, where they are currently being tested to find new range. The resistance level has been overpowering, and shares have failed to break this sharp resistance level since August. We can see the lower trend line is currently flat, and the downward pressure from the top is closing the mouth of the descending triangle that is seen on the chart below. Shares need to break through this level of resistance or at least hold support at the lower trend line, in order to advocate for entry based on the charts. From the scene below, we firmly believe that the current investor sentiment is bearish, which also balances our neutral view on the investment. Longer-term investors may gain confidence in prices breaking through the resistance level, and reverting back towards the 2020 mean, which is currently around the $22-$28 mark (depending on the testing period). Thus, there is hope for pricing outcomes in the near term. What investors should keep a close eye on in terms of inflection points is the applications for Verigene and NxTAG assays that may drive shares north again. However, based on PFE's story, capital may be rotating out of names like LMNX based on Covid-19 exposure, so we believe a more realistic catalyst is within the sales outcomes outside of Covid-19.

Data Source: Author's Bloomberg Terminal

In Short

LMNX has had a volatile year on the charts that have been reflected in the company's story YTD. Several key inflection points have been missed this year, which has resulted in shares giving away ~3% YTD. Although there are upcoming catalysts to price change staged for the coming 12 months, much of this is still banking on Covid-19 exposure, and investors need greater evidence of the company's growth engine outside of this realm. Management has downgraded FY2020 guidance by ~$5 million but is confident in ~15% organic growth for 2021, driven by S2A placements and growth in the MDx segment. However, the latter is a fierce competitive playground, where disruption is common and regulation is tight. We've seen evidence of this YTD in LMNX's story, with FDA roadblocks in NxTAG and Verigene I & II that have caused setbacks to organic growth for the year. Additionally, much of management guidance earlier in the year had Covid-19 related targets baked into the modelling, which has now been reshuffled in view of the wider progressions within that space. Additionally, the valuation remains behind, and although shares trade at a discount multiples to the relative peer group, this is justified by poor return on capital and via fair value. Thus, shares are discounted, but not in unison with reasonable value. Therefore, LMNX is certainly in a "show me" stage where investors are demanding evidence of performance outside of Covid-19 tailwinds, and the ability to increase capacity in the MDx segment for years to come. So, whilst the upcoming catalysts and growth projections look promising, the above factors balance our neutral view. We look forward to providing additional coverage.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.